The Prisoner`s Dilemma Dan Kelsey Definition: The Blackwell

advertisement

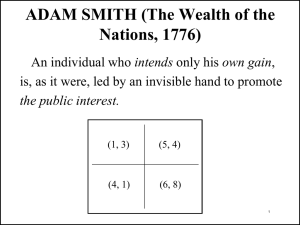

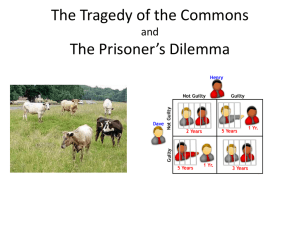

The Prisoner’s Dilemma Dan Kelsey Definition: The Blackwell Encyclopedic of Managerial Economics (McAuliffe, 2005) provides the following definition of the Prisoner’s Dilemma (PD). “Two suspects are arrested by the police and are charged with a minor crime. They are also suspected of a major crime but there is not enough evidence to convict them without a confession. The two prisoners are then offered the following deal: 1. 2. 3. If one prisoner confesses to the major crime and implicates the other, he will serve 6 months in jail while the other will serve 6 years in jail. If neither prisoner confesses to the major crime, each will be convicted of the minor offense and will serve 1 year in prison. If both prisoners confess to the major crime, they will both serve 3 years in prison” The following table illustrates the Prisoner’s Dilemma: Prisoner A Confess Confess 3, 3 Don’t Confess 6, .5 Prisoner B Don’t Confess .5, 6 1, 1 (The first number represents Prisoner A, the second number represents Prisoner B.) The PD allows an individual or firm to determine the best strategy to pursue based on predictions of the effects of a rival individual or firm pursuing the same or opposite strategy. A commonly used term is a Nash Equilibrium. This occurs when no player in the PD is able to improve payoff by unilaterally changing their strategy, given the other player’s strategies (Baye, 2006, p. 357). Baye (2006, p. 361) illustrates a Nash Equilibrium in the following way: Firm A Firm B Advertise Don’t Advertise Advertise $4, $4 $20, $1 Don’t Advertise $1, $20 $10, $10 In this example, the Nash Equilibrium for the game is for each Firm to advertise. The decision to advertise cannot be improved on given the other firm’s decision. Another term is used in the Prisoner’s Dilemma is a player’s dominant strategy. A dominant strategy is a strategy that results in the highest payoff to a player regardless of the opponent’s action (Baye, 2006, p. 355). In the above example, each firm has a dominant strategy of Advertise. If Firm B decides to advertise, then the best alternative is for Firm A to advertise because they will earn $4. If firm B decides to not advertise, then the best alternative for Firm A is to advertise. As a result, Firm A has a dominant strategy to advertise. Discussion: The Prisoner’s Dilemma (PD) was created by John Nash, who was awarded the Nobel prize for his work in originating game theory. In the definition provided above, the key piece of information is that the prisoners are unable to communicate and arrange a mutually beneficial strategy. Collusion is not an option. When the PD is played one time, the winning strategy is to “rat out the other guy” (Steidtmann, 2007). But what happens when the game is played multiple times? This is most similar to the business environment where competitors are fiercely competitive and trying to gain market share. In this situation, the most effective strategy for multiple plays is “Tit-for-Tat”. Do to your opponent what he did to you in the last turn (Steidtmann, 2007). To summarize, if you and your best friend rob a bank and are picked up by the police, your best strategy is to confess to the crime and rat out your friend. But if you and your best friend are business rivals, and one of you lowers your price, then the best strategy is for the other to lower his price. However, this could result in a price war. Application: The PD can be applied in any situation where a firm or situation is faced with a dilemma. It was applied to management (Seale, Arend, & Phelan, 2006), leadership (Clark & Lee, 2005), policy, global economic issues ("Playing games with the planet.," 2007), retail (Steidtmann, 2007), labor negotiations (Haber, 2006), the effect on “free riders” (Gunnthorsdottir & Rapoport, 2006), and standard setting (Axelrod & Mitchell, 1995). The PD was applied to leadership and management (Clark & Lee, 2005; Seale et al., 2006) by examining the effect interaction between a leadership and the ability of leadership to minimize the effect of a PD. Clark and Lee (2005), determined that while good leadership can help groups reduce the harmful effects of the PD, poor leadership can result in personal benefit at the expense of the organization. Furthermore, they state “good leaders have a responsibility to reduce the harm their group suffers from the non-cooperative behavior of others”. In other words, good leadership can result in people acting for the good of the firm instead of the good of the individual. When managers are considering alliances, Seale and Phelan (2006) suggest that managers should, in addition to other factors, enter alliances with a bias toward to cooperation, remain in the alliance for as a long as a partner’s expected level of cooperation exceeds the solution , favor alliances with compact payoffs, and choose less experienced alliance partners. By remaining in alliance when cooperation exceeds the solution, both parties are acting in one another’s best interest. Otherwise, the alliance will turn into a one shot PD where a firm will “rat out the other firm”. In applying the PD to labor negotiations in the 2002 Major League Baseball Players Association contract talks, Haber (2006) uses the players and labor as the two sides in a PD. In this game, each party can choose to be aggressive or conciliatory. In those cases where both sides choose to be aggressive, strikes have happened and resulted in an impasse. This is a no-win situation for everyone. Currently, many unions in the United States (US) are faced with this dilemma. Although many of the unions were highly successful in the past, they are finding their ability to act in the best interests of their members is somewhat limited. Because of the ability to outsource manufacturing at drastically lower labor costs, a union may find itself in its’ own PD. Should the union act in the best interests of the organization as a whole, or act in a way that benefits the workers. By taking a strong stance in representing the workers, unions are increasing management’s willingness to pursue the option that is most advantageous for them. PD can also be applied to environmental and public policy decisions. In one article, the PD is applied to the Kyoto Accord and governments of other countries either being unwilling to address global warming or assuming others will address the issue ("Playing games with the planet.," 2007). In discussing various forms of a PD, Arce and Sandler (2005) extend a scenario to a situation where one country causes river pollution in a downstream country while the downstream country causes air pollution in downwind in the first country. In this case they state mutual altruism can lead to net gains in both countries. From a business competition perspective, the best known public PD was the competition for two competing industry standards for tapes used in video cassette recorders (VCRs) (Axelrod & Mitchell, 1995). The competition for standards represents an ideal situation for the PD. When a decision is made regarding what will be the standard in a given industry, the potential profits to the creator of the standard can be enormous. Because the adoption of their standard provides the greatest payback, an organization will push for adoption and often times not attempt to reach an alliance with competitors where a win-win solution can be reached. The final area is the topic of free-riding. By using the concept of a PD, it was shown that a basic reinforcement based learning model can reduce intra-group rivalry and thereby increase inter-group success (Gunnthorsdottir & Rapoport, 2006). For example, a disruptive player on an athletic team can be highly detrimental to the team despite the level of talent contained within the team. As a result, the team is held back from reaching its’ potential. But when a reinforcement model is used and the troublesome player learns how a change in behavior can impact the success of the team. In some respects, the PD is applicable where collusion is not permitted. If collusion were permitted, firms would act in a way that is most beneficial to both firms. Since collusion is not an option, Nash was able to develop a model that is highly applicable to a variety of settings ranging from public policy to relationships within a team. By applying the PD to a situation, an individual or organization is better able to determine the best option. Questions A student is preparing for final exams. The student is trying to determine if study time should be devoted to the economics final exam. The student, being a very bright and intelligent MBA student, constructed the following PD. The student figures he can get a higher score on a true / false test, but the professor only gives true / false tests 40% of the time and multiple choice tests 60% of the time. The students will not find out the format of the test until the professor distributes the test. Student Professor Mult. Choice Study 90, 60 T/F 95, 40 Not Study 75, 60 80, 40 1. What is the student’s dominant strategy? a. Study b. Not Study c. The Student does not have a dominant strategy 2. The student figures he needs to score at least an 80 on the test to get an A in the class. What is the best strategy for the student? a. Not study and hope the test is true / false. b. Study c. A and B above d. None of the above 3. Assume the PD above is representative of the entire class, and not one person. The Professor has both tests when he enters the room, but has just come from a faculty meeting and is very frustrated. He decides to take it out on the class and make sure the students get the lowest grade possible. What test should he provide? a. Multiple Choice b. True/False c. Essay d. Does not matter, the students are all failing anyway. 4. You own a gas station on one corner, and a rival owns a gas station on the opposite corner. You have both been in business for many years and plan to remain in business for many years to come. Your rival drops the price of gas on Monday. What should you do? a. Offer a free carwash. b. Lower your price so it is less than the rival’s price. c. Nothing, you have loyal customers you are certain will continue to come to your station. d. Raise your price as a means of differentiating yourself from the competition. 5. Many firms offer profit sharing plans and issue checks to employees for meeting certain performance goals. What should a manager do to earn the maximum bonus available? a. Assure the employees under him are working together in pursuit of departmental and company goals. b. Do the same as always and hope the company has a really good year. c. Use a “slash and burn” policy in reaching the goals and then quit the company after receiving the profit sharing check. Answer Key: Question 1: Correct answer is a. Study. If the professor gives a multiple choice test, the student will get the highest grade through study. If the professor gives a T/F test, the student will get a higher grade through study. Queston 2: Correct answer is c. A and B above. If the student studies, the minimum grade is 90. But if the student does not study, they only way to get the required grade is if the test is True/False. Question 3: The professor should give the multiple choice test. If students have studied, they will get a lower test score. Essay is not an option. The correct answer is a. Question 4: Correct Answer is b. This is not a one play situation. Therefore, since multiple games are involved, the correct answer is to use a tit-for-tat strategy. Although answer a may bring in some customers, according to game theory the best option is tit-for-tat. Question 5: According to PD theory, the best option is to take what you can when it is a one shot game. In this case, the best answer is c. But if the manager intends on staying with the firm, then the correct answer is A. Based on the question and one shot theory, the answer is a. References Arce M., D. G., & Sandler, T. (2005). The Dilemma of the Prisoners Dilemmas. Kyklos, 58(1), 3-24. Axelrod, R., & Mitchell, W. (1995). Coalition Formation in Standard-setting Alliances. Management Science, 41(9), 1493-1508. Baye, M. R. (2006). Managerial Economics and Business Strategy (5th Edition ed.). New York: McGraw Hill Irwin. Clark, J. R., & Lee, D. R. (2005). Leadership, Prisoners' Dilemmas, and Politics. CATO Journal, 25(2), 379397. Gunnthorsdottir, A., & Rapoport, A. (2006). Embedding social dilemmas in intergroup competition reduces free-riding. Organizational Behavior & Human Decision Processes, 101(2), 184-199. Haber, L. J. (2006). Labor Negotiations and Game Theory: The Case of Asymmetric Bargaining Power. Journal of Collective Negotiations, 31(1), 21-32. McAuliffe, R. E. (2005). Prisoner's dilemma. Blackwell Encyclopedic Dictionary of Managerial Economics, 1-194. Playing games with the planet. (2007). Economist, 384(8548), 83. Seale, D. A., Arend, R. J., & Phelan, S. (2006). Modeling alliance activity: Opportunity cost effects and manipulations in an iterated prisoners dilemma with exit option. Organizational Behavior & Human Decision Processes, 100(1), 60-75. Steidtmann, C. (2007). The Nash Equilibrium: Game Theory and Organizational Success. Gourmet Retailer, 28(9), 138.