108th Day] Tuesday, April 24, 2012 Journal of the House [108th Day

advertisement

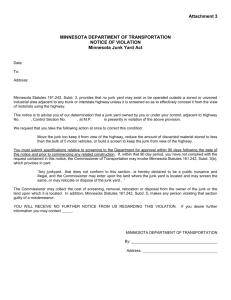

![108th Day] Tuesday, April 24, 2012 Journal of the House [108th Day](http://s3.studylib.net/store/data/006929169_1-2268bf6ef47b31a615434c42d4764c5a-768x994.png)