Beverage Containers Decision RIS - Best Practice Regulation Updates

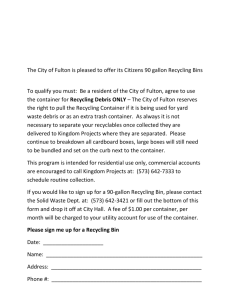

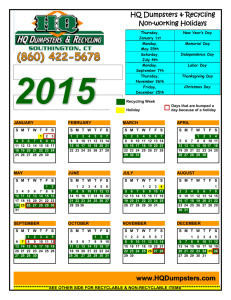

advertisement