1 Measures not separately listed in this Overview

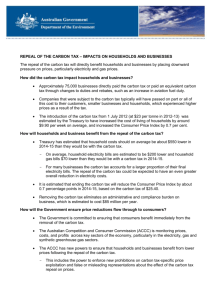

advertisement