swfa2013_submission_20 - Northeastern State University

advertisement

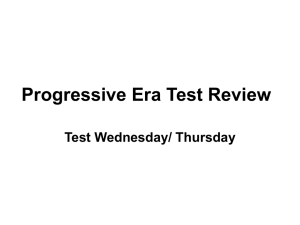

Improved IV Estimation of Vertical Property Tax Inequity Michael D. S. Morris1 Department of Economics and Legal Studies in Business Oklahoma State University William S. Dare Department of Finance Oklahoma State University Abstract In this paper we propose a new IV estimator to be used in detecting vertical property tax inequity. We conduct Monte Carlo experiments to evaluate the bias of this estimator in comparison to traditional linear regression based estimators. We find that the new estimator is more robust to bias across alternative average assessment ratios, even in the presences of errorsin-variables, than the IV estimator suggested by Clapp (1990) and frequently used for such purposes. Furthermore, the new instrument allows for an investigation into how strong the measurement error in sales prices relative to that in assessed values must be for theresults to change from those of the traditional methods.. Keywords: Property Tax, Inequity, Instrumental Variables, Monte Carlo JEL Codes: H2, C15, R3 1 Contact Author: 700 N. Greenwood Ave., Tulsa, OK 74106. Email: michael.ds.morris@okstate.edu 1 1. INTRODUCTION Property taxes are a significant, if often unpopular, source of revenue for local governments around the United States. These taxes are typically determined in an ad valorem tax, where a tax rate is applied to a pre-determined amount of assessed value of the property. The correctness and fairness of the assessment process is often asource of criticism. Inequities, where different properties are assessed differently, can be due to horizontal or vertical issues. Horizontal inequity involves properties of similar value being assessed differently. Vertical inequity arises when homes of different values are assessed differently. The inequity can be regressive, where less valuable homes are assessed at a higher rate; or progressive where less valuable homes are assessed at a lower rate. Various methods for identifying the presence of vertical property tax inequity have been proposed over the last several decades (see Simrans, Gatzlaff & Macpherson (2008) for a review). However, there is no clear consensus as to a preferred approach. This is primarily due to the potential presence of errors-in-variables, in which case both the observed sales price and the observed assessed value are measures of the true value of the property, each measured with error. If this is the case, the traditional regression based techniques will lead to biased conclusions, as pointed out by Clapp (1990). Clapp proposes an IV estimator to deal with this bias problem. However, there has been little investigation as to the practical extent of the bias of these estimators in the presence of measurement error issues, nor the robustness of the Clapp estimator itself which assumes the measurement error is the same for both sales prices and assessed values. In this paper we address this by conducting a series of Monte Carlo studies to identify the percentage of time various estimators would indicate regressive or progressive inequity when 2 there was none. We do this for a range of average assessment ratio values, for various degrees of the errors-in-variables problems, and even allowing for a partial recapitalization of assessment changes into the sales price. We propose a new instrument that is more robust than the Clapp instrument when faced with differing target assessment ratios and also allows for flexible assumptions regarding the extent of the measurement error in sales prices relative to that in assessed values. The results indicate that the estimators not designed to deal with the errors-invariables problems can regularly find inequities in the expected biased directions when such measurement errors are present. More surprisingly, the Clapp estimator can become quite biased when the target assessment ratio falls or when the measurement error in sales prices falls relative to that in assessed value. The new instrument corrects the problems with the Clapp instrument across alternative average assessment ratios and allows researchers to investigate how strong the errors in variables problem must be for the different estimators to reach alternative conclusions. The next section of the paper reviews the traditional estimation techniques for vertical inequity that we consider, along with introducing the new instrument for IV estimation and its motivation. Section three explains the Monte Carlo procedures. Section four presents the results of the analyses and the final section offers conclusions. 2. EMPIRICAL TESTS FOR VERTICAL PROPERTY TAX INEQUITY 2.1 Current Testing Procedures There have been several methods proposed to identify the presence of vertical inequity in property taxes. Most of these tests rely on using data on sales prices (SP) and assessed values (AV) of homes. If there is no vertical inequity, then the relationship between AV and SP should be steady across different home prices; for example the assessment ratio, AV/SP, should be 3 constant across all ranges of SP. While Sirmans, Gatzlaff and Macpherson (2008) provide a nice summary of these methods, we will review a few key approaches here as they will be evaluated later. Table 1 gives a summary of these procedures. The Paglin & Fogarty (PF) test is based on a linear regression of AV on SP, with a positive intercept indicating regressivity. The Cheng model is the same regression using the natural logs of AV and SP, where a slope coefficient of less than 1 indicates regressivity. The IAOO model from 1978 uses the assessment ratio as the dependent variable in a regression on SP and a negative slope coefficient would indicate regressivity. Kochin and Parks (1982) reverse the variables of the Cheng model regression, so that a slope coefficient of greater than one indicates regressivity. Clapp (1990) argues that due to an errors-in-variables problem these models are biased. He argues that both SP and AV are measures of an unobserved true market value (MV), and each is measured with error, creating the errors-in-variable problem. In contrast, the other models mentioned above (except for Kochin and Parks) can be essentially thought of as considering the sales price to be a correct (i.e. without measurement error) reflection of the value of the property. This is consistent with economists’ traditional measure of value being willingness to pay. The Kochin and Parks model can be essentially thought of as considering the assessed value to be a correct (i.e. without measurement error) reflection of the property value. They motivate this by assuming objective assessment procedures using the full information available. However, as pointed out by Kennedy (1984), this actually assumes away subjective assessment bias that is often the concern of these analyses. If there is an errors-invariables issue as described by Clapp, where both AV and SP are measures of the true value, measured with error, then the standard regression coefficients in the Kochin and Parks model would be biased toward finding a progressive result, while the coefficients in the others biased 4 toward finding a regressive result. To deal with this possibility, the Clapp model reverses the Cheng model and then uses two-stage least squares (2SLS) to instrument for the natural log of AV using a constructed variable Z.2 Z takes a value of 1 if both AV and SP are both in the top third of their respective values, -1 if AV and SP are both in the bottom third of their respective values, and zero otherwise. A coefficient greater than one on the instrumented lnAV term indicates regressive bias in the assessment ratio. We will consider the effectiveness of this instrument later in the paper. (Table 1 about here) Other estimation procedures have been suggested to deal with potential nonlinearities between the AV and SP relationship including using a quadratic in SP (Bell, 1984) or a linear spline (Sunderman, et. al., 1990). Furthermore, there have been some nonparametric approaches recommended. The IAOO’s current standard for the detection of vertical tax inequity is based on the Price Related Differential (PRD), which is the mean of the AV/SP ratio divided by the weighted mean where the weights are the sales prices (IAOO 1999). This can be calculated as shown in Table 1. The IAOO guidelines consider the property tax structure regressive if the PRD exceeds 1.03 and progressive if it is less than 0.98. In their proposed VHAAS inequity correction procedure, Birch, Sunderman and Hamilton (1992) suggest identifying vertical iniquity within a neighborhood by conducting a nonparametric Mann-Whitney test between the AV/SP ratios of the high and low value properties. In applying this procedure, Birch, Sunderman and Smith (2004) identify the low value properties as those where both sales price and assessed value are in their lower quartile and high groups being those where both sales price and assessed value are in their upper quartile, essentially utilizing a variant of Clapp’s 2 Note that the conclusions from Clapp’s IV procedure are actually the same whether lnSP or lnAV is specified as the dependent variable. 5 instrument. Lastly, McMillen (2012) suggests using nonparametric locally weighted regressions (LOWESS) and quantile analsysis to graphically examine the observed relationship between SP and the AV/SP ratio. A few studies have applied a variety of these models and compared the results. Sirmans, Diskin & Friday (1996), Smith (2000) and Allen (2003) each used the regression-based approaches to examine a different real estate market, though none of these studies really helped determine a preferred estimator. The reason, as mentioned in both Smith (2000) and Allen (2003), is that the correct method depends not only on potential nonlinearities in the assessments, but even more importantly on the underlying potential of an errors-in-variables problem. In both of their studies, however, all of the methods lead to the same conclusion and so the issue was relatively mute. In the Sirmans, Diskin & Friday (1996) study, the Clapp estimates suggested progressive while the various others suggested regressive (they did not use the Kochin and Parks specification). In making a conclusion, they suggest that this is likely evidence of the need to account for the errors-in-variables issue as suggested by Clapp. In fact, this thinking is also reflected in the method of choosing the high and low quartiles used by Birch, Sunderman and Smith (2004). However, as pointed out by Sirmans, Gatzlaff and Macpherson (2008), such a conclusion puts a lot of weight in the performance of the Clapp model as a superior estimator. 2.2 Reconsidering Errors-in-Variables and Endogeneity The errors-in-variables problem is essentially an endogeneity problem; the unexplained variation in explaining AV as a dependent variable is correlated with the independent variable SP. The instrument proposed by Clapp is based on the Bartlett’s (1949) three-group extension of 6 the original two group suggestion by Wald (1940). Durbin (1954) proposed using the actual rank as the instrument and it has been shown to be the most efficient of the three (Kennedy, 2008). The validity of these instruments relies on the measurement error not significantly altering the rank ordering of AV or SP to be different from the rank ordering of the unobserved true MV. For example, an alteration of order could occur if a positive measurement error lead to one observation of SP exceeding the one ranked above it as ranked by true MV. Hence, the observed rank ordering will be more likely to reflect that of the true MV if the measurement error is small relative to the distance between observed values. Clapp argues that by using both assessed value and sales price, the resulting rank ordering will be most accurate since it used information from both measures. However, as pointed out by Bell (1984), it would be reasonable to assume that the error in the sales prices might be much less than the assessed values. He uses this assumption to preference sales price as the independent variable. Clapp also acknowledges that is it widely assumed that sales price is measured with much less error than assessed value. If the sales price rank ordering does more accurately reflect the true unobserved ranking, then factoring in information based on the assessed value ranking could actually lead to an inferior instrument. A theoretically superior instrument could be constructed by weighing the information provided by AV and SP. In this paper we propose an alternative instrument: 𝑍𝑤 = 𝛿 ( 𝑉𝑎𝑟(𝐴𝑉) ) 𝑅𝑎𝑛𝑘(𝐴𝑉) + 𝑅𝑎𝑛𝑘(𝑆𝑃) 𝑉𝑎𝑟(𝑆𝑃) (1) 2 ⁄ 2 where, 𝛿 = 𝜎𝑆𝑃 𝜎𝐴𝑉 . The idea is to use the more efficient full ranking as proposed by Durbin (1954), and to weight in the information from the assessed value ranking based on its merits as 7 an accurate rank ordering relative to that given by the sales price. (𝑉𝑎𝑟(𝐴𝑉)⁄𝑉𝑎𝑟(𝑆𝑃)) is the ratio of the variance of observed assessed values to the variance of observed sales prices. If the observations of AV are less spread apart than those of SP, the instrument gives less weight to the AV ranking. This is beneficial because in this case, for a similarly sized measurement error, the AV rank order is more likely to differ from that of the MV rank order than the SP rank order. These variances can easily be measured in the data and the weight constructed. 𝛿 is the ratio of the variance of the measurement error of sales price to the variance of the measurement error of assessed value. If the measurement error on sales price is much less than that of the assessed value, then this will reduce the weight placed on the assessed value ranking. Unfortunately, 2 ⁄ 2 ) (𝜎𝑆𝑃 𝜎𝐴𝑉 is unknown and will require an assumption as to its value, which is in truth the fundamental problem with errors-in-variables problems of this nature3. The instrument used by Clapp essentially gives equal weight to both, and that assumption is common in measurement error models. However, in this instance, it might be more reasonable to assume it is something less than one. This is due to the fact that sales price is generally considered the better measure of market value than assessed value. Furthermore, even if they were the same, since assessed values are often fractions of the sales price they may have smaller variance and hence a greater likelihood that the measurement error causes the observed ranking to differ from the true ranking. Beyond the errors-in-variables issues, there have been other debates as to the potential bias related to using sales price as an independent variable. The traditional formulations view sales price as a strong, independent measure of market value and are testing for biases in the 3 If the ratio of the variance of the measurement errors is known, then corrected estimation procedures can be attempted in ways similar to the one proposed here (Kennedy, 2008). The difference here is that by using the ratio of the observed variances the weighted instrument here can partially improve on the Clapp model even without correctly specifying the ratio of the underlying measurement error variances. 8 assessment process. However, Edelstein (1979) finds evidence that some changes in assessed values were re-capitalized into the sales price; increased assessed values lead to higher taxes and slightly lower selling prices. Clapp notes that by using information from both the sales price and assessed value the instrumentshould be relatively robust to biases both from measurement errorand other bias concerns as long as the rank ordering of property values is not impacted, a benefit also noted by Smith (2000). Furthermore, it seems likely the recapitalization effect would be small since most U.S. households pay only around 1% of the homes sales price value in taxes (Siniavskaia, 2007). Given these endogeneity issues, turning to nonparametric methods can sound appealing. However, such methods do not avoid the problems above. For example, in the nonparametric Mann-Whitney approach suggested by Birch, Sunderman and Smith (2004) one must still determine how to separate the sample into quartiles and the choice of how can influence the results. In fact, using the 𝑍𝑤 instrument above could improve the performance of that estimator instead of relying on a ranking similar to that of Clapp. Even conclusions from nonparametric LOWESS smoothing can give misleading conclusions regarding bias in the assessment process;the reason being that these are largely descriptive of the relationship between SP and AV, describing the expected values or distribution of the assessment ratio given sales price. As pointed out by McMillen (2012) they are not attempting to determine that there is any causation or explanation as to why the relationship is as observed. For example, an observation that the assessment ratio declines as sales price increases could be due to either bias in the assessment process or just due to the errors-in-variables problems. It would be instructive, then, to evaluate the extent of the bias in these various regressionbased estimators and the newly proposed instrument, both when measurement error is present 9 and when it is not. We compare the various measures using data randomly generated biased and unbiased data in Monte Carlo simulations in the next section. 3. MONTE CARLO METHODOLOGY A data set of 1000 observations4 will be created for a variety of relationships between AV and SP. The empirical tests noted above will be performed to determine if they indicate regressive or progressive inequity. In particular, our focus is to determine the extent that the methods just discussed would give biased results in the presence of varying degrees of measurement error and also in the presence of some recapitalization of assessed value changes into sales prices. To asses this, we will generate data in which there is no fundamental assessment bias toward regressive or progressive, so that any tendencies to conclude one or the other would indicate an inherent bias for the test. While there will be no fundamental bias in the assessment process, we will allow for an array of differences in the degree and type of mean-zero measurement errors, the target AV/SP ratio, and the extent to which changes in the AV are recapitalized into the sales price and these differences will be the source of the observed biases in the estimators. The data generating process is as follows. The market value of the properties is drawn from a log-normal distribution 𝑀𝑉~𝐿𝑁(12,0.36) (2) which gives a distribution of values at least similar to those found empirically (e.g. McMillan, 2008). From this the assessed value is calculated as 4 Most property tax studies relying on recent sales figures have 1000 or fewer observations. 10 𝐴𝑉 = 𝛼𝑀𝑉 + 𝜀𝐴𝑉 𝑀𝑉, 𝜀𝐴𝑉 ~𝑁(0,0.01) (3) where 𝛼 gives the average, or target, AV/MV ratio. The sales price is calculated as 𝑆𝑃 = 𝑀𝑉 − 𝛾𝐴𝑉 + 𝛿𝜀𝑆𝑃 𝑀𝑉, 𝜀𝑆𝑃 ~𝑁(0,0.01) (4) where 𝛾 is the percent of assessed value that is recapitalized into sales price (with 𝛾 = 0 indicating no recapitalization). With 𝜀𝐴𝑉 and 𝜀𝑆𝑃 having the same distribution, 𝛿 determines the relative measurement error in sales price compared to assessed value; by setting 𝛿 = 0 we have no measurement error in sales prices and for 𝛿 = 1 both AV and SP have the same measurement 2 2 error (𝜎𝑆𝑃 = 𝜎𝐴𝑉 ). Hence by adjusting 𝛿 and 𝛾 we can allow for a range of error-in-vairables problems as well as the potential bias due to the re-capitalization of assessed value. Based on this data generating process, the general Monte Carlo procedure for each estimator is then: 1) Fix parameters 𝛼, 𝛿 and 𝛾 2) Generate data set of 1000 observations using (2)-(4) 3) Trim outliers as suggested by IAOO (1999) and McMillen (2012) 4) Run empirical estimate and determine if the estimator concludes evidence of regressive or progressive inequity (or neither) at a 95% confidence level 5) Repeat 10,000 times By averaging the results of step four over the 10,000 repetitions we can estimate what percentage of the time the estimator would indicate regressive or progressive inequity. For the instrumental 11 variable estimators, we will also compute the Durbin-Hausman-Wu (DHW) statistic to test for the presence of endogeneity. We conduct simulations for a range of values of 𝛼, 𝛿 and 𝛾. Since we expect the Clapp instrument to worsen as the average AV/MV falls, we consider; 𝛼 = 1.00, 0.75 and 0.50. For each of these levels, we consider varying degrees of measurement error; 𝛿 = 0.00, 0.25, 0.50 and 1.00. Lastly, we will run these sets of parameters for both no assessed value recapitalization, 𝛾 = 0, and three percent recapitalization, 𝛾 = 0.03. The tests specifically considered are those proposed by PF, Cheng, IAOO, KP, Clapp, the newly proposed IV based on the instrument given by (1) above, and a Mann-Whitney test. The Mann-Whitney will be done for various methods of determining the high and low quartiles, in particular using both the both the Clapp ranking procedure (both AV and SP in top and bottom quintile as suggested by Birch, Sunderman and Smith (2004)) as well as ranking according to the new instrument, 𝑍𝑤 . We will also calculate the PRD and determine if it indicates regressive or progressive inequity according to the thresholds suggested by the IAOO. 4. RESULTS Table 2 contains the results for simulations with no inequity and no recapitalization of AV. Even though there is no inequity in the data, you can see that the traditional PF, Cheng and IAOO models become quite biased toward finding regressive inequity as the measurement error in SP approaches that of AV (i.e. as 𝛿 approaches 1). However, the biases diminish as the average AV/MV ratio falls. Of the three, the PF test appears to be more robust to the errors-invariables problem mistakenly finding regressive inequity only 21% of the time with 𝛿 = 1 and 𝛼 = 0.5 versus 54% for the Cheng model. Still, the results bring into question the validity of any 12 of these methods when they indicate a regressive tax structure. On the other hand, they all do a reasonable (less than five percent error) when the measurement error of SP falls to zero. (Table 2 about here) The KP model has the opposite result from the others and is more biased toward finding non-existing progressivity. In truth, though, this is because the world the KP model is designed for would have 𝛿 well above 1, where the sales price has a lot of measurement error and not the assessed value. Since there is a general consensus that this is not the case, it is included here more for completeness than the expectation that it performs well. Of some interest, however, is that its bias increases as the average AV/SP ratio falls and that when 𝛼 = 1 and 𝛿 = 1 it is biased toward progressive to the same degree the Cheng model is biased toward regressive, a large 88% of time. While the above biases were expected, the Clapp model struggles to correct the biases. In fact, the Clapp estimates regularly show bias toward finding progressive inequity. While it is unbiased when the average AV/MV ratio is one and the ratio of the measurement errors is one, it quickly deteriorates as the measurement error in SP shrinks. For example with 𝛼 = 1 and 𝛿 = 0.25 the Clapp models inappropriately finds progressive inequity 28% of the time, a larger margin than the Cheng model’s bias for the same parameterization. Moreover, the Clapp model performs worse as the average AV/MV ratio falls. In particular note that even when the true data process has equal measurement error in AV and SP (i.e. 𝛿 = 1), if the average AV/MV ratio is 0.5 the Clapp model finds progressivity 83% of the time. In contrast, the New IV estimator based on 𝑍𝑤 maintains its performance as the average AV/MV ratio falls. For example, constructing 𝑍𝑤 assuming that the ratio of the measurement errors is one, just as the Clapp model does, the new IV estimate maintains its unbiased estimation 13 when the true process is generated by equal measurement errors even as the AV/MV ratio falls. Hence it is more robust than the Clapp instrument. This can be seen by comparing the boxed results for the Clapp estimator in Table 2 with the boxed results for the new IV estimate in the same column. Furthermore, the new IV estimate allows for unbiased performance for any range of measurement error in sales price relative to that in assessed value as shown by the diagonal results boxed in Table 2. However, it is not a panacea for estimation as it still performs poorly when 𝑍𝑤 is constructed assuming an incorrect 𝛿, which is seen when moving off the diagonal. Considering the Mann-Whitney estimates it is apparent that they are very similar to the IV estimates associated with the method in which the high and low quartiles were determined. As such, utilizing 𝑍𝑤 is more robust than determining the quartile splits based on the Clapp procedure, but once again the results hinge on correctly specifying the extent of the measurement error. The PRD test, using the boundaries recommended by the IAOO, never indicates either progressive or regressive bias in the assessment ratio. particularly useful. This seems to suggest it might be However, it turns out that the suggested threshold bounds are very conservative. While not fully reported here, results of Table 1 were run for regressive and progressive data constructions in which and the PRD indicated inequity less than 5% of the time while all of the other estimators found the correct inequity at a much higher rate. Why not simply look at graphic LOWESS estimates of the relationship between AV and SP? As mentioned above, this can give a robust description of the relationship given sales price, but cannot determine the source of any visible signs of regressive or progressive inequity. For example, consider a LOWESS curve fit to a data set drawn with no measurement error or recapitalization (𝛿 = 𝛾 = 0) and with 𝛼 = 1. The LOWESS curve, as shown in the left panel of 14 Figure 1, shows no strongly noticeable bias. Now, consider a similar data set drawn from the same parameters except for 𝛿 = 1. As seen in the right panel of Figure 1, there is now a clear downward trend showing higher sales prices are associated with lower assessment ratios, particularly for home up to the average sale price of about 130,000. This is observably a true descriptive relationship, but the LOWESS smoothing is not attempting to attribute a cause for the observed relationship. In this case, the cause is due to the measurement error, not bias in the assessment process. The bias toward regressivity in the PF, Cheng and IAOO tests in this situation are due to the fact that they are incorrectly attributing the cause as bias in the assessment process, instead of just a descriptive relationship. (Figure 1 about here) It would clearly be useful to be able to know just which δ to use in 𝑍𝑤 . Unfortunately, the extent of the measurement error is unknown and there is no way to determine that from the data given only the two observed variables, AV and SP. While there are tests for the presence of endogeneity, they perform poorly here. In particular, while not reported in Table 2, the DWH test conducted for the IV estimates regularly suggested, over 80% of the time, the need for the IV estimate even when there was no measurement error problem and it was the IV estimate that was biased. The problem is that these tests are based on the assumption that under the null of no endoegeneity, both estimates are consistent and therefore there is no need for the IV, but for the errors-in-variables problem here, that is not the case. Table 3 conducts the same simulations as done in Table 2, but this time with an added recapitalization of AV into SP of 3% (i.e. 𝛾 = 0.03). The results are very similar to those in Table 2. The additional of the recapitalization did move all of the estimators to a slightly higher probability of finding regressive inequity, though in general only by 1 or 2 percent, a much 15 smaller issue than the biases in the presence of the errors-in-variables problems. This would increase if for some reason a very large percent of changes in assessed value were actually recapitalized into sales prices. (Table 3 about here) 5. CONCLUSION In this paper we compare the results of various linear (or log-linear) regression-based estimators designed to identify the presence of vertical tax inequity in property tax structures. We use Monte Carlo simulations of differing degrees of the errors-in-variables problem as well as different average (or target) assessment ratios to highlight potential bias inherent in the methods. As expected, the traditional PF, Cheng and IAOO are biased toward finding regressivity in the presence of errors-in-variables (though it diminishes some as the assessment ratio falls), while the KP estimator is biased toward finding progressive inequity. More interestingly, we find that the Clapp estimator becomes biased toward progressivity as the measurement error for assessed values exceeds that of the sales prices. Furthermore, the Clapp estimator biases toward finding progressive inequity as the average assessment ratio falls, even when the measurement error of assessed values and sales prices is the same. We propose and simultaneously examine a new instrument that improves on the performance of Clapp’s instrument. The new instrument is shown to be much more robust to different average assessment ratio situations. In addition, the newly proposed instrument has the flexibility to adapt to various beliefs as to the extent of the measurement error in sales prices relative to that in assessed values. In truth, correctly accounting for this difference is the key to getting a truly unbiased estimator. However, the difference is unknown do the econometrician 16 and cannot be estimated from just information on assessed values and sales prices. Hence, some belief must be set. The traditional PF, Cheng and IAOO regression models in essence operate under the belief that the measurement error in sales price is zero. In contrast, the KP model operates under the belief that the measurement error in assessed value is zero. The Clapp model in essence assumes the measurement error is the same for both. Overall, though, most authors (e.g. Bell, 1984; Kennedy, 1984; Clapp, 1990; Smith, 2000) seem to feel that while theoretically there is likely some errors-in-variables problem, sales price would be the more accurate measure of true value, meaning that the measurement error in sales prices should be lower than that in assessed values. The new estimator allows the econometrician to set this at a ratio they assume appropriate. In practice, when trying to identify the presence of vertical inequity, if the inequity is strong enough, all of the traditional estimators will agree (e.g. Smith, 2000 and Allen, 2003). However, in other situations they will differ with the PF, Cheng and/or IAOO models finding regressivity finding while the Clapp, and KP finding progressivity. In such cases, the new estimator can be very useful. First it can be used to improve upon the Clapp IV estimate by removing potential bias due to mean assessment ratios. Furthermore, the econometrician can proceed to adjust the assumed ratio of measurement errors from 𝛿 = 0 toward 𝛿 = 1 in increments to see at which values the results hold. This information can then be used to infer the more likely truth. For example, if the regressive results only hold when 𝛿 is close to zero, and hence require an assumption of very little measurement error in sales prices, , then it might be prudent to be skeptical of the more regressive findings. Alteratively, if the regressive findings hold up through a 𝛿 of 50% or more, meaning an assumption only that the measurement error in 17 sales prices is somewhat less that of the assessed values, then the more regressive findings might be the more reasonable conclusion. Lastly, it would be interesting to pursue using the new instrument as part of other methods used in considering vertical inequity. For example, it could be used to rank and identify the high and low valued properties in the VHAAS inequity correction procedure of Birch, Sunderman and Hamilton. It would also be interesting to consider a piece-wise linear model for different sales price ranges, as first suggested by Sunderman, Birch and Hamilton (1990), where each piece was estimated using the IV procedure instead of an extension of the PF estimator. 18 REFERENCES Allen, M. T. (2003). Measuring Vertical Property Tax Inequity in Multifamily Property Markets. Journal of Real Estate Research, 25(2). Bartlett, M. S. (1949). Fitting a Straight Line when Both Variables are Subject to Error. Biometrics, 5. Bell, E. J. (1984). Administrative Inequity and Property Assessment: The Case for the Traditional Approach. Property Tax Journal, 3(2). Birch, J. W., Sunderman, M. A. & Hamilton, T. W. (1992). “Adjusting for Vertical and Horizontal Inequity: Supplementing Mass Appraisal Systems,” Property Tax Journal, 11(3). Birch, J. W., Sunderman, M. A. & Smith, B. C. (2004). Vertical Inequity in Property Taxation: A Neighborhood Based Analysis. Journal of Real Estate Finance and Economics, 29(1). Cheng, P. L. (1974). Property Taxation, Assessment Performance and its Measurement. Public Finance, 29(3). Clapp, J. M. (1990). A New Test for Equitable Real Estate Tax Assessment. Journal of Real Estate Finance and Economics, 3(9). Durbin, J. (1954). Errors in Variables. Review of the International Statistical Institute, 34. Edelstein, R. H. (1979). An Appraisal of Residential Property Tax Regressivity. Journal of Financial and Quantitative Analysis, 14(4). International Association of Assessing Officers (IAOO) (1978). Improving Real Property Assessment: A Reference Manual. Chicago: IAOO. International Association of Assessing Officers (IAOO). (1999). Standard on Ratio Studies. Assessment Journal, 6(5). Kennedy, P. (1984). On an Unfair Appraisal of Vertical Equity in Real Estate Assessment. Economic Inquiry, 22(2). Kennedy, P. (2008). A Guide to Econometrics, 6th Ed., Blackwell Publishing, Malden, MA. Kochin, L. A. & Parks, R. W. (1982). Vertical Equity in Real Estate Assessment: A Fair Appraisal. Economic Inquiry, 20(4). McMillen, D. P. (2008). Changes in the Distribution of House Prices Over Time: Structural Characteristics, Neighborhood, or Coefficients? Journal of Urban Economics, 64:573-589. McMillen, D. P. (2012). The Effect of Appeals on Assessment Ratio Distributions: Some Nonparametric Approaches. Real Estate Economics, forthcoming. 19 Paglin, M., & Fogarty, M. (1972). Equity and the Property Tax: A New Conceptual Focus. National Tax Journal, 25(4). Sirmans, G. S., Diskin, B. A. & Friday, H. S. (1995). Vertical Inequity in the Taxation of Real Property. National Tax Journal, 48(1). Sirmans, G. S., Gatzlaff, D. H. & Macpherson, D. A. (2008). Horizontal and Vertical Inequity in Real Property Taxation. Journal of Real Estate Literature, 16(2). Sinianvkaia, N. (2007). Residential Real Estate Tax Rates in the American Community Survey. Housing Economics Online. Smith, B. C. (2000). Applying Models to Test for Vertical Inequity in the Property Tax to a NonMarket Value State. Journal of Real Estate Research, 19(3). Sunderman, M. A., Birch, J. W. & Hamilton, T. W. (1990), “Testing for Vertical Inequity in Property Tax Systems,” Journal of Real Estate Research, 5(3). Wald, A. (1940). The Fitting of Straight Lines if Both Variables are Subject to Errors. Annals of Mathematical Statistics, 32. 20 Table 1: Summary of Some Standard Tests for Vertical Inequity Model Null Regressive Progressive Author 𝐴𝑉 = 𝛽0 + 𝛽1 𝑆𝑃 𝛽0 = 0 𝛽0 > 0 𝛽0 < 0 Palgin & Fogarty 𝑙𝑛𝐴𝑉 = 𝛽0 + 𝛽1 𝑙𝑛𝑆𝑃 𝛽1 = 1 𝛽1 < 1 𝛽1 > 1 Cheng 𝐴𝑉/𝑆𝑃 = 𝛽0 + 𝛽1 𝑆𝑃 𝛽1 = 0 𝛽1 < 0 𝛽1 > 0 IAOO (1979) 𝑙𝑛𝑆𝑃 = 𝛽0 + 𝛽1 𝑙𝑛𝐴𝑉 𝛽1 = 1 𝛽1 > 1 𝛽1 < 1 Kochin & Parks 𝑙𝑛𝑆𝑃 = 𝛽0 + 𝛽1 𝑙𝑛𝐴𝑉 𝑙𝑛𝐴𝑉 = 𝛼0 + 𝛼1 𝑍 𝛽1 = 1 𝛽1 > 1 𝛽1 < 1 Clapp 𝑛 𝐴𝑉 ∑𝑛𝑖=1 𝐴𝑉𝑖 1 𝑖 𝑃𝑅𝐷 = ( ∑ )⁄( 𝑛 ) ∑𝑖=1 𝑆𝑃𝑖 𝑛 𝑖=1 𝑆𝑃𝑖 𝑃𝑅𝐷 = 1 𝑃𝑅𝐷 > 1.03 𝑃𝑅𝐷 < 0.98 IAOO (1999) Notes: The null hypothesis is that there is no vertical inequity. AV is the assessed value, SP is the observed sales price, Z is a dichotomous variable equal to 1 if both AV and SV are in the top third of their respective values and -1 if both AV and SV are in the bottom third of their respective values. The regressive and progressive boundaries for the PRD are the IAOO recommended thresholds and not a statistical test. 21 Table 2: Results for no Inequity, no Recapitalization of AV Model 1 (𝛼 =1.00) Estimator Conclusion 𝛿 = 0.00 0.25 0.50 1.00 Model 2 (𝛼 =0.75) 0.00 0.25 0.50 1.00 Model 1 (𝛼 =0.50) 0.00 0.25 0.50 1.00 PF Regressive Progressive 0.03 0.03 0.08 0.01 0.18 0.00 0.44 0.00 0.03 0.03 0.07 0.01 0.14 0.00 0.34 0.00 0.03 0.03 0.05 0.01 0.10 0.01 0.21 0.00 Cheng Regressive Progressive 0.03 0.03 0.17 0.00 0.45 0.00 0.88 0.00 0.03 0.03 0.12 0.00 0.32 0.00 0.74 0.00 0.03 0.03 0.09 0.01 0.19 0.00 0.54 0.00 IAOO Regressive Progressive 0.04 0.03 0.16 0.00 0.39 0.00 0.82 0.00 0.04 0.03 0.12 0.00 0.27 0.00 0.70 0.00 0.03 0.03 0.08 0.00 0.17 0.00 0.45 0.00 KP Regressive Progressive 0.00 0.99 0.00 0.98 0.00 0.95 0.00 0.88 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 Clapp Regressive Progressive 0.00 0.54 0.00 0.28 0.01 0.13 0.03 0.03 0.00 0.79 0.00 0.62 0.00 0.50 0.00 0.17 0.00 0.99 0.00 0.97 0.00 0.95 0.00 0.83 PRD Regressive Progressive 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Assume 𝛿=0.00 Regressive Progressive 0.03 0.03 0.17 0.00 0.42 0.00 0.87 0.00 0.03 0.03 0.12 0.00 0.32 0.00 0.73 0.00 0.03 0.03 0.08 0.01 0.18 0.00 0.51 0.00 Assume 𝛿=0.25 Regressive Progressive 0.00 0.14 0.03 0.03 0.11 0.00 0.46 0.00 0.00 0.11 0.03 0.03 0.09 0.00 0.41 0.00 0.01 0.08 0.03 0.03 0.07 0.01 0.27 0.00 Assume 𝛿=0.50 Regressive Progressive 0.00 0.32 0.01 0.09 0.03 0.03 0.18 0.00 0.00 0.27 0.01 0.09 0.03 0.03 0.17 0.00 0.00 0.19 0.01 0.09 0.03 0.04 0.13 0.00 Assume 𝛿=1.00 Regressive Progressive 0.00 0.60 0.00 0.32 0.00 0.15 0.03 0.03 0.00 0.58 0.00 0.32 0.00 0.16 0.03 0.04 0.00 0.47 0.00 0.30 0.00 0.16 0.03 0.04 New IV Notes: Table reports the percentage each estimator determined the presence of regressive and progressive vertical inequity. 𝛿 = 𝜎2𝑠𝑝 ⁄𝜎2𝑎𝑣 is the ratio of the variance of the sales price measurement error to assessed value measurement error, as in the true model (column headings) and as assumed by the estimators (row headings). 22 Table 2 (continued): Results for no Inequity, no Recapitalization of AV Model 1 (𝛼 =1.00) Model 2 (𝛼 =0.75) Estimator Conclusion 𝛿 = 0.00 0.25 0.50 1.00 0.00 0.25 0.50 1.00 MW Regressive 0.00 0.00 0.00 0.03 0.00 0.00 0.00 0.00 Clapp Z Progressive 0.54 0.28 0.14 0.03 0.79 0.56 0.41 0.17 Model 1 (𝛼 =0.50) 0.00 0.25 0.50 1.00 0.00 0.99 0.00 0.96 0.00 0.93 0.00 0.80 Assume 𝛿=0.00 Regressive Progressive 0.03 0.02 0.14 0.00 0.36 0.00 0.80 0.00 0.03 0.02 0.11 0.00 0.26 0.00 0.67 0.00 0.04 0.02 0.08 0.01 0.16 0.00 0.44 0.00 Assume 𝛿=0.25 Regressive Progressive 0.00 0.11 0.03 0.03 0.11 0.00 0.38 0.00 0.00 0.09 0.04 0.03 0.10 0.00 0.33 0.00 0.01 0.06 0.03 0.03 0.07 0.01 0.25 0.00 Assume 𝛿=0.50 Regressive Progressive 0.00 0.26 0.01 0.08 0.03 0.02 0.17 0.00 0.00 0.21 0.01 0.08 0.03 0.03 0.17 0.00 0.00 0.15 0.01 0.07 0.03 0.03 0.13 0.00 Assume 𝛿=1.00 Regressive Progressive 0.00 0.52 0.00 0.26 0.00 0.12 0.03 0.03 0.00 0.50 0.00 0.27 0.00 0.14 0.03 0.03 0.00 0.39 0.00 0.23 0.00 0.13 0.02 0.03 Notes: Table reports the percentage each estimator determined the presence of regressive and progressive vertical inequity. 𝛿 = 𝜎2𝑠𝑝 ⁄𝜎2𝑎𝑣 is the ratio of the variance of the sales price measurement error to assessed value measurement error, as in the true model (column headings) and as assumed by the estimators (row headings). 23 Table 3: Results for no Inequity, 3% Recapitalization of AV Model 1 (𝛼 =1.00) Estimator Conclusion 𝛿 = 0.00 0.25 0.50 1.00 Model 2 (𝛼 =0.75) 0.00 0.25 0.50 1.00 Model 3 (𝛼 =0.50) 0.00 0.25 0.50 1.00 PF Regressive Progressive 0.03 0.02 0.10 0.00 0.21 0.00 0.48 0.00 0.03 0.02 0.08 0.01 0.15 0.00 0.36 0.00 0.03 0.02 0.07 0.01 0.11 0.01 0.24 0.00 Cheng Regressive Progressive 0.04 0.02 0.22 0.00 0.53 0.00 0.92 0.00 0.04 0.02 0.17 0.00 0.38 0.00 0.80 0.00 0.04 0.02 0.10 0.00 0.23 0.00 0.58 0.00 IAOO Regressive Progressive 0.04 0.02 0.19 0.00 0.45 0.00 0.86 0.00 0.04 0.02 0.15 0.00 0.32 0.00 0.74 0.00 0.04 0.02 0.10 0.00 0.20 0.00 0.51 0.00 KP Regressive Progressive 0.00 0.99 0.00 0.98 0.00 0.95 0.00 0.88 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 0.00 1.00 Clapp Regressive Progressive 0.00 0.52 0.00 0.26 0.01 0.12 0.04 0.02 0.00 0.78 0.00 0.60 0.00 0.41 0.00 0.15 0.00 0.99 0.00 0.97 0.00 0.94 0.00 0.82 PRD Regressive Progressive 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Assume 𝛿=0.00 Regressive Progressive 0.04 0.02 0.22 0.00 0.50 0.00 0.91 0.00 0.04 0.02 0.16 0.00 0.36 0.00 0.78 0.00 0.04 0.02 0.10 0.00 0.21 0.00 0.56 0.00 Assume 𝛿=0.25 Regressive Progressive 0.00 0.13 0.04 0.03 0.13 0.00 0.49 0.00 0.01 0.10 0.03 0.03 0.11 0.00 0.44 0.00 0.01 0.07 0.04 0.03 0.08 0.01 0.31 0.00 Assume 𝛿=0.50 Regressive Progressive 0.00 0.32 0.01 0.09 0.03 0.02 0.19 0.00 0.00 0.25 0.01 0.08 0.04 0.03 0.19 0.00 0.00 0.16 0.01 0.07 0.03 0.03 0.15 0.00 Assume 𝛿=1.00 Regressive Progressive 0.00 0.60 0.00 0.32 0.00 0.15 0.03 0.03 0.00 0.56 0.00 0.31 0.00 0.15 0.03 0.03 0.00 0.44 0.00 0.27 0.00 0.15 0.03 0.03 New IV Notes: Table reports the percentage each estimator determined the presence of regressive and progressive vertical inequity. 𝛿 = 𝜎2𝑠𝑝 ⁄𝜎2𝑎𝑣 is the ratio of the variance of the sales price measurement error to assessed value measurement error, as in the true model (column headings) and as assumed by the estimators (row headings). 24 Table 3 (continued): Results for no Inequity, 3% Recapitalization of AV Model 1 (𝛼 =1.00) Model 2 (𝛼 =0.75) Estimator Conclusion 𝛿 = 0.00 0.25 0.50 1.00 0.00 0.25 0.50 1.00 MW Regressive 0.00 0.00 0.00 0.04 0.00 0.00 0.00 0.00 Clapp Z Progressive 0.51 0.27 0.12 0.02 0.78 0.56 0.39 0.15 Model 3 (𝛼 =0.50) 0.00 0.25 0.50 1.00 0.00 0.98 0.00 0.96 0.00 0.92 0.00 0.77 Assume 𝛿=0.00 Regressive Progressive 0.04 0.02 0.19 0.00 0.42 0.00 0.84 0.00 0.04 0.02 0.13 0.00 0.31 0.00 0.72 0.00 0.04 0.02 0.09 0.01 0.18 0.00 0.50 0.00 Assume 𝛿=0.25 Regressive Progressive 0.00 0.10 0.04 0.02 0.12 0.00 0.41 0.00 0.01 0.08 0.04 0.03 0.12 0.00 0.38 0.00 0.01 0.05 0.03 0.02 0.08 0.01 0.27 0.00 Assume 𝛿=0.50 Regressive Progressive 0.00 0.25 0.01 0.07 0.04 0.02 0.18 0.00 0.00 0.20 0.01 0.07 0.03 0.03 0.18 0.00 0.00 0.13 0.01 0.06 0.04 0.02 0.14 0.00 Assume 𝛿=1.00 Regressive Progressive 0.00 0.53 0.00 0.27 0.00 0.12 0.02 0.02 0.00 0.49 0.00 0.26 0.00 0.13 0.03 0.03 0.00 0.36 0.00 0.22 0.00 0.11 0.03 0.03 Notes: Table reports the percentage each estimator determined the presence of regressive and progressive vertical inequity. 𝛿 = 𝜎2𝑠𝑝 ⁄𝜎2𝑎𝑣 is the ratio of the variance of the sales price measurement error to assessed value measurement error, as in the true model (column headings) and as assumed by the estimators (row headings). 25 Figure 1: LOWESS smoothing, with and without errors in variables 26