5-20-2013 - Shelby Township

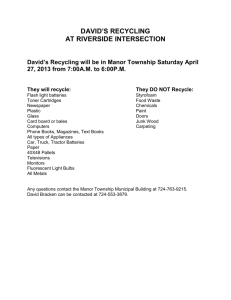

advertisement

MINUTES OF THE REGULAR MEETING OF THE CHARTER TOWNSHIP OF SHELBY FIRE & POLICE PENSION AND RETIREMENT BOARD HELD ON MONDAY, MAY 20, 2013 AT FIRE STATION #1, 6345 23 MILE ROAD, SHELBY TOWNSHIP, MICHIGAN. The meeting was called to order at 5:05 p.m. by Chairman Matt Stachowicz. Members Present: David Diegel, Michael Flynn, Jerome Moffitt, Mark Semaan, Matt Stachowicz Also Present: Brian Brice, Merrill Lynch, The Brice Group Rebecca Wolfe, Merrill Lynch, The Brice Group Randy Dziubek, Gabriel, Roeder, Smith Kevin Noelke, Gabriel, Roeder, Smith APPROVAL OF MINUTES MOTION by Diegel, supported by Moffitt, to approve the minutes of the Regular Meeting of the Charter Township of Shelby Fire & Police Pension and Retirement Board held on Monday, April 15, 2013, as presented, and waive the reading. Motion carried. PRESENTATIONS Gabriel, Roeder, Smith – Actuarial Report Mr. Dziubek of Gabriel Roeder reviewed the Fire and Police Retirement System Actuarial Valuation Report dated December 31, 2012 at length. He highlighted pertinent sections of the report dealing with contribution rates, computed contributions, valuation assets and unfunded actuarial accrued liability, funding projections, actuarial cost method, actuarial assumptions used for the valuations, and valuation assumptions. Mr. Dziubek advised there are two main pieces to the required contribution. The first is called the normal cost. That is the amount required to prefund benefits for the active work force. The goal of prefunding the retirement system is when a person starts employment you start setting aside contributions on behalf of that person so, in theory, by the time they retire you have accumulated the proper amount of money to pay their benefits at that time. The normal cost is something that Gabriel Roeder calculates with their actuarial cost method. The second piece of the required contribution has to do FIRE & POLICE PENSION BOARD MAY 20, 2013 with how well funded the system is on the valuation date. They collect data and measure the pension fund’s liabilities and asset information and determine if the Township has an unfunded liability or an over-funded liability. Most retirement systems in this environment have an unfunded liability so in addition to their normal cost the Township has to make a payment toward that unfunded amount. Mr. Dziubek pointed out charts reflecting the normal costs for the current year and the prior year. Most of the results are represented as percentages of payroll. Their expectation is that payroll will increase over time normally at 4 ¼% although the Township has a temporary assumption of zero % payroll growth for another couple of years. The decision was 5 years initially and then it would go back. Mr. Dziubek stated the assets applied against actuarial accrued liabilities in determining unfunded actuarial accrued liabilities were calculated as follows – computed actuarial accrued liabilities were reflected at $84,149,619 with applied assets of $58,945,340 leaving unfunded actuarial accrued liabilities of $25,204,279 down a little from last year which was $26.3 million. This is a good sign and shows the Township is moving in the right direction. Because we have this unfunded liability, in addition to your normal cost, the Township needs to make a payment toward that unfunded balance so it can be paid off over some period of time. The length of time that the Township decides to pay that off is a policy and not a decision of Gabriel Roeder. The current GASB rules state that it can be paid off over as long as 30 years. The unfunded actuarial accrued liabilities is 21.03%, the percent of paid contributions towards that amount of funding based on a 14 year payoff, amortization period. Last year, we used a 15-year payoff. There have been some changes in that period. The longer the period, the lower the contribution and the less volatile it would be. The smaller that period gets, the unfunded will be paid off faster and it requires a larger dollar contribution and it is more volatile from a year-to-year situation. Mr. Dziubek continued his presentation by discussing the amortization period and reviewing the comparative schedule provided in the submittal. The figures provided include the fiscal year 1969-1970 through the current valuation date of December 31, 2012. The funded percentage began at under 10% gradually rising to 70%, for the first time in the history of the retirement system, which is certainly good news. He appointed out the amortization periods over the last 45 years, and stated the Township is currently at a 14-year amortization period. As far as Township contributions, the last column of the chart shows the recommended dollars and actual dollars, which indicates the Township contributed the recommended amount. There were years that the Township actually contributed in excess of the recommended amount. Mr. Diegel commented that if the Township had contributed the amount required by the actuarial report every year, we would have been fully funded by now. This is why we are 30% underfunded. Page 2 FIRE & POLICE PENSION BOARD MAY 20, 2013 Mr. Dziubek addressed the recent change in the amortization period. The amount being collected will drop in 2022. There was some effort to tie the amortization period to that point so the unfunded liability would be paid off. The 14 years will take the Township beyond that point. He provided several alternatives to take the Township to 100% funding in 2022. To accomplish this, we are dropping the amortization years by more than 1 for much of the time period. This goes along with higher contributions over this period but it will get the Township to 100% funding by 2022. This submittal is for informational purposes. Gabriel Roeder is fully comfortable with the contributions stated. In his closing statements, Mr. Dziubek referred to the Comments page. It summarizes what he had discussed this evening. He highlighted actuarial experience, current funding policy, alternate funding policy and the advantages and disadvantages to the alternate funding policy. Mr. Dziubek indicated that Mr. Kausch of Gabriel Roeder would like to review the actuarial assumptions. The last experience study was in 2008. For a plan this size, a full study is probably not necessary. However, the mortality assumption is outdated, the economic assumption may be aggressive, and the retirement rates may need review. They recommend a limited review of these assumptions. The new GASB rules were briefly addressed. They don’t affect the Township’s funding requirements. The Township can continue funding the system the way they always have. The Township will have to account for the different financial statements based on these new rules. Mr. Dziubek briefly explained the new rules and how they will affect our accounting statements. Mr. Stachowicz asked to have information e-mailed to the Pension Board regarding the GASB rules and how they apply to our pension system so we understand which changes apply to us. Mr. Dziubek advised that generic information is available on their website. More specific information can be put together by Mr. Kausch and Mr. Noelke. MOTION by Diegel, supported by Moffitt, to receive and file the actuarial report, as presented. Motion carried. Merrill Lynch Mrs. Wolfe reviewed the Treasurer’s Report for the month ending April 30, 2013. The beginning market value was $63,889,352. Withdrawals during the month were $515,848. Interest and dividends credited were $16,569. There were market gains of $820,780. The ending market value was $64,310,852. The bottom of the report reflects a benefit payment made on April 1 together with a summary of the payments made since the beginning of the year. Page 3 FIRE & POLICE PENSION BOARD MAY 20, 2013 Mrs. Wolfe referred to the updated Asset Allocation Report which provides a market value as of Friday’s close – May 17, 2013. Total equities are reflected at $43,546,902. Total fixed income is shown at $21,884,969. The market value as of May 17 is $65,431,872. The market continues to appreciate. A benefit payment went out during this time period on May 1. The total equities are at 66.6% with the IPS Target at 65% and fixed income and cash is reflected at 33.4%, with a target of 35%. Mr. Brice provided information with regard to the US Performance Monitor dated May 1, 2013. There was an unusual occurrence in April. We actually saw T-bonds do pretty well at 4.2%. Stocks also held up reasonably well at 1.8%. However, gold was down -8.1%. This lineup is incredibly rare - since 1976, we have seen this scenario (bonds ahead of stocks, gold down) happen less than 8% of the time. When it has happened, forward 12-month returns have been positive in all but three cases, and have averaged about 15%. Regionally, Japan equities led last month, whereas US equities posted some of the weakest returns. Mr. Brice continued his presentation by highlighting pertinent sections in the Investment Performance Analysis Report for the quarter ending March 31, 2013. He reviewed the Global Markets Overview as they relate to equity, fixed income, and global equities comparing percentages for 2012 and the first quarter of 2013. Technology stocks were the least performing sectors. Mr. Brice reviewed the section entitled “Equity Focus” which compared performance by the S&P Section as they relate to Health Care, Consumer Staples, Utilities, Consumer Discretionary, Financials, Industrials, Energy, Telecommunications, Materials, and Information Technology. Under International Focus, he pointed out the larger building blocks of the developed countries and international countries – EAFE, Japan, UK, Germany and France. A brief summary was made of the Investment Performance Executive Summary as of March 31, 2013 comparing the performance, benchmark and ranking of the Total Retirement System, Domestic Taxable Fixed Income, Equity – Total Retirement System, Domestic Large Cap Core Equity, Domestic Large Cap Value Equity, Domestic Large Cap Growth Equity, Domestic Small /Mid Cap Core Equity, International Equity, and Real Estate Investment Trusts (REITS). The numbers for Alidade are not available at this time. The schedule will be revised when this information is available and it will affect the Total Retirement System relating to Composite, Custom Index Return and Rankings. Mr. Brice pointed out the performance of Eaton Vance, the manager that has been on watch for an extended period of time. They were up 10.2% for the quarter and we were looking for something in the neighborhood of 12%. It ranks in the 86 percentile against its peers. Last year its performance was 16.4%. It still fell short of expectations by more than 18%. It ranked in the 43 rd percentile amongst value managers which shows it wasn’t completely easy going for anybody out there. Page 4 FIRE & POLICE PENSION BOARD MAY 20, 2013 Marsico Capital, also a manager that has been on watch for some time, is up 10.3%. It ranked in the 21st percentile amongst their peers. Last year its performance was 13.6%. They were inconsistent with other growth managers. At the end of the quarter they had about a 35% weight in consumer discretionary. They were about 18.5 percentage points over the Russell 1000 growth index and consumer discretionary stocks. They were underweight by 13.6% in technology stocks which would be an area where most growth managers would spend a lot of time. Mr. Flynn questioned why Marsico and Eaton Vance show net of fees, while the other investments don’t. Mr. Brice responded that World Asset Management is in a collective fund or mutual fund format. Since they are index funds, they have very nominal fees. Most funds would be at an internal expense ratio. Mr. Semaan advised that WAM-Fixed Income Index Fund and WAM-500 Index Fund bill the Pension Board directly and he has invoices for both funds to be paid this evening. Mr. Flynn understands it is very nominal; however, the other funds we are invested in have an active manager that is charging active manager fees. Brief discussion followed. Mr. Brice reminded the members that the Alidade information is not available. figures will be updated once the information is received. These Mr. Brice briefly referred to the handout reflecting market values as of May 17, 2013. Under the “Actual” column in the middle of the page, Large Cap Equity is reflected at 39.5%, Small/Mid Cap Equity at 10.5%, International Equity at 11.8% and Real Estate at 4.7%. The sub-total on equities assuming real estate would be held within the equities portion is 66.6%. Fixed income totals out at 31.1%, Cash at 2.4%, with an ending market value of $65,431,872. Mr. Brice referred to the section under Allocation by Investment Manager which shows each manager’s cash allocation which is approximately 3.8%. Equities and Securities total 65.1% and Fixed Income is reflected at 31.1%. The members agreed not to have the Strategic Allocation Modeling Study and Domestic Large Cap Value Equity and Domestic Large Cap Growth Equity Reports discussed this evening. MOTION by Diegel, supported by Moffitt, to accept the Treasurer’s Report, as presented. Motion carried. Mr. Semaan said in the interest of being fair, he asked the Brice Group to provide us with an RFP so that we can compare apples to apples. We have RFP’s from people who want our business but we don’t have Merrill Lynch’s RFP. We need some type of comparison. Mr. Moffitt asked why the Brice Group did not respond to our Request for Proposals. Mr. Brice responded that they never received notification whether it be oral, Page 5 FIRE & POLICE PENSION BOARD MAY 20, 2013 written or some other direction. He didn’t find out until Friday. Mr. Semaan advised him at that time if they put one together we would have something to compare what we have against where we are now. Mr. Moffitt said he understands. The Brice Group had the RFP prepared over the weekend and presented it this evening. The RFP was accepted by the Board, and a copy was given to each Board member. Mr. Brice and Mrs. Wolfe of the Brice Group left the meeting. CSSC Investment Advisory Services, Inc. Mr. Eric Smith and Mrs. Maryann Foster were in attendance representing CSSC Investment Advisory Services, Inc. Mr. Smith explained the services offered by their firm regarding the investment consulting process and the fees associated with these services. Questions of the Board were addressed by Mr. Smith. NEW BUSINESS Review Bids for Consulting Services and Select Firms to be Invited for Interviews Mr. Moffitt felt we should absolutely go with the Brice Group to provide an interview. The Pension Board members briefly discussed the following groups who submitted an RFP for Investment Consulting services – Asset Strategies Bogdahn Group Dahab Associates Fund Evaluation Group Graystone Consulting UBS Institutional Consulting Group MOTION by Semaan, supported by Diegel, to remove Asset Strategies and Dahab Associates from the group who will be invited to be part of our interview process. Motion carried. It was agreed that the Bogdahn Group , Fund Evaluation Group, Graystone Consulting (The Holy Cross Group), and UBS Institutional Consulting Group along with the Brice Group be included in the interview process. It was the consensus of the Board that each group be allotted 30 minutes to make a presentation with a 10 minute question and answer period. One session will be held on Tuesday, June 11 beginning at 5:30 p.m. and the other immediately after our regular meeting scheduled for Monday, June 17. It was agreed that three interviews will be Page 6 FIRE & POLICE PENSION BOARD MAY 20, 2013 held on Tuesday, June 11 at 5:30 p.m. and two will be held on Monday, June 17 immediately after our regular meeting. The members agreed that the invitations will be handled by phone call. agreed to handle the calls and set up the schedule. Mr. Semaan OLD BUSINESS Mr. Stachowicz questioned if we received any correspondence from Comerica regarding a rate increase. He said that one of his acquaintances from the Shores notified him that there was an increase. Mr. Semaan mentioned the Comerica lawsuit. This was discussed previously with Gary Bender and Dan Berd. They informed him that there was a fund that went bankrupt and that is what caused us to lose money since it was invested in a money market account. In order to settle this matter, Comerica had to hire a company to sue them and that is why there is a Class Action Lawsuit to settle this with the money lost in this bankruptcy. Mr. Semaan felt that members shouldn’t contact Mr. Thumm without consulting with the other members and have the Board’s approval since information may be available without incurring legal fees. If anyone has a question on the Board with regard to what has happened in the past, he would like them to contact someone who has been on the Board a while. Mr. Flynn questioned if he receives a lawsuit in the mail, he shouldn’t forward it to Mr. Thumm, our attorney. Mr. Semaan responded that he should first talk to the Board to see if there is any previous history regarding the lawsuit. Mr. Semaan said he could have gotten Mr. Flynn an answer by calling Dan Berd without contacting Mr. Thumm. This came up previously and they are just remedying the situation regarding the company that went bankrupt. Mr. Semaan said if he had a lawsuit sent to him, he probably would want to go right to the attorney but contacting a Board member would be best. Mr. Stachowicz doesn’t have a problem sending lawsuits to the attorney. He wants something in place to say this is what we are going to do from this point forward. Mr. Semaan has no problem with this suggestion. The members agreed that discretion should be followed. APPROVAL OF BILLS Mr. Semaan said that the MAPERS Conference is coming up at the end of the month. He has to send in a check representing the balance for the hotel in the amount of $771.78 plus issue per diem and mileage checks. It was agreed that he will write checks for these expenses from the Pension Board checking account. Page 7 FIRE & POLICE PENSION BOARD MAY 20, 2013 $2,073.50 - Lewis Thumm – legal fees from 2-2-2013 – 4-30-2013 $6,386.16 - Comerica World Asset Management 1-1-2013 – 3-31-2013 $ 931.48 - Comerica Institutional Trust 1-1-2013 – 3-31-2013 Mr. Stachowicz questioned if the bill for Comerica is the same every quarter. Mr. Semaan stated the bill for Comerica Institutional Trust is $203.44 higher than last quarter. MOTION by Diegel, supported by Flynn, to pay the bills. Motion carried. It was agreed that the next regular Pension Board meeting will be held on Monday, June 17, 2013. Mr. Semaan advised that he will call the companies selected to partake in the interview process tomorrow to schedule appointments. MOTION by Moffitt, supported by Flynn, to adjourn. Motion carried. The meeting adjourned at 6:55 p.m. ______________________________ Mark C. Semaan, Secretary ds Page 8