APFA Demonstration Farm * Feasibility Study

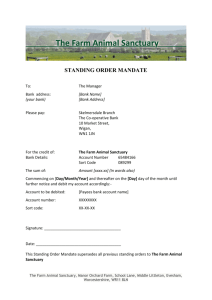

advertisement