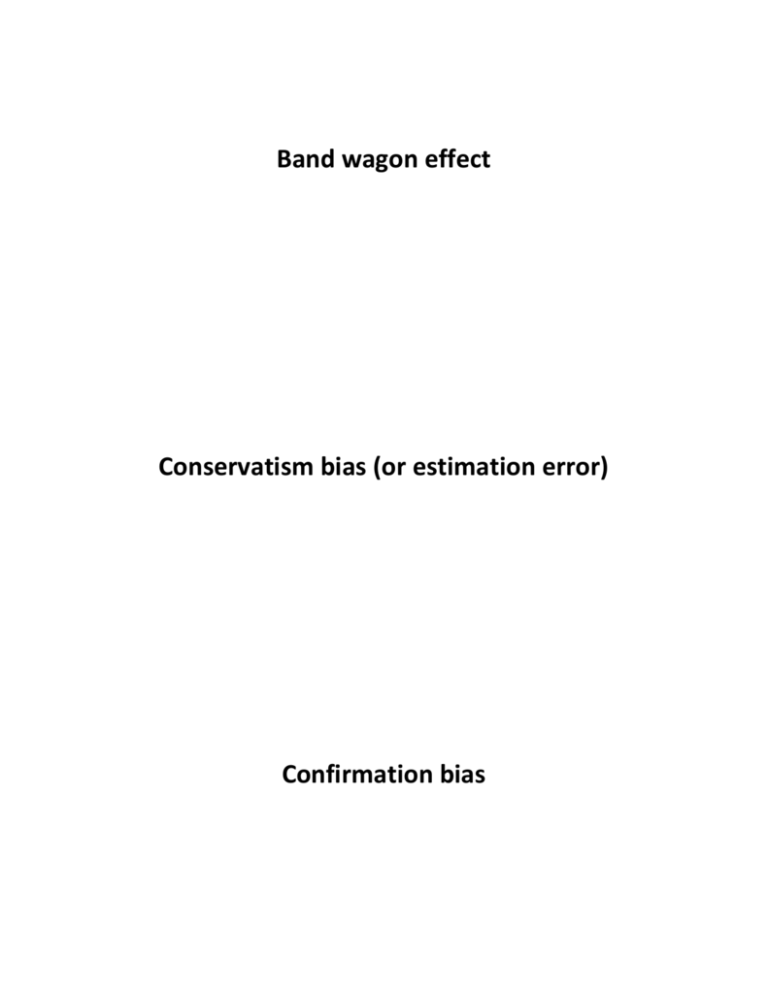

Band wagon effect Conservatism bias (or estimation error

advertisement

Band wagon effect Conservatism bias (or estimation error) Confirmation bias The tendency to believe something just because many other people believe the same. The tendency to underestimate high values and overestimate low ones. (e.g. “The Price is Right” phenomenon) The tendency to selectively use other’s opinions to justify one’s own choices/opinions. Denomination effect Endowment effect Framing effect The tendency to spend more money when it is denominated in small amounts (e.g. coins) rather than large amounts (e.g. bills). Note: this is why casinos use chips. The tendency for people to demand much more to give up an item they already own than they would be willing to pay for it. The effect on perception when the situation is presented or described in different ways (contrast: a surgeon says either that 5% of patients die or 95% of patients recover). Money Illusion Present bias (example of time inconsistency) Information overload The tendency to think of currency in nominal rather than real terms (thus ignoring inflation and time value of money). The tendency to have a stronger preference for immediate reward rather than a later reward. The tendency to seek information even when it cannot affect action. Loss aversion Mental accounting Sunk cost effect The tendency to avoid losses much more than accepting equal gains. The tendency to group spending (or savings) into separate categories. The tendency to have a psychological investment in costs that have already been incurred regardless of what the current costs and benefits are. Status quo effect Reference dependent preference Compromise effect The tendency to stick with the default option (e.g. opt-in vs. opt-out choice). The tendency to judge one’s well-being relative to some reference point (e.g. what other people have or are doing) rather than in absolute terms. The tendency to choose an option that represents a compromise (e.g. buying the mid-priced appliance or TV). Hindsight bias Lake Wobegon effect (from Garrison Keiler) False consensus effect To filter memory of past events through present knowledge, so that those events look more predictable than they actually were (“I knew it all along”). This phenomenon occurs when a supermajority of people evaluate themselves as above average in ability (or other desirable quality). The tendency for people to overestimate the degree to which others agree with them. Anchoring Availability bias Gambler’s Fallacy The tendency to rely too heavily on the first piece of information offered even when it is irrelevant. (e.g. the first price offered for a used car becomes the basis for the negotiation) The tendency to believe something is more likely based on what is available in memory (bias toward vivid, unusual, or emotionally charged examples). The tendency to expect extreme performance to continue; also ignoring averages (or probability) in favor of recent data. (Thus, “hot” streaks are confused for the norm.) Certainty effect (in risk situations) Fairness (or Inequality) bias Heuristics The tendency to prefer a certain small reward rather than a probable larger reward. (Even though the expected returns are the same.) The tendency to be averse to unfair outcomes and be willing to forego a benefit (or incur a cost) in order to punish others who are seen as unfair. To make a decision using a rule of thumb, an educated guess, an intuitive judgment, or common sense.