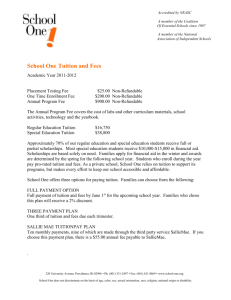

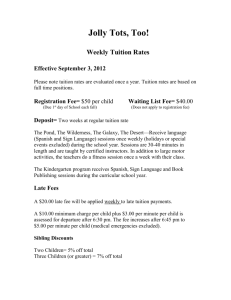

Financial Critical Enabler

advertisement

Financial Critical Enabler University of Idaho Strategic Plan 2011-15 Revised Draft (January 29, 2012) Major Themes Revenue Growth Stewardship Key Components - Stewardship Revenue Growth and Innovation The use of the three interlocking circles (borrowed from Jim Collins, Good to Great) is meant to suggest a certain level of tension to be overcome, or balance to be achieved, among the qualities expressed in each of the circles. For example, growth can pursued in ways that do not sustain the needed revenue or in ways that violate sound principles of stewardship. Revenue decisions can be made that are not scalable and thus cannot support growth. Stewardship principles can be adhered to in ways that severely limit the ability to increase revenues or to grow programs. All financial decisions should achieve a balance between at least two of the qualities, and the goal should be to make decisions and take actions that would occupy the “sweet spot” at the intersection of all three qualities. Statement of Financial Philosophy Stewardship Stewardship, in this context, refers to the institutional responsibility, as a public entity, to manage, allocate and monitor its financial resources on behalf of the citizens of the state, the institution’s 1 students and it’s Board. At a minimum this means a commitment to following generally accepted accounting principles and known “best practices” in higher education financial management. Basic Practices of Good Stewardship - - - - Be intentional about financial matters (do not put financial issues on “autopilot”) While it is easy to focus on the decision process for very large projects or major financial changes, the institution should commit to making every financial decision in a manner that is sustainable – decisions that will not require regular reworking to stay viable. Promote budgetary and financial transparency The university, and operating units within it, will maintain balanced operating budgets, on a cash basis, on both a yearly and long-term basis. All budgets should be generally aligned and reasonably consistent with the University Strategic Plan or with the key principles of one of the Critical Enablers. Units should strive to achieve a balance between institutional needs and priorities and unit needs and priorities, as expressed in unit strategic plans. Programmatic growth or change should first be addressed through internal reallocation of resources, where at all feasible, in order to minimize demand for additional central resources. This is the general principle of “growth by substitution”. Opportunities for shared services and collaborative administrative efforts should be aggressively pursued, particularly opportunities for centralizing broad, complex functions. As revenue sources change in response to changing economic conditions, the university will need to be strongly and constantly driven to reduce costs – within the framework of our role and mission, our brand, our “core competencies” and our strategic plan. Comprehensive Financial Model – the University needs to develop and implement a comprehensive, coherent financial model that can be used to provide structure to financial decision making across units and across time. The model should be: - Internally consistent Flexible Scalable Able to sustain institutional and programmatic growth or short term decline. RCM – Responsibility Centered Management – the university implemented at least portions of an RCM financial model nearly a decade ago. Remnants of that model still exist in various functions of the university. The principles and underlying assumptions of the RCM financial model are incompatible with the evolving new financial model. Consequently, RCM functions and centers will be replaced with the principles of the evolving new financial model. 2 First Financial Principle – All Funds Budgeting - A comprehensive financial plan must address all of the financial resources of the institution. As such, all sources of funding must be included in any fundamental financial planning and budgeting for institutional activities. Obviously, restricted funds (research, designated gifts) must be used for their designated purposes. But where Generally Accepted Accounting Principles and/or state fiscal rules permit, all other financial resources of the institution should be considered to be fungible and should be used in a thoughtful and planned manner in order to meet the overall financial needs of the institution. o The University should revisit current revenue distributions where revenue from similar sources is being distributed to different fund groups o In an “all funds budgeting” environment, the university should revisit the existing multiple fund types to determine whether several fund groups could be consolidated. Second Financial Principle – Adequate Reserves - In order to effectively manage its finances, the University must maintain an adequate level of centrally managed unrestricted financial reserves that are accessible for meeting unexpected financial issues throughout the year and meet the financial expectations of outside bond rating agencies. o The State Board of Education has set a goal of an unrestricted, unobligated and undesignated institutional reserve equal to 5% of the total annual operating budget. At current levels, this would be a reserve of about $15 million. o The University Budget Advisory Committee (UBAC), a budget task force created by Interim President Steve Daily-Larsen, recommended in January 2010 that the university develop a “central reserve” equal to 5% of the comprehensive General Education budget. At current funding levels, this would be a reserve of about $7.5 million o Due to the institution’s constitutional status, the university has the ability to invest its financial assets, in particular its reserves, and use the resulting interest earnings to fund the ongoing operating costs of the institution. Currently (FY12) these investments provide about $1.7 million annually for the General Education budget. Appropriate use of reserves - All reserves are one-time funds and should only be used in a manner consistent with that fact: o To cover true one-time expenditures (start-up costs, facilities or other projects of fixed duration). 3 o - - - - - - As “bridge” funds – to bridge on-going operating costs through a (brief) period of financial difficulty where there is a known and acceptable end to the use of the funds. The institution should consider programs or plans that would enable some of these reserves to be loaned out internally to accomplish important university initiatives – with clear expectations for loan repayment. o The amount under loan at any point in time should be marginal in scale to the overall reserve. o The loans should be of short enough duration that the University could stop the program in a reasonable period of time should overall institutional finances dictate a more immediate need of the cash in the reserves. o The current Vandal Strategic Loan Fund (VSLF) accomplishes this purpose. Unit-level Reserves – individual department reserves (or individual program or faculty reserves) should, in general, be of limited amount and focused to achieve specific, identified objectives (equipment replacement, bridge funding on awards). Substantial amounts in reserves held in units below the institutional level generally mean that large amounts of cash have been taken out of active use and important or necessary local investments are not being made – including investments in instructional equipment (IT, student lab equipment); facility maintenance (carpet, furniture, paint); faculty start-up. o Each major unit (college, department, division) should have written policies on operating reserves with clear indication of scope of use. Appropriate financial planning for reserves should include consideration for the fact that once reserves are used for any purpose, they must ultimately be restored to appropriate levels. In working toward appropriate levels of institutional reserves, the institution must balance the need for larger reserves with the need for adequate funds to meet ongoing expenses and strategic needs of the university. While reserves may be invested and earn interest, investment limitations appropriate for a public institution may mean that the overall return on the funds is quite small. Financial Ratios As a financial Stewardship goal, the university should strive to meet at least minimum acceptable financial standards, as expressed in widely recognized higher education financial ratios. - A national, independently determined series of appropriate financial ratios has been developed by the accounting firm KPMG. Each ratio can be scored on a scale of 1 – 10, with a score of 3 indicting a basic, sound financial status on that particular measure. This is the measures “threshold” value. An appropriate financial goal should be to achieve an institutional score of 3 on each of the four primary financial ratios o Primary Reserve Ratio – indicator of overall trend in institutional wealth 4 - Indicates whether the institution has been able to retain expendable resources as it has grown its commitments/expenditures o Net Income from Operations Indicates whether unrestricted operations resulted in a surplus or a deficit o Return on Net Assets Indicates an overall measure of the growth or decline of an institution’s wealth over a single year o Viability A measure of the extent to which the institution has net assets sufficient to pay off long term debt. The Primary Reserve Ratio threshold is set at 40% of total expenses; Net Income from Operations at 4%; Return on Net Assets at 6%; and Viability at 1.25x (125% of debt). Revenue The primary goal of revenue generation with respect to the academic core of the institution (the General Education budget) should be to cover the cost of instruction and full administrative support functions and, assuming that our instructional function is no more expensive to provide than it is for our peers, to achieve peer average funding on a per student basis, where this funding includes tuition for both resident and non-resident students as well as state appropriations for the General Education programs. - Average Net Tuition Revenue –“net tuition revenue” is defined as gross tuition revenue (the published tuition rate times number of students) minus any institutionally funded financial aid or tuition waivers, including the implicit waivers in special tuition rates that are less than the regular rate (e.g., WUE). o Based on current (FY12) peer averages, the university needs to achieve average net tuition revenue of $13,000 per student FTE over the next 2-3 years. This is tuition revenue and does not include: student activity fees, facility fees, technology fees, course fees or professional fees. o For resident students this amount does include per student funding from state appropriations. This includes graduate students as well as undergraduates. o Once achieved, this average net revenue goal should increase by at least higher education inflationary levels on an annual basis, based on the higher education price index or HEPI. If there is a clear way to determine overall General Education cost increases, then the $13,000 should, at a minimum, grow at the annual rate of increased costs. o At current (FY11) levels of state support, the average net revenue per student is calculated to be about $10,520 per year. 5 o Achieving average net tuition (and state support) revenue of $13,000 per student FTE given FY11 total FTE enrollments would result in an additional $24 million dollars in annual operating revenue for the General Education portion of the budget (Note: this is based on no enrollment growth; enrollment growth could substantially increase that amount.) For auxiliary activities, the general revenue principle is that they need to generate revenues at least at the level of the fully loaded cost of the operation. - Auxiliary functions have currently set the following revenue goals: o Net income equal to 5% of gross sales o Operating reserve equal to 5% of operating expenditures o Capital reserve contribution of $1.5 million toward deferred maintenance Third Financial Principle – Full Cost Decisions on pricing university programs and services should generally be directed at full cost recovery, where “full cost” includes both the direct expenses of program or service offering as well as indirect expenses such as administrative costs; library support; technology support; facility repair and maintenance; as appropriate for the service or program. - - Tuition rates for all programs should meet or exceed the total financial support per resident FTE where “total financial support” is equal to resident tuition plus current average perstudent- funding received from the state of Idaho o If the state funding per resident student continues to decline, appropriate tuition rates must include consideration of the overall average full cost of instruction and rates should be set, so that, on average, the institution meets or exceeds that average cost. o Tuition rates for nonresident students should be set to capture at least 120% to 130% of the total financial support per resident student (i.e., 120% of the total of resident tuition plus state support per resident FTE) o A general rule of thumb is that nonresident tuition and fees should be 3 times the amount of resident tuition and fees (unwritten guidelines from SBOE in April 2011). o Where direct program costs, for a specific program that purports to be “self funded”, approach or exceed the average full cost of university programs, then tuition rates should be adjusted upward, in excess of general tuition rates, such that the residual dollars, after paying for direct program costs, still provide equivalent levels of funding for university overhead operating costs. Tuition “Discounting” – generally tuition rates should not be “waived” where “waiving” tuition means that the university simply does not collect the revenue. o Any proposed “discounting” requires the approval of the senior leadership of the University. o Any approved “discounting” should be managed as a budgeted expense. 6 - - - The program would budget the full “list price” tuition from students and would also budget an appropriate expense amount to cover the cost of any proposed “discounts” o That is, rather than booking “net” tuition (full tuition rate net of any discount), the program would book gross tuition and also book an expense corresponding to any discounts applied. Grant and contract activity should be fully costed with both direct and indirect expenses. Full F&A reimbursement should be requested from the sponsoring agency, foundation or business in accordance with generally accepted accounting principles and regulatory policy and procedures. Internal, cash funded programs, such as auxiliaries and Athletics, should be charged an appropriate administrative overhead charge on all of their cash activity. At present, such charges are referred to as G&A charges. o This is the internal version of the Finance and administrative (F&A) charge that is levied against sponsored grant and contract activity. o These charges are designed to insure that internal cash funded functions also contribute to the overall administrative support costs of the institution. The current G&A rate is generally 10% For each program or activity that does not meet “full cost” – i.e., that does not contribute to the overall operating resources of the institution – there must be: o another program or function of the institution that earns revenues at more than full cost levels in order for the institution to have adequate financial resources to “back fill” or subsidize the program that does not meet full cost, or There must be a source of funds outside of the institution that is willing to provide the funding necessary to sustain the non-full cost programs. Fourth Financial Principle – Maximize Flexible Dollars - - - The University should, wherever and whenever possible, maximize its flexible financial resources rather than restricted dollars that cannot be used in a flexible manner to meet the overall needs of the university. o Restricted resources (gifts, grants) should be used for their intended purpose before using unrestricted resources for the same purpose. Currently the State Board of Education considers the annual “fee” increase to apply to a package of the following four fees: Basic Tuition Technology Fee Facility Fee Student Activity Fee Due to their unrestricted nature, tuition dollars can be used to support the functions covered by the Technology Fee as well as the debt service or capital functions covered by the Facility Fee. Tuition revenue can also be used to support some selected functions now 7 - covered by the Student Activity Fee. However, the reverse is not the case – revenue generated by the Technology, Facility and Student Activity fees cannot be redirected to support other financial needs outside of these areas. Based on these facts, the university should maximize the amount of the increase directed to the “basic tuition” component of the fee package since that component provides the maximum flexibility in the use of the revenues to meet overall operating needs of the institution. The “flexibility” that is a function of funding activities via tuition revenue means that the funding for these functions can be “reallocated” – that is, the funding could be redirected from currently supported activities or programs to other aspects or programs within the institution. Fifth Financial Principle - Central “Fee” Management Adding, changing or eliminating the various fees of the institution is a function of central administrative leadership unless explicitly delegated to other units within the campus. - - - - - - - Fees are a visible part of the institutions culture and public image and, as such, should be reviewed centrally for appropriateness and consistency. o For parents and students, fees of any sort look the same as tuition – just part of what it costs a student to attend the University of Idaho. o Although there continue to be concerns about increased prices for educational services, the public still seems to believe that price reflects quality – at least at some level. As a representation of the overall institutional culture, it is reasonable that there be an institutional, i.e., central, review of all fees and charges so that we understand and approve of the financial image the institution projects to its many constituents In general, access to the overall student population of the university as a source of new revenue via new fees is reserved to University leadership decision making and no specific operating unit has a unique right to the proceeds of such fees. Fee Policies and Practices – it seems prudent to establish a fee policy that charges fees where there is a clear, transparent, direct, immediate benefit to the student, or any other individual, who is paying the fee. Fees that would be charged to the entire student population or to significant subsections of that population should be managed in the same manner as general tuition – the fees are collected centrally and become a part of the overall budgeted resources of the institution. The decision to charge or not charge for instructional activities at “market” rates can have a great impact on the public image of the institution. Competing to be the low cost provider is only appropriate if it is consistent with the institution’s strategic plan, brand and desired public image. The basic principle of seeking to maximize flexible dollars at the institutional level suggests that we not pursue a financial model that contains a wide range of dedicated, restricted fees where the revenues are targeted to or limited to small groups or units within the institution. 8 - - - The proposed financial model is to incorporate fees into larger financial charges and then set appropriate budgets to the operating units, based on university strategic goals and priorities. Additional fees to students should be kept to a minimum and should not be used to cover costs for materials or services that would generally be considered to be covered with tuition charges. o Payment of regular tuition rates should provide students with full access to all regularly scheduled semester course offerings, including web delivery of courses, within the standard academic program. Course fees, such as a web delivery fee are appropriate additions to the basic tuition Use of fees for institutional support functions is generally appropriate where services or materials are used unevenly across campus units or by different groups of students. Fees may be used, from time to time, as an effective means of rationing the use of services or materials or as a means of reinforcing desirable behavior (e.g., penalties and fines). Separate fees should, generally, not be charged for items that are considered a “public good” where we encourage and expect use by a majority of students. Activities or materials covered by a fee should, generally, be optional to the student and should involve costs or efforts over and above normal operations of the unit. Course and Lab fees are an exception to this principle. Growth ‘Growth’ in this context refers to both mechanisms for increasing institutional net revenue without increasing the number of services or enrollments, as well as to models for enabling and supporting increased enrollments and new programs. Sixth Financial Principle – Focus on the Core - The primary focus of the institution should always be on achieving a viable, sustainable, scalable financial/programmatic core for the institution The Strategic Plan must address the financial/programmatic core of the institution Three core functions of the institution – basic undergraduate and graduate instruction; sponsored research; auxiliary enterprises such as student housing and dining – generate more than $300 million dollars per year in institutional revenues. By conducting our core activities in accordance with standard higher education business practices, we have the potential to increase revenues significantly and do so with very low risk. In doing so we continue to enhance the brand image and reinforce the public perception of the value and quality of our core products. Examples of standard higher education business practice include: o Employing waivers in a financially viable manner (potential increase of $20 million in base funds per year) o Setting tuition rates for Distance Education on a par with regular resident and nonresident tuition rates – potential for $100,000s annually. 9 o o o o o o o Setting nonresident tuition rates for summer session and regular semester “Outreach” classes – more than $1 million annually Managing staff/spouse waivers as benefits ($350,000 per year) Charging full nonresident tuition (or near full tuition) to grants and contracts ($1.5 million to $3 million per year) Managing research grants to go after equipment matching grants Establishing “core” research facilities rather than duplication Clearly defining “in load” and “overload” activities and budgeting expenses accordingly Managing new initiatives effectively – don’t waste opportunities Corollary – the current financial core of the institution is neither strong enough to support/sustain large numbers of (financially) marginal activities nor to sustain significant financial risk. Seventh Financial Principle – Sustainable Entrepreneurship An institutional financial model or plan that adequately accommodates growth and change should include some similar consideration for financially evolving new programs. - - The central purpose of entrepreneurial activity within the institution is to develop new core functions and programs that will sustain the university over the long haul. o In business and industry, the role of the entrepreneur is to develop either a fully self-sustaining and profitable stand alone business or, in the context of larger corporations, to develop new products and services that become core components of the company’s offerings over time. o Entrepreneurial activity must focus on the core functions, or appropriate (brand consistent) extensions of the core functions of the business. o Successful entrepreneurial activity cannot chase marginal revenues or programmatically marginal functions indefinitely. This activity distracts attention from the core functions of the institution and, over time, may weaken the effectiveness of the core and/or weaken the institutions brand. o The institution should establish fundamental financial and programmatic expectations for successful business plans for entrepreneurial activities. Investment in Entrepreneurial Activity – the institution must determine whether the investments it makes in entrepreneurial activities are in the form of gifts and grants or in the form of loans. o Gifts and Grants require access to financial reserves that will not be replenished and may imply that the institution does not expect general financial return from its investment o Investment in the form of loans can be accomplished via “revolving funds” with clear expectations on financial return in order to have the funds to invest in the next entrepreneurial project 10 - Entrepreneurial Financial Life Cycle and Financial Incentives– successful business practice has shown that entrepreneurial extensions of a company’s core functions often require a slightly modified financial life cycle. o Start up – where the initial phases of the new activity are “protected” until they can take root – where the protection may take the form of being exempt from meeting the fully loaded cost assessment normally expected of a core function. The length of this phase is determined by company practice and the complexity of the new offering – but may be typically 2 to 4 years. This does not mean that the program is under-priced in its start up period – a decision that is often impossible to reverse once the program is established - but it does mean that some margin of revenue is available during the start-up period to accommodate unexpected expenses, less than anticipated participation, or to provide some level of financial reward to those who engaged in the activity.. o Full Integration – in this phase, the entrepreneurial or startup activity is fully integrated into the complete operational expectations of the firm – including fully allocated costs as well as all normal Human Resource policies and practices o Denouement – in this stage obsolete products may continue to provide significant financial resources as the functions or product is phased out, to be replaced by new core functions. In higher education, many programs never reach this stage. Eighth Financial Principle - Grow at Average Cost - Colleges and universities have traditionally not had ready access to the capital markets that are necessary to fund growth when it is necessary to make “step” increases in capacity or production. As a result, higher education institutions are better served when they commit to growth at an average cost of the activity rather than at “marginal cost”, thereby assuring that when the time comes for the next substantial increase in personnel or facilities, the institution has the funds available to fund that increase. 11