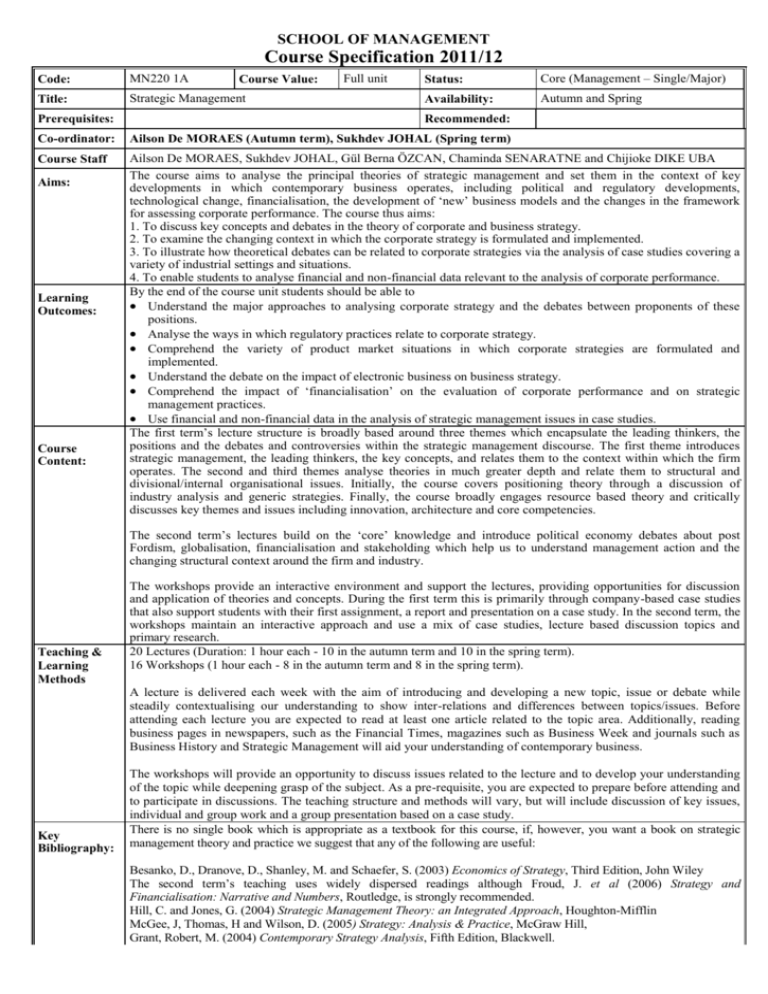

Strategic Management

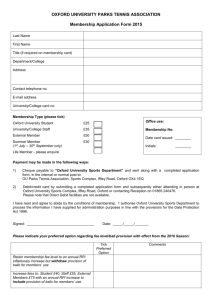

advertisement

SCHOOL OF MANAGEMENT Course Specification 2011/12 Code: MN220 1A Title: Strategic Management Course Value: Full unit Status: Core (Management – Single/Major) Availability: Autumn and Spring Prerequisites: Recommended: Co-ordinator: Ailson De MORAES (Autumn term), Sukhdev JOHAL (Spring term) Course Staff Ailson De MORAES, Sukhdev JOHAL, Gül Berna ÖZCAN, Chaminda SENARATNE and Chijioke DIKE UBA The course aims to analyse the principal theories of strategic management and set them in the context of key developments in which contemporary business operates, including political and regulatory developments, technological change, financialisation, the development of ‘new’ business models and the changes in the framework for assessing corporate performance. The course thus aims: 1. To discuss key concepts and debates in the theory of corporate and business strategy. 2. To examine the changing context in which the corporate strategy is formulated and implemented. 3. To illustrate how theoretical debates can be related to corporate strategies via the analysis of case studies covering a variety of industrial settings and situations. 4. To enable students to analyse financial and non-financial data relevant to the analysis of corporate performance. By the end of the course unit students should be able to Understand the major approaches to analysing corporate strategy and the debates between proponents of these positions. Analyse the ways in which regulatory practices relate to corporate strategy. Comprehend the variety of product market situations in which corporate strategies are formulated and implemented. Understand the debate on the impact of electronic business on business strategy. Comprehend the impact of ‘financialisation’ on the evaluation of corporate performance and on strategic management practices. Use financial and non-financial data in the analysis of strategic management issues in case studies. The first term’s lecture structure is broadly based around three themes which encapsulate the leading thinkers, the positions and the debates and controversies within the strategic management discourse. The first theme introduces strategic management, the leading thinkers, the key concepts, and relates them to the context within which the firm operates. The second and third themes analyse theories in much greater depth and relate them to structural and divisional/internal organisational issues. Initially, the course covers positioning theory through a discussion of industry analysis and generic strategies. Finally, the course broadly engages resource based theory and critically discusses key themes and issues including innovation, architecture and core competencies. Aims: Learning Outcomes: Course Content: The second term’s lectures build on the ‘core’ knowledge and introduce political economy debates about post Fordism, globalisation, financialisation and stakeholding which help us to understand management action and the changing structural context around the firm and industry. Teaching & Learning Methods The workshops provide an interactive environment and support the lectures, providing opportunities for discussion and application of theories and concepts. During the first term this is primarily through company-based case studies that also support students with their first assignment, a report and presentation on a case study. In the second term, the workshops maintain an interactive approach and use a mix of case studies, lecture based discussion topics and primary research. 20 Lectures (Duration: 1 hour each - 10 in the autumn term and 10 in the spring term). 16 Workshops (1 hour each - 8 in the autumn term and 8 in the spring term). A lecture is delivered each week with the aim of introducing and developing a new topic, issue or debate while steadily contextualising our understanding to show inter-relations and differences between topics/issues. Before attending each lecture you are expected to read at least one article related to the topic area. Additionally, reading business pages in newspapers, such as the Financial Times, magazines such as Business Week and journals such as Business History and Strategic Management will aid your understanding of contemporary business. Key Bibliography: The workshops will provide an opportunity to discuss issues related to the lecture and to develop your understanding of the topic while deepening grasp of the subject. As a pre-requisite, you are expected to prepare before attending and to participate in discussions. The teaching structure and methods will vary, but will include discussion of key issues, individual and group work and a group presentation based on a case study. There is no single book which is appropriate as a textbook for this course, if, however, you want a book on strategic management theory and practice we suggest that any of the following are useful: Besanko, D., Dranove, D., Shanley, M. and Schaefer, S. (2003) Economics of Strategy, Third Edition, John Wiley The second term’s teaching uses widely dispersed readings although Froud, J. et al (2006) Strategy and Financialisation: Narrative and Numbers, Routledge, is strongly recommended. Hill, C. and Jones, G. (2004) Strategic Management Theory: an Integrated Approach, Houghton-Mifflin McGee, J, Thomas, H and Wilson, D. (2005) Strategy: Analysis & Practice, McGraw Hill, Grant, Robert, M. (2004) Contemporary Strategy Analysis, Fifth Edition, Blackwell. Lynch, Richard (2009) Strategic Management, 5th Edition, Prentice Hall. Highly recommended. In-course Feedback: The workshop tutor will provide feedback during workshops and through assessment of the written assignment. Standard School of Management course evaluation forms will be distributed in either week 16 or 18. Assessment: Coursework = 30% (2 pieces of work) - Term 1, submit ONE case study based report –participation in a (nonassessed) group presentation is a pre-requisite for submission. Term 2, submit ONE essay. Coursework submissions must be word-processed. Examination = 70% - Essay format - no calculations. Three-hour unseen paper, containing eight questions. Answer three questions. The information contained in this course outline is correct at the time of publication, but may be subject to change as part of the Department’s policy of continuous improvement and development. Every effort will be made to notify you of any such changes 2 MN220: Strategic Management 2010/2011 Course tutors: Ailson de Moraes (co-ordinator autumn term) Sukhdev Johal, (co-ordinator spring term) Gül Berna Özcan Chaminda Senaratne Chijioke Dike Uba a.moraes@rhul.ac.uk s.johal@rhul.ac.uk G.Ozcan@rhul.ac.uk Chaminda.Senaratne.2008@llive.rhul.ac.uk Chijioke.uba.2008@live.rhul.ac.uk Brief Outline and Aims of the Course The course will analyse the principal theories of strategic management and set them in the context of key developments in which contemporary business operates, including political and regulatory developments, technological change, financialisation, the development of ‘new’ business models and the changes in the framework for assessing corporate performance. The course aims: 1. To discuss key concepts and debates in the theory of corporate and business strategy. 2. To examine the changing context in which the corporate strategy is formulated and implemented. 3. To illustrate how theoretical debates can be related to corporate strategies via the analysis of case studies covering a variety of industrial settings and situations. 4. To enable students to analyse financial and non-financial data relevant to the analysis of corporate performance. Learning outcomes By the end of the course unit students should be able to: Understand the major approaches to analysing corporate strategy and the debates between proponents of these positions. Analyse the ways in which regulatory practices relate to corporate strategy. Comprehend the variety of product market situations in which corporate strategies are formulated and implemented. Understand the debate on the impact of electronic business on business strategy. Comprehend the impact of ‘financialisation’ on the evaluation of corporate performance and on strategic management practices. Overview of Lecture and Workshop Topics Week Beginning Lecture Workshop Topic AUTUMN TERM Week 1 (30 Sept) th Week 2 (7th Oct) Week 3 (14th Oct) Week 4 (21st Oct) Week 5 (28th Oct) Week 6 (4th Nov) Week 7 (11th Nov) Week 8 (18th Nov) Week 9 (25th Nov) Week 10 (2nd Dec) Introduction: Strategic Management: key concepts. Strategic Management: context – ‘product and capital markets’ Strategic Management: key theories and controversies. Positioning Theory I: Industry analysis Positioning Theory II: Generic strategies. Resource Based Theory: Innovation. Resource Based Theory: ‘Architecture’. Resource Based Theory: Strategic Assets. Resource Based Theory: Core competencies. Resource Based Theory: ‘Competing for the future’. No workshop Workshop 1: Allocation of case study presentations. Case study 1- Responses to product and capital market pressures ‘downstream integration’ at Ford and General Motors No workshop. Preparation for presentations. Workshop 2: Case study 2- ‘Cost Leadership’ as a generic strategy: Southwest Airlines. Workshop 3: Case study 3- ‘Differentiation’ as a Generic Strategy: Daimler Chrysler. Workshop 4: Case study 4- Innovation and Competitive Increase Cost Advantage: Recovery GlaxoSmithKline. Workshop 5: Case Study 5- ‘Architecture’ and Competitive Advantage: Marks and Spencer. Workshop 6: Case Study 6- Regulatory Policy and Strategic Assets: Food and Grocery Retailing in the UK and USA.. Workshop 7: Case Study 7- Core Competencies and Competitive Advantage: Sony. Workshop 8: Case study 8- Competing for the Future: ‘New Economy’ Companies Amazon and Egg. SPRING TERM 11 (9th Jan) 12 (16th Jan) 13 (23rd Jan) 14 (30th Jan) Introduction: what is management and business analysis? 1980s Porter and strategy as classification Strategy and organisation(al learning) Stakeholder analysis, distributive conflict and value added 16 (13th Feb) Globalisation and the macro economy Meso analysis: production chain v sector matrix 17 (20th Feb) Shareholder value and Financialization 15 (6th Feb) 18 (27th Feb) 19 (5th Mar) Restructuring for capital and against labour The Banking Crisis: The New Economy, Private Equity and 4 No workshop No workshop Japan v America in cars in the 80s: what’s the business problem and what should Ford and GM do about it? Strategy and structure: general motors, the ‘autonomy’ of strategic management and the displacement of Ford as the industry leader 19091929 The House that Jack built? Analysing GE and the source of growth Analysing shifts in product demand; must have products, household income, and market fragmentation? Brenner article Porter’s concept of value chain, Gereffi’s concept of global commodity chain and “motoring sector matrix”. BT: Delivering shareholder value during the 1990s? Caterpillar a “checklist for critical reading” and the field of the visible. 20 (12th Mar) Hedge Funds and how they change business calculations Synthesis: sustainable advantage and what management can do? GSK: The model for emulation? Organisation 20 Lectures (Duration: 1 hour each.) 10 in the autumn term and 10 in the spring term). 16 Workshops (Duration: 1 hour each) Eight sessions during the first term and eight during the second term. Room allocations: see timetable. Workshop groups: see notice board (moodle) Autumn term: Lectures start on the week beginning 26th September 2011. The first lecture is scheduled on Friday 30th September. Workshops start on the week beginning 3rd October 2011- see the Workshop Schedule on Page 4. Please note that there is NO workshop in Week 3. Students are required to self study and prepare for the formal presentations, which are scheduled from Week 4 onwards. Important note: Attend at your allocated time. Spring term: Lectures start on the week beginning 9th January 2012. Workshops start on the week beginning 16th January 2012- see the Workshop Schedule . Important note: Attend at your allocated time. Workshop Allocation You are in charge to choose your Workshop with The Teaching Programmes and Admissions Office. If you have any problems, please email Mrs Marianne Bowyer – Mariane.Bowyer@rhul.ac.uk Workshops The workshops will provide an opportunity to discuss issues related to the lecture and to develop your understanding of the topic while deepening grasp of the subject. As a pre-requisite, you are expected to prepare before attending and to participate in discussions. The teaching structure and methods will vary, but will include discussion of key issues, individual and group work and a group presentation based on a case study. During most weeks you will receive a worksheet containing tasks that you must complete for the following weeks’ workshop as it will serve as a basis for discussion. Additionally in the first term you must present, within a group, a short case study based on a company. Your workshop tutor will allocate company cases and presentation dates during the first workshop. Remember that you will have to produce a report based on the case study you will be presenting and turnitin on the deadline. Marks will award for the report and not for the presentation, though it is compulsory to present your case in class. Lecture Programme Organisation 20 Lectures (Duration: 1 hour each. 10 in the autumn term and 10 in the summer term). The lectures are held in the Windsor Building Auditorium each Friday during the term. 5 16 Workshops (Duration: 1 hour each). 8 sessions x Autumn Term 8 sessions x Spring Term Room allocations: see timetable. Autumn Term Week 1 - 30th October Introduction: Strategic Management: key concepts Discussion issues: The concept of ‘strategic management’; the distinctiveness of ‘strategic’ as against functional management; criteria for the evaluation of strategic decisions. Basic reading: Besanko, D., Dranove, D., Shanley, M. and Schaefer, S. (2003) Economics of Strategy, Third Edition, John Wiley, pp1-2. (Future references to this text will be as Besanko et al. (2003) Grant, R. (2002) Contemporary Strategy Analysis, 4th edition, Blackwell, pp.16-17. Further reading: Shaoul, J. (1998) ‘Critical financial analysis and accounting for stakeholders’, Critical Perspectives on Accounting, 9, 235-249. Stoney, C. and Winstanley, D. (2001) ‘Stakeholding: Confusion or Utopia? Mapping the Conceptual Terrain’, Journal of Management Studies, 38 (5), 603-626. Lynch, Richard (2009) Strategic Management, 5th Edition, Prentice Hall. Week 2 - 7th October Strategic Management: context –‘product and capital markets’ Discussion issues: The concept of cost recovery and the role of product markets in relation to cost recovery. Introduction to the role of capital markets in assessing corporate performance. Basic reading: Williams, K, Haslam, C., Johal, S and Williams, J. (1995) ‘The crisis of cost recovery and the waste of the advanced economies’, Competition and Change, 1 (1) pp. 67-93. Further reading Cutler, T. (2004) ‘The Wages of Capital: the Rise and Rise of ‘Corporate Governance’’, Competition and Change, 8 (1), 65-83 (particularly the discussion of stakeholding and shareholder primacy in pp. 67-71). Week 3 - 14th October Strategic Management: key theories and controversies Discussion issues: The broad distinction between ‘positioning’ and ‘resource based’ approaches to corporate strategy; debates between positioning and resource based approaches and their implications for the scope and efficacy of strategic management. Basic reading: Grant, R. (2002) Contemporary Strategy Analysis, 4th edition, Blackwell, chapters 3 and 5. Further reading Hamel, G. and Prahalad, C. (1999) ‘The Core Competencies of the Corporation’ in H. Mintzberg, J.Quinn and S.Ghoshal (eds.) The Strategy Process, Financial Times/Prentice Hall, pp.82-91. Porter, M. (1999) ‘How Competition Forces Shape Strategy’ in H.Mintzberg, J.Quinn and S.Ghoshal (eds.) The Strategy Process, Financial Times/Prentice Hall, pp.60-69. Kay, J. (1993) Foundations of Corporate Success, Oxford University Press, pp.63-5. 6 Week 4 - 21st October Positioning Theory I: Industry analysis Discussion issues: The role of ‘industry analysis’ in positioning theory; the key elements in industry analysis and how it claims to inform strategic management practice. Basic reading: Besanko et al. (2003) Ch.10 Grant, R. (2002) Contemporary Strategy Analysis, 4th edition, Blackwell, pp. 71-82. Hill, C. and Jones, G. (2004) Strategic Management Theory: an Integrated Approach, Houghton-Mifflin, pp.40-50 (future references to this text will be as Hill and Jones (2004) McGee, J, Thomas, H and Wilson, D. (2005) Strategy: Analysis & Practice, McGraw Hill, pp. 149-153 (future references to this text will be as McGee et al. (2005) Further reading Porter, M. (1980) Competitive Strategy, Free Press, chapter 1. Porter, M. (1985) Competitive Advantage, Free Press, pp.4-10. Week 5 - 28th October Positioning Theory II: Generic strategies Discussion issues: The concept of ‘generic strategy’ in positioning theory; types of generic strategy; problems in combining generic strategies. Basic reading: Besanko et al (2003) pp. 397-400 Hill and Jones (2004) pp. 156-172 McGee et al (2005) pp. 157-9. Porter, M. (1985) Competitive Advantage, Free Press, pp.12-25. Further reading Porter, M. (1980) Competitive Strategy, Free Press, chapter 2. Grant, R. (2002) Contemporary Strategy Analysis, 4th edition, Blackwell, pp.246-250. Week 6 - 4th November Resource Based Theory: Innovation Discussion issues: Innovation as a means of generating competitive advantage; problems in the strategic management of innovation and the role of intellectual property. Basic reading: Angell, M. (2005) The Truth About the Drug Companies, Random House, Chapters 1-4. Kay, J. (1993) Foundations of Corporate Success, Oxford University Press, chapter 1. Further reading Schweitzer, S. (1997) Pharmaceutical Economics and Policy, Oxford University Press, chapters 2 and 9. Froud, J., Haslam, C., Johal, S., Williams, K. and Willis, R. (1998) ‘British pharmaceuticals: a cautionary tale’, Economy & Society, 27(4), 554-584 (particularly pp.564-575). Week 7 - 11th November Resource Based Theory: ‘Architecture’ Discussion issues: ‘Architecture’ as a source of competitive advantage; the distinctive character of ‘relational’ contracts with workers/suppliers; advantages and disadvantages of ‘architecture’. Basic reading: Kay, J. (1993) Foundations of Corporate Success, Oxford University Press, chapters 4 and 5. 7 Further reading Besanko et al (2003) pp. 119-121 Week 8 - 18th November Resource Based Theory: Strategic Assets Discussion issues: ‘Strategic assets’ as a source of competitive advantage; access to strategic assets; management of strategic assets and the impact of regulation. Basic reading: Kay, J. (1993) Foundations of Corporate Success, Oxford University Press, chapter 8. Further reading Froud, J., Haslam, C., Johal, S., Shaoul, J. and Williams, K. (1996) ‘Stakeholder Economy? From Utility Privatisation to New Labour’, Capital and Class, No.60, 119-134. Thatcher, M. (1999) The Politics of Telecommunications, Oxford University Press, Parts III and IV. Week 9 - 25th November Resource Based Theory: Core competencies Discussion issues: The concept of corporate competencies; the development and use of competencies, core competencies and financial metrics in strategic decision making. Basic reading: Hamel, G. and Prahalad, C. (1994) Competing for the Future, Harvard Business School Press, chapters 2, 4-7 and 10. Further reading Hamel, G. and Prahalad, C. (1993) ‘Strategy as Stretch and Leverage’, Harvard Business Review, 71, March-April, pp.75-86. Grant, R. (2002) Contemporary Strategy Analysis, 4th edition, Blackwell, chapter 5. Week 10 - 2nd December Resource Based Theory: ‘Competing for the future’ Discussion issues: ‘Future’ oriented approaches to strategic management, the limitations and problems of static approaches to strategic decision making, links to ‘new economy’ concepts, problems of ‘competing for the future’. Basic reading: Hamel, G. and Prahalad, C. (1994) Competing for the Future, Harvard Business School Press, chapters 4, 8 and 9. Further reading Gordon, R. (2000) ‘Does the new economy measure up to the great inventions of the past?’, Journal of Economic Perspectives, 14(4), 49-74. Willis, R., Marshall, J. and Richardson, R. (2001) ‘The impact of branchless banking on building society branch networks’, Environment and Planning A, 33, 1371-1384. Spring Term (week beginning) Week 11 - 9th January Week 12 - 16th January Introduction: what is management and business analysis? 1980s Porter and strategy as classification 8 Original statement: Porter M. E. (1985) Competitive Advantage, especially chap.1 pp.1-30 on the five forces and generic strategies. Reprinted in DeWitt and Meyer, Strategy Process, Content, Context, pp.344-358 with a useful preceding introduction and other readings. (Reading used in the first term) Johnson G. and Scholes K. (1999) Exploring Corporate Strategy (5th edition) chap 3 on analyzing the environment, pp. 97-141. Especially pp.115-141 (straightforward textbook account of positioning) Week 13 - 23rd January Strategy and organisation(al learning) Classic original statements: Prahalad, C. and Hamel, G. “The Core Competences of the Corporation” Harvard Business Review, May/June 1990. (for revision/or as introduction) Prahalad, C. and Hamel, G. “Strategy as stretch and leverage” Harvard Business Review, March/April 1993. (for revision/or as introduction –used in the first term) Additional optional reading –on mainstream strategy usage of RBT: Baden-Fuller, C. and Stopford, J. (1993) Rejuvenating the Mature Business, London: Routledge., chap 1 “Maturity is a State of mind” pp.1-12 and Chapter 2 “The Firm Matters, Not the Industry” pp.13-24. Sections reprinted in Segal-Horn, S. (1999) The Strategy Reader, Oxford: Blackwell, pp.125-140. Leaver, A. (2001) “Organic Farming: ex post strategy or ex ante business analysis?” Competition and Change. Barney, J.B. “Strategic Factor Markets” in Chapter 12 pp.146-160 (a neo-classical view on RBT) in Foss, N. (1997) Resources, Firms and Strategies, Oxford: OUP (the best advanced text for new and classic interpretations). Week 14 - 30th January added Stakeholder analysis, distributive conflict and value Select at least 1 from: Jensen, M. (1998) “The takeover controversy: analysis and evidence”: in Stern, J.M. and Chew, D.H. (eds), The Revolution in Corporate Finance (3rd edition, 1998) Oxford: Blackwell, pp.351-377. (disciplining managers, from an agency point of view). Shleifer A. and Summers L H (1988) “Breach of trust in hostile takeovers” in Auerbach, A. J. (ed) Corporate Takeovers: Causes and Consequences, Chicago: University of Chicago Press, pp.33-68. (takeover as a breach of implicit contracts with workers and suppliers). Froud, J., Haslam, C., Johal, S. and Williams, K. (2000) “Restructuring for shareholder value and its implications for labour” Cambridge Journal of Economics, Vol. 24, pp. 771-797 (using accounting data from a redistribution perspective). Froud, J, Haslam C, Johal S and Williams K (2001) “Accumulation under conditions of inequality”, Review of International Political Economy, Vol. 8, No 1, Spring, pp. 66-95 (identifies UK and US shareholders as households in the top 40% by income). Week 15 - 6th February Globalisation and the macro economy Ther topic is broad and developed from a range of perspectives. Therefore select at least 1 from: Amin, A. (1994) Post-Fordism: A Reader, Oxford: Blackwell. Introduction (standard beginners guide to Regulationism) Boyer, R. (1990) The Regulation School: A Critical Introduction, New York: Columbia University Press. Chapter 2, pp.29-46. (statement by one of the French founders) Piore, M. and Sabel, C. (1984) The Second Industrial Divide: Possibilities for Prosperity, Basic Books: USA. “Introduction”, pp.1-19. (launched flexible specialisation: hugely influential) For perspective/ criticism: Jessop, B. (1995) "The Regulation Approach, Governance and Post-Fordism: Alternative Perspectives on Economic and Political Change", Economy and Society, Vol.24, No.3, pp.307-333.(by a British Regulationist). 9 Peck, J. and Tickell, A. (1995) “Social Regulation After Fordism: Regulation theory, neo-liberalism and the global-local nexus” Economy and Society Vol.24, No.3, pp.357-386. (critiques Regulationism) Williams, K. Cutler, T. Williams, J. Haslam, C. (1987) “The End of Mass production?” Economy and Society, Vol. 16, No.3, pp.405-439. (the standard critique of Piore and Sabel). Globalisation: a) For the political economy debates see: Dicken, P. (1998) Global Shift: Transforming the World Economy (3rd edition) London: Paul Chapman. Chapter 2 “The changing global map: Trends in production and trade” pp.16-46. and Prologue of Pt.1 pp.91-96. See also pt. 3 for some sectoral examples. (balanced overview) Hirst, P. and Thompson, G. (1999) Globalisation in Question (2nd edition) Malden: Polity Press. Chapter 1 “Globalisation: A necessary myth?” pp.1-18; Chapter 2 “Globalisation and the history of the international economy” pp.19-65. (the best known critique of globalisation). Sutcliffe B and Glyn A. “Still underwhelmed: indicators of globalisation and their misinterpretation” Review of Radical Political Economy, 1999, Vl 31, No 1, pp.111-37. (excellent statistics) Kaplinsky, R. “Is globalization all it is cracked up to be?” Review of International Political Economy, Vol. 8, No.1, Spring 2001, pp.45-65 (on the implications of bringing China and India into the global system). b) For the business school debates see: Levitt, T. (1983) “The Globalisation of markets”, Harvard Business Review, May/June 1983, Reprinted in DeWit, B. and Meyer, R. (1999) Strategy: Process, Content and Context, (1999, 2nd edition) pp.733-741. (The original statement about globalisation of markets). Bartlett, C and Ghoshal, S. (1995 2nd edition) Transnational Management: Text, Cases, and Readings in Cross-Border Management, RD Irwin Inc. Chapter 5 “Transnational management”; also reprinted in DeWit and Meyer (1999, 2nd edition) Strategy: Process, Content and Context, pp.785-801. (on the complications of running an international company) Week 16 - 13th February Meso analysis: production chain v sector matrix Select at least 1. Various positions on chain and matrix: Porter, M. E. Competitive Advantage (1985), chap 2 “the value chain and competitive advantage” New York: Free Press, pp. 13-61 (started it all) Gereffi, G. Korzeniewicz, M. and Korzeniewicz, R. (1994) “Introduction: global commodity chains” pp. in Gereffi, G. and Korzeniewicz, M. (eds) Commodity Chains and Global Capitalism, London: Praeger (political economy takes up chains). Froud, J. Haslam, C. Johal S. and Williams K. (1998) “Breaking the chains? A sector matrix for motoring” Competition and Change, vol. 3. no 3, pp. 293-334 (a different way of thinking, illustrated by cars) Week 17 - 20th February Financialisation Macro analysis (b) capital market, shareholder value and The February 2000 special issue of Economy and Society is a standard political economy introduction to shareholder value and financialisation –available via metalib. As well as the three articles cited below it includes articles by Morin and Juergens which cover change in France and Germany and a full length introduction by Williams which provides an overview of the issues. Froud J., Haslam C., Johal S. and Williams K. (2000) “Shareholder value and financialization: consultancy promises and management moves”, Economy and Society, Vol. 29, No 1, February 2000, pp 80-110. (on the difficulty of generating EVA). Lazonick, W and O’Sullivan, M (2000) “Maximising shareholder value: A new ideology for corporate governance” Economy and Society Vol. 29, No.1 Feb 2000, pp.13-35. (on US corporations and “downsize and distribute”). 10 Boyer, R (2000) “Is a finance-led growth regime a viable alternative to Fordism? A preliminary analysis” Economy and Society Vol. 29, No.1, pp.111-145. (theoretically important contribution on the dynamics of a wealth-based growth regime). Shiller R J (2000), Irrational Exuberance, Princeton:Princeton University Press, chap 1 (pp.3-14) on current stock prices, chap 9 (pp.171-190) attacking efficient markets, chap 11 conclusion (pp.203-233) (a cogent statement from the behavioural finance camp) On measures of success after financialisation: Stern, J. and Chew, D. (1998 3rd ed.) The Revolution in Corporate Finance Oxford: Blackwell. Read: Stern, J, Stewart III, J. and Chew Jr., D. “The EVA financial management system” pp.474-488. (about selling EVA). Kay, J. (1993) Foundations of Corporate Success, Oxford: Oxford University Press, chap 1 “the structure of strategy” (pp.3-18); chap 2 “adding value” (pp19-32) and chap 13 “the value of competitive advantage” (pp.192-218) (Prestigious English attempt to define success in terms of abnormal profit i.e. “added value”). Week 18 - 27th February Restructuring for capital and against labour Select at least 1 from: Jensen, M. (1998) “The takeover controversy: analysis and evidence”: in Stern, J.M. and Chew, D.H. (eds), The Revolution in Corporate Finance (3rd edition, 1998) Oxford: Blackwell, pp.351-377. (disciplining managers, from an agency point of view). Shleifer A. and Summers L H (1988) “Breach of trust in hostile takeovers” in Auerbach, A. J. (ed) Corporate Takeovers: Causes and Consequences, Chicago: University of Chicago Press, pp.33-68. (takeover as a breach of implicit contracts with workers and suppliers). Froud, J., Haslam, C., Johal, S. and Williams, K. (2000) “Restructuring for shareholder value and its implications for labour” Cambridge Journal of Economics, Vol. 24, pp. 771-797 (using accounting data from a redistribution perspective). Froud, J, Haslam C, Johal S and Williams K (2001) “Accumulation under conditions of inequality”, Review of International Political Economy, Vol. 8, No 1, Spring, pp. 66-95 (identifies UK and US shareholders as households in the top 40% by income). Week 19 - 5th March The Banking Crisis. The readings should be read in conjunction with those on Financialization and shareholder value. CRESC (2009) ‘An alternative report on UK banking reform’, a special interest report from the Centre for Research on Socio Cultural Change. Available from the CRESC website) Bischoff, W. and Darling, A. (2009), UK international financial services –the future: A report from UK based financial services leaders to the Government, HM Treasury, London. (Available from the HM Treasury website) Wigley, B. (2008), London: winning in a changing world, Merrill Lynch Europe Limited. Week 20 - 12th March Synthesis: sustainable advantage and what management can do? 11 Assessments Coursework = 30% AUTUMN TERM - Submit ONE group report of 2,500 words (max) on a given case study. Note: the submission is dependent on an in-class, non-assessed presentation. Further information supplied during the workshops. SUBMISSION DEADLINE: 7TH Wednesday, December 2012 by 12 noon. SPRING TERM - Submit ONE essay of 2,000 words (max). The essay titles are included in this course outline. SUBMISSION DEADLINE: 22nd Thursday, March 2012 by 12 noon. Examination = 70% - Essay format during the final term. Coursework You are required to hand in TWO copies of all of your assignments and we strongly urge you to keep copies for yourself. Please consult your School of Management Student Handbook 2011/2012 for the full regulations on the submission of coursework and the penalties for late submission of work. Second submission You must submit the coursework to Moodle/TURNITIN and to the School of Management Reception. Extensions are in practice only awarded for medical reasons and require a supporting certificate. Students who fail to complete the assignment and therefore the course may not be allowed to sit the examination. You will be expected to plan ahead for any illnesses or personal issues that may occur between the start of the course in September and the submission date in March. Any short-term illnesses or personal issues, or any illnesses or personal issues of which the UG office are unaware will not be accepted as an excuse for an extension. Extensions are given only for certificated medical reasons, for long term medical conditions known to the UG office, or for long term personal issues known to the UG office. You are invited to see the lecturing staff about the assignment at any point after the beginning of the course, and you are advised not to leave enquiries to the last few weeks of the spring term. Try and plan your reading and research well in advance of the submission date, and plan for events such as short term illness. Please note that, as a rule, the week 12th March to 16th March is the last week for making appointments to discuss the assignment. Lecturers may judge that consultations will be too near completion to be of value. Examination The paper will contain 2 sections –not necessarily of equal length –and you are required to answer at least one question from each section. The three-hour examination requires three essay style answers chosen from an unseen exam paper containing eight questions within 2 sections. The examination is sat during the Examination Term (May and/or June). 12 Recommended textbook The second term’s readings are widely dispersed although Froud et al (2006) Strategy and Financialization: Narrative and Numbers, Routledge, provides coverage of many second term topics. Reading articles from journals like the Harvard Business Review, Business History/Review, Competition & Change and Economy & Society (via EBSCO), magazines like Business Week and The Economist, and newspapers like The Financial will add to your background knowledge. N.B. Please ensure that you keep all course outlines as they will prove valuable in obtaining exemptions for postgraduate qualifications, e.g. CIMA and useful for future employers. Note that the Department only keeps previous year's outlines for a limited period. Current outlines and other course materials are available from the School of Management Web Site - http://www.ms.rhbnc.ac.uk/courses/index.htm ESSAY Questions for the Spring term: select ONE question and submit a 2,000 word process essay. 1. Critically examine how a ‘sector matrix’ framework is useful for analysing demand and supply linkages. Use two contrasting examples. 2. To what extent does restructuring transform corporate market and financial performance? Discuss using an extended example. 3. Use an example to discuss the view that financialization creates a ‘discrepancy between promise and outcome’ (Froud et al., 2006) in the corporate sector. 4. To what extent is the pursuit of shareholder value and the ‘new economy’ boom connected to the process of ‘Financialization’? Discuss the implications of institutional investor behaviour on corporate strategy and performance? (These essay questions are from section B of last year’s MN220 exam paper). 13