2012 Compensation Guidelines and Worksheets

advertisement

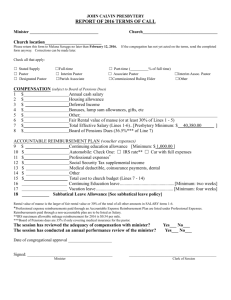

MINISTERIAL COMPENSATION FOR FULL TIME INSTALLED POSITIONS A Plan and Guide for the Presbytery of Middle Tennessee Adopted by the Presbytery of Middle Tennessee May 3, 2001 Revised by the Committee on Ministry September 6, 2001 Revised by the Committee on Ministry October 3, 2002 PREFACE The plan is formulated on the premise that the TOTAL COMPENSATION paid and/or furnished to a minister should appear reasonable, just, and fair to the leaders of a congregation, to a majority of the members of a congregation, and to the minister. For the peace, unity and effectiveness of the church, general acceptance by all of these is essential as the minister and members work together to carry out the mission of the church. Several principles underline the development of the plan: 1) Scripture indicates in Luke 10:4-7 that one who labors for the gospel “deserves to be paid.” 1 Corinthians 9:14 states “that those who proclaim the gospel should get their living by the gospel.” 2) As the life of the early church developed, it was suggested that those who served with distinction should receive material rewards. “Let the elders who rule well be considered worthy of double honor, especially those who labor in preaching and teaching.” (1 Timothy 5:17) 3) Remuneration for services rendered by the pastor should be in line with the income levels of the area in which that service takes place. 4) The pastor is a trained professional with responsibilities for which the Church has required long years of preparation and training. 5) Principles of Justice and Fairness are to be honored and emphasized. (Book of Order G-14.0510a.(3)) It is hoped that each congregation in the Presbytery, through its Session, will enter into dialogue with its minister(s) so the concerns of each can be aired and fair compensation can be determined. USING THIS GUIDE This guide will assist in negotiating ministerial compensation. Section 1 “Minimum Compensation” states the Presbytery approved minimum compensation and the rationale. Section 2 “Guidelines for Fair Compensation” provides a rationale and basis for clergy compensation. Section 3 “Salary Adjustments” lists a number of factors that should be considered in adjusting ministerial compensation. Section 4 “Avoiding Unnecessary Tax Liability” provides guidance (not legal advice ) on ways churches can increase ministerial income simply by stating the Terms of Call in a way that avoids certain tax issues. Worksheet 1 is for calculating Fair Effective Salary based upon the “Guidelines for Fair Compensation.” Worksheet 2 is for calculating Housing and Utility allowances for use in Terms of Call. Worksheet 3 delineates the Terms of Call and Continuation of Terms of Call. 1 SECTION 1 MINIMUM EFFECTIVE SALARY1 The Presbytery fixes the Minimum Effective Salary requirements at 80% of the Churchwide Median Salary as established annually by the Board of Pensions. “Effective Salary” is defined as the combination of cash salary and housing. For 2012, the Churchwide Median Salary is $53,300; therefore the Minimum Effective Salary is $42,640. (Figuring allowances for housing, utilities, etc. is done on Worksheet 2.) Other requirements include: a. Full dues to the Benefits Plan of the Board of Pensions (32.25% for 2012 of Effective Salary as defined by the Board of Pensions); b. Salary supplement equal to no less than 50% of the Social Security Self-Employment Tax; c. Four weeks or one month paid vacation inclusive of Sundays; d. Professional Expense Reimbursement Plan - Presbytery has approved a minimum of $2500 for reimbursement of automobile expenses, books, continuing education and other professional expenses when substantiated to the Church Treasurer or other person designated by the session; e. Annual Study Leave of two weeks; f. Annual review of the terms of call and covenant with an evaluation of the mutual achievement of mission goals by minister and session with serious consideration given to the current Effective Salary and Guidelines for Fair Compensation (explained in Section 2). g. A comprehensive evaluation of ministry every five years to consider a three month sabbatical from church duties after six years of continuous full time service. 1These figures will be revised annually at the July presbytery meeting to be effective for the following calendar year. SECTION 2 GUIDELINES FOR FAIR COMPENSATION It is difficult to assess fair compensation for clergy because of comparing ministry with any similar calling, profession, or job that is equivalent in necessary training, scope of responsibility, hours of work, and emotional involvement. Every church should establish terms of call that provide a comfortable standard of living for the minister and her or his family. Additionally, the Terms of Call need to reflect years of experience, special training, additional education, or unusual circumstances or skills required of the minister. The Presbytery of Middle Tennessee has adopted the Median Family Income figure as the fairest guideline for determining Fair Compensation. The median figure is a mid-point income figure that takes into account both high and low incomes in the area. The Percept Group, Inc., a demographic service, provides the Presbytery with a median household income based upon the exact geographic boundaries of the Presbytery, including our large cities and rural areas. The Presbytery sets Fair Effective Salary as equal to the median household income figure at $46,596. Fair Compensation includes Fair Effective Salary and other benefits as given in Section 1. The Guidelines for Fair Compensation adopted by Presbytery are recommended to congregations and agencies of Presbytery in the hope that they will be able to compensate their ministers at the level recommended. NOTE: The Guidelines for Fair Compensation are recommendations and ARE NOT TO BE CONFUSED with Minimum Compensation required of each congregation. 2 SECTION 3 - SALARY ADJUSTMENTS Experience Factor Since Ordination serving in a Add to the Church Related Vocation Base Figure 0 - 2 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0% 3 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .+ 2% 4 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .+ 4% 5 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .+ 6% 6 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .+ 8% 7 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .+ 10% 8 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .+ 12% 9 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .+ 14% 10 years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . + 16% 11 years to 20 years (maximum), 1% per year additional, up to a maximum of 26%. Special Qualifications This includes special talents expected of the minister and the possibility that a degree beyond the basic theological degree should be considered for additional compensation. SECTION 4 - AVOIDING UNNECESSARY TAX LIABILITY (Guidance, Not Legal Advice) Ministers are classified in an unusual tax category that can be confusing. If a church uses care in preparing the Terms of Call the minister can avoid some unnecessary tax burdens. According to the “Self-Employment Test” of the Internal Revenue Service most ministers need to file as employees. (By a previous IRS test most ministers could file as self-employed.) Certain allowances are exempt from Income Tax to the extent they are actually used. By Social Security Statute ministers are self-employed. Certain allowances that are not considered for Income Taxes must be included in figuring Social Security Self-Employment taxes. Housing, Utilities, and Furnishings. Ministers do not pay Income Tax on amounts designated for housing, including utilities, furnishings, maintenance, and appurtenances. Social Security Supplement. This salary supplement covers the cost of Social Security Self-Employment Tax. In order to calculate the amount of the tax, multiply the TOTAL ANNUAL SALARY (which includes allowances for housing and utilities or the value of housing and/or utilities provided) by 15.3% for 2012. Professional Reimbursement Plan. Changes in tax laws make it beneficial for the minister to substantiate professional expenses (auto usage, books, magazines, continuing education, subscriptions, dues to professional organizations, etc.) and submit these to the church for reimbursement. The recommended minimum figure for 2012 is $2,500. Ministerial Compensation for Pulpit Supply The Committee on Ministry commends to the church the following guidelines for compensation of Sunday services by guest ministers. ∙ For congregations of less than 100 members--$100 plus round trip mileage reimbursed at the current rate approved by the IRS. ∙ For congregations of 101 to 500 members--$150 plus round trip mileage reimbursed at the current rate approved by the IRS. ∙ For congregations of 501or more members--$200 plus round trip mileage reimbursed at the current rate approved by the IRS. Congregations may vary from these guidelines only in extraordinary circumstances (i.e. multiple worship services, congregation size, etc.) and with prior negotiation with the minister. 3 WORKSHEET 1 CALCULATING FAIR EFFECTIVE SALARY PORTION OF THE TOTAL COMPENSATION USING THE GUIDELINES FOR FAIR COMPENSATION Line 1. Total Effective Salary Area Adjusted Median Family Income 2. Experience Factor (See Section 2) a. Number of years since ordination ________ b. Percent according to table c. Multiply % in Line 2.b times Base Figure in Line 1 3. Add Lines 1 and 2c. 4. Special Qualifications (List with figures) $ % _________________ $_________________ a.________________________________ $_______________ b.________________________________ $_______________ c.________________________________ $_______________ 5. Subtotal (Add Lines 4a., 4b., 4c.) $_______________ 6. Total (Add Line 3 and Line 5) $ NOTE: Line 6 is the TOTAL EFFECTIVE SALARY according to the Guidelines for Fair Compensation. To calculate for Housing, Utilities etc., use Worksheet 2. 4 WORKSHEET 2 DETERMINING HOUSING AND UTILITY ALLOWANCES Note whether the call to your pastor(s) falls into: Category A: You do not provide a manse and utilities, but provide a designation or an allowance to cover these. Category B: You provide a manse, but have a designation or allowance for utilities. Category C: You provide a manse and furnish the full cost of utilities. Choose the correct category below, and ignore the other categories. Please remember that for the purposes of calculating major medical and pension payments to the Board of Pensions that the church must establish an Effective Salary, or the total of cash salary and housing combined. The following paragraphs are intended to assist with this calculation. CATEGORY A: MINISTERS WITH NO MANSE OR UTILITIES FURNISHED A portion of the effective salary can be designated as a housing allowance. Under IRS regulations, the housing allowance may be up to 49% of the effective salary. The effective salary is the sum of cash paid and the amount designated as housing allowance. Please note that it is the responsibility of the minister to substantiate the amount and use of funds spent for housing if audited by the Internal Revenue Service. CATEGORY B: MINISTERS WITH MANSE FURNISHED BUT NO UTILITIES The effective salary will be the sum of cash paid, the assumed value of the manse, and the amount designated as housing allowance for utilities, furnishings, and appurtenances paid as cash. The assumed value of a manse will be at least 20% of the effective salary, or should correspond with the local rental value of housing of a similar size and nature, whichever is the greater. The allowance for utilities may be up to 20% of effective salary. CATEGORY C: MINISTERS WITH MANSE AND UTILITIES FURNISHED The effective salary will be the sum of cash paid, the assumed value of the manse, the budgeted amount for manse utilities, and the amount designated for furnishings and appurtenances paid as cash. The assumed value of the manse will be at least 20% of the effective salary, or should correspond with the local rental value of housing of a similar size and nature, which ever is the greater. The budgeted amount for manse utilities (minimum $1,200) should be adjusted annually in relation to cost fluctuations. The amount designated for furnishings and appurtenances may be up to 20% of the effective salary. An additional allowance for furnishings and appurtenances may be designated as agreed upon by the minister and the church, and may be adjusted annually. 5 WORKSHEET 3 DELINEATING TERMS OF CALL RECORDING OF SALARY AND HOUSING CATEGORY A: MINISTERS WITH NO MANSE OR UTILITIES FURNISHED SALARY AND HOUSING OF $______________ of which $_______________ is designated for housing, utilities, furnishings and appurtenances. CATEGORY B: MINISTERS WITH MANSE FURNISHED BUT NO UTILITIES 1. Cash Salary of $______________ of which $________________ is designated for utilities, furnishings, and appurtenances. 2. Free use of a manse - Annual Value $_________ for SALARY AND HOUSING of $_____________. CATEGORY C: MINISTERS WITH MANSE AND UTILITIES FURNISHED 1. Cash Salary of $______________ of which $______________ is designated for furnishings and appurtenances. 2. Free use of a manse - Annual Value $______________. 3. Manse utilities provided - Annual Value $______________ for SALARY AND HOUSING of $______________. 6 Call Form (Initial) The _________________ Presbyterian Church of (Location) _______________________, Tennessee, belonging to The Presbytery of Middle Tennessee, being well satisfied with your qualifications for ministry and confident that we have been led to you by the Holy Spirit as one whose service will be profitable to the spiritual interests of our church and fruitful for the Kingdom of our Lord, earnestly and solemnly calls you, _____________________________________________________________ (Name) to undertake the office of pastor (associate pastor) of this congregation, promising you in the discharge of your duty all proper support, encouragement, and allegiance in the Lord. That you may be free to devote yourself full time (part time) to the ministry of the Word and Sacrament among us, we promise and obligate ourselves to pay you the following (those agreed upon are to be filled in): Annual salary Use of the manse Housing allowance Utilities allowance Other medical insurance Professional expenses $________ (in regular monthly or semi-monthly payments) $________ $________ $________ $________ $________ (includes: automobile, continuing education, books, and personal business expenses) $________ $________ $________ Social Security Tax Other (specify) Moving costs Vacation of (time period) _______ Continuing Education (time period) _______ and we will pay regularly in advance to the board responsible for benefits a sum equal to that requisite percent of your salary which may be fixed by the General Assembly of the Presbyterian Church (U.S.A.) for participation in the Benefits Plan of the Presbyterian Church (U.S.A.), including both pension and medical coverage, or any successor plan approved by the General Assembly, during the time of your being and continuing in the pastoral relationship set forth in this call to this church. We further promise and obligate ourselves to review with you annually the adequacy of this compensation. In testimony where of we have subscribed our names this _______ day of ________, A.D. _________. (Signatures) Having moderated the congregational meeting which extended this call for ministerial services, I do certify that the call has been made in all respect according to the rules laid down in the Form of Government, and that the persons who signed the foregoing call were authorized to do so by vote of the congregation. (Signed) _______________________________ Moderator of the Congregational Meeting 7 Annual Terms of Call Form (Continuing) The _________________ Presbyterian Church of (Location) _______________________, Tennessee, belonging to the Presbytery of Middle Tennessee, being well satisfied with your qualifications for ministry and confident that we have been led to you by the Holy Spirit as one whose service will be profitable to the spiritual interests of our church and fruitful for the Kingdom of our Lord, earnestly and solemnly calls you, _____________________________________________________________ (Name) to continue the office of pastor (associate pastor) of this congregation, promising you in the discharge of your duty all proper support, encouragement, and allegiance in the Lord. That you may be free to continue to devote yourself full time (part time) to the ministry of the Word and Sacrament among us, we promise and obligate ourselves to pay you the following (those agreed upon are to be filled in): Annual salary Use of the manse Housing allowance Utilities allowance Other medical insurance Professional expenses $________ (in regular monthly or semi-monthly payments) $________ $________ $________ $________ $________ (includes: automobile, continuing education, books, and personal business expenses) $________ $________ Social Security Tax Other (specify) Vacation of (time period) _______ Continuing Education (time period) _______ and we will pay regularly in advance to the board responsible for benefits a sum equal to that requisite percent of your salary which may be fixed by the General Assembly of the Presbyterian Church (U.S.A.) for participation in the Benefits Plan of the Presbyterian Church (U.S.A.), including both pension and medical coverage, or any successor plan approved by the General Assembly, during the time of your being and continuing in the pastoral relationship set forth in this call to this church. We further promise and obligate ourselves to continue to review with you annually the adequacy of this compensation. In testimony where of we have subscribed our names this _______ day of ________, A.D. _________. (Signatures) Having moderated the congregational meeting which extended this call for ministerial services, I do certify that the call has been made in all respect according to the rules laid down in the Form of Government, and that the persons who signed the foregoing call were authorized to do so by vote of the congregation. (Signed) _______________________________ Moderator of the Congregational Meeting 8