Return on Investment (ROI) – Click here to see the different ways in

advertisement

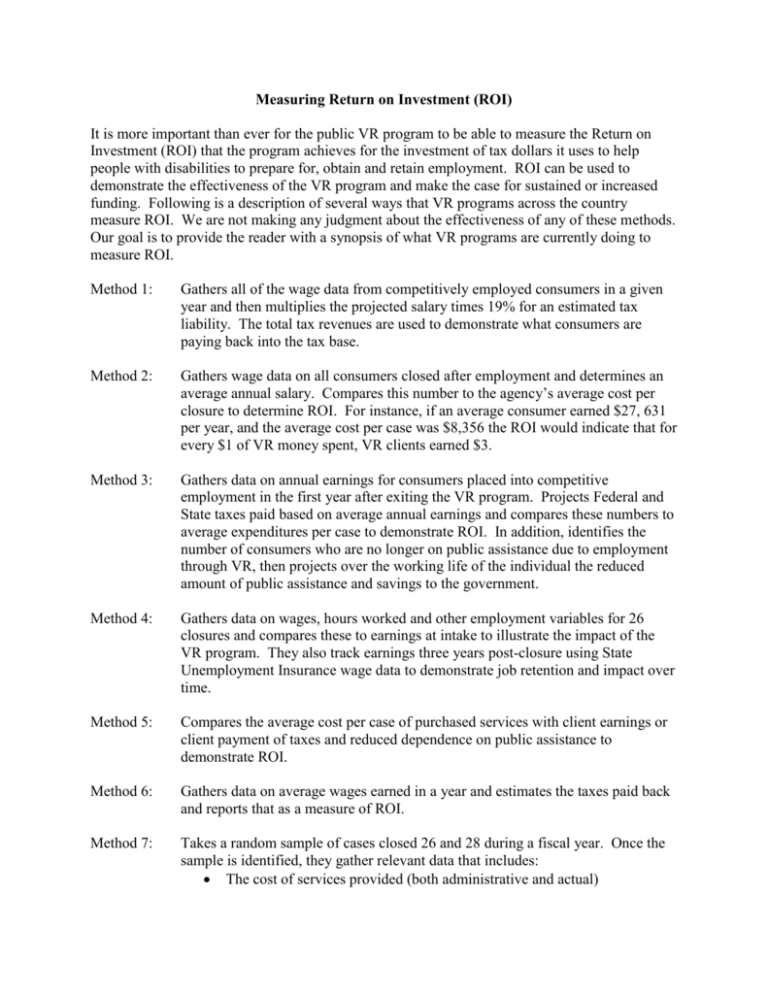

Measuring Return on Investment (ROI) It is more important than ever for the public VR program to be able to measure the Return on Investment (ROI) that the program achieves for the investment of tax dollars it uses to help people with disabilities to prepare for, obtain and retain employment. ROI can be used to demonstrate the effectiveness of the VR program and make the case for sustained or increased funding. Following is a description of several ways that VR programs across the country measure ROI. We are not making any judgment about the effectiveness of any of these methods. Our goal is to provide the reader with a synopsis of what VR programs are currently doing to measure ROI. Method 1: Gathers all of the wage data from competitively employed consumers in a given year and then multiplies the projected salary times 19% for an estimated tax liability. The total tax revenues are used to demonstrate what consumers are paying back into the tax base. Method 2: Gathers wage data on all consumers closed after employment and determines an average annual salary. Compares this number to the agency’s average cost per closure to determine ROI. For instance, if an average consumer earned $27, 631 per year, and the average cost per case was $8,356 the ROI would indicate that for every $1 of VR money spent, VR clients earned $3. Method 3: Gathers data on annual earnings for consumers placed into competitive employment in the first year after exiting the VR program. Projects Federal and State taxes paid based on average annual earnings and compares these numbers to average expenditures per case to demonstrate ROI. In addition, identifies the number of consumers who are no longer on public assistance due to employment through VR, then projects over the working life of the individual the reduced amount of public assistance and savings to the government. Method 4: Gathers data on wages, hours worked and other employment variables for 26 closures and compares these to earnings at intake to illustrate the impact of the VR program. They also track earnings three years post-closure using State Unemployment Insurance wage data to demonstrate job retention and impact over time. Method 5: Compares the average cost per case of purchased services with client earnings or client payment of taxes and reduced dependence on public assistance to demonstrate ROI. Method 6: Gathers data on average wages earned in a year and estimates the taxes paid back and reports that as a measure of ROI. Method 7: Takes a random sample of cases closed 26 and 28 during a fiscal year. Once the sample is identified, they gather relevant data that includes: The cost of services provided (both administrative and actual) The quarterly wages clients earned after closure for three years (12 quarters) Social Security payments saved if applicable Social Security taxes paid Federal, State and Medicare taxes paid These costs and benefits are compared for each of the relevant information areas for the sample and then extrapolated to the entire program for all three years to identify ROI. This method is used by the VR program in West Virginia. They graciously agreed to allow us to post their report. You can read their ROI report in its entirety by clicking here: ..\..\West Virginia ROI.pdf Method 8: Measures the return to a consumer of the VR program by comparing the cost of purchased services to the annual wages earned by the consumer. For instance, if the cost of services was $5,000 and a consumer got a job after receipt of services that paid $20,000 per year, the ROI for the individual is $4 for every $1 invested. This same method is used on a larger scale by County or statewide to demonstrate ROI for a given state or area of the state. Very similar to Method 2 except it is expanded beyond the individual to larger geographic areas. Method 9: Identifies the total number of VR consumers that obtained employment in a given year, approximates their total earnings, and estimates the total amount of taxes they will pay. This information is reported as summary data for what consumers and society gained by participation in the VR program. Method 10: Identifies the total amount of wages earned at closure and the projected taxes to be paid from employment to the State appropriation of dollars to give an ROI for every state dollar spent. Method 11: Identifies the cost of rehabilitation services per consumer by averaging case service dollars actually expended, identifying the cost of counselor time per case, and the average administration costs per case. This total cost per case is then compared to the increase in taxes paid and the reduction in public assistance costs to obtain an ROI. Method 12: Compares public assistance savings to costs per case and projects savings out over 1, 3,5,10 and 30 years to demonstrate the long-term ROI of the VR program. Method 13: Estimates the length of time it will take for the State to be paid back their portion of the cost of an average VR case in State taxes by multiplying the average case costs for a 26 closure by .213, dividing that number by State taxes paid and then multiplying that number by 12 months. This same computation is used for the federal portion (.787) and the total State and Federal portion (1.0).