Treasurer`s report 2014

advertisement

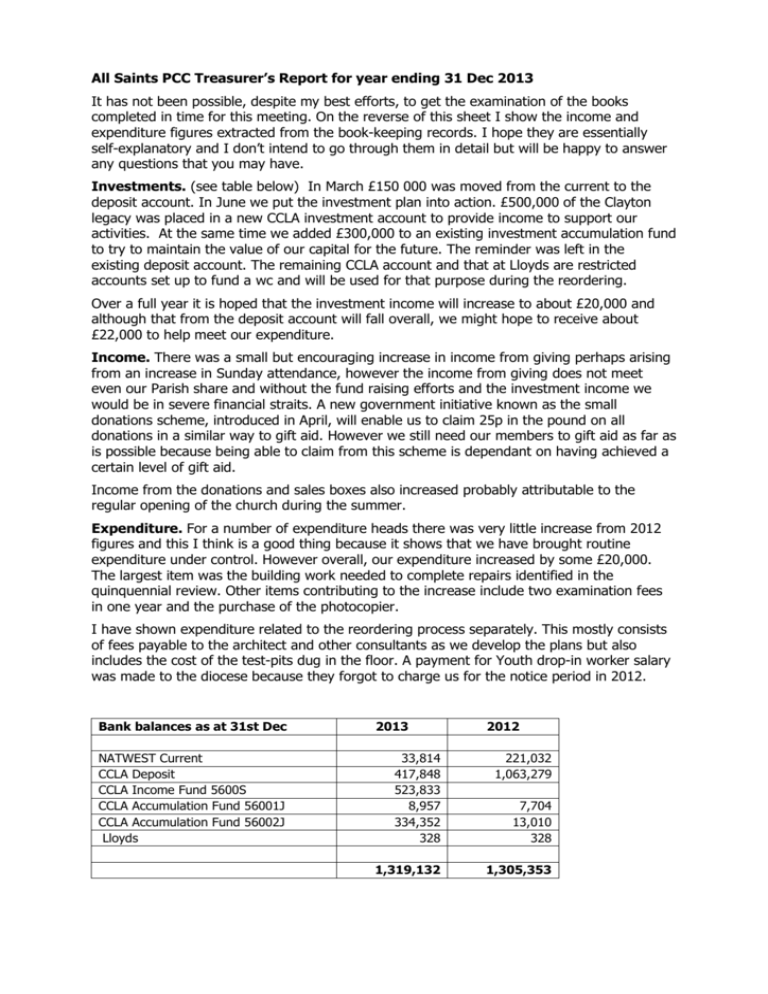

All Saints PCC Treasurer’s Report for year ending 31 Dec 2013 It has not been possible, despite my best efforts, to get the examination of the books completed in time for this meeting. On the reverse of this sheet I show the income and expenditure figures extracted from the book-keeping records. I hope they are essentially self-explanatory and I don’t intend to go through them in detail but will be happy to answer any questions that you may have. Investments. (see table below) In March £150 000 was moved from the current to the deposit account. In June we put the investment plan into action. £500,000 of the Clayton legacy was placed in a new CCLA investment account to provide income to support our activities. At the same time we added £300,000 to an existing investment accumulation fund to try to maintain the value of our capital for the future. The reminder was left in the existing deposit account. The remaining CCLA account and that at Lloyds are restricted accounts set up to fund a wc and will be used for that purpose during the reordering. Over a full year it is hoped that the investment income will increase to about £20,000 and although that from the deposit account will fall overall, we might hope to receive about £22,000 to help meet our expenditure. Income. There was a small but encouraging increase in income from giving perhaps arising from an increase in Sunday attendance, however the income from giving does not meet even our Parish share and without the fund raising efforts and the investment income we would be in severe financial straits. A new government initiative known as the small donations scheme, introduced in April, will enable us to claim 25p in the pound on all donations in a similar way to gift aid. However we still need our members to gift aid as far as is possible because being able to claim from this scheme is dependant on having achieved a certain level of gift aid. Income from the donations and sales boxes also increased probably attributable to the regular opening of the church during the summer. Expenditure. For a number of expenditure heads there was very little increase from 2012 figures and this I think is a good thing because it shows that we have brought routine expenditure under control. However overall, our expenditure increased by some £20,000. The largest item was the building work needed to complete repairs identified in the quinquennial review. Other items contributing to the increase include two examination fees in one year and the purchase of the photocopier. I have shown expenditure related to the reordering process separately. This mostly consists of fees payable to the architect and other consultants as we develop the plans but also includes the cost of the test-pits dug in the floor. A payment for Youth drop-in worker salary was made to the diocese because they forgot to charge us for the notice period in 2012. Bank balances as at 31st Dec NATWEST Current CCLA Deposit CCLA Income Fund 5600S CCLA Accumulation Fund 56001J CCLA Accumulation Fund 56002J Lloyds 2013 2012 33,814 417,848 523,833 8,957 334,352 328 221,032 1,063,279 1,319,132 1,305,353 7,704 13,010 328 Income Envelopes Yellow Envelopes pledged Sunday collections STO/DD Donations Gift Aid applying Other donations Other service collections Fees Banns, Weddings, Funerals Recharge Rectors expenses Gift aid refund FIT payment (PV panels) Yard Sales Other events Box, sales, coffee etc Recharge Arch lib expenses Misc Self Generated Total Bank Interest CCLA invest ac Bank interest CCLA deposit Legacy Total income 2013 1,117.00 1,445.00 2,062.00 4,505.00 5,500.00 196.00 2,050.00 4,783.00 797.00 3,494.00 774.00 758.00 1,801.00 2291.00 857.00 264.00 32,704.00 9,446.00 4,564.00 3,003.00 49,717.00 Expenditure Ely DBF Parish Share Fees DBF Church Insurance Audit Clergy expenses Churchwarden expenses Service costs Books and Course materials Utilities Organist, Choir, Bells Organ maintenance & music Building maintenance Charities Cleaning Subscriptions Children/ Youth Publicity Flowers Misc Events Archdeaconry Library St Mary's repairs Total Running costs Development fees & expenses Planned building development Drop In worker salary Total Expenditure 22,319.00 2,731.00 4,698.00 4,320.00 2,503.00 216.00 657.00 141.00 3,620.00 1,254.00 1,218.00 10,375.00 1,212.00 553.00 508.00 198.00 444.00 80.00 53.00 415.00 6,317.00 368.00 64,200.00 14,841.00 2,758.00 2,207.00 84,006.00 2012 1,007.00 3,401.00 1,611.00 2,972.00 6,350.00 119.00 1,021.00 2,286.00 142.00 6,337.00 491.00 822.00 1,121.00 1927.00 Comments some users moved to DD for 2 years in 2012 Increase as result of regular open church 384.00 31,493.00 for July - Dec 9,330.00 40,823.00 22,112.00 1,062.00 4,829.00 2,486.00 240.00 620.00 3,826.00 1,665.00 813.00 2,327.00 823.00 446.00 563.00 137.00 Increase because more funerals for 2012 & 13 Total, AS share is 54% of this includes purchase of keyboard £8400 for quinqennial works mostly from dedicated collections 129.00 1,854.00 Agape meal and one organ recital includes purchase of copier £4000 44,575.00 £1498 balance of roof works 2012