Budget 2015

advertisement

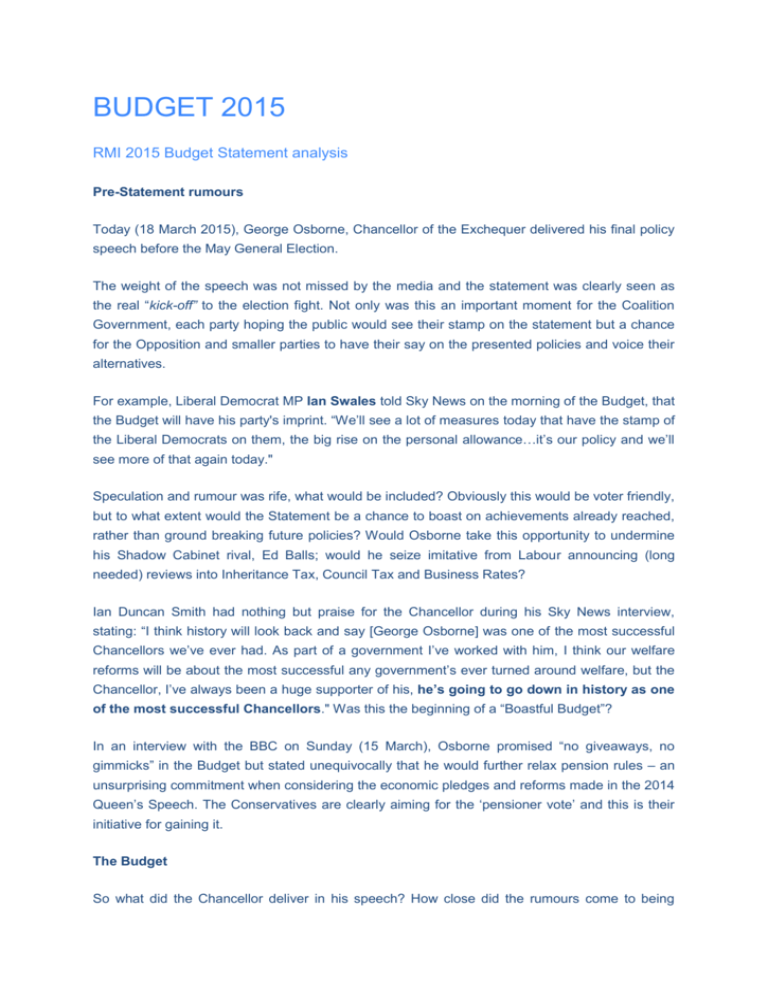

BUDGET 2015 RMI 2015 Budget Statement analysis Pre-Statement rumours Today (18 March 2015), George Osborne, Chancellor of the Exchequer delivered his final policy speech before the May General Election. The weight of the speech was not missed by the media and the statement was clearly seen as the real “kick-off” to the election fight. Not only was this an important moment for the Coalition Government, each party hoping the public would see their stamp on the statement but a chance for the Opposition and smaller parties to have their say on the presented policies and voice their alternatives. For example, Liberal Democrat MP Ian Swales told Sky News on the morning of the Budget, that the Budget will have his party's imprint. “We’ll see a lot of measures today that have the stamp of the Liberal Democrats on them, the big rise on the personal allowance…it’s our policy and we’ll see more of that again today." Speculation and rumour was rife, what would be included? Obviously this would be voter friendly, but to what extent would the Statement be a chance to boast on achievements already reached, rather than ground breaking future policies? Would Osborne take this opportunity to undermine his Shadow Cabinet rival, Ed Balls; would he seize imitative from Labour announcing (long needed) reviews into Inheritance Tax, Council Tax and Business Rates? Ian Duncan Smith had nothing but praise for the Chancellor during his Sky News interview, stating: “I think history will look back and say [George Osborne] was one of the most successful Chancellors we’ve ever had. As part of a government I’ve worked with him, I think our welfare reforms will be about the most successful any government’s ever turned around welfare, but the Chancellor, I’ve always been a huge supporter of his, he’s going to go down in history as one of the most successful Chancellors." Was this the beginning of a “Boastful Budget”? In an interview with the BBC on Sunday (15 March), Osborne promised “no giveaways, no gimmicks” in the Budget but stated unequivocally that he would further relax pension rules – an unsurprising commitment when considering the economic pledges and reforms made in the 2014 Queen’s Speech. The Conservatives are clearly aiming for the ‘pensioner vote’ and this is their initiative for gaining it. The Budget So what did the Chancellor deliver in his speech? How close did the rumours come to being true? Will this win the Conservatives the election? The RMI Policy Department details some of the key announcements that will affect businesses and industry. The Budget was undoubtedly a moment for Chancellor to praise his party (and the Government) on the economic success of “The Comeback Country”. The BBC questioned whether the Budget was “optimistic or triumphant”. A number of important economic facts and figures were detailed throughout the speech... Economic forecasts Positive economic forecasts were delivered by the Chancellor, notable figures include: Britain grew faster than any other major advanced economy in the world in 2014 – 2.6%. GDP growth is forecast to be higher than announced during the Autumn Statement reaching 2.5%. Business investment has grown four times faster than household consumption. The Policy Commitments Automotive industry We’re going to back our brilliant automotive industry by investing £100 million to stay ahead in the race to driverless technology. To encourage a new generation of low emission vehicles we will increase their company car tax more slowly than previously planned, while increasing other rates by 3% in 2019-20. Osborne announced the reduction of toll rates from 2018 in the Severn Crossings, and abolishes the higher band for small vans and buses. Osborne stated: “It’s a boost for the drivers of white vans”. Fuel Petrol frozen again, September’s fuel duty increased has been cancelled. Note: longest fuel duty freeze in over twenty years. Small Business As of April, corporation tax will be 20% As of April, the Government will abolish National Insurance for employee’s 21 and under. April 2016 will bring the abolition of National Insurance for young apprentices. This April will see the extension of small business rate relief Annual Investment Allowance will end at the end of the year. Next Parliament will abolish Class 2 National Insurance contributions for the self-employed. Abolished the annual tax return - a revolutionary simplification of tax collection. Employment Britain has the highest rate of employment in its history More women in work than ever before Since 2010, 1000 more jobs have been created every single day Personal Allowance Increase in Personal Allowance to £10,600 (2015) Increase in Personal Allowance to £10,800 (2016) Increase in Personal Allowance to £11,000 (2017) Inflation The OBR revise down their forecast for inflation this year to 0.2%, and revise it down for the following three years. The OBR report that debt as a share of GDP falls from 80.4% in 2014-15; to 80.2% in the year 2015-16, 79.8% in 2016-17, 77.8% the following year, to 74.8% in 2018-19, 71.6% in 2019-20. Tax avoidance Reduction for the Lifetime Allowance from £1.25 million to £1 million From 2018 Osborne stated he will index the Lifetime Allowance Amendments to corporation tax rules to prevent contrived loss arrangements. Close loopholes to make sure Entrepreneurs Relief is only available to those selling genuine stakes in businesses. Overall, the new measures against tax avoidance and evasion will raise £3.1 billion over the forecast period. Oil Introduction from April of a single, simple and generous tax allowance to stimulate investment at all stages of the industry. Government will invest in new seismic surveys in under-explored areas of the UK Continental Shelf. Petroleum Revenue Tax will be cut from 50% to 35% to support continued production in older fields. With immediate effect cutting the Supplementary Charge from 30% to 20%, and backdating it to the beginning of January. Duties No changes to duties on tobacco changes to duties on tobacco.