Market Performance in the Era of Buy Local

advertisement

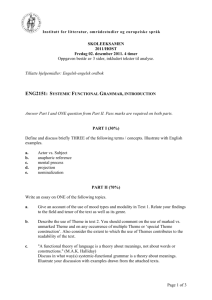

Market Performance in the Era of Buy Local: A Welfare Analysis of Colorado Apples to Assess Winners and Losers Wenjing Hu, Dawn Thilmany McFadden, Yuko Onozaka and Dustin L. Pendell2 Colorado State University and UiS Business School, University of Stavanger, Norway . CSU Working Paper The authors wish to acknowledge funding support from USDA-CSREES NRI Project #2008-35400-18693 and the Colorado Ag Experiment Station. Market Performance in the Era of Buy Local: A Welfare Analysis of Colorado Apples to Assess Winners and Losers Abstract The widespread emergence of state-based and other local labeling programs is one signal of the general acceptance that consumers value such indicators. Subsequent discussions of the benefits, tradeoffs or market performance implications of such marketing strategies are now prevalent. This study focuses on the fresh apple market, and assesses the market dynamics and welfare effects in the presence of differentiated markets for locally grown products within direct markets as an alternative to shipping points for conventional retailers using an equilibrium displacement model. The markets are segmented for demand and supply; first by estimation of stated consumer valuations of regional-origin labeling (demand side), and then, by estimated differential costs and intermediate prices in marketing channels (supply side). The results show that, in the long run, consumers would shift their demand toward local apples and the increased share of locally produced apples would be marketed directly rather than through conventional supply chains. Although suppliers who continue marketing through shipping points would lose in the short run, all local suppliers would gain in the long run. These results suggest market incentives will encourage integration of local produce into more retail food supply chains. Key Words: local food promotion, marketing channels, welfare analysis, apple markets, equilibrium displacement model 2 1. Introduction There is a growing public interest in localized food systems since localization activities are perceived to impact several key issues including: improving environmental outcomes, more localized control of food-security to address anti-corporate sentiment, and supporting community-based economic development strategies (Martinez et al., 2010). In recent years, the local foods movement was ranked as a top story by several relevant media outlets, including the Packer and The National Restaurant Association’s annual What’s Hot list (Galbraith, 2011). Subsequently, there are an increasing array of policies and programs targeted to support the development of local food systems (a listing of federal programs are now compiled at the U.S. Department of Agriculture’s Know your Farmer, Know your Food website), but critics note that such programs are being put forth without adequate evaluation of how local foods will affect market performance and the welfare of key stakeholders. Within markets, the interest and promotion surrounding local foods has significantly increased the demand for local produce (Adelaja et al., 1990; Carpio and Isengildina-Massa, 2009; Costanigro et al., 2011). The structure of markets has also been affected, as demand has stimulated a proliferation of localized, direct marketing supply chains linking growers directly to consumers, such as farmers’ markets and community supported agriculture organizations, farm stands and on-farm sales. According to the 2007 Census of Agriculture, direct sales of agricultural products for human consumption amounted to $1.2 billion in 2007, a 117.79% increase in sales from 1997, but still only 0.4% of total agricultural sales; moreover, many believe those numbers are significantly below the volume of sales now occurring in direct, and locally-focused markets. 1 One driving motivation for the locally-focused policies and programs relates to potential gains to producers, consumers and local markets from having more food choices available. There are some studies that have investigated the impacts of a more localized food system on market players. However, most of these studies were based on surveys of markets and consumers and data from sales/financial reports. (Brown and Miller, 2008; Darby et al., 2008; Myers, 2004). More recently, studies have evaluated the impact of local promotions using more theoretically-based economic models (e.g., Carpio and Isengildina-Massa, 2010). However, with a focus primarily on consumers’ responses to promotions of local or state-based labels, such studies may neglect supply side implications related to the restructuring of supply chains. This study contributes to the literature by filling this gap using a system-wide economic approach which examines how consumers’ response and the restructuring of the supply chain affect the welfare of consumers and suppliers. In particular, we aim to answer the following questions regarding the impacts of the introduction of local labeling: How do consumers and suppliers respond to the local labeling efforts? What would the new structure of demand and supply markets look like given such responses? What will be the supply chain-wide economic impacts of a local labeling program? Does the potential for targeted, differentiated pricing strategies encourage some producers to redirect their supply to segmented marketing channels to optimize potential profits? To answer these questions, the structural and performance dynamics of fresh apple markets is investigated, while accounting for demand shocks due to the introduction of local labeling by segmenting markets by product origin. The marketing channels on the supply side are segmented to include direct, short supply 2 chains, in addition to the more conventional grower-shipping point-terminal market-retail chain. Such delineation allows one to determine how more localized systems influence the dynamics of market and evaluate the performance of markets in the face of increasing consumer demand. The results from this study will also contribute to the literature by providing insights on how strong consumer responses to local produce offerings (albeit among a relatively small set of buyers) may affect market dynamics. By allowing for segregated markets, akin to what occurs more formally with organic produce, both the conceptual and empirical framework provides a method to analyze welfare effects within a more differentiated food system. The analysis of such delineated market system requires a great deal of detailed information for each segment of the market. Consequently, this study focuses on a generalized U.S. and Colorado fresh apple markets. Focusing on fresh apple market has several advantages. Apples are generalizable to many different countries and regions, as it is one produce category in which cultivation is possible within diverse geographic locations. Thus, more localized supply is plausible in terms of growing conditions, although economic feasibility of such production is a question explored in this study. In case of U.S., local and regional production areas still remain in most states, but generally, with reduced volume since most areas did not fare well in the face of competition from global trade partners and dominant U.S. production areas in the late 1990’s. The state of Colorado exhibits these typical trends—high consumption of fresh apples, dominant presence of apples imported from outside of Colorado, shrunken but increasing production of state apple production, the presence of direct marketing channels, and state 3 program to promote Colorado grown fresh produce. Thus, Colorado can arguably be considered as a “representative” case of local apple market. The unique characteristics of apples are also considered in the local vs. non-local context. Apples are not highly perishable, so that the local harvest can be stretched across a longer season with some post-harvest handling. On the other hand, supply response is constrained by the long lead time for apple orchard establishment, thus, consideration of short- and long-run market adjustment is important. It is also worth noting that fresh produce is a category gaining particularly high attention from consumers, producers, government agencies, and media in the context of food miles and the local food movement (Thilmany McFadden and Low, 2012). Thus, impacts from shifting to more regionalized market in fresh produce category is of great interest to many stakeholders. 2. Background and Previous Research U.S. Apple Market U.S. apple production was 9,515 million pounds in 2008, and was commercially valued at $2,206 million in revenue. The U.S. was the third largest among global producing countries after China and EU, accounting for 6.4% of world apple production. In 2008, 34% of U.S. produced apples were processed to make juice, applesauce, cider, and other processed products, but the majority of U.S. production (66%) entered the fresh market. In 2008, apples ranked first in fresh fruit consumption, at 16.2 pounds per capita (U.S. Department of Agriculture: Economic Research Service, 2012). Apples are grown in all 50 U.S. states, however, Washington is the largest fresh apple supplying state, accounted for 72% of domestic supplies (U.S. Department of Agriculture: Economic Research 4 Service, 2012). The apple industry has been shrinking in most states since the late 1990s under the pressure of global competition. Colorado’s production of apples for 2008 was reported at 18 million pounds, including the supply of apples that were directed to fresh market sales (10 million pounds). In short, production could no longer meet the demand of over 5 million Coloradans (81 million pounds if one just considers fresh apples), but current supplies of fresh apples are mostly marketed in-state to fill 12% to 13% of current fresh demand. As is the case with most product categories, the conventional supply chain for U.S. fresh apples includes growers, packers, shippers, processors, brokers, and retailers. However, because apples are not as perishable as some other crops, they can be marketed over a longer season using controlled atmosphere (CA) storage. There are still fairly competitive market conditions as packers and marketers sell their apples to retailers on the spot market (Lynch and Coleman, 2010), while big retailers like Wal-Mart and Costco use contracts with large suppliers to ensure year-round supplies. According to Gomez (2010) and Pirog and Tyndall (1999), the production in main consumption areas such as Iowa was mainly consumed within state through direct sales such as farmers’ markets, while the apples produced in main production regions such as Washington and New York were mainly exported or shipped to other states through packers and shippers. Still, this market structure’s flexibility has allowed for the apple market to revert to more localized sourcing conditions for short seasons in a number of places in the country. Thus, the interaction between Colorado and the U.S. apple market is a representative case study to examine effects of a localized marketing strategy. Impacts of Local Promotion 5 Local promotion programs have not only increased consumers’ demand for local produce, but also stimulated the spread of more localized supply chains. There are a few veins of literature that examine the impacts of farmers’ markets and CSAs on producers, consumers, and communities (Brown and Miller, 2008; Darby et al., 2008; Henneberry et al., 2008; Myers, 2004) using surveys of markets and consumers and data from sales/financial reports. Carpio and Isengildina-Massa (2010) were one of the first to go a step further in exploring the welfare implications of any potential shifts to more locally marketed foods using a quantitative model based on economic theory. We follow their lead in estimating these same effects, but for a more specific food category, apples, and further delineating changes in the structure of marketing channels. Preference for local attributes There is a significant amount of work that has been conducted to investigate consumers’ demand for local produce. According to Adams and Salois’ (2010) review of literature on consumers’ perceptions and willingness to pay (WTP) for local and organic food characteristics, studies started to find that consumers were willing to pay a higher premium for local than for organic attributes as early as the late 1990s. In the early 2000’s, Loureiro and Hine (2002) and Mabiso et al. (2005) found consumers were willing to pay more for local potatoes and apples labeled “U.S.A. Grown”, respectively. In later studies, Darby et al. (2008) and Hinson and Bruchhaus (2005) found that the majority of respondents were willing to pay a premium for locally produced strawberries. In a more broadly framed study, Carpio and Isengildina-Massa (2009) found that 95% of South Carolina consumers prefer state-grown produce to all types of domestic produce, and 78% and 30% of consumers chose state-grown produce at a 5% and 50% 6 premium level, respectively. The resulting estimated mean WTP premium for South Carolina grown produce was 27.5%. More specific to this study, Onozaka and Thilmany McFadden (2011) found that U.S. consumers had a strong positive preference for local apples averaging a WTP of $0.22/lb or $0.24/lb premia with respect to domestic apples, depending on the marketing channel where they were purchased. In a complementary project, Costanigro et al. (2011) found the average premium for the local apple attribute was 101% in a store experiment. Equilibrium displacement model An equilibrium displacement model is a commonly used method to analyze the impacts of exogenous shocks such as measuring the performance of food programs and policies (e.g. Brester et al., 2004; Carpio and Isengildina-Massa, 2010; Lusk and Anderson, 2004; Thompson et al., 2005). Lusk and Anderson (2004) and Brester et al. (2004) examined the welfare effects of the Country-of Origin Labeling (COOL) program in the livestock industry. Thompson et al. (2005) used an EDM to assess the direct and distributional effects of state-financed quality control and regional origin assurance programs in Bavaria so they were required to separate the market into two regions. Using an EDM, it is relatively easy to deal with substitution among markets and segmented markets by examining multiple stages in the supply chain as well as multiple markets (Burrell et al., 2006), but this study is one of the first to say a producer redirecting some of their production to direct sales, which represents a new marketing channel. Although EDMs have been widely used in assessing the effects of food programs and policies, there have been a very small number of examinations of the performance of local promotion programs. One example is Carpio and Isengildina-Massa (2010)’s 7 evaluation of the potential economic impacts of a regional promotional campaign in South Carolina. They disaggregated the markets into two segments: locally labeled and marketed and mass marketed with no designation of production source. Carpio and Isengildina-Massa (2010) provided a good starting point of reference to evaluate the effects of local promotion programs; however, there are some limitations in their research. First, the parameters used in their study were mostly aggregate demand and supply parameters, such as demand and supply elasticities for fruits and vegetables, which made it difficult to estimate the parameters accurately and lowered the precision of the estimation of welfare changes. Second, they only differentiated on the demand side and did not segment the markets in the supply side (thereby assuming the costs of marketing two different ways would not vary). However, the demand shock due to the local campaign will not only affect the performance of the local market, but also change the structure of local marketing channels. Thus, this study will further their research in a number of ways: by investigating a specific market, the fresh apple market in Colorado, and segmenting by marketing channels on the supply side, and with more differentiation between short- and long-run scenarios. 3. Methodology An equilibrium displacement model (EDM) is developed for Colorado fresh apples and used to analyze the impacts of local labeling. This study will segment markets by estimation of increased consumer valuation due to regional-origin labeling with quality control on the demand side as well as realizing differential costs and prices in marketing channels on the supply side. Several assumptions for the apple market and marketing 8 channels are made in order to implement this EDM: all locally labeled apples are consumed in Colorado; the effects of the local marketing initiatives are concentrated in Colorado; Colorado apples and domestic apples are weakly separable; apples marketed through different market channels are weakly separable; Colorado supplies of Colorado produced fresh apples can be marketed directly in local markets or marketed through shipping points in or outside the state; and, domestic apples (from other regions of the U.S.) can only be marketed through shipping points and cannot enter direct markets.1 The economy is separated into two regions: Colorado (Region A) and the rest of the United States (Region B) which has supply and demand relationships with the Colorado apple sector. The EDM framework specifies demand and supply equations for each region, market clearing conditions and price relationships (price margins), yielding a total of 13 linear equations. The structural model can be described as follows: Region A (Colorado) Demand: (1) 𝐷𝐴𝑙 = 𝐷𝐴𝑙 (𝑃𝐴𝑙 , 𝑃𝐴𝑑 , ∝𝑙 ) (2) 𝐷𝐴𝑑 = 𝐷𝐴𝑑 (𝑃𝐴𝑙 , 𝑃𝐴𝑑 , ∝𝑑 ) Supply: (3) 𝑆𝐴𝐹 = 𝑆𝐴𝐹 (𝑃𝐴𝐹 , 𝑃𝐴𝑆 ) (4) 𝑆𝐴𝑆 = 𝑆𝐴𝑆 (𝑃𝐴𝐹 , 𝑃𝐴𝑆 ) (5) 𝑆𝐴𝑆𝐴 = 𝑆𝐴𝑆𝐴 (𝑃𝐴𝐹 , 𝑃𝐴𝑆 , 𝑃𝐴𝑙 , 𝑃𝐴𝑑 , 𝑃𝐵𝑑 ) Region B (rest of the United States) Demand: 1 More complete details are available in Hu (2012) 9 𝐷𝐵𝑑 = 𝐷𝐵𝑑 (𝑃𝐵𝑑 ) (6) Supply: 𝑆𝐵𝑆 = 𝑆𝐵𝑆 (𝑃𝐵𝑆 ) (7) Market-Clearing Conditions (8) 𝐷𝐴𝑙 = 𝑆𝐴𝐹 + 𝑆𝐴𝑆𝐴 (9) 𝐷𝐴𝑙 + 𝐷𝐴𝑑 + 𝐷𝐵𝑑 = 𝑆𝐴𝐹 + 𝑆𝐴𝑠 + 𝑆𝐵𝑠 Price Relationships (10) 𝑙 𝑃𝐴𝑑 (1 + 𝑡𝐴−𝐶𝑂 ) = 𝑃𝐴𝑙 (11) 𝑑 𝑃𝐵𝑑 (1 + 𝑡𝐴−𝐶𝑂,𝑈𝑆 ) = 𝑃𝐴𝑑 (12) 𝐹 ) = 𝑃𝐴𝐹 𝑃𝐴𝑆 (1 + 𝑡𝐴−𝐶𝑂 (13) 𝑆 𝑃𝐵𝑆 (1 + 𝑡𝐴−𝐶𝑂,𝑈𝑆 ) = 𝑃𝐴𝑆 The price parameters 𝑃𝑖𝑘 , k=l, d, F, S; i=A,B are derived from different sources to construct the demand and supply equations where l and d denotes local and domestic, respectively; F and S denotes apples marketed through direct markets and through shipping points, respectively; A and B denotes Colorado and the rest of the United States, respectively. ∝𝑘 represents demand shifters for differentiated apples related to attributes that consumers perceive through the local labeling efforts. 𝐷𝑖𝑘 and 𝑆𝑖𝑘 represent the 𝑙 demand and supply for apples through channel k in region i, respectively. 𝑡𝐴−𝐶𝑂 is the 𝑑 market margin between farmers’ market and retail market in Colorado. 𝑡𝐴−𝐶𝑂,𝑈𝑆 is the 𝐹 market margin between Colorado and domestic retail markets. 𝑡𝐴−𝐶𝑂 is the supply price difference between selling in direct markets and selling to shipping points in Colorado (if, 10 empirically, such a difference is found to exist in spatial analysis of market prices). This is confirmed in Gomez (2010) that the producers’ share of the retail dollar was 80% with direct marketing in New York, while the shares of Washington and New York suppliers 𝑆 for conventional supply chain are 35% and 47-60%, respectively. 𝑡𝐴−𝐶𝑂,𝑈𝑆 is the supply price difference between Colorado and domestic shipping points. All variables and parameters for the structural model are defined in Appendix A. It is important to note that equation (5) shows that the supply for Colorado apples marketed through shipping points and shipped back to Colorado (SASA) is a function of direct market price (𝑃𝐴𝐹 ), Colorado shipping point price (𝑃𝐴𝑆 ), farmers’ market price for local apples (𝑃𝐴𝑙 ), domestic apple retail price in Colorado (𝑃𝐴𝑑 ), and domestic apple retail price in the rest of the United States. (𝑃𝐵𝑑 ). 𝑃𝐴𝐹 and 𝑃𝐴𝑆 determine whether to market direct or through shipping points. Then processors need to decide whether it is economical to ship apples back to Colorado or to other states (since we assume they will not be differentiated as Colorado grown once they are in wholesale channels). The share of apples marketed through different channels ultimately depends on the farmers’ market price of local apples and the prevailing domestic apple retail price. In equilibrium, the demand for local apples in Colorado equals the supply of Colorado apples in direct markets plus the supply of Colorado apples through shipping points to Colorado, which means 𝐷𝐴𝑙 = 𝑆𝐴𝐹 + 𝑆𝐴𝑆𝐴 (equation (8)). In the equilibrium, total apple demands equals total apple supply (since we assume no imports or exports of fresh apples and all apples produced in a harvest year are consumed in the same year and no storage will enter the market of next year) (equation (9)). 11 Totally differentiating equations (1)-(13) yields the EDM of the apple market. The EDM can be found in Appendix B (see equations B.1-B.13). All variables and parameters for the EDM are defined in Appendix A. Specifically, 𝛾 = 𝑑𝑙𝑛(∝𝑙 ) represents the increase in consumer demand for local apples resulting from local labeling efforts. 4. Model Inputs Prices and quantities The Colorado farmers’ market apple price is used to represent the “retail” price of local apples and the fresh Red Delicious apple retail price in Southcentral retail market (which includes Colorado) is used to represent the conventional retail price of domestic apples in Colorado. The Red Delicious apple is chosen due to its market share dominance in the apple market and the consistent availability of price data. The Red Delicious apple price in the Northwest retail market is used to represent the retail price of domestic apples in the rest of the U.S. based on the results from complementary retail market relationship analysis (Hu, 2012). Although the Southwest market was a market leader in the price formation of all other retail markets, it is not chosen due to the limited production of Red Delicious apples in that region. The Northwest retail market significantly affected the price formation process of other retail markets except the Southeast market. More importantly, the Northwest region is the main production area for fresh apples in the U.S. The direct market price is represented by the Colorado farmers’ market apple price. Due to the lack of Colorado shipping point price data, the Colorado shipping point price is estimated using the Washington shipping point price for Red Delicious apples 12 and chosen based on its dominant market position (Hu, 2012), the relatively short distance to Colorado compared to other major production regions, and the consistent availability of data in that series. Weekly shipping point price, retail price and domestic truck rate report data for fresh Red Delicious apples are collected from USDA’s Agricultural Marketing Service (U.S. Department of Agriculture: Agricultural Marketing Service, 2012). Weekly Colorado farmers’ market prices are collected from Colorado State University Extension’s Fresh Produce and Meat Market Reports (2012). Weekly Midwest, Rocky Mountain, East Coast, and West Coast on-highway diesel fuel prices are collected from the U.S. Energy Information Administration (2012) to adjust the shipping point price to account for direct transportation costs. The seasonal Colorado farmers’ market price only covered a period from August to October, 2011, so the farmers’ market price is only used as base price for estimation of price relationship parameters to populate the EDM. Based on estimates outlined in Table 1 using data described in Appendix A, the production and consumption levels for the rest of the country are estimated as 6,235 (SBs) and 4,851 million pounds (DBd), respectively. Since there are no reported data on the volume of directly marketed apples in Colorado, the amount of directly marketed apples is estimated based on the proportion of directly marketed fruits in Colorado (see Hu, 2012 for more details on estimation). Similarly, the consumption of local apples in Colorado is calculated using the proportion of local food sales through all channels within the U.S. The resulting estimates of locally 13 marketed demand and supply are given in Table 1. 2 The estimated production and consumption levels of apples used in the simulation of EDM are shown in Table 2. Price premium & market margin The price premium between local and domestic apple prices is estimated based on the price difference between farmers’ markets and retail markets: (14) 𝑙 𝑡𝐴−𝐶𝑂 = 𝑃𝐴𝑙 𝑃𝐴𝑑 3.35 − 1 = 1.61 − 1 = 1.08. Table 3 presents the market margins estimated between the Colorado retail market and domestic retail market, the Colorado shipping point (if it were to exist) (𝑃𝐴𝑆 ) and the domestic shipping point (𝑃𝐵𝑆 ). Given those estimates, the resulting supply price difference between selling in Colorado farmers’ markets (𝑃𝐴𝐹 ) and selling to Colorado shipping 𝐹 points (𝑃𝐴𝑆 ) is estimated as 𝑡𝐴−𝐶𝑂 = 0.89. Upper and lower bounds for the marketing margin are only estimated for the short-run scenarios. In the long run, all transaction costs and other factors that affect the price difference can be adjusted, thus the price difference is assumed to be constant and the average value of the lower and upper bound is used. More details of the estimation are available in Hu (2012). The estimated market shares and price margins are shown in Table 3.Demand elasticities The demand for apples in Colorado that differentiate local and domestic origins was first estimated in a 2008 national survey data from Onozaka et al. (2008) which utilized to 2 Although the Census of Agriculture is available for 2007, the production and consumption of fresh apples are estimated for 2008 and the proportions of direct marketed apples and consumption of local apples are assumed to be stable from 2007 (when Census data was available) to 2008. 14 estimate the WTP and market share for local and domestic apples in Colorado. 3 The estimation shows that the demand for fresh local apples in Colorado is a kinked demand curve due to segmentation of consumers in the market (Figure 1). The horizontal axis is the market share of consumers who would purchase local apples under a specific price. As we can see in Figure 1, the kinked point is at price level of $1.80/lb and is close to the prevailing retail price of conventional Washington Gala apples given in the survey’s choice experiment ($1.89/lb). If the local apple price is lower than the kinked point (i.e., the price of local apples is lower than the price of domestic apples), almost all consumers would buy local apples. However, if local apple price is higher than the kinked point (i.e., the price of local apples is higher than the price of domestic apples), only a segment of the consumers would buy local apples. Figure 2 suggests that about ten percent of consumers are relatively insensitive to price changes, indicating they are relatively loyal local apple consumers. This is consistent with the results given in Onozaka, Nurse and Thilmany McFadden (2011) that 11% of the sample in 2008 survey shop at direct markets where locally grown products are sold. It is interesting to note that the premium suggested by the 11% representative consumer in the 2008 survey data ($1.00/lb) is close to the premium estimated by actual prices paid given historical price data ($0.81/lb). Given the kinked demand that is revealed, we infer that this EDM analysis may need to be handled differently than what is commonly done, which inherently serves as a form of sensitivity analysis. The two separate EDMs will be estimated, one shocked at 3 Details of the data and estimation results can be found in Onozaka and Thilmany McFadden (2011). 15 the median consumer level (median market buyers, or MMB) and one at an 11% market share level of direct market (current market buyers, or CMB). Subsequently, a premium of WTP for local apples with respect to domestic apples is set as $0.20/lb and $1.00/lb. Based on the 2008 mean price in Southcentral and Northwest retail markets, the base prices of domestic apples in Colorado and other states are set as $1.61/lb and $1.56/lb, respectively. 4 The own price elasticities are derived through the formula: (15) 𝜀ℎ𝑖𝑖 = ∆𝑀𝑎𝑟𝑘𝑒𝑡 𝑆ℎ𝑎𝑟𝑒 𝑖 ∆𝑊𝑇𝑃𝑖 𝑊𝑇𝑃𝑖 ∗ 𝑀𝑎𝑟𝑘𝑒𝑡 𝑆ℎ𝑎𝑟𝑒 𝑖, while the cross-price elasticities are estimated using: (16) ij εh = ∆Market Share i ∆WTPj WTPj * Market Share i . The distribution of estimated individual-level WTP among Colorado consumers compared against respondents from the remainder of the U.S. were not found to be significantly different in the 2008 survey data, thus, domestic own price elasticities in Colorado and the rest of the country are assumed to be the same. Demand shocks The WTP for local apples with respect to domestic apples is based on the premium estimated by Onozaka and Thilmany McFadden (2011) at $0.20/lb for MMB and 4 The premium suggested by the median representative consumer premium of WTP in 2008 survey data ($0.20/lb) is different from the premium estimated through historical prices ($0.81/lb). This may reflect the specific situation of Colorado, where supply of local apples could not meet the demand for local apples which drives up the price of local apples and above median consumers’ willingness to pay, so that supplies go to the most fervent local consumers. 16 $1.00/lb for CMB. The introduction of the local label is assumed to be an exogenous shock (𝛾) because the production source was not known by consumers before local labeling programs were established and promoted (and the gain from that new labeling effort was the justification many states made for the development of state programs). Demand shocks are calculated based on the following formulas: (17) 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 𝛾 = − 𝑑𝑜𝑚𝑒𝑠𝑡𝑖𝑐 𝑝𝑟𝑖𝑐𝑒 ∗ 𝜀𝐴𝑙𝑙 = 0.019 Median Market Buyers (MMB) and (18) 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 𝛾 = − 𝑑𝑜𝑚𝑒𝑠𝑡𝑖𝑐 𝑝𝑟𝑖𝑐𝑒 ∗ 𝜀𝐴𝑙𝑙 = 0.372 Current Market Buyers (CMB). Supply elasticities On the supply side, elasticities are estimated in two steps following Alston, Norton, and Pardey (1995). First, decomposed supply elasticities for Colorado (𝛽𝐴 ) and other states (𝛽𝐵 ), together with the supply elasticity of apples produced and consumed in Colorado and marketed through shipping points (𝛽𝐴𝑆𝐴 ), are estimated based on Armington (1969) and following Alston, Norton, and Pardey’s formula (1995). Second, further decomposed supply elasticities are estimated using the aggregate elasticities estimated in the last step. The second step is mainly based on Armington’s formula (1969) using parameters defined in Tables 1-4 and Table A.1: 𝑖𝑗 (19) 𝐷𝑖 (𝜌 𝛽𝐴 = 𝜔𝐴𝐴 𝑖 𝛽𝐴 + 𝜏) − 𝛿𝑖𝑗 𝜏 (20) 𝐷𝑖 (𝜌 𝛽𝐵 = 𝑤𝐵𝐵 𝑖 𝛽𝐵 + 𝜏) − 𝛿𝑖𝑗 𝜏 𝑖𝑗 i=S,F,SA i=S,F. Both short- and long-run scenarios are considered in this study. Based on the available data in the 2008 survey, the demand parameters in both the short- and long-run models are assumed to be identical. In contrast, the supply elasticities are different for the 17 short and long run. For the long-run EDM, the aggregate own-price supply elasticity (β) is chosen to be 1.0 based on previous literature and economic theory (Carpio and Isengildina-Massa, 2010; Chavas and Cox, 1995). In the short run, when producers have a limited ability to react to changes in demand by changing their supply, the aggregate own-price supply elasticity is chosen to be 0.44 based on Chavas and Cox’s estimation. The elasticity of transformation (𝜏) is included to ensure local marketed apples and apples marketed through shipping points are treated as substitutes delineated by marketing channel (following Carpio and Isengildina-Massa (2010) which is -0.5 in short run and 1.8 in long run. δij is the Kronecker delta (𝛿𝑖𝑗 = 1 when i=j; 𝛿𝑖𝑗 = 0 when i≠j). The expansion elasticity of directly marketed apples (𝜌𝐹 ) is assumed to be 0.5 in short run and 1.0 in long run. Apples marketed through shipping points have expansion elasticities that are recovered from equations (21) and (22) (James and Alston, 2002): (21) (22) 𝐷𝐹 𝐷𝐹 𝜌𝑆 = (1 − 𝜌𝐹 ∗ 𝜔𝐴𝐴 )/(1 − 𝜔𝐴𝐴 ) 𝑆𝐹 𝑆𝐹 𝜌𝑆𝐴 = (1 − 𝜌𝐹 ∗ 𝜔𝐴𝐴𝑙 )/(1 − 𝜔𝐴𝐴𝑙 ). 5. EDM results The price, quantity and changes in producer welfare due to new local labeling efforts and promotions are presented in Table 4. Two scenarios were considered. The first scenario was assuming a “fixed supply,” which analyzed the effects in the very short run when suppliers could not react to the increase in consumer demand. In this scenario, the increase in producer welfare was only due to the price change. The second scenario allowed for “elastic supply”, which analyzed the effects in a relatively long run when suppliers could react to the shocks in consumer demand. In this scenario, both the prices 18 and quantities adjusted to demand shifts. Within each scenario, simulations based on MMB and CMB are presented. Local labeling increases consumers’ WTP for local apples relative to domestic apples in Colorado, and subsequently, the supply price for direct markets increases (by 67.67% in the short run, and 128.82% (MMC) and 115.33% (CMB) in the long run) compared to the supply price for shipping points, which decreased by 21.33% in short run and increased by 39.82% (MMB) and 26.33% (CMB) in the long run. Subsequently, in Colorado, demand for both local and domestic apples increases in the long run (by 12.07% (MMB) and 10.78% (CMB) for local apples, 874.14% (MMB) and 63.48% (CMB) for domestic apples. The increase is larger for domestic apples partially due to the currently low production capacity of Colorado, which cannot meet the state demand. On the supply side, the increase in the direct market price compared to the shipping point price lead the Colorado supply for direct markets to increase by 230.97% (MMB) and 206.84% (CMB) relative to the supply for shipping points, which decreases in the long run by 62.33% (MMB) and 65.17% (CMB). In terms of producer welfare, Colorado suppliers for direct markets gain ($0.58 million) while Colorado suppliers for shipping points lose ($1.37 million to $1.52 million) in the short run. In the long run, however, both suppliers will gain, but the suppliers for direct markets will gain more (over $2 million) than the suppliers for shipping points (over $1 million). The big loss in the short run is due to the high premium between supply price for direct market and shipping point which is based on historical price differences in these channels, and explains why many remaining Colorado orchards now focus on locallyfocused market strategies. Additionally, the high cross price demand elasticity between 19 local apples and domestic apples derived from 2008 survey data contributes to the loss. These market forces drive the shipping point price much lower, but the suppliers could not reduce supply due to “fixed supply” in the very short run. Because of the lower level of direct sales of apples in Colorado compared with supplies for shipping points, the gain of suppliers for direct markets could not offset the loss of suppliers for shipping points, but those losses may just be the persistence of broader competitive challenges small production states have faced in the apple industry. Thus, there is a big loss in Colorado in short run. The big change in prices and quantities are due to the high premium between supply price for direct market and shipping point and the high cross price demand elasticity between local apples and shipping points. Overall, there is little difference in the results for lower bound parameters and upper bound parameters partly due to their association with short run supply parameters. In the EDM, the suppliers are assumed not to be able to react to the changes in demand in the short run. However, this does not imply that the results are not sensitive to supply prices and price differences. On the other hand, most of the changes based on CMB are similar to the changes based on MMB, except the changes in Colorado demand for domestic apples. This coincides with the fact that CMB consumers are more loyal to local apples so their inelastic demand yields a larger relative shock to the demand for local apples. Again, much of the shock resonates from the significant difference in the elasticity of demand for domestic apples with respect to local apple price using CMB (inelastic) and MMB (significantly elastic). Sensitivity analysis 20 Sensitivity analysis was conducted to test the robustness of the estimated welfare measures with respect to changes in the values of the parameters. Based on the approach proposed by Zhao et al. (2000), truncated normal distributions are assigned to the twelve parameters (𝜀𝐴𝑙𝑙 , 𝜀𝐴𝑙𝑑 , 𝜀𝐴𝑑𝑙 , 𝜀𝐴𝑑𝑑 , ∆WTP, 𝛽 , 𝜏, ρ F , 𝑡𝑙 , 𝑡𝑑 , 𝑡𝐹 , 𝑡𝑆 ) which specify the possible values of each parameter and the corresponding probabilities. All other parameters are functions of these twelve parameters. There are 100,000 simulated observations and 35,201 are left for the short run and 59,933 for the long run after discarding the observations that violate the substitution restriction (see Hu (2012) for complete results). The 95% confidence intervals of the changes in producer welfare in the brackets in Table 4 show that suppliers for direct markets would always gain from local promotion efforts. Based on median consumers’ WTP, suppliers for shipping points would always lose in the short run due to the shift of demand toward local apples, and subsequently, the supply shift toward direct markets. Whether the gain by suppliers for direct markets could always offset the loss by suppliers for shipping points in the long run depends on market conditions. However, in the long run, suppliers for shipping points would more likely to gain. Most of the changes in producer welfare simulated based on the variables and parameters in Table 1-4 lie in the 95% interval. The sensitivity to individual parameter analysis shows that the changes in Colorado total producer welfare are sensitive to all parameters and the intervals show that the influence of all parameters are statistically different from zero5. The changes are most sensitive to the cross price demand elasticity between local apples and domestic apples (𝜀𝐴𝑙𝑑 , 𝜀𝐴𝑑𝑙 ), aggregate own price supply elasticity (𝛽), elasticity of transformation between 5 More complete details are available in Hu (2012). 21 marketing through direct markets and through shipping points ( τ ), and the price difference between supply price for direct markets and for shipping points (𝑡𝑓 ). The results suggest that factors connected with the substitution between local apples and domestic apples dominate the changes in producer welfare. 6. Policy Implications and Conclusions This study assesses the potential gains and losses under the policies and programs that support the revitalization of local and regional food systems by examining the impacts of changes in the Colorado apple market: a sector that has seen active relocalization as a response to its fading market share in the face of national and international competition. By integrating changes in the prices and demanded quantities of Colorado labeled apples relative to domestically produced apples, as well as changes in prices and supplied quantities of directly marketed apples relative to more conventionally marketed apples through major shipping points, the welfare changes for both consumers and producers were explored. The results show that, in the long run, consumers will shift their demand toward local apples due to increased labeling efforts, promotion and access to markets that implement local labeling (building on findings from earlier consumer analysis by Onozaka and McFadden, 2011). Increases in Colorado’s production of apples would be expected given higher prices, and also, new supplies would be marketed more directly relative to the volume marketed through shipping points due to those demand shocks. In short, the implications for Colorado producers are mixed depending on their market orientation. For this reason, our findings motivate great interest in what the 2012 Ag 22 Census will show in terms of sales growth and number of producers re-investing in specialty crop production and using more direct marketing channels. These results are interesting for several reasons. First, local labeling programs, together or in addition to an increasing number of direct markets, seem to be the mainstays of the emerging local foods movement (Martinez, et al, 2010). As a complement to work done by Carpio and Isengildina-Massa (2010), it shows there may be long term gains to producers as they strategically position some of their produce to more localized markets, thereby justifying resources invested in local promotion programs by many state Departments of Agriculture and mapping tools that create awareness of producers (e.g., MarketMaker and LocalHarvest). Second, the widespread acceptance of an emerging local food sector working alongside the conventional supply chains, in contrast to continued polarization that suggests a zero-sum game where there will be losers to offset the winners of local food gains, is precarious. We show there may be a short-run downside for the majority of producers. However, these results may be sensitive to the elasticity of transformation between marketing through direct markets and through shipping points (τ), and the price difference between supply price for direct markets and for shipping points (𝑡𝑓 ), so more empirical research on these economic forces is needed. For example, using price wedges to represent marketing costs will cause the gain to producers to be overstated due to new labeling efforts and promotional campaigns; we are currently constrained to refine such estimates by the availability of data. However, this study’s extrapolation is more careful than previous studies that assumed levels from the broader literature, since most of these parameters were derived from market-based data. Furthermore, empirical evidence from 23 local orchards in Colorado suggest that local markets are the highest margin outlets, even when marketing costs are considered, but locally-focused apple producers do concede that some of the price premia is lost to additional marketing labor and expenditures. Third, there are likely winners and losers in programs to support local foods, as is the case with many policies. When markets start to fragment, welfare analysis should be decomposed by those who are buying or selling through different channels in order to assess the winners and losers, as well as including information for policymakers to assess the net welfare change and whether prevailing market forces (i.e., strong consumer interest in product assurances) inform how public choice would guide their decisions. In the long run, consumers may “vote with their dollars” and shift to the market they feel suits them best, and in response, suppliers could realize more perfect price discrimination if they shift some of their production to other supply chains, which can be Pareto optimal. In essence, suppliers will create more refined pricing strategies with regard to different consumer groups, and redevelop marketing channels to improve on the efficiency losses inherent in more fragmented distribution systems (Martinez et al, 2010). One notable limitation of the study is that we only consider the fresh apple market, even though most state marketing programs for local foods cover the full array of food products. Although limiting our scope to a single market was necessitated by the complexity of our model, this may also explain why these welfare changes are much smaller than those reported by Carpio and Isengildina-Massa. Previous studies had to use parameter estimates that were more simplified in terms of market channels (not allowing directly marketed produce to vary from products offered in more conventional markets), which is a limitation given that WTP does seem to vary by where consumers shop 24 (Onozaka et al., 2011). This study is also constrained by the overly simplified assumption that global markets do not matter. Based on the available data, this is necessary at this point. However, given the importance of the international markets, with increasing volume and value of international trade of fresh produce, as well as the relevance of global food market in the context of local food movement, the extension of the current research to include the international market seems warranted. Despite several limitations of this research, the results and modeling efforts are readily applicable to other products and regions where parameters can vary based on the characteristics of the food product and the dynamics of the market, such as level of imports, number of areas that have a suitable climate for production, lands and facilities to produce the food, and level of processing needed. Moreover, this study provides useful insights to those who seek to analyze local food markets, or more generally, any other relocalized sectors using an EDM on the key factors that matter most such as the sensitivity of consumers’ demand for a relocalized product to the price of a conventional product, the transformation between marketing methods associated with relocalization, and the costs of switching marketing channels. 25 References Adams, D.C., Salois, M.J., 2010. Local versus organic: A turn in consumer preferences and willingness-to-pay. Renew Agr Food Syst 25, 331-341. Adelaja, A.O., Brumfield, R.G., Lininger, K., 1990. Product Differentiation and State Promotion of Farm Produce: An Analysis of the Jersey Fresh Tomato. Journal of Food Distribution Research 90, 73-85. Alston, J.M., Norton, G.W., Pardey, P.G., 1995. Science Under Scarcity: Principles and Practice for Agricultural Research Evaluation and Priority Setting. Cornell University Press, Ithaca, NY. Armington, P.S., 1969. Theory of Demand for Products Distinguished by Place of Production. Int Monet Fund S Pap 16, 159-178. Brester, G.W., Marsh, J.M., Atwood, J.A., 2004. Distributional impacts of country-oforigin labeling in the US meat industry. J Agr Resour Econ 29, 206-227. Brown, C., Miller, S., 2008. The Impacts of Local Markets: A Review of Research on Farmers Markets and Community Supported Agriculture (CSA). Am J Agr Econ 90, 1296-1302. Burrell, A., Gijsbers, G., Kosse, A., Nahon, D., Requillart, V., Zee, F.V.d., 2006. Assessment of Research Methodologies and Data Constraints: Preparatory Economic Analysis of The Value-adding Process Within Integrated Supply Chains in Food and Agriculture. European Commission. Carpio, C.E., Isengildina-Massa, O., 2009. Consumer Willingness to Pay for Locally Grown Products: The Case of South Carolina. Agribusiness 25, 412-426. Carpio, C.E., Isengildina-Massa, O., 2010. To Fund or Not to Fund: Assessment of the Potential Impact of a Regional Promotion Campaign. J Agr Resour Econ 35, 245-260. Chavas, J.P., Cox, T.L., 1995. On Nonparametric Supply Response Analysis. Am J Agr Econ 77, 80-92. Colorado State University Extension, 2012. Fresh Produce and Meat Market Reports. Fort Collins, Colorado. Online. Available at http://www.extension.colostate.edu/boulder/ag/abm.shtml#prices. [Accessed February 2012]. Costanigro, M., McFadden, D.T., Kroll, S., Nurse, G., 2011. An In-Store Valuation of Local and Organic Apples: The Role of Social Desirability. Agribusiness 27, 465-477. Darby, K., Batte, M.T., Ernst, S., Roe, B., 2008. Decomposing local: a conjoint analysis of locally produced foods. Am J Agr Econ 90, 476-486. 26 Galbraith, D., 2011. Top 10 Produce Industry Stories of 2011. The Packer. Online. Available at http://www.thepacker.com [Accessed February 2012]. Gomez, M., 2010. Moving Local Foods from Farm to Consumers: Lessons from NYS Apples. Research & Policy Brief Series, Cornell University. Henneberry, S.R., Agustini, H.N., Taylor, M., Mutondo, J.E., Whitacre, B., Roberts, B.W., 2008. The Economic Impacts of Direct Produce Marketing: A Case Study of Oklahoma’s Farmers’ Markets, Southern Agricultural Economics Association Annual Meeting. Hinson, R.A., Bruchhaus, M.N., 2005. Louisiana Strawberries: Consumer Preferences and Retailer Advertising. Journal of Food Distribution Research 36, 86-90. Hu, W., 2012. Evaluating Performance and Welfare Dynamics of Local Food Systems: The Case of Local Markets in the Colorado Apple Industry, Department of Agricultural and Resource Economics. Colorado, Fort Collins. Available at http://digitool.library.colostate.edu///exlibris/dtl/d3_1/apache_media/L2V4bGlicmlzL2R0 bC9kM18xL2FwYWNoZV9tZWRpYS8xNzE1MzE=.pdf. James, J.S., Alston, J.M., 2002. Taxes and quality: A market-level analysis. Aust J Agr Resour Ec 46, 417-445. Loureiro, M.L., Hine, S., 2002. Discovering Niche Markets: A Comparison of Consumer Willingness to Pay for Local (Colorado-Grown), Organic, and GMO-free Products. Journal of Agricultural and Applied Economics 34, 477-487. Lusk, J.L., Anderson, J.D., 2004. Effects of country-of-origin labeling on meat producers and consumers. J Agr Resour Econ 29, 185-205. Lynch, B., Coleman, J., 2010. Apples: Industry & Trade Summary. United States International Trade Commission. Commissioners: Aranoff, S.,Pearson, D. R.,Tanner Okun, D.,R. Lane, C.,A. Williamson, I.,A. Pinkert, D.,A. Rogowsky, R.,LaneyCummings, K., Washington, DC. Mabiso, A., Sterns, J., L., H., Wysocki, A., 2005. Estimating Consumers’ WillingnessTo-Pay for Country-Of-Origin Labels in Fresh Apples and Tomatoes: A Double-Hurdle Probit Analysis of American Data Using Factor Scores, American Agricultural Economics Association Annual Meeting. Martinez, S., Hand, M., Pra, D.M., Pollack.S., Ralston.K., Smith, T., Vogel, S., Clark, S., Lohr, L., Low, S., Newman., C., 2010. Local Food Systems: Concepts, Impacts, and. Issues, in: Agriculture, U.S.D.o., ERS (Eds.). Myers, G.S., 2004. Howard County Farmers’ Market Economic Impact Study 2004. Report. Howard Co. (MD) Economic Development Auth. Agricultural Marketing Program. 27 Onozaka, Y., McFadden, D.T., 2011. Does Local Labeling Complement or Compete with Other Sustainable Labels? A Conjoint Analysis of Direct and Joint Values for Fresh Produce Claim. Am J Agr Econ 93, 689-702. Onozaka, Y., Nurse, G., McFadden, D.T., 2011. Defining Sustainable Food Market Segments: Do Motivations and Values Vary by Shopping Locale? Am J Agr Econ 93, 583-589. Pirog, R., Tyndall, J., 1999. Comparing Apples to Apples: An Iowa Perspective on Apples and Local Food Systems. Leopold Center for Sustainable Agriculture, Iowa State University, Ames. Thompson, S.R., Anders, S., Herrmann, R., 2005. Regional-Origin Labeling with Quality Control: An Economic Analysis, 2005 International Congress. U.S. Department of Agriculture: Agricultural Marketing Service, 2012. Washington, DC: USDA/AMS. Online. Available at http://www.marketnews.usda.gov/portal/fv. [Accessed April 2012.]. U.S. Department of Agriculture: Economic Research Service, 2012. U.S. Apple Statistics. Washington, DC: USDA/ERS. Online. Available at http://www.ers.usda.gov/publications/FTS/2008/09SEP/FTS334.pdf [Accessed February 2012]. U.S. Energy Information Administration, 2012. Gasoline and Diesel Fuel Update. EIA. Online. Available at http://www.eia.gov/petroleum/gasdiesel/ [Accessed February 2012]. United States Census Bureau, 2012. Online. Available at http://www.census.gov/. [Accessed January 2012.]. United States Department of Agriculture: National Agricultural Statistics Service, 2008. 2007 Census of Agriculture. Washington, DC: USDA/NASS. Online. Available at http://www.agcensus.usda.gov/Publications/2007/index.php. [Accessed April 2011.]. Zhao, X.Y., Griffiths, W.E., Griffith, G.R., Mullen, J.D., 2000. Probability distributions for economic surplus changes: the case of technical change in the Australian wool industry. Aust J Agr Resour Ec 44, 83-106. 28 Table 1. Supply and Demand Quantities Calculation Variables Supply Values of Variables Calculation U.S. utilized fresh apple (S) 6243.9 million pounds Production of the rest of the country (SBS) Colorado utilized fresh apple (SA) 10 million pounds 6233.9 million pounds (0.16% of U.S.sup) (99.84% of U.S. sup) Delta directly sold ag products proportion 3.267% Weights of Delta fruit production w.r.t. Colorado fruit production 38.164% Mesa directly sold ag products proportion 7.723% Weights of Mesa fruit production w.r.t. 4 counties total fruit production Montezuma directly sold ag products proportion 43.912% Weights of Montezuma fruit production w.r.t. 4 counties fruit production Montrose directly sold ag products proportion 3.790% Weights of Montrose fruit production w.r.t. 4 counties fruit production 3.674% Colorado shipping point marketed apples (SAS): 9.47 million pounds (94.73% of CO total supply) Colorado directly marketed apples (SAF): 0.53 million pounds (5.27% of CO total supply) (39.94% of local apple consumption) 4 counties weighted proportion of direct fruit sale: 5.27% 1.166% A Colorado consumption of local apple through shipping points (SASA) : 0.79 million pounds (60.06% of local apple consumption) 0.901% 29 Table 1. Supply and Demand Quantities Calculation, Continued Variables Values of Variables Calculation Demand U.S. population 304,797,761 U.S. apple consumption (D): 4846.28 million pounds U.S. per capita consumption of fresh apples 15.9 pounds Colorado population 4,939,456 Colorado apple consumption (DA): 78.54 million pounds (1.62% of U.S. total consumption) U.S. local food sales through all channels U.S. all food sales 5000 million dollars 297220.491million dollars The rest of the country apple consumption (DBd): 4767.75 million pounds (98.38% of U.S. total consumption) Colorado consumption of local apples (DAl): 1.32 million pounds (1.68% of CO total consumption) Colorado consumption of domestic apples (DAd): 77.22 million pounds (98.32% of CO total consumption) Proportion of local food sales : 1.68% 30 Table 2. Prices and Quantities Used for the EDM Variablesa,b Directly Marketed (i=F) Shipping Point Marketed (i=S) Demand Farmers’ market price (𝑃𝐴𝑙 ) ($/lb) 3.35 Southcentral retail price (𝑃𝐴𝑑 ) ($/lb) 1.61 (𝑃𝐵𝑑 ) 1.56 Northwest retail price ($/lb) CO aggregate demand (DA) (mil.lbs.) REST aggregate demand (DBd) CO consumption of local apple 78.54 (mil.lbs.) (DAl) CO consumption of domestic apple (mil.lbs) (DAd) 4767.75 1.32 77.22 Supply Supply price (𝑃𝐵𝑖 ) ($/lb) 0.68 Supply price (𝑃𝐴𝑖 ) ($/lb) 3.35 (farmers’ market price) 1.61 (real supply price) CO aggregate supply (SA) (mil.lbs.) REST aggregate supply CO directly marketed (SBS) (SAF) (mil.lbs.) 10 6233.90 (mil.lbs) 0.53 (SAS) 9.47 CO shipping point marketed (mil.lbs) 0.71 (LR) 0.75U 0.68L(SR) (SASA) CO SP marketed local consumed 0.79 (mil.lbs) Note: a. l stands for local apples and d stands for domestic apples. F stands for supply through direct markets and S stands for supply through shipping points. SA stands for consumption of local apples through shipping points. L stands for lower band and U stands for upper band. b. All prices are deflated by 1998 January CPI (United States Census Bureau, 2012). 31 Table 3. Market Shares and Price Margins Used for the EDM Parametersa Directly Marketed (i=F) Shipping Point Marketed (i=S) Demand Market Shares 𝐷𝑑 𝑤𝐴𝑇 0.0159 𝐷𝑙 𝑤𝐴𝑇 0.0003 𝐷𝑑 𝑤𝐵𝑇 𝐷𝑖 𝑤𝐴𝐴 𝐷𝑆𝐴 𝑤𝐴𝐴 𝐷𝑖 𝑤𝐵𝐵 𝐷𝑙 𝑤𝐴𝐴 𝐷𝑑 𝑤𝐴𝐴 𝐷𝑖 𝑤𝐴𝐴𝑙 0.9838 0.0067 0.9933 0.0101 -- 1 0.0168 0.9832 0.4015 0.5985(SA) 0.0001 0.0015 Supply Market Shares 𝑆𝑖 𝑤𝐴𝑇 𝑆𝐹 𝑤𝐴𝐴 𝑆𝑆𝐴 𝑤𝐴𝐴 𝑆𝑆 𝑤𝐴𝐴 𝑆𝐹𝑙 𝑤𝐴𝐴 𝑆𝑆𝐴𝑙 𝑤𝐴𝐴 𝑆𝑖 𝑤𝐵𝑇 0.0530 0.0790 0.9470 0.4015 0.5985 -- 0.9984 Price Margins 𝑙 𝑡𝐴−𝐶𝑂 𝑑 𝑡𝐴−𝐶𝑂,𝑈𝑆 𝐹 𝑡𝐴−𝐶𝑂 𝑆 𝑡𝐴−𝐶𝑂,𝑈𝑆 1.08 0.22(LR) 0.27U 0.17L (SR) 0.89 0.25 Note: l stands for local apples and d stands for domestic apples. F stands for supply through direct markets and S stands for supply through shipping points. SA stands for consumption of local apples through shipping points. L stands for lower band and U stands for upper band. 32 Table 4. Demand and Supply Elasticities Used for the EDM Parametersa Directly Marketed (i=F) Shipping Point Marketed (i=S) Demand Elasticities Colorado&Colorado(𝜀𝐴𝑙𝑙 ) -0.16 (MMB) -0.60 (CMB) Colorado&Domestic(𝜀𝐴𝑙𝑑 ) 5.31 (MMB) Domestic&Domestic(𝜀𝐴𝑑𝑑 ) Domestic&Colorado(𝜀𝐴𝑑𝑙 ) Domestic&Domestic(𝜀𝐵𝑑𝑑 ) -0.35 (MMB) -0.35 (CMB) 7.73 (MMB) 0.56 (CMB) Demand shock (𝛾) 0.019 (MMB) 0.372 (CMB) 2.84 (CMB) -0.05 (MMB) -0.05 (CMB) Supply Elasticities Colorado grown(𝛽𝐴𝐹𝑖 ) 1.79 (LR) 0.50 (SR) Colorado grown(𝛽𝐴𝑆𝑖 ) -0.79 (LR) -0.06 (SR) Colorado grown (𝛽𝐴𝑆𝐴,𝑖 ) -0.01 (LR) Colorado grown (𝛽𝐴𝑆𝐴,𝑙 ) Colorado grown (𝛽𝐴𝑆𝐴,𝑑 ) Other States grown(𝛽𝐵𝑆𝑖 ) Aggregate own price elasticity of supply(𝛽) Elasticity of transformation(𝜏) Expansion Elasticity(𝜌𝑖 ) 0 (SR) -0.01 (LR) 0 (SR) 1.01 (LR) 0.44 (SR) -0.01 (LR) 0 (SR) -0.01(LR) 0 (SR) -0.01(LR) 0 (SR) -- 1.00 (LR) 0.44 (SR) 1.00 (LR) 0.44 (SR) -1.80 (LR) -0.50 (SR) 1.00 (LR) 0.50 (SR) 1.00 (LR) 1.00 (SR) Note: a. l stands for local apples and d stands for domestic apples. F stands for supply through direct markets and S stands for supply through shipping points. SA stands for consumption of local apples through shipping points. L stands for lower band and U stands for upper band. 33 Table 5. Price, Quantity, and Producer Welfare Changes Variablesa Fixed Supplyd (MMBb) lowere 𝑡𝐴𝑑 =0.17 upper 𝑡𝐴𝑑 =0.27 = 0.019 Fixed Supply (CMBc) lower 𝑡𝐴𝑑 =0.17 upper 𝑡𝐴𝑑 =0.27 = 0.372 Elastic Supply (MMB) Elastic Supply (CMB) = 0.019 = 0.372 %∆𝐷𝐴𝑙 -0.10 -0.10 0.01 0.02 12.07 10.78 %∆𝐷𝐴𝑑 849.29 849.03 62.46 62.46 874.14 63.48 %∆𝐷𝐵𝑑 -6.40 -6.15 -0.38 -0.13 0.83 0.24 %∆𝑆𝐴𝐹 0 0 0 0 230.97 206.84 %∆𝑆𝐴𝑆 0 0 0 0 -62.33 -65.17 %∆𝑆𝐴𝑆𝐴 0 0 0 0 -2.19 -2.25 %∆𝑆𝐵𝑆 0 0 0 0 14.82 1.33 %∆𝑃𝐴𝑙 110.02 109.99 120.34 120.34 113.33 125.14 %∆𝑃𝐴𝑑 2.92 2.92 12.33 12.34 5.33 17.14 %∆𝑃𝐵𝑑 -13.72 -23.71 -4.64 -14.62 -16.67 -4.86 %∆𝑃𝐴𝐹 67.67 67.67 67.67 67.67 128.82 115.33 %∆𝑃𝐴𝑆 -21.33 -21.33 -21.33 -21.33 39.82 26.33 %∆𝑃𝐵𝑆 -46.33 -46.33 -46.33 -46.33 14.82 1.33 34 Table 5. Price, Quantity, and Producer Welfare Changes, Continued Variables ∆𝑃𝑆𝐴𝐹 (mil.$)f ∆𝑃𝑆𝐴𝑆 (mil.$) ∆𝑃𝑆𝐴 (mil.$) Fixed Supply (MMB) lower 𝑡𝐴𝑑 =0.17 upper 𝑡𝐴𝑑 =0.27 Fixed Supply (CMB) lower 𝑡𝐴𝑑 =0.17 upper 𝑡𝐴𝑑 =0.27 Elastic Supply (MMB) Elastic Supply (CMB) 0.58 0.58 0.58 0.58 2.37 2.00 (0.11, 1.15)g (0.20, 2.03) (0.38, 0.66) (0.31,0.74) (1.42, 34.54) (1.98, 4.61) -1.37 -1.52 -1.37 -1.52 1.84 1.19 (-3.68, 0.67) (-8.08, 0.37) (-2.28, 0.40) (-2.11, -0.53) (-90.04, 2.67) (-0.12, 0.39) -0.79 -0.94 -0.79 -0.94 4.21 3.19 (-4.17, 1.12) (-4.19, 1.11) (-4.16, 1.10) (-4.14,1.11) (-245.78, 14.56 ) (-23.15, 12.78) Note: a. All simulations are based on 2008 average prices and quantities that are deflated by 1998 January CPI (United States Census Bureau, 2012). b. The shock to demand for local apples due to origin labeling efforts was estimated to be 0.019 using MMB. c. The shock to demand for local apples due to origin labeling efforts was estimated to be 0.372 using CMB. d. In the “fixed supply” scenario, a perfectly inelastic supply situation, suppliers cannot react to the changes in demand by changing the quantities supplied. In the “elastic supply” scenario, suppliers can adjust their supply to the changes in the demand. e. In the “lower 𝑡𝐴𝑑 ” scenario in “fixed supply”, lower bound estimated 𝑡𝐴𝑑 is used in the simulation, while upper bound estimated 𝑡𝐴𝑑 is used in the simulation for “upper 𝑡𝐴𝑑 ” scenario. f. ∆𝑃𝑆𝐴𝐹 is changes in producer welfare of Colorado suppliers for direct markets, ∆𝑃𝑆𝐴𝑆 is changes in producer welfare of Colorado suppliers for shipping points, and ∆𝑃𝑆𝐴 is the total changes in producer welfare of Colorado suppliers. The values in brackets are 95% probability intervals of producer welfare changes. 35 5 Local Price ($/lb) 4 3 2 1 0 0.2 0.4 0.6 Market Share of Buy Local (%) 0.8 1 Figure 1 Demand for Local Apples Note: The dashed line is the real demand curve based on 2008 survey data, while the solid line is a trend line. Price Premium of Local vs Domestic ($/lb) 2.0 1.5 1.0 0.5 0 0 0.2 0.4 0.6 Market Share of Buy Local (%) 0.8 1 Figure 2 Price Premium of Local Apples vs Market Share 36 Appendix A Table A.1 Variables and Parameters Definition Variables Definition Demand 𝑃𝑖𝑘 Retail (farmers’ market) price for apple k in region i 𝐷𝑖𝑘 Supply The demand for apple k in region i 𝑃𝑖𝑘 The supply price for apples marketed through channel k in region i 𝑆𝑖𝑘 The supply of apples through channel k in region i Transaction costs ratio 𝑙 𝑡𝐴−𝐶𝑂 Market margin between farmers’ market and retail market in Colorado 𝑑 𝑡𝐴−𝐶𝑂,𝑈𝑆 𝐹 𝑡𝐴−𝐶𝑂 Market margin between Colorado and domestic retail markets 𝑆 𝑡𝐴−𝐶𝑂,𝑈𝑆 Weights 𝑤𝑖𝑖𝐷𝑘 𝐷𝑘 𝑤𝑖𝑖𝑙 𝐷𝑘 𝑤𝑖𝑇 𝑤𝑖𝑖𝑆𝑘 𝑆𝑘𝑙 𝑤𝐴𝐴 𝑆𝑘 𝑤𝑖𝑇 The supply price difference between selling in direct markets and selling to shipping points in Colorado The supply price difference between Colorado and domestic shipping points Region i share of demand for apple k (or apples marketed through channel k) with respect to Region i total demand Region i share of demand for local apples marketed through channel k with respect to region i total demand for local apples Region i share of demand for apple k with respect to U.S. total demand Region i share of supply for apples marketed through channel k with respect to Region i total supply Region i share of supply for apples marketed through channel k with respect to region i total supply of local apples Region i share of supply for apples marketed through channel k with respect to U.S. total supply Elasticities 𝜀𝑖𝑘𝑘 Apple k own price demand elasticity in region i 𝜀𝑖𝑘ℎ Apple k cross price demand elasticity with respect to apple h price in region i 𝛽𝑖𝑘𝑘 𝛽𝑖𝑘ℎ Apples marketed through channel k own price supply elasticity in region i 𝛽𝐴𝑆𝐴𝑘 Apples marketed through channel k cross price supply elasticity with respect to price marketed through channel h in region i Colorado shipping point marketed local apple cross price supply elasticity with respect to price of apple k (or price of apples marketed through channel k ) 37 Table A.1 Variables and Parameters Definition, Continued Variables Other Parameters 𝛾 𝛼𝑘 𝜌𝑘 𝜌𝑆𝐴 𝜗 𝜏 𝜀 𝛽 Definition Premium Demand shock to local apples: 𝛾 = − domestic price ∗ 𝜀𝐴𝑙𝑙 Expenditure elasticity of apple k Expansion elasticity of apples marketed through channel k Expansion elasticity of shipping point marketed local apples Elasticity of substitution Elasticity of transformation Aggregate own price elasticities of demand Aggregate own price elasticities of supply 38 Appendix B: Equilibrium Displacement Model for the Colorado Apple Market (B.1) (B.2) 𝑑𝑙𝑛(𝐷𝐴𝑙 ) = 𝜀𝐴𝑙𝑙 𝑑𝑙𝑛(𝑃𝐴𝑙 )+𝜀𝐴𝑙𝑑 𝑑𝑙𝑛(𝑃𝐴𝑑 ) + 𝛾 𝑑𝑙𝑛(𝐷𝐴𝑑 ) = 𝜀𝐴𝑑𝑙 𝑑𝑙𝑛(𝑃𝐴𝑙 )+𝜀𝐴𝑑𝑑 𝑑𝑙𝑛(𝑃𝐴𝑑 ) − 𝐷𝑙 𝑤𝐴𝐴 𝐷𝑑 𝑤𝐴𝐴 𝛾 (B.3) 𝑑𝑙𝑛(𝑆𝐴𝐹 ) = 𝛽𝐴𝐹𝐹 𝑑𝑙𝑛(𝑃𝐴𝐹 )+𝛽𝐴𝐹𝑆 𝑑𝑙𝑛(𝑃𝐴𝑆 ) (B.4) 𝑑𝑙𝑛(𝑆𝐴𝑆 ) = 𝛽𝐴𝑆𝐹 𝑑𝑙𝑛(𝑃𝐴𝐹 )+𝛽𝐴𝑆𝑆 𝑑𝑙𝑛(𝑃𝐴𝑆 ) (B.5) 𝑑𝑙𝑛(𝑆𝐴𝑆𝐴 ) = 𝛽𝐴𝑆𝐴,𝐹 𝑑𝑙𝑛(𝑃𝐴𝐹 )+𝛽𝐴𝑆𝐴,𝑆 𝑑𝑙𝑛(𝑃𝐴𝑆 )+𝛽𝐴𝑆𝐴,𝑙 𝑑𝑙𝑛(𝑃𝐴𝑙 )+𝛽𝐴𝑆𝐴,𝑑 𝑑𝑙𝑛(𝑃𝐴𝑑 ) +𝛽𝐴𝑆𝐴,𝑑 𝑑𝑙𝑛(𝑃𝐵𝑑 ) (B.6) 𝑑𝑙𝑛(𝐷𝐵𝑑 ) = 𝜀𝐵𝑑𝑑 𝑑𝑙𝑛(𝑃𝐵𝑑 ) (B.7) 𝑑𝑙𝑛(𝑆𝐵𝑆 ) = 𝛽𝐵𝑆𝑆 𝑑𝑙𝑛(𝑃𝐵𝑆 ) (B.8) 𝑆,𝑆𝐴𝑙 𝑆𝐹𝑙 𝑑𝑙𝑛(𝐷𝐴𝑙 ) = 𝑤𝐴𝐴 𝑑𝑙𝑛(𝑆𝐴𝐹 ) + 𝑤𝐴𝐴 𝑑𝑙𝑛(𝑆𝐴𝑆𝐴 ) (B.9) (B.10) (B.11) (B.12) (B.13) 𝐷𝑙 𝐷𝑑 𝐷𝑑 𝑆𝑆 𝜔𝐴𝑇 𝑑𝑙𝑛(𝐷𝐴𝑙 ) + 𝜔𝐴𝑇 𝑑𝑙𝑛(𝐷𝐴𝑑 ) + 𝜔𝐵𝑇 𝑑𝑙𝑛(𝐷𝐵𝑑 ) = 𝜔𝐴𝑇 𝑑𝑙𝑛(𝑆𝐴𝑠 ) 𝑆𝑆 𝑆𝐹 +𝜔𝐵𝑇 𝑑𝑙𝑛(𝑆𝐵𝑠 ) + 𝜔𝐴𝑇 𝑑𝑙𝑛(𝑆𝐴𝐹 ) 𝑙 𝑑𝑙𝑛(𝑃𝐴𝑙 ) = 𝑑𝑙𝑛(𝑃𝐴𝑑 ) + 𝑡𝐴−𝐶𝑂 𝑑 𝑑𝑙𝑛(𝑃𝐴𝑑 ) = 𝑑𝑙𝑛(𝑃𝐵𝑑 ) + 𝑡𝐴−𝐶𝑂,𝑈𝑆 𝐹 𝑑𝑙𝑛(𝑃𝐴𝐹 ) = 𝑑𝑙𝑛(𝑃𝐴𝑆 ) + 𝑡𝐴−𝐶𝑂 𝑆 𝑑𝑙𝑛(𝑃𝐴𝑆 ) = 𝑑𝑙𝑛(𝑃𝐵𝑆 ) + 𝑡𝐴−𝐶𝑂,𝑈𝑆 Data for the Colorado Apple Market (see Table 2) The production of apples for fresh use in Colorado in 2008 was 10 million pounds (SA), while the production for fresh use for the United States was 6,245 million pounds (S) (United States Department of Agriculture: National Agricultural Statistics Service, 2008). The U.S. per capita consumption of fresh apples in 2008 was 16.2 pounds(United States Department of Agriculture: National Agricultural Statistics Service, 2008), while the population of Colorado and the United States was 4.94 million and 304.37 million in 2008, respectively (United States Census Bureau, 2012). Thus, the estimated consumption of fresh apples for Colorado and the U.S. in 2008 was 80 million pounds (DA) and 4,931 million pounds (D), respectively. 39