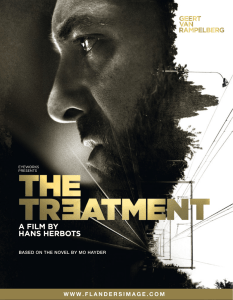

A financial revolution in Flanders

advertisement