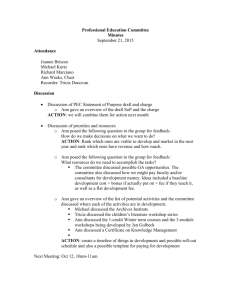

CHAPTER 11

advertisement

CHAPTER 11 The Road Traveled Key Points The first ten chapters of this book examined the role of accounting in planning, performing, and evaluating business-operating activities. Chapters 1 – 3 laid the basic foundation as we explored the evolution of accounting and the role of accounting in today’s business environment, the basic business processes and the balanced scorecard. In Chapters 4 – 6, we investigated the planning process for operating activities and how accounting information is used in this process. Chapter 7 introduced the accounting cycle and the process of recording and communicating accounting events. Chapters 8 - 10 built on these ideas as we examined the process of recording and evaluating expenditure, revenue, and conversion process activities. . Operating, investing, and financing decisions are cyclical in nature. You Are Here The second half of this text follows the format developed in the first half—planning, performing, and evaluating. However, now we explore the capital resources process (investing and financing activities). Since these types of activities are long-term in nature (whereas operating activities studied in the first half of the book tend to be short-term), we must consider the time value of money. Chapter 11 discusses the risk-reward relationship, the concept of compound interest, and uses these ideas to examine the time value of money. This chapter, then, lays the foundation for the second half of the book. The Road Ahead Chapter 12 uses the time value of money concepts discussed in Chapter 11 to examine the capital budgeting process. We explore how companies determine whether certain long-term projects should be accepted or rejected. Chapter 13 is the first of two chapters that explore the process of raising the capital necessary to run the business and enable it to invest in long-term projects and human capital. Chapter 13 investigates equity (owner) financing and Chapter 14 considers debt (creditor) financing. 5e Risk and return are related. A dollar today is worth more than a dollar tomorrow. The six time value of money elements are: FV = future value PV = present value ANN = annuity (equal payments over equal time periods) r = annual interest rate c = number of compoundings (payments) per year n = total number of compoundings (payments) over the life DISCUSSION OUTLINE Chapter 11’s discussion should focus on the time value of money. You must understand the components of time value of money problems (r, c, n, FV, PV, ANN) and you must know when a problem is an annuity. Investing and Financing Activities • • Investing activities concern Purchase Use Sale of long term assets Financing activities concern Raising cash by borrowing By issuing an ownership interest in the business Paying cash to repay monies borrowed from creditors To provide a return to owners What is the difference between return of and return on investment and what is the expected rate of return? Return of investment Return on investment— Expected rate of return— What is risk, how is it measured, and how is it related to return? 5e Risk— Inflation risk— Business risk— Liquidity risk— Risk premium— What is the difference between simple and compound interest and why did we use simple interest in the operating section of the book? 5e Simple— Compound— We used simple interest in the operating section because the decisions were shortterm and, therefore, any compounding would be immaterial http://www.youtube.com/watch?v=gRYh41zllUk&feature=related What is the future value of $1? Answers the question, what amount will $1 grow to in the future If I invest $3,000 today, what will it be worth in 5 years if I earn 8 percent interest compounded quarterly? r = 8, c = 4, n = 20, PV = 3,000, ANN = 0, FV = $4,457.84 FV = ($1 + 0.08/4)20 * $3,000 = $4,457.84 What is the present value of $1? Answers the question, what is $1 in the future worth today If I receive $3,000 in 5 years, what is it worth today if I could invest it at 8 percent compounded quarterly? r = 8, c = 4, n = 20, FV = 3,000, ANN = 0, PV = $2,018.91 PV = 1/($1 +0.08/4)20 * 3,000 = $2,018.91 What is an annuity? A series of EQUAL cash payments made at EQUAL intervals What is the future value of an annuity? Answers the question, what is a series of payments going to be worth in the future If I invest $200 every month for 10 years and earn 11 percent annual interest, how much money will I have in 10 years? r = 11, c = 12, n = 120, PV = 0, ANN = 200, FV = $43,399.63 FV = [($1 + 0.11/12)120 - $1]/0.11/12 * $200 = $43,399.63 What is the present value of an annuity? Answers the question, how much must be received today to generate a series of equal payments in the future? If I want to buy a new car for $25,000 and the dealer will finance me at 8 percent annual interest for 6 years, what is my monthly car payment? r = 8, c = 12, n = 72, PV = 25,000, FV = 0, ANN = $438.33 $25,000 = [$1 – $1/($1 + 0.08/12)72]/0.08/12 * ANN; ANN = $438.33 5e Lecture Examples 1. You want to save for a new stereo system for your car. The system costs $3,000. How much money must you put aside every month for 2 years if you can earn 8 percent interest annually? r = 8, c = 12, n = 24, FV = 3,000, PV = 0, ANN = $115.68 2. You want to buy a new car when you graduate with your Ph.D. in accounting. How much money should you invest today to have $40,000 in 10 years if you can earn 9 percent annually? FV= 40,000, c = 1, n = 10, r = 8, ANN = 0, PV = $18,527.74 3. You want to buy a used car today. The car costs $16,000. You can obtain financing at 10 percent interest for 4 years. How much is your monthly payment? PV = 16,000, r = 10, c = 12, n = 48, FV = 0, ANN = $405.80 4. You have $2,000 to invest. If you earn 15 percent in the stock market, what will your investments be worth when you graduate in 3.5 years? PV = 2,000, r = 15, c = 1, n = 3.5, ANN = 0, FV = $2,088.88 5e