Introduction To Business Statistics

advertisement

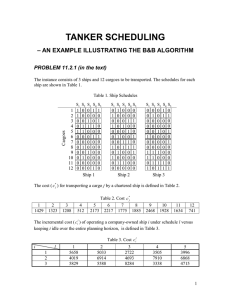

INTRODUCTION TO BUSINESS STATISTICS SOLUTIONS – NOVEMBER 2011 SECTION A Question One (a) Either Binomial distribution, or Poisson A1 Conditions – there is a fixed number of trials, A1 - (b) there are two possible outcomes called success and failure. A1 Let X be the number of vehicles serviceable per day. Then X ~ Poiss ( 3) . M1 Then (i) (ii) P x 0 0e x! 0 P(at most 3)= Px 3 P( x 0 or 1or 2 or 3) M1 = (c) 3 3 0e! 0.04979 , M1, A1 3 0 e 3 0! 3 3 1e! 3 1 101 0.1 and ample proportion is p ^ Then the 98% CI is p 1.64 0.13 1.64 (1 ) n 0.1(10.1) 200 26 200 e 3 2! 2 3 3 3e! 0.64723 , M2, A1 3 0.13 , M1 ^ p p 1.64 (1 ) p 0.13 1.64 n , M1 (finding 1.64) 0.1(10.1) 200 , M1 i.e. 0.095 p 0.165 , M1, A1 Question Two (a) (i) Independents events are events in which the occurrence of one event does not affect the occurrence of the other event. A1 Example: Occurrence of a head of the first and occurrence of a tail on the second toss. A2 (ii) Mutually exclusive events are events that have no common elements. A1 Example: Drawing a red card and drawing a black heart when one card is randomly selected from a pack of 52 cards. A2 (b) (i) Let A, B and B be events that entries were made by A, B and C respectively. Let E be the event an entry has errors. Since total number of entries made = 3000 + 2500+4500 = 10000, M1 then P(A)=0.3, P(B)=0.25 and P(C)=0.45. M1 Tree diagram (or contingency table): M2 E 0.01 A 0.99 E' 0.3 E 0.012 0.25 B 0.998 E' 0.45 C 0.02 E 0.98 E' P(entry has errors) = P(E) = P( A E or B E or C E ) , M1 = 0.3 0.01 0.25 0.012 0.45 0.02 0.015 , M1, A1 (i) If found to have errors, probability it was entered by staff B = P( B | E ) P (PB(E )E ) , M2 0.012 0.2 , M1, A1 = 0.250.015 Question Three (a) (i) Importance of index numbers: - measuring relative changes prices or quantities of items - may be used in salary negotiations - used in calculating the real values of commodities, A3 (b) (i) Price indices: 11 100 110 , A1 = 10 Product A: (ii) Product B: 25 23 100 108.7 , A1 Product C: 17 17 100 100 , A1 Product D: 20 19 100 105.3 , A1 Laspeyres quantity index = p0 q1 p0 q0 100 Sum p 0 q1 p0 q0 p1 q1 240 1173 1428 200 1265 1071 264 1275 1428 646 3487 532 3068 680 3647 M1 M1 Hence Laspeyres quantity index = (iii) Paasche price index = p1q1 p0 q1 M1 (for products), M1 (for summing) 3487 3068 100 100 3647 3068 113.7 , M1, A1 100 104.6 t, M1, A1 Question Four (a) Linear constraints represent limited resources under which optimality is to be achieved. They give a limit to how much resources may be used. A2 (b) Let x11 , x12 , x13 be number of radios shipped from Kajiso to Jenda, Lizulu and Songani respectively. Similarly, x 21 , x 22 , x 23 be number of radios shipped from Oleriwa to Jenda, Lizulu and Songani respectively. And x31 , x32 , x33 be number of radios shipped from to Jenda, Lizulu and Songani respectively. M1 Hence the LP model is: Minimise Z 6 x11 4 x12 x13 x21 2 x22 5 x23 3x31 8 x32 12 x33 , A1 subject t: x11 x12 x13 300 x21 x22 x213 200 x31 x32 x33 200 x11 x21 x31 250 x12 x22 x32 200 x13 x23 x33 250 , A5 where xij 0 , for all 1 i, j 3 . (c) Accounting Rate of Return (ARR) = (i) Averageannualreturn Initialcos t of investment Investment A: Average annual return = K Hence ARR= 280, 000 1, 000, 000 (ii) 220, 000 1, 000, 000 ( 200 300 400 400100) 000 5 K 280,000 , M1 100 28% , A1 Investment B: Average annual return = K Hence ARR= 100 : (125 275 0 500 200) 000 5 K 220,000 , M1 100 22% , A1 Recommend Investment A on account of ARR being higher than in the second investment. A2 SECTION B Question Five (a) (i) Let X be the number of girls. Then X: x = 0, 1, 2, 3, M1 3 1 1 0 2 2 0 3 Now Px 0 3 1 1 , Px 1 8 1 2 1 2 3 1 8 2 2 1 3 0 3 1 1 3 3 1 1 1 and Px 2 Px 3 , M2 8 2 2 2 8 3 2 2 Hence probability distribution: M1, A1 X: x P(X=x) (ii) (I) (II) 0 1 2 3 1 8 3 8 3 8 1 8 EX xP( X x) 0 18 1 83 2 83 3 18 1.5 , M1, A1 Now EX x P( X x) 0 1 2 Then VarX Ex 1.5 3 2.25 0.75 , A1 VarX E x 2 EX E x 2 1.5 2 , M1 2 2 2 2 (b) 2 1 8 2 2 Calculating expected values for each alternative: Low tender: 0.3 10 0.3 15 0.4 16 13.9 , M1 Medium tender: 0.3 5 0.3 20 0.4 10 11.5 , M1 High tender: 0.3 18 0.3 10 0.4 (5) 6.4 , M1 3 8 2 3 8 32 18 3 , M2 The company should submit the low tender because it gives the highest expected profit. M1, A1 (c) Let X be the numbers of defects. Then X ~ Bin (n 12, p 0.1) , M1 Then P(at least 4 defects) = P( X 4) 1 P( X 3) , M1 = 1 P( x 0) P( x 1) P( x 2) P( x 3) = 1 12 0.10 1 0.112 12 0.11 1 0.111 12 0.12 1 0.110 12 0.13 1 0.19 0.02564 ,M1, A1 0 1 2 3 Question Six (a) A, B are two events. Let number of events be labeled a, b and c as shown. A B b a c Then a+ b = 25, b+ c =15. M1 But n(A and B) =10, then b = 10. Hence a = 15, c = 5 and so a+b+c=15+10+5=30, M1 (b) (i) P(A|B)= P ( A B ) P(B) 2 1 533 00 10 15 3 , M1, A1 (ii) P(B|A)= P ( B A) P ( A) A 95% CI is x 1.96 10 n 10 30 25 30 2 10 25 5 , M1, A1 x 1.96 So the width is x 1.96 n ( x 1.96 Since width is 20,000, then 2 1.96 21.96 20000 (c) n n , M1 ) 2 1.96 n n , M1 20000 , M1 1.96 9660000 21.20000 138 , M1, A1 n or n 220000 2 2 Let x c and x v be mean time required for form completing and verification processes respectively. Then P x c x v P x c x v 0 , M1 (i) But x c x v ~ N c v , ncc nvv , M1 2 2 where c v 20 15 5 and Thus P x c x v 0 P xc xv 0 P z c2 nc nvv 1230.5 1040.5 7.96458 , M1 05 7.96458 2 2 2 P( z 1.77) 0.0384 , M1, A1 P x c x v 43 . But x c x v ~ N c v , ncc nvv , M1, (ii) where c v 20 15 35 and 2 c2 nc 2 nvv 1230.5 1040.5 7.96458 , M1 2 2 2 Thus P x c x v 43 P xc xv 43 Pz 4335 7.96458 P( z 2.83) 0.0023 , M1, A1 Question Seven (a) Seasonal variation are short term fluctuations due to seasons or period of the year while cyclic variation are longer term fluctuations lasting between four and seven years usually caused by economic factors. A2 (b) (i) Graphing the data: Labeled axes: M2, Plotted and joining points: M1, A1 F r a u d 90 80 70 60 50 c a s e s 40 30 20 10 0 0 5 10 Time points 15 20 (ii) Trend values: Upper group: 84, 53, 60, 75, 81, 57, 51, 73: x u 84538.... 73 66.75 , M1, A1 Lower group: 69, 37, 40, 77, 73, 46, 39, 63: x l 6937.... 63 8 55.5 , M1, A1 Trend line plotted: M1 Trend values read off (approximate values): M1, A1 Year 2007 2008 2009 2010 (ii) Quarter 1 67 62 57 53 Quarter 2 65 61 56 52 Quarter 3 64 60 55 51 Quarter 4 63 58 54 50 Seasonal factors: Table of y/t: M1 2007 2008 2009 2010 Year Quarter 1 1.25 1.31 1.21 1.38 Quarter 2 0.82 0.93 0.66 0.88 Quarter 3 0.94 0.85 0.73 0.76 Quarter 4 1.19 1.26 1.43 1.26 Total Average Adjusted s. factors 5.15 1.2875 1.222 3.29 0.8225 0.781 3.28 0.82 0.778 5.14, M1 1.285, M1 1.219, A1 Sum of average = 4.215 Correction factor = (iii) period total average 4 4.215 0.94899 ,M1 Estimated trend for 2011 Qrtr 1 = 49, M1 Hence forecast 49 1.222 59.878 , approximately 60 cases. A1 Question eight (a) (b) Four major steps: (i) Formulating the null and alternative hypotheses (ii) Choosing and applying an appropriate test statistic (iii) Using an appropriate significance level to come up with a decision rule (iv) Making a conclusion based on parts (i) and (iii). A4 Hypotheses: H 0 : 15,000 , H1 : 15,000 , M2 Test Statistic: Since n = 45 is large, use the normal distribution. Hence z x 15000 14300 -2.3479 , M1 2000 n 45 Decision Rule: At 5% level of significance, reject H 0 if z > 1.96 or z < -1.96. M1 Conclusion: Since z = -2.3479 < -1.96, H 0 has to be rejected i.e. there is significant evidence that to suggest that the average salary is different from K15,000. M1, A1 (c) (i) Type I error is committed when H 0 is rejected when true while type II error is an error that is made when H 0 is accepted when false. A2 (ii)(I) Hypotheses: H 0 : Difference in opinion is independent of age H 1 : Difference in opinion depends on age, M1 Test Statistic: 2 O E 2 E (100121) 2 121 184) 10) ( 200184 .... (1510 (1588) 24.6985 , M3 2 Expected frequencies (in brackets) calculated: M3 2 2 Age in years Opinion Very unfair Fair Don’t Care No opinion 20 but less than 30 100(121) 200(184) 50(42) 30(33) 30 but less than 40 300(270) 400(412) 80(93) 70(74) 20(29) 40(44) 15(10) 15(8) 40 and older Decision Rule: At 5%, reject H 0 if 2 02.[(0541)( 31)6 ] 12.6 , M1 Conclusion: Since 2 24.6985 12.6 , reject H 0 i.e. difference in opinion is not independent of age. A1 (II) Type I may have been made. A1