Wire: Bloomberg News (BN) Date: Sep 30 2013 8:57:19 U.S. Stocks

advertisement

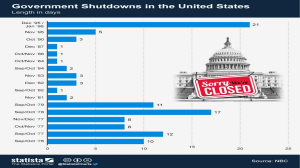

Wire: Bloomberg News (BN) Date: Sep 30 2013 8:57:19 U.S. Stocks Decline as Investors Anticipate Government Shutdown By Namitha Jagadeesh and Nikolaj Gammeltoft Sept. 30 (Bloomberg) -- U.S. stocks slid, paring a quarterly gain for the Standard & Poor’s 500 Index, as a stalemate over the federal budget increased the likelihood of a government shutdown. All 10 main industries in the S&P 500 dropped, with technology and energy shares falling the most. Bank of America Corp. fell 1.1 percent and JPMorgan Chase & Co. slipped 1.4 percent. EBay Inc. declined 1.1 percent after losing a bid to dismiss a U.S. lawsuit alleging violation of antitrust laws. The S&P 500 fell 0.8 percent to 1,677.72 at 9:55 a.m. in New York. The benchmark gauge has added 2.7 percent this month, extending its quarterly gain to 4.4 percent, as the Federal Reserve kept its $85 billion of monthly bond-buying. The Dow Jones Industrial Average lost 150.21 points, or 1 percent, to 15,108.03 today. Trading in S&P 500 stocks was 2.9 percent above the 30-day average at this time of day. “The negative market reaction is appropriate,” Tim Hartzell, who helps manage about $425 million as chief investment officer at Sequent Asset Management, said via phone from Houston. “We’ve been down this road before. It’ll last until there’s some disruption or event that’ll cause outrage in the public and then the politicians snap in line to settle it.” U.S. lawmakers have to approve emergency legislation by midnight to keep the federal government operating from tomorrow, the beginning of the 2014 fiscal year. Failure to do so may result in as many as 800,000 federal employees being placed on temporary unpaid leave. Government Negotiations The Senate convenes at 2 p.m. in Washington today, after a weekend with no signs of negotiations from Republicans and Democrats. House Republicans want to delay President Barack Obama’s Affordable Care Act for a year and make other changes to the health law. The Democrats vow not to let that happen. In a government shutdown, essential operations and programs with dedicated funding would continue. The Treasury will sell debt, while economic reports from the Commerce Department will be suspended and the Bureau of Labor Statistics will stop operations. Commerce is scheduled to release data this week on construction spending and factory orders before the Labor Department’s closely watched jobs report on Oct. 4. The S&P 500 fell 1.1 percent last week, its first weekly drop since August, amid concern the budget impasse will hurt the economy. A shutdown would reduce fourth-quarter economic growth by as much as 1.4 percentage points depending on its duration, according to economists. Three rounds of Fed stimulus and betterthan-forecast corporate earnings have pushed the S&P 500 up 150 percent from a March 2009 low. Debt Ceiling U.S. lawmakers face their next fiscal dispute over raising the $16.7 trillion debt ceiling. The Treasury has said measures to avoid exceeding the limit will be exhausted on Oct. 17. The debt limit is a bigger problem than a federal shutdown, though the U.S. will probably avoid both, Moody’s Investors Service said in a report today. “It’s a headwind with the government shutdown, but it’s not as meaningful to investors as the debt ceiling,” Oliver Pursche, co-manager of the GMG Defensive Beta Fund and president of Suffern, New York-based Gary Goldberg Financial Services, said in a phone interview. The firm manages about $800 million. “If we don’t raise the debt ceiling, then the U.S. government won’t be able to pay its bills and that’s much more damaging.” Bank of America, the second-biggest U.S. lender by assets, fell 1.1 percent to $13.75. JPMorgan Chase lost 1.4 percent to $51.50. Government Suit EBay declined 1.1 percent to $55.18 as the world’s biggest online marketplace lost a bid to dismiss a U.S. government lawsuit claiming the company violated antitrust laws by agreeing not to hire people working for Intuit Inc. Achillion Pharmaceuticals Inc. plunged 52 percent to $3.50 after saying U.S. regulators are keeping its experimental hepatitis C drug on hold because of abnormal liver results. The Food & Drug Administration determined Achillion should not resume development of its sovaprevir drug even after the company responded to all the issues raised by the agency in June, according to a statement late Sept. 27. U.S. stocks are trading virtually in lockstep with 1954, the best year for American equities and the time when shares recovered all their losses from the Great Depression, data compiled by Bloomberg and Bespoke Investment Group show. In no other year are the trading patterns more similar to 2013 since data began 86 years ago. The S&P 500 has surged 19 percent in 2013, trading above the 2007 peak from before the global financial crisis that led to the collapse of Lehman Brothers Holdings Inc. in 2008. Similarly, the equity benchmark reached a new high in 1954 for the first time since 1929. “The return of confidence theme is analogous to what was experienced in the ’50s,” Jim Russell, a senior equity strategist at U.S. Bank Wealth Management, which manages about $112 billion, said in a Sept. 24 phone interview. “We’ll never get an all-clear signal, but we got the good enough signal. People feel the crisis environment is behind us.” --With assistance from Tom Redmond in Tokyo, Satoshi Kawano in 東京, Whitney Kisling in New York and Wes Goodman in Singapore. Editors: Jeff Sutherland, Jeremy Herron To contact the reporters on this story: Namitha Jagadeesh in London at +44-20-7073-3596 or njagadeesh@bloomberg.net; Nikolaj Gammeltoft in New York at +1-212-617-1061 or ngammeltoft@bloomberg.net To contact the editor responsible for this story: Lynn Thomasson at +1-212-617-0506 or lthomasson@bloomberg.net