CICV Health Plan Document 2015

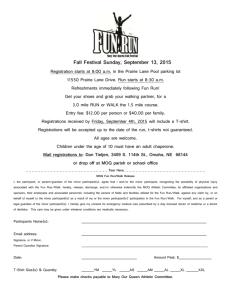

advertisement