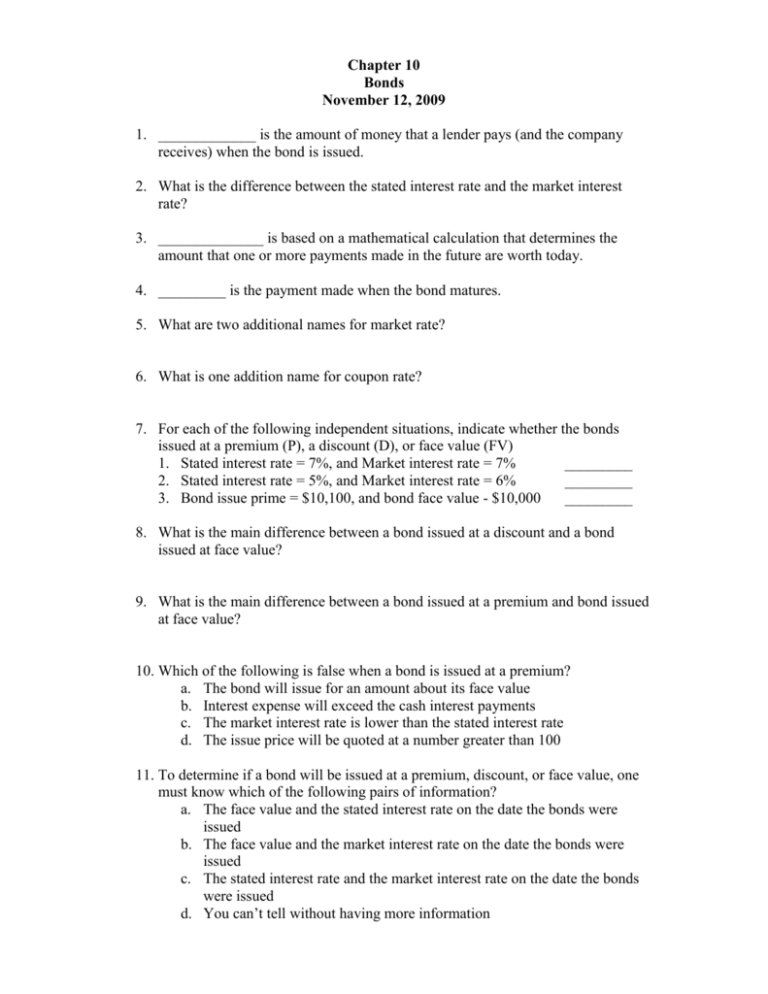

Chapter 10-2

advertisement

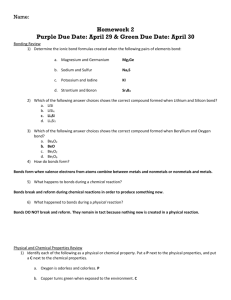

Chapter 10 Bonds November 12, 2009 1. _____________ is the amount of money that a lender pays (and the company receives) when the bond is issued. 2. What is the difference between the stated interest rate and the market interest rate? 3. ______________ is based on a mathematical calculation that determines the amount that one or more payments made in the future are worth today. 4. _________ is the payment made when the bond matures. 5. What are two additional names for market rate? 6. What is one addition name for coupon rate? 7. For each of the following independent situations, indicate whether the bonds issued at a premium (P), a discount (D), or face value (FV) 1. Stated interest rate = 7%, and Market interest rate = 7% _________ 2. Stated interest rate = 5%, and Market interest rate = 6% _________ 3. Bond issue prime = $10,100, and bond face value - $10,000 _________ 8. What is the main difference between a bond issued at a discount and a bond issued at face value? 9. What is the main difference between a bond issued at a premium and bond issued at face value? 10. Which of the following is false when a bond is issued at a premium? a. The bond will issue for an amount about its face value b. Interest expense will exceed the cash interest payments c. The market interest rate is lower than the stated interest rate d. The issue price will be quoted at a number greater than 100 11. To determine if a bond will be issued at a premium, discount, or face value, one must know which of the following pairs of information? a. The face value and the stated interest rate on the date the bonds were issued b. The face value and the market interest rate on the date the bonds were issued c. The stated interest rate and the market interest rate on the date the bonds were issued d. You can’t tell without having more information 12. Company A issued 25,000, 10-year, 6 percent, $100 bonds on January 1, 2008, at face value. Interest is payable each January 1. Show the accounting equation effects and prepare journal entries for (a) the issuance f these bonds on January 1, 2008, (b) accrual of interest on December 21, 2008, and (c) the interest payment on January 1, 2009. 13. On January 1, 2007, Applied Technologies Corporation issued $600,000 in bonds that mature in 10 years. The bonds have a stated interest rate of 10 percent. When the bonds were issued, the market interest rate was 10 percent. The bonds pay interest once per year on January 1. a. Determine the price at which the bonds were issued and the amount that the company received at issuance. b. Prepare the journal entry to record the bond issuance c. Prepare the journal entry to accrue interest on December 31, 2007, assuming no interest has been accrued earlier in the year. d. Prepare the journal entry to record the interest payment on January 1, 2008. 14. Company B received $300,328 for $250,000, 11 percent bonds issued on January 1, 2008, at a market interest rate of 8 percent. The bonds stated that interest would be paid each January 1 and that they mature on January 1, 2018. a. Prepare the journal entry to record the bond issuance. b. Prepare the journal entry to record the interest accrual on December 31, 2008.