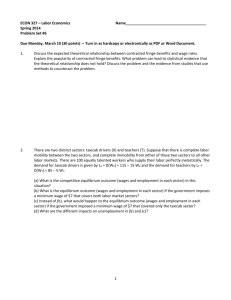

The Labor Market

advertisement

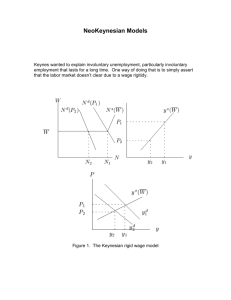

Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke Contract models Contract models are based on the observation that labor contracts often forbid firms from changing wages in the short run The existence of long term relationships between firms and workers implies that wage does not have to adjust to clear the labor market in each period. Workers are content to stay in their current jobs as long as the income streams they expect to obtain are preferable to their outside opportunities. Because of their longterm relationships with their employers, their current wages may be relatively unimportant to this comparison. Workers are risk averse while the firm is assumed to be risk neutral. - Firms offer implicit insurance to workers in the form of contracts that reduce sensitivity of workers’ incomes in response to fluctuation in labor demand. In exchange, workers accept lower wages than they would otherwise demand. There is a mutual gain since the firm (who does not care about risk) raises its expected profit but incurs more risk, and the workers reduce risk enough to more than offset the utility lost from lower expected incomes. - 1 Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke Basic Model Firm’s profits where L is the quantity of labor employed and w is the wage. A reflects technology and shifts the profit function. Consider a world with a finite set of possible states of the Ai where A is random. The firm’s expected profits are: where pi is the probability that A= Ai with i =1,…,K and Li, wi is the realization if A is Ai Each worker is assumed to work the same amount. The worker’s utility is: where U() is the utility from consumption and V() is the disutility from working. Workers are risk averse with U’’()<0. Worker’s expected utility is: with some reservation level of expected utility u0 that workers must obtain to work for the firm. To solve the problem, firms maximize expected profits subject to worker’s expected utility exceeding their reservation level of utility u0 that they get from not working. We also assume that the worker’s consumption C is equal to their labor income wL. 2 Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke Set up the Lagrangian: Solving the model: The model implies strong real wage rigidity since workers real incomes are constant under efficient contracts firms supply workers with insurance against income uncertainty thereby producing a relatively stable real wage 3 Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke Minimum wages Walrasian wage is w* with full employment L* If minimum wage is employed above the market clearing level, there will be unemployment of The magnitude of unemployment arising from the minimum wage law depends on the elasticity of the labor supply and labor demand curves. If both are inelastic, the unemployment gap is small. Typically, minimum wages are set well below the average wage in the economy. If wages are set at w2, the minimum wage has no effect as it is non-binding Empirically, minimum wages have relatively minor employment effects However, they have significant impacts during certain time periods and on certain group of workers, especially unskilled and teenager workers We need a segmented model for skilled and young workers better study the effects of minimum wage laws and spillovers between markets Two sector labor market 4 Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke In the skilled labor market, the equilibrium wage exceeds the minimum wage, so there is no direct effect of the minimum wage law on unskilled labor, while the wage floor is effective in the market for unskilled market. There may be demand or supply spillovers on either the demand or supply side, or both. Supply side: In the short run, there would be no immediate spillover of workers from one market to the other. Unskilled workers cannot, presumably, become skilled immediately, while skilled workers earn a higher wage in the skilled market and have no incentive to move. In the longer run, supply flows in either direction are possible. Demand side: firms’ demand for skilled workers may be affected by the increase in the wage for unskilled labor. If skilled and unskilled workers are substitutes, the firm will increase its demand for skilled workers, which will tend to push skilled wages upward. If they are complements, this will reduce skilled-labor demand and lower skilled wages. Although the substitute-complement relationship between skilled and unskilled labor is likely to vary across industries, the most common assumption is that they tend to be substitutes. If that assumption is true, then an increase in the minimum wage will raise the wages of skilled workers. 5 Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke Unions and bargaining The presence of a labor union that engages in collective bargaining on behalf of workers can leads to a different pattern of real wages and employment than would be observed under competition. How wages and unemployment is determined can be analyzed in a two sector model with a union and nonunion sector. Spillovers between models can be analyzed similar to the minimum wage case above. Blanchard proposes a simple bargaining model to explain the high levels of unemployment in the 1970s in Europe. He uses it to argue that the rise in unemployment is due to adverse supply shocks due to technological growth and oil price shocks. Blanchard bargaining model (wage setting/ price setting model) The wage setting curve (WS), reflects the bargaining power of unions (or workers) the price setting curve (PS) reflects the market power of firms over prices. Price setting equation: Firms are assumed to act as price-setting monopolists. They have market power and set prices as a markup (µ>0) over cost. Firms produce goods using only labor with production function Y=AN. This leads to prices being set as a constant mark up over nominal unit labor costs. 6 Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke Wage setting equation: Wages are assumed to be determined through bargaining between workers and firms, which is referred to as the bargained wage: Unemployment has a negative relationship with real wage z measures other factors that have a positive effect on wages given the price level and unemployment rate The level of unemployment that makes the wage and price curves intersect is labeled the natural rate or the NAIRU (these terms are often used interchangeably). The NAIRU changes if either PS or WS shift. 7 Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke The NAIRU is a long run equilibrium rate of unemployment which only depends on structural supply factors. In the short run the unemployment rate may diverge from the NAIRU due to demand (macroeconmic policies), but in the medium/long term the economy returns to the NAIRU as inflation stabilizes. Note: When ω=1 (or close to 1) Add two sources of frictions (real and nominal wage rigidities) to see how a can affect NAIRU and explain the slow adjustment in unemployment Real rigidities Change the wage bargaining equation into: Assume it is updated as While the actual process follows a random walk What is the equilibrium level of employment? 8 Econ 701-Survey of Macroeconomics Spring 2015/ Manopimoke Suppose there is a one period adverse supply shock ∆a=ɛ<0, what will happen? In the previous model with at= ate we get an immediate shift in the real wage but no change in the unemployment rate/NAIRU since ω=1 This type of real rigidity can explain why adverse supply shocks in the 70s had effects on unemployment for a long period Real wage rigidities are frictions that prevent the real wage from adjusting to its long run equilibrium value. Nominal rigidities This is when nominal prices slowly adjust. The bargaining model becomes: So it is not just productivity that the workers have to form expectations over, but also the price level. This gives us nominal wage stickiness. Equilibrium level of unemployment is now: Shows that monetary policy can counteract real wage rigidities using monetary policy to change the rate of inflation. But unemployment in Europe continued to rise during the 1980s. Hard to argue that this was the effect of shocks more than 10 years ago. Furthermore, inflation stabilized while unemployment was high. Why? Next time: Two new elements to explain this: (i) Responses of capital accumulation, (ii) Hysteresis. 9