Now - Lothian Pension Fund

advertisement

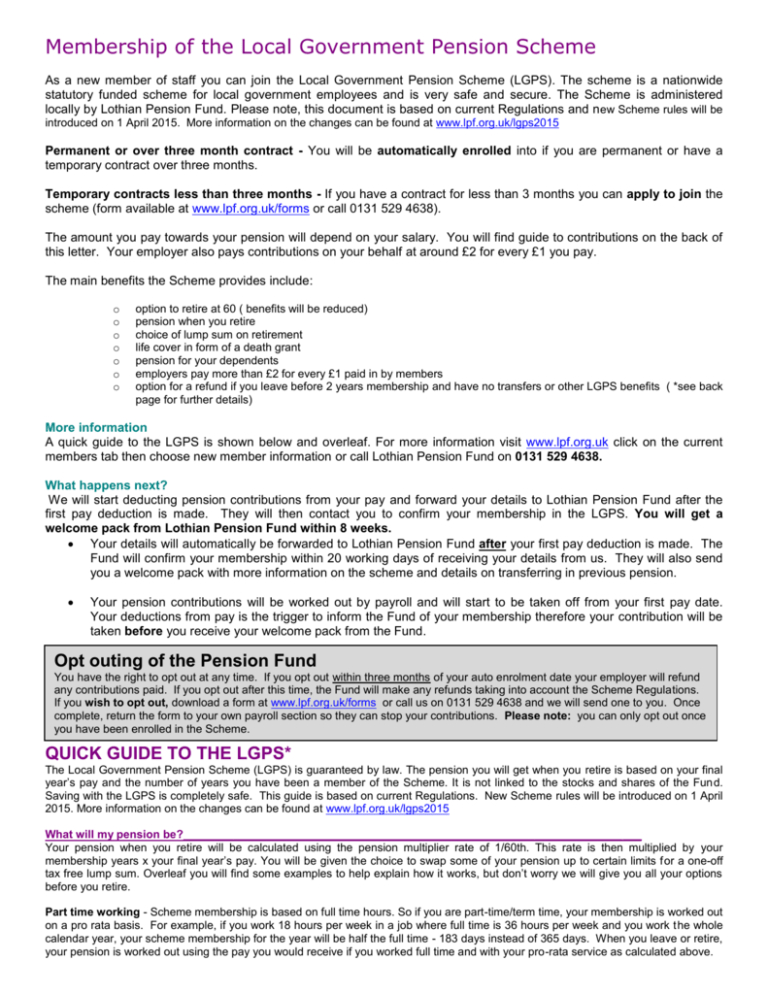

Membership of the Local Government Pension Scheme As a new member of staff you can join the Local Government Pension Scheme (LGPS). The scheme is a nationwide statutory funded scheme for local government employees and is very safe and secure. The Scheme is administered locally by Lothian Pension Fund. Please note, this document is based on current Regulations and n ew Scheme rules will be introduced on 1 April 2015. More information on the changes can be found at www.lpf.org.uk/lgps2015 Permanent or over three month contract - You will be automatically enrolled into if you are permanent or have a temporary contract over three months. Temporary contracts less than three months - If you have a contract for less than 3 months you can apply to join the scheme (form available at www.lpf.org.uk/forms or call 0131 529 4638). The amount you pay towards your pension will depend on your salary. You will find guide to contributions on the back of this letter. Your employer also pays contributions on your behalf at around £2 for every £1 you pay. The main benefits the Scheme provides include: o o o o o o o option to retire at 60 ( benefits will be reduced) pension when you retire choice of lump sum on retirement life cover in form of a death grant pension for your dependents employers pay more than £2 for every £1 paid in by members option for a refund if you leave before 2 years membership and have no transfers or other LGPS benefits ( *see back page for further details) More information A quick guide to the LGPS is shown below and overleaf. For more information visit www.lpf.org.uk click on the current members tab then choose new member information or call Lothian Pension Fund on 0131 529 4638. What happens next? We will start deducting pension contributions from your pay and forward your details to Lothian Pension Fund after the first pay deduction is made. They will then contact you to confirm your membership in the LGPS. You will get a welcome pack from Lothian Pension Fund within 8 weeks. Your details will automatically be forwarded to Lothian Pension Fund after your first pay deduction is made. The Fund will confirm your membership within 20 working days of receiving your details from us. They will also send you a welcome pack with more information on the scheme and details on transferring in previous pension. Your pension contributions will be worked out by payroll and will start to be taken off from your first pay date. Your deductions from pay is the trigger to inform the Fund of your membership therefore your contribution will be taken before you receive your welcome pack from the Fund. Opt outing of the Pension Fund You have the right opt outPension at any time. IfFund you opt out within three months of your auto enrolment date your employer will refund Opt outing ofto the any contributions paid. If you opt out after this time, the Fund will make any refunds taking into account the Scheme Regulations. If you wish to opt out, download a form at www.lpf.org.uk/forms or call us on 0131 529 4638 and we will send one to you. Once complete, return the form to your own payroll section so they can stop your contributions. Please note: you can only opt out once Personnel/HR you have beenDepartment enrolled in the Scheme. QUICK GUIDE TO THE LGPS* The Local Government Pension Scheme (LGPS) is guaranteed by law. The pension you will get when you retire is based on your final year’s pay and the number of years you have been a member of the Scheme. It is not linked to the stocks and shares of the Fun d. Saving with the LGPS is completely safe. This guide is based on current Regulations. New Scheme rules will be introduced on 1 April 2015. More information on the changes can be found at www.lpf.org.uk/lgps2015 What will my pension be?_________________________________________________________________________ Your pension when you retire will be calculated using the pension multiplier rate of 1/60th. This rate is then multiplied by your membership years x your final year’s pay. You will be given the choice to swap some of your pension up to certain limits for a one-off tax free lump sum. Overleaf you will find some examples to help explain how it works, but don’t worry we will give you all your options before you retire. Part time working - Scheme membership is based on full time hours. So if you are part-time/term time, your membership is worked out on a pro rata basis. For example, if you work 18 hours per week in a job where full time is 36 hours per week and you work the whole calendar year, your scheme membership for the year will be half the full time - 183 days instead of 365 days. When you leave or retire, your pension is worked out using the pay you would receive if you worked full time and with your pro-rata service as calculated above. QUICK GUIDE TO THE LGPS continued Examples of pensions Your scheme membership 20 years 40 years 40 years 10 years 40 years Your final year’s pay £10,000 £10,000 £20,000 £30,000 £30,000 Your annual pension (1/60th x scheme membership x final year’s pay) (1/60 x 20 x £10,000) = £3,333 (1/60 x 40 x £10,000) = £6,666 (1/60 x 40 x £20,000) = £13,333 (1/60 x 10 x £30,000) = £5,000 (1/60 x 40 x £30,000) = £20,000 How much will I pay?___________________________________________________________________ _____________ How much you pay depends on how much you are paid but it will be between 5.5% and 11% of your pay. The rate Rate of pay on 31/3/14 Contribution rates 2014/15 depends on which pay band you fall into and will be Less than £20,933 5.5% confirmed by your employer. Between £20,934 and £27,205 Between 5.6% and 6.0% Between £27,206 and £34,152 Between 6.1% and 6.5% The table opposite is a guide to the contribution which Between £34,153 and £48,141 Between 6.6% and 7.5% increase each April in line inflation. Visit our website Between £48,142 and £54,235 Between 7.6% and 8.0% www.lpf.org.uk for current rates and a contributions Between £54,236 and £72,620 Between 8.1% and 9.0% calculator which estimate your contribution rate. Between £72,621 and £109,862 Between 9.1% and 10.0% More than £109,863 10.1% and over If you work part-time, your rate will be based on the wholetime rate for your job, although you will only pay contributions on the pay you actually earn. Less tax____________________________________________________________________________________________________ In fact, it costs you less than this because you do not pay tax on these contributions and also pay a lower national insurance rate. Your employer pays the rest of the costs needed to guarantee your benefits, usually around £2 for every £1 of member contributions. Yearly pay £10,000 £20,000 £40,000 Contribution rate 5.5% 5.6% 7.1% Your contribution £550 £1140 £2840 Reduction in tax £110 (if 20% tax) £228 (if 20% tax) £1136 (if 40% tax) Employer contributes About £1,500 About £3,000 About £6,000 When can I retire?____________________________________________________________________________________________ Normal retirement age for the Local Government Pension Scheme is 65. You can choose to retire early from age 60 in return for a lower pension. Visit www.lpf.org.uk/retirement for more information. What other benefits are there?________________________________________________________________ _________________ Life cover: a lump sum of three times your annual pay (actual pay for part time staff) Survivor’s pensions: Your husband, wife, civil partner or any dependent children may receive a pension if you die. Nominated cohabiting partners also may be eligible if you have submitted a nomination. You have to meet certain conditions and can find a form and more details on the Fund’s website: www.lpf.org.uk Ill-health: You may get a pension if you have to retire due to ill health subject to an independent medical examination. What if I leave the Scheme?____________________________________________________________________________________ If you have more than two years, or transfer in other pension benefits you can: o preserve your benefits until retirement o transfer benefits to an approved pension scheme o link former membership if you rejoin the scheme later on. Less than two years, and have no other LGPS pension in Scotland, you can get a refund of contributions less tax and national insurance. You can transfer preserved benefits out of the Scheme at any time before you retire. See your latest benefit statement online___________________ ________________________________ ________ Your pension information and benefit forecast can be viewed online. Contact mss.pensions@lpf.org.uk if you need an activation code or other assistance with the system. You can see age 60 and age 65 estimate on your online statement, model retirement options over age 60, change address and check service history and death grant nominations all online. Want to increase your pensions?___________________________________________________________ _____ You can pay extra each month to increase your pension when you retire. You can buy extra pension in multiples of £250 up to a £5,000 annual pension income called Additional Regular Contributions (ARCs). The second choice is to make Additional Voluntary Contributions (AVCs) to a separate investment pot out with Lothian Pension Fund. When you retire, your AVCs can be taken in a number of ways including as part of your lump sum. Visit our website www.lpf.org.uk/extrapension LPF contact information Website: www.lpf.org.uk Email: pensions@lpf.org.uk Pensions helpline: 0131 529 4638 This guide is based on current Regulations. New Scheme rules will be introduced on 1 April 2015. More information on the changes can be found at www.lpf.org.uk/lgps2015. Information is for guidance only and Scheme Regulations take precedence in any disputes.