file

advertisement

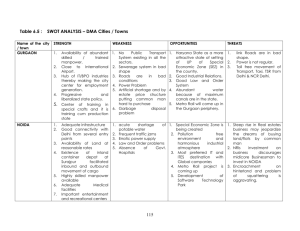

Impact of Sustainability Attributes on the Performance of Prime Office Market in the National Capital Region of Delhi Anil Kashyap, Jim Berry and Terry Grissom University of Ulster, UK Paper presented at 17th European Real Estate Society Conference, 23-26 June 2010 at Milan, Italy 25 June 2010 Structure of the Paper Background to the research and case study Literature review Analysis framework Evidence from the case study Discussion of preliminary results Key conclusions Background • With Indian economy growing strongly, requirements of housing, commercial and industrial infrastructure bound to rise. • More than 367 Million Sq. Ft. of additional office space needed by 2012-13 ( Estimated by Ernst & young) • 4.7 million housing units would have to be completed by 2030 (Estimated by Deutsche Bank) • Asian Development Bank estimates requirements of 10 million units by 2030 • Indian Ministry of Tourism forecasted requirements of 2.9 and 6.6 Million hotel rooms to meet the tourism and business by 2010 and 2020. • Fast growing Medical tourism will become US$2 billion industry by 2012 and will require huge investment in Health Services sector. The National Capital Region, Delhi Year NCR Population (million) / Growth(%) 1981 19.88 1991 27.36 (37.62%) 2001 26.64 (35.59%) Delhi Population (million) / Growth(%) 6.22 (53%) 9.42 (51.45%) 13.80 (47.02%) National Capital Region Planning Board Act (1985) - preparation of a plan - allocation of land uses - economic base for growth - infrastructure provisions NCR Regional Plan-2021 NCR Region Growth Real estate in the National Capital Region of Delhi has experienced an unprecedented boom in development specifically in the industrial, information technology and retail sectors of the economy which in turn is creating a escalation in demand for residential and office space. The liberal policies of government, in relation to the streamlining of planning permissions and licence procedures for mega construction projects, have attracted foreign investments since the 1990s. As the traditional CBD in Delhi did not have sufficient space to accommodate modern office buildings, the emergence of multi-centred office developments in the sub-region has been a key driver in the real estate market. Sky line – Case Study Sky line – Case Study FDI in India 25000 19531 US $ m 20000 15000 10000 7722 6130 6051 5035 5000 4322 4029 0 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 Sustainability impact in Office Market Evidence on rental premiums and occupancy levels (Spivey and Florance, 2008; Eichholtz eta al, 2009; Furest and McAllister, 2009) Kats (2003) suggest present value benefits of $37 to $55 USD per sq ft as productivity gains from less sickness level and improved work outputs. Resulted from better ventilation, lighting and general environment within the buildings Haynes (2007) suggest that office productivity linked to office layout and office comfort. Modelling Framework The paper analyses the impact of sustainability attributes on the performance of office space based on a classification of key variables (property, design, energy efficiency in the National Capital Region of Delhi. Rent= Alpha + Beta (Property Variables) +Beta (Accessibility) + Beta (energy efficiency variables) This research examines how rental value is influenced by sustainability criteria in the office market and will be of benefit to players in the private (real estate providers) and the public sectors (planners and policy makers) Data Presentation Initial results Key Conclusions Work in progress… The impact of property, sustainability variables found significant on the rent Need to analyse sensitivity in relation of other variables – using multivariate analysis Advice on how to make this analysis more robust and comprehensive..