DDA Work Order: Outsourcing Services for Commonwealth Games Village

advertisement

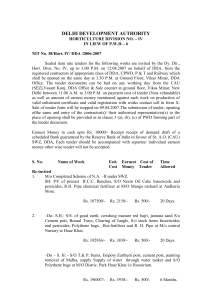

CPWD-11 DELHI DEVELOPMENT AUTHORITY WORK ORDER Work Order No. 02/EE/CGD.1/DDA/2014-2015 Dated: 19/05/2014 (In continuation of Work Order No. 05/EE/CGD.1/DDA/2013-2014 Dated: 24.01.2014) STATE: DELHI BRANCH: D.D.A. DIVISION: COMMONWEALTH GAMES DIVN.1 SUB DIVN. : III/CGD.1/D.D.A. Name of work: Development of Commonwealth Games Village-2010. Sub Head: Contingencies – Outsourcing of One No. Computer Operator, One No. Security Guard, One No. Peon and One No. Graduate Clerk for CAU(P&CWG)/DDA. Estimated cost : Rs.2,34,972/Work order Amount(Negotiated) : Rs. 260982/- + Service tax reimbursable as per notified rate of Govt. of India. Time allowed : 6 Months (From19/05/2014 to 18/11/2014) Order for work described below given to M/s High Command, 171-B, DG-II, Vikas Puri, New Delhi – 110 018 to be executed as per conditions attached and the rates in the schedule:Item No. Description 1. Providing one No. Computer Operator for CAU(P&CWG), DDA office at SFSC, New Delhi. Qualification & Experience: The computer operator must be Graduate, one year diploma in computer application, should have command over English language, knowledge of internet, E-mail etc. and having work experience of minimum two years. Providing One No. Security Guard and One No. peon for CAU (P&CWG), DDA office at SFSC New Delhi. 2. 3. Qty. Unit 1 No. x Each 6 Per months month Each 2 Nos. x per 6 month months Providing One No. Graduate Clerk for CAU Each (P&CWG), DDA office at SFSC New Delhi. 1No. x per 6 month months Total : Negotiated Amount and accepted Rate as per prev. work order Rs.14100/- Rs.84600/- Rs.8820/- Rs.105840/- Rs.11751/- Rs.70542/= Rs.260982/- + Service Tax reimbursable. Contd….P/2…….. :2: TERMS & CONDITIONS: 1. The agency shall provide complete profile of the staff provided by them and the work shall be carried out as per specification and direction of Engineer-in-charge. 2. The placement of the staff will be in the office of Sr. Accounts Officer/CAU (P&CWG)/DDA, Sirifort Sport Complex, New Delhi. 3. Service Tax shall be reimbursed on production of documentary proof of payment to concerned Service Tax Department as per rates notified by Government of India, Ministry of Finance on Budget at the time of execution of work. The reimbursement shall be limited to payment made by agency for the work executed under this contract. The Agency/firm/person will submit a certificate and proof that he had paid the said amount to concerned department for this work only. The Agency/firm/person is liable to return the entire money with commercial interest, if any wrong information is submitted/detected at any stage of work. 4. The above staff is required to work in a week except Sunday, 2nd Saturday and Gazetted Holidays. 5. The staff provided by the agency will be an employee of the agency only and in no case and circumstances the incumbent shall be considered an employee of the DDA. 6. The approved rate shall be paid by the Delhi Development Authority to the agency who shall be solely responsible for making the requisite payment to the staff provided by them. The agency shall be responsible and ensure all admissible and/or fringe benefits accorded to its employee and under no circumstances shall be the responsibility of the Delhi Development Authority. 7. In case the staff is found absent from duty, the Delhi Development Authority shall be entitled to make proportionate deductions out of the money payable by Delhi Development Authority to the Agency. 8. That there would be no privity of contract of any nature whatsoever between the above staff and the Delhi Development Authority and the only parties bound by this contract shall be the agency and the Delhi Development Authority. 9. That any loss/damages/theft caused during the period shall be the responsibility of the Agency. In case the staff are found absent from duty, the Delhi Development Authority shall be entitled to make proportionate deductions out of the money payable by Delhi Development Authority to the Agency. 10. That the above staff shall carry out work as per order/instruction of Sr. A.O./CAU(P&CWG)/DDA. 11. That for any violation of the terms and conditions on the part of the Agency the decisions of the Engineer-in-charge shall be final and binding on the Agency. 12. That in case of any requirement of Delhi Development Authority about the professional deficiency of the above staff, the Agency shall be bound by the directions of DDA. 13. Necessary statutory deductions will be made as applicable from the payment made to the Agency by Delhi Development Authority. 14. All taxes as levied by Govt. of India/Govt. of Delhi will be deducted from the bills of the Agency and nothing extra will be paid beyond Work order amount. 15. The rate are inclusive of all taxes and overhead charges and nothing extra shall be payable to the agency beyond Work Order Amount. 16. The time allowed for carrying out the work is 6 months w.e.f. 19.05.2014 to 18.11.2014. Sd/S.E./CC-11/DDA (On charge of EE/cGD.1/DDA) To M/s High Command 171-B, DG-II, Vikas Puri, New Delhi – 110 018 Copy to: 1. Sr. AO/CAU(P&CWG)/DDA. 2. AE- III/CGD.1/DDA. Sd/S.E./CC-11/DDA (On charge of EE/cGD.1/DDA)