Summary of Amicus Briefs - Council of the District of Columbia

advertisement

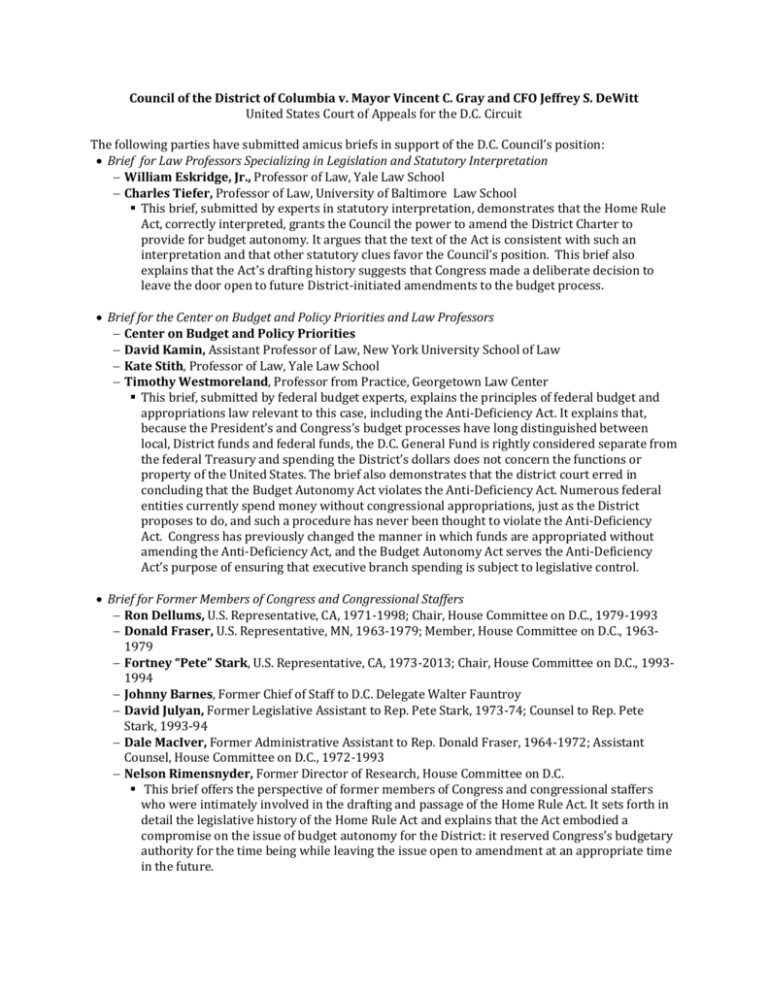

Council of the District of Columbia v. Mayor Vincent C. Gray and CFO Jeffrey S. DeWitt United States Court of Appeals for the D.C. Circuit The following parties have submitted amicus briefs in support of the D.C. Council’s position: Brief for Law Professors Specializing in Legislation and Statutory Interpretation William Eskridge, Jr., Professor of Law, Yale Law School Charles Tiefer, Professor of Law, University of Baltimore Law School This brief, submitted by experts in statutory interpretation, demonstrates that the Home Rule Act, correctly interpreted, grants the Council the power to amend the District Charter to provide for budget autonomy. It argues that the text of the Act is consistent with such an interpretation and that other statutory clues favor the Council’s position. This brief also explains that the Act’s drafting history suggests that Congress made a deliberate decision to leave the door open to future District-initiated amendments to the budget process. Brief for the Center on Budget and Policy Priorities and Law Professors Center on Budget and Policy Priorities David Kamin, Assistant Professor of Law, New York University School of Law Kate Stith, Professor of Law, Yale Law School Timothy Westmoreland, Professor from Practice, Georgetown Law Center This brief, submitted by federal budget experts, explains the principles of federal budget and appropriations law relevant to this case, including the Anti-Deficiency Act. It explains that, because the President’s and Congress’s budget processes have long distinguished between local, District funds and federal funds, the D.C. General Fund is rightly considered separate from the federal Treasury and spending the District’s dollars does not concern the functions or property of the United States. The brief also demonstrates that the district court erred in concluding that the Budget Autonomy Act violates the Anti-Deficiency Act. Numerous federal entities currently spend money without congressional appropriations, just as the District proposes to do, and such a procedure has never been thought to violate the Anti-Deficiency Act. Congress has previously changed the manner in which funds are appropriated without amending the Anti-Deficiency Act, and the Budget Autonomy Act serves the Anti-Deficiency Act’s purpose of ensuring that executive branch spending is subject to legislative control. Brief for Former Members of Congress and Congressional Staffers Ron Dellums, U.S. Representative, CA, 1971-1998; Chair, House Committee on D.C., 1979-1993 Donald Fraser, U.S. Representative, MN, 1963-1979; Member, House Committee on D.C., 19631979 Fortney “Pete” Stark, U.S. Representative, CA, 1973-2013; Chair, House Committee on D.C., 19931994 Johnny Barnes, Former Chief of Staff to D.C. Delegate Walter Fauntroy David Julyan, Former Legislative Assistant to Rep. Pete Stark, 1973-74; Counsel to Rep. Pete Stark, 1993-94 Dale MacIver, Former Administrative Assistant to Rep. Donald Fraser, 1964-1972; Assistant Counsel, House Committee on D.C., 1972-1993 Nelson Rimensnyder, Former Director of Research, House Committee on D.C. This brief offers the perspective of former members of Congress and congressional staffers who were intimately involved in the drafting and passage of the Home Rule Act. It sets forth in detail the legislative history of the Home Rule Act and explains that the Act embodied a compromise on the issue of budget autonomy for the District: it reserved Congress’s budgetary authority for the time being while leaving the issue open to amendment at an appropriate time in the future. Brief for Local Government Law Professors Sheryll D. Cashin, Professor of Law, Georgetown Law Center David Schleicher, Associate Professor of Law, George Mason University School of Law David A. Super, Professor of Law, Georgetown Law Center This brief, submitted by local government law scholars, explains the legal principles that apply to grants of municipal home rule. It describes how, throughout the twentieth century, American states moved away from highly constrained forms of home rule toward approaches that granted more and more authority to localities. The Home Rule Act must be understood and interpreted in light of that historical shift. Further, the brief asserts that a local government’s authority is traditionally at its apex in areas such as budgeting and spending, making it counterintuitive to interpret the Home Rule Act to completely deny the Council budgetary authority. Brief for Former D.C. Attorney General Peter J. Nickles Peter J. Nickles, Senior Counsel, Covington & Burling (Formerly: Attorney General, District of Columbia, January 2008-January 2011) This brief is submitted by a former Attorney General for the District who has a distinct perspective on the application of laws in and to the District. This brief underscores the dynamic nature of the District Charter and explains that it was through this document that Congress intended to grant the District the authority to shape its own internal governance into the future. Although the Charter’s amendment authority has certain narrow exceptions, those exceptions should be narrowly construed in accordance with the Home Rule Act’s purpose. The District government has a long tradition of construing limitations on the District’s authority narrowly, and the D.C. Court of Appeals has consistently agreed; the federal courts should do likewise in order to avoid calling this longstanding interpretive practice into question and creating unforeseen problems in the day-to-day management of the District. Brief for Concerned D.C. Legal Professionals Mark Fleischaker, Chairman Emeritus, Arent Fox LLP Ron Jessamy, Partner, Law Office of Ronald C. Jessamy, PLLC Carolyn B. Lamm, Partner, White & Case LLP Daniel Solomon, Director, Naomi & Nehemiah Cohen Foundation Bruce V. Spiva, Founder and Principal, The Spiva Law Firm, PLLC Melvin White, Formerly: Lead Counsel, Clearspire LLP Thomas Williamson, Senior Counsel, Covington & Burling LLP This brief traces the history of home rule in the District and explains that the Home Rule Act should be interpreted consistent with its purpose: to effectuate self-governance for the District. The brief asserts that the Home Rule Act left the question of budget autonomy open to future D.C. governments and Congresses; indeed, the Act would have been an “empty promise” had it forever withheld this essential prerogative of self-government from the District. The brief argues that the Budget Autonomy Act is consistent with the Home Rule Act’s purpose, in that it grants the District responsibility for allocating local tax revenue. The brief also explains that the Budget Autonomy Act does nothing to diminish Congress’s plenary authority over the District’s budget; at any time, Congress can override the budgetary choices of the District government and allocate the District’s funds as it sees fit, or even reject the Budget Autonomy Act entirely. Brief for DC Nonprofit Organizations Appleseed Center for Law and Justice is dedicated to solving public policy problems facing D.C.. DC Vote is dedicated to securing voting representation and full equality for the D.C. residents. The DC Fiscal Policy Institute conducts research and public education on budget and tax issues The League of Women Voters of D.C. encourages informed and active participation in government. This brief explains why the Local Budget Autonomy Act is a quintessential local act and how the district court erred by failing to remand this local government dispute to the Superior Court of the District of Columbia. The brief further asserts that the district court erred by failing to afford any deference to the District’s legislature’s or the District’s highest court’s interpretations of the Home Rule Act and by failing to recognize that Congress had tacitly approved the Local Budget Autonomy Act when it decided not to veto the Local Budget Autonomy Act during the congressional review period. The following parties have submitted a brief in support of neither party: Brief for Budget Policy Experts Thomas M. Davis, CEO, Republican Main Street Partnership (U.S. Congressman, VA, 1995-2008) Alice Rivlin, Senior Fellow, Brookings Institution (Formerly: Director, Office of Management and Budget, 1975-1983, 1994-1996; Vice Chair, Federal Reserve 1996-1999) Anthony A. Williams, Mayor, Washington D.C., 1999-2007 This brief argues that there is no policy reason for denying the District of Columbia budget autonomy. To the contrary, the budget process in place prior to enactment of the Budget Autonomy Act distorted the budget process, cost District taxpayers millions of dollars each year, and created uncertainty regarding the provision of basic services. At a time when nearly 98% of the District’s funds are locally raised, and in an environment where the District has consistently demonstrated fiscal responsibility—producing 17 consecutive balanced budgets— continued restrictions on the District’s budget autonomy, subject to congressional oversight, are unnecessary and destructive.