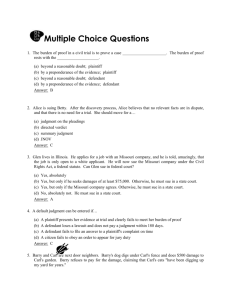

commercial-court-2015-102

advertisement