Advanced - Department of Agricultural Economics

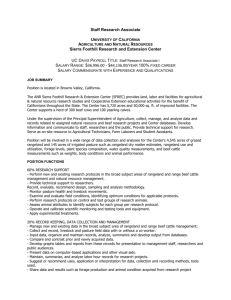

advertisement