Now - Hambleton District Council

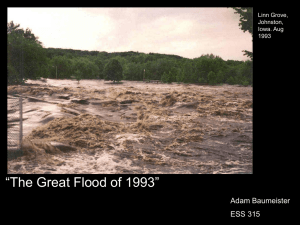

advertisement

Hambleton Flood relief discounts package Central government have announced a package of measures to support residents and business affected by the recent storms Desmond and Eva which include council tax and NNDR discounts for a minimum of 3 months. Discounts will be available for a minimum of 3 months initially for the period 26.12.15 to 31.3.16. Definition of flooding Section 1 of the Flood & Water Management Act 2010 1(1) “Flood” includes any case where land not normally covered by water becomes covered by water. (2) It does not matter for the purpose of subsection (1) whether a flood is caused by— (a) heavy rainfall, (b) a river overflowing or its banks being breached, (c) a dam overflowing or being breached, (d) tidal waters, (e) groundwater, or (e) anything else (including any combination of factors). (3) But “flood” does not include— (a) a flood from any part of a sewerage system, unless wholly or partly caused by an increase in the volume of rainwater (including snow and other precipitation) entering or otherwise affecting the system, or (b) a flood caused by a burst water main (within the meaning given by section 219 of the Water Industry Act 1991 Council Tax discount scheme: Eligibility criteria A 100% discount will be given for a minimum of three months in respect of any domestic property flooded in whole or part as a result of adverse weather conditions; even if you reoccupy the property within that time This includes domestic properties where: o Gardens / adjoining land / outbuildings have been severely affected; o Services such as sewerage, drainage, and electricity are severely affected; o Upper storey flats (above ground level) where accessibility or impacted services mean the property is unliveable. Where a person has had to move into temporary accommodation and is liable to pay Council Tax on that property a 100% discount will also be applied to the temporary accommodation in parallel with the discount on their flooded property No discount is available for second homes or dwellings that were empty on the day before they became flooded Discounts are available for properties where services or access were unavailable, even if home not flooded (e.g. if you were 2nd floor flat and the ground floor was flooded) What happens after 3 months? You must contact us if you remain out of your property for more than 3 months to apply for an extended period of relief Where you have applied for extended relief you will continue receive a 100% discount on both the flooded property and the temporary accommodation until such time as you are able to return home, up to a maximum of 12 months in total Discounts for partly occupied properties where the householder has remained within the property but it remains partly uninhabitable due to the flooding and occupation of the whole property is limited by flood damage after 3 months may be able to have a further discount but this will be subject to verification / inspection by Council Officers Properties affected by multiple instances of flooding Where your property was rendered unliveable due to multiple separate flooding events, discounts will be offered in respect of each event. So (for example) someone, whose home became unliveable in December 2015 and again in subsequent flood events, could be granted separate three-month periods of relief. Householders receiving multiple periods of relief would also be eligible for additional discounts in each period, if they remained out of their home after 3 months Where the two separate instances of flooding occur within 3 months of each other, the two discount periods would run concurrently. For example, if a second flooding episode occurred after 2 months, and rendered the property unliveable, discounts would be available for another 3 months, making the total discount period 5 months Partially demolished or structurally damaged properties If your domestic property has been partially demolished, structurally damaged and is uninhabitable, the Valuation Office Agency (VOA) may be able to help you. They will look at each case on merit. email: ctnorth@voa.gsi.gov.uk Phone: 03000 501501 Further information is available at: https://www.gov.uk/government/news/properties-affectedby-adverse-weather Non Domestic Rates – (Business Rates) As flood relief is subject to State Aid limits, where the business is part of a national company or a large hereditament we may contact the head office to complete a State Aid declaration before we are able to apply any relief. Eligibility: 100 per cent rate relief for a minimum of three months (regardless of whether they reoccupy the premises during that period) for those premises which meet the following criteria: For any day: o the premises have been flooded in whole or in part as a result of adverse weather conditions; and o on that day, as a result of the flooding at the hereditament, the business activity undertaken at the hereditament was adversely affected; and o the rateable value of the hereditament on that day was less than £10 million o ratepayers affected at more than one property will receive relief in respect of each property Relief is not available to properties where flooding was due to the failure of a water main, internal water systems or the failure of a sewerage system (unless the failure was itself caused by the adverse weather conditions) Where the ratepayer occupies more than one property relief can be granted for all eligible properties Empty Properties that have been subject to flooding The scheme does not cover relief for any premises which were empty at the time it was flooded as there was no business activity on the premises at the time Where a hereditament becomes empty after the flood then it will receive the normal 3 or 6 months (as applicable) empty property rate free period or will continue to receive the balance of the flooding relief What about properties removed from the rating list due to flooding? Seriously damaged properties may be taken off the ratings list by the Valuation Office Agency (VOA) Where a property is removed from the rating list the ratepayer is not liable for business rates Once the property returns to the list it may be eligible for any remaining period of flood relief that would have otherwise been given. For example, a property that was taken out of the list for a month would then become eligible for a minimum of two months flood relief. Valuation Office Agency (VOA) Property Inspectors are visiting businesses in the worst affected areas. What about businesses that have not been directly flooded but have seen trade affected? If your premises have not actually been flooded but you have seen a reduction or loss in trade due to infrastructure issues such road or bridge closures you should contact the Valuation Office Agency (VOA). They will consider temporarily lowering the Rateable Value (RV) for your property, which will have the effect of reducing your business rates liability. Where there are prolonged bridge closures reductions in RV will continue for however long it takes to re-instate it to normal (i.e. open to both road and foot traffic). The Valuation Office Agency can be contacted on: email: ratingnortheast@voa.gsi.gov.uk Phone: 03000 501501 Further information is available at: https://www.gov.uk/government/news/properties-affectedby-adverse-weather