methane hydrates aff HSS 14

advertisement

methane hydrates aff HSS 14

plan texts

The United States federal government should substantially increase its investment in oceanic

methane hydrate extraction via carbon capture and sequestration.

The United States federal government should substantially increase its oceanic methane hydrate

extraction via carbon capture and sequestration.

The United States federal government should substantially increases its investment in oceanic

methane hydrate extraction using carbon capture and sequestration.

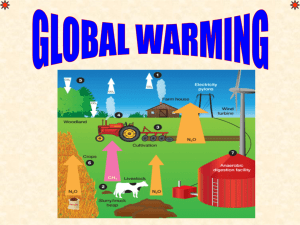

***WARMING ADV***

Clathrate Gun Module

Methane hydrates are melting now – that leads to massive methane blowouts that

lock in positive feedbacks and guarantee global extinction – only a risk extraction

solves – and the Alaskan Arctic is key

Light 12 (Malcolm, PhD from the University of London, “Charting Mankind’s Arctic Methane

Emission Exponential Expressway to Total Extinction in the Next 50 Years”, http://arcticnews.blogspot.com/2012/08/charting-mankinds-expressway-to-extinction.html // AK)

Unless immediate and concerted action is taken by governments and oil companies to depressurize the

Arctic subsea methane reserves by extracting the methane , liquefying it and selling it as a green house

gas energy source, rising sea levels will breach the Thames Barrier by 2029 flooding London. The

base of the Washington Monument (D.C.) will be inundated by 2031. Total global

deglaciation will finally cause the sea level to rise up the lower 35% of the Washington

Monument by 2051 (68.3 m or 224 feet above present sea level). Introduction Recent atmospheric methane

observations (May 01, 2012) at Barrow Point Alaska show extreme methane concentrations as high

as 2500 ppb (2.5 ppm Methane, Figure 1)(Generated by ESRL/GMD May 01, 2012 from Carana, 2012b). The present

atmospheric methane concentration at Point Barrow exceeds all previous measurements in the

Arctic and if it represented the mean atmospheric concentration after an extended period of

subsea Arctic methane emission (10 to 20 years) at a methane global warming potential (GWP) of

100 (Dessus et al. 2008) it would be equal to a 2.5 degrees C mean global temperature increase

and a methane-carbon output of some 6 Gt. This would be equivalent to adding and extra 250

ppm of carbon dioxide to the atmosphere or about 2/3 of the present carbon dioxide content. The

rising light Arctic methane migration routes have been interpreted on the Hippo profile in Figure 2a (from Wofsy et al. et al. 2009)

using the inflexion points on the temperature and methane concentration profiles similar to the system used to identify deep oceanic

current trends using salinity and temperature data (Tharp and Frankel, 1986). The light Arctic methane is rising almost vertically up

to the stratosphere between 60o North and the North Pole. This is consistent with the methane rising in the same way as hydrogen

with respect to the cold dry polar air because it has almost half the density of air at STP(Engineering Toolbox, 2011) (methane in wet

air may be transported horizontally by storm systems). In

addition because methane has a global warming

potential of close to 100 during the first 15 to 20 years of its life (Dessus et al. 2001) it will preferentially warm

up and expand compared to the other atmospheric gases and thus drop even further in density making it much

lighter than the air. This methane rises into the upper stratosphere where it is trapped below the hydrogen against which it has an

upper diffuse boundary as shown by the fall off in methane concentration between 40 km and 50 km altitude (Figure 2a after Nassar

et al. 2005). It

is clear from the flattening of the methane concentration trend in the stratosphere

between 30 km and 47 km (Nassar et al. 2005) that this probably represents an expanding, world

encompassing methane global warming veil (Figure 2a after Nassar et al. 2005). This stratospheric methane is

above the ozone layer and it appears entirely stable between 30 km and 40 km where it shows little change (Figure 2a after Nassar et

It is therefore very likely that the methane global warming veil will form a giant reservoir

for quickly rising low density methane emitted into the dry Arctic atmosphere by progressive

destabilization of subsea Arctic methane hydrates (Light, 2011, 2012) combined with smaller amounts of methane

al. 2005).

formed by methanogenesis (Allen and Allen, 1990; Lopatin 1971). Much of the dry, light methane is able to bypass the ozone layer

unimpeded in a tropospheric - stratospheric circulation system to be discussed later. There

is a transition zone from

about 60o to 65o North where the methane begins to spiral outwards from the Arctic region

towards the mid latitudes and upwards towards the stratosphere to reach the base of the ozone

layer where it is being mixed into the stratosphere by giant vortices active at different times (Light 2012;

NSIDC 2011a). The continuous vertical motion of the methane in the Arctic region as it rises to the stratosphere between 60o to 65o

North which has a lateral motion impressed on it at lower latitudes must set up a methane partial pressure - concentration gradient

between the Arctic surface atmospheric methane emissions and the stratospheric methane global warming veil. Therefore

any

marked increase in the surface methane concentration and partial pressure should be marked by

similar increases in the upper stratosphere within the methane global warming veil. A further

consequence of the light methane rising like hydrogen into the upper stratosphere where it

forms a stable zone beneath the hydrogen between 30 km and 50 km height, is that this

methane is never recorded in the mean global warming gas measurements made at Mauna Loa.

We therefore have a completely separate high reservoir for methane, which at the moment we

only have vague information on and it may contain sufficient methane gas to multiply the

Mauna Loa readings by a considerable amount. Graphic Display of The Effects of the Methane Warming Veil

Figure 2b is a graphic display of the atmosphere from 0 to 55 km altitude versus increasing Arctic atmospheric methane

concentration reaching up to 6000 ppb (6 ppmv methane). The troposphere, tropopause, stratosphere, stratopause, mesosphere,

and ozone layer are from Heicklen, 1976. The various events related to global warming (droughts, water stress, coral bleaching and

death, deglaciation, sea level rise and major global extinction) are from Parry et al. 2007. Figure 2b has been designed to graphically

portray the growth of the subsea Arctic atmospheric methane as new observations become available and how this build up

strengthens the methane concentration in the stratosphere where it forms a world encompassing methane global warming veil at an

altitude of 30 km to 47 km. Figure 2b will be used to progressively chart mankind's Arctic methane emission, exponential

expressway to extinction within the next half century. As

the light-rising Arctic methane is spread around the

world by the Arctic stratospheric vortex system (NSIDC 2011a), it can be expected to lead to more

ozone and water vapor in the stratosphere, both of which will add to the greenhouse effect and

thus cause temperatures to increase globally. In the Arctic, where there is very little water vapour in the

atmosphere, the ozone layer may well be further depleted, because the rising methane behaves like a chloro-fluoro-hydrocarbon

(CFC) under the action of sunlight increasing the damaging effects of ultraviolet radiation on the Earth’s surface (Engineering

Toolbox, 2011; Anitei, 2007). Large

abrupt releases of methane in the Arctic lead to high local

concentrations of methane in the atmosphere and hydroxyl depletion, making that methane will persist

longer at its highest warming potential, i.e. of over 100 times that of carbon dioxide. (Carana, 2011a).

The presence of a large hole in the Arctic ozone layer in 2011 is most likely a result of this same

process of ozone depletion caused by a buildup of greenhouse gases from the massive upward transfer of

methane from the Arctic emission zones through the lower stratosphere up into the stratospheric veil between 30 km and 47 km

height (Science Daily, 2011). Anomalous Arctic Atmospheric Methane Concentrations The

extremely high content

of atmospheric methane measured in May 2012 at Barrow Point Alaska (2500 ppb) represents a

very dangerous turn of events in the Arctic and further substantiates the claim that the whole

Arctic has now become a latent subsea methane hydrate sourced blowout zone which will

require immediate remedial action if there is any faint hope of containing the now fast

increasing ( exponential ) rates of methane eruptions into the atmosphere (Light 2012c - Angels

proposal; see end of this text). The exponential increase in the Arctic atmospheric methane content from

the destabilization of the subsea methane hydrates is defined by the exponential decrease in the

volume of Arctic sea ice caused by the resulting global warming due to the build up of the

atmospheric methane (Carana, 2012d). The exponential increase in the Arctic atmospheric methane

is also implied by an exponential decrease in the continent wide reflectivity (albedo) of the

Greenland ice cap caused by increasing rates of surface melting (Figure 3; NASA Mod 10A1 data, from

Carana, 2012c). Albedo data for Greenland shows that it will become free of a continuous snow cover by about 2014, so that the

underlying old ice cover which has low reflectivity will be totally exposed to the sun in the summer (Carana, 2012c). This

darker

material will become a major heat absorber after 2014 starting the fast melt down of the

Greenland ice cap and this process will probably affect the older ice in the floating Arctic sea ice

fields. The Arctic ocean will also become free of sea ice by 2015 exposing the low reflectivity

ocean water directly to the sun, causing a high rate of temperature rise in Arctic waters and the

consequent destabilization of shelf and slope methane hydrates releasing large volumes of

methane into the atmosphere (Carana, 2012d; AIRS data Yurganov, 2012). As a consequence, the enhanced

global warming will melt the global ice sheets at a fast increasing rate causing the sea level to

begin rising at 15.182 cm/yr in the first few years after 2015 giving an accurate way of gauging

the worldwide continental ice loss (Figure 3). This sudden increase in the rate of sea level rise will

mark the last moment mankind will have to take control of the Arctic wide blowout of methane

into the atmosphere and a massive effort must be made by governments and oil companies to

stem the flow of the erupting subsea methane in the Arctic before this time. The loss of complete

snow cover in Greenland precedes the loss of the sea ice cap in the Arctic by a year which may be

due to the more extreme weather conditions that usually prevail over continents than over the

sea which moderates the weather. Methane and Ozone Circulation The components of the atmosphere undergo diffusion by a number of processes.

The mean speed of horizontal displacement of the stratosphere around the Earth is known to be about 120 km/hr from the Krakatoa eruption in 1883 (Heicklen, 1976). Winds

also transfer material northward and southward in the stratosphere in quite a different pattern to that of the tropospheric wind flows (Heicklen, 1976). Mean wind velocities

within the global methane warming veil and above it (36 km to 91 km altitude) are some 48 m/sec during the day and 56 m/sec at night (Olivier 1942, 1948). Large latitudinal

variations in the atmospheric density at 100 km altitude require meridional flows of 10 to 50 m/sec (Heicklen, 1976). At subarctic latitudes at the height of the global methane

warming veil (30 km to 50 km altitude) the ozone concentration lies between 1.7 to 1.9*10^12 molecules/cc to 5.4*10^10 molecules/cc and does not vary during the day

(Heicklen, 1976). The sub-arctic ozone reaches a maximum in the lower stratosphere in winter at an altitude of 17 km to 19 km (7.7*10^12 molecules/cc) and in summer at an

altitude of 18 km to 19 km (5.1*10^12 molecules/cc)(Heicklen, 1976). The seasonal variation of ozone in the stratosphere in Arctic latitudes is caused by a circulation transfer

system which moves ozone from the upper stratosphere in equatorial and mid-latitudes to the Arctic lower stratosphere during the winter (Heicklen, 1976). The stored Arctic

lower stratospheric ozone is lost in the summer by chemical dissociation when it moves downwards or by photosynthetic destruction if it moves upwards (Heicklen, 1976). The

Hippo methane concentration and temperature profiles shown in Figures 2a and 2b extend from the surface to some 14.4 km altitude and from the North Pole southwards

across the Equator to a latitude of -40o south (Wofsy et al. 2009). As already described the methane flow trends on Hippo methane concentration and temperature profiles have

been interpreted in detail using a similar system to that used by the Meteor expedition in determining deep ocean circulation patterns from salinity and temperature data

(Figure 2a - see Tharp and Frankel, 1986). Methane erupted from destabilizing methane hydrates in the subsea Arctic and of methanogenic origin has almost half the density of

air at STP in dry Arctic conditions and is seen to be rising vertically to the top of the Troposphere between 70o North and the North Pole on the Hippo methane concentration

profiles (Engineering Toolbox, 2011; Wofsy et al. 2009 ). On the Hippo data, at latitudes less than 70o North, the rising methane clouds are being spun out and laterally spread

in the middle and upper troposphere and upper stratosphere by stratospheric vortices (NSIDC, 2011a). The methane appears to be entering the lower stratosphere in the low

latitudes between 25o North and the equator which it then overlaps and is carried into the Southern Hemisphere to almost -40o South (Figure 2a)(Light 2011c). In the

equatorial regions the growth of the methane global warming veil will amplify the effects of El Nino in the Pacific further enhancing its deleterious effects on the climate. As this

vertically and laterally migrating methane enters the stratosphere in equatorial and mid-latitude positions it is helping to displace the equatorial and mid-latitude ozone which

migrates downwards and northwards towards the north pole (Heicklen, 1976) to complete the cycle. The methane may be partly drawn up into the lower and upper stratosphere

by a global pressure differential set up by the poleward and downward motion of the ozone (Heicklen, 1976) Once the methane has entered the stratosphere and has helped to

displace some of the ozone, it is able to accumulate in the upper stratosphere beneath the hydrogen as a continuous stable layer between 30 and 47 km forming a world wide

global warming veil (Figures 2a and 2b; Light 2011c). In the Arctic region methane has been shown to rise nearly vertically and is locally charging the global warming veil in

addition to methane that has diffused from mid latitude and equatorial regions. There must therefore exist a partial pressure gradient between the Arctic surface methane

anomalies and the upper stratosphere methane global warming veil such that any increase of the surface methane concentration and partial pressure should lead to a transfer of

methane into the upper stratosphere and to a similar increase in the partial pressure and concentration of the methane there. The methane partial pressure gradient that exists

between the anomalous Arctic ocean surface methane emissions and the stratospheric methane global warming veil at 30 km to 47 km height is partly controlled by the complex

motions and reactions of the Arctic ozone layer which separates the troposphere from the upper stratosphere and shows little variation in the day or between summer and winter

(Heicklen, 1976). Consequently the concentration of the methane in the upper stratospheric global warming veil should track the increase of Arctic atmospheric methane to

some degree and knowledge of the latter can allow absolute maximum estimates to be made on the magnitude of the former. This will give a rough estimate of what the highest

value the methane concentration is likely to reach within the global warming veil within the Arctic area. This is a worst case scenario which has to be assumed in order to prevent

Murphy’s law being operative (i.e. if anything can go wrong, it will go wrong in estimating the maximum methane value). An alternative is to view this solution of the methane

concentration in the global warming veil as German over-engineering in order to eliminate any possible errors in the estimate of the maximum value. My Father, a Saxon would

have commended me on this approach. This is precisely what mainstream world climatologists have failed to do in their modeling of the effects of Arctic methane hydrate

emissions on the mean heat balance of the atmosphere and why we are now facing such a severe climatic catastrophe from which we may very likely not escape. Let us hope and

pray that the Merlin Lidar methane detection satellite does not find methane magnitudes in the Arctic global warming methane veil (30 km – 47 km altitude) at the levels

predicted in this paper, when it is launched in 2014. The maximum global methane veil concentration in the mid latitudes (30o to 60o North) between 30 km and 40 km altitude

was estimated by occultation at some 0.97 ppmv methane (970 ppb) between February to April, 2004 (Nassar et al. 2005). In 2004 - 2005 the Arctic atmosphere at Point

Barrow, Alaska reached an anomalous maximum of some 2.014 ppmv methane (2014 ppb)(Carana, 2012e). This means that the most extreme methane concentration anomalies

in the Arctic (Point Barrow) are leading the maximum concentration in the global warming methane veil by some 1.044 ppmv methane (1044 ppb). Consequently as a first rule

of thumb assuming that the vertical methane partial pressure gradient has remained relatively unchanged, we can estimate the maximum methane concentration within the

Arctic methane global warming veil between 30 km and 47 km height by subtracting 1.044 ppmv methane (1044 ppb) from measured surface Arctic atmospheric value at the

same time. High methane concentrations of 2 ppmv (2000 ppb) were being reached in the Arctic in 2011 (position a. in Figure 2b) similar to those recorded in 2004 – 2005 at

Point Barrow Alaska (Carana, 2012e). It is therefore likely that by 2011 that the maximum concentration of methane in the methane global warming veil had remained relatively

unchanged since 2004. This is consistent with the start of major methane emissions in the Arctic in August 2010 as recorded at the Svalbard station and in the East Siberian

Shelf in 2011 which would not have given the emitted gases sufficient time to reach the upper stratosphere(Light, 2012a, Shakova et al. 2010a, b and c). On May 01, 2012 an

atmospheric methane concentration of 2.5 ppmv (2500 ppb) was recorded at Point Barrow indicating an increase in the maximum methane concentration anomaly of 0.5 ppmv

methane (500 ppb) in one year (yellow spike on Figure 1; position b. in Figure 2b)(ESRL/GMO graph from Carana 2012b). We can therefore predict conservatively that the

maximum concentration of the methane in the Arctic stratospheric methane global warming veil between 30 km and 47 km altitude may be as high as 1.456 ppmv methane

(1456 ppb) (= 2500 -1044 ppmv) (position b. in Figure 2b)(ESRL/GMO graph from Carana 2012b). Assuming that the maximum Arctic surface atmospheric methane content

continues to increase now at a rate of 0.5 ppmv (500 ppb) each year we can roughly predict that by 2013 it will have reached 3 ppmv (3000 ppb) and by 2014, 3.5 ppmv (3500

ppb) which is when the Merlin Lidar methane detection satellite will be launched (Ehret, 2010). Using the previous method of predicting the maximum likely methane content

in the Arctic methane global warming veil between 30 km and 47 km altitude, the maximum for 2013 is 1.956 ppmv methane (1956 ppb)(position c. in Figure 2b) and for 2014 is

2.456 ppmv methane (2456 ppb) (position d. in Figure 2b). This means that by the time the Merlin Lidar satellite is launched the Arctic Ocean will have emited sufficient

Once the entire atmospheric mean exceeds a 2oC temperature

increase it will precipitate fast deglaciation, the start of widespread inundation of worldwide

coastlines, extensive droughts and water stress for billions of people (Figure 2b)(after Parry et

al. 2007). This high predicted concentration of methane in the Arctic methane global warming

veil in 2014 is consistent with the exponentially falling albedo data for the Greenland ice cap

which suggests that major melting will begin in 2014 (Carana, 2012c). The exponential reduction in

volume of the Arctic sea ice to zero in 2015 (Carana, 2012d) will precipitate a massive increase in

the release of Arctic subsea methane from destabilization of the methane hydrates as the dark

ice free Arctic ocean absorbs large quantities of heat from the sun (Light, 2012a). MERLIN Lidar Satellite The MERLIN

methane to have surpassed the 2oC anomaly limit.

lidar satellite (Methane Remote Sensing Lidar Mission) , which is a joint collaboration between France and Germany will orbit the Earth at 650 km altitude and will be able to

detect the methane concentration in the atmosphere from 50 km altitude to the surface of the Earth (Ehret, 2010). The Lidar methane detection instrument was jointly

developed by DLR (Deutches Zentrum für Luft –und Raumfahrt), ADLARES GmBH and E. ON Ruhrgas AG (Ehret, 2010). This satellite is scheduled to be launched sometime in

2014 (Ehret, 2010) and will be the first time that real time data will be able to detect the concentration of methane within the world encompassing methane global warming veil

between 30 km and 47 km altitude and give us the first detailed picture of the size of the beast we are dealing with. Previous indications of this layer in the mid latitudes was

made using occultation (Nassar et al. 2005) The high anomalous atmospheric methane contents recorded this year (May 01) at Barrow Point Alaska (see Figure 2b, Carana

2012b) and the fact that they may be linked via a stable partial pressure gradient with increased maximum methane contents in the world encompassing global warming veil

(estimated at ca 1456 ppb methane) makes it imperative that the Merlin lidar satellite be launched as soon as is feasibly possible so we can get a clear idea of how high the

Earth’s stratospheric methane concentrations are. The Merlin satellite will continuously give us real time information on the size of the stratospheric methane global warming

This information shows how extremely serious the Arctic

methane emission problem is and how urgently we need to measure the status of the Arctic stratospheric methane global warming veil between 30 km

veil that is gathering its strength in the upper atmosphere.

and 47 km height. An early warning of high methane contents in the methane global warming veil will give humanity time to react to the existing and new threats that are

developing in the Arctic. Methane detecting Lidar instruments could also be installed immediately on the International Space Station to give us early warning of the methane

build up in the stratosphere and act as a back up in case the Merlin satellite fails. Sea Level Rise The progressive rise in sea level from 2015 is shown on Figures 3, 4 and 5.

Figures 4 and 5 are simplified versions of Figures 7, 8 and 9 in Light 2012a and Figures 12 and 13 in Light 2012c. The various events related to global warming (droughts, water

stress, coral bleaching and death, deglaciation, sea level rise and major global extinction) are from Parry et al. 2007. At the time of total worldwide deglaciation, the sea level is

estimated to rise some 68.3 metres (224 feet) (Wales, 2012) The maximum time of inundation of various coastal cities, coastlines and coastal barriers is shown on Table 1 (after

Hillen et al. 2010; Hargraves, 2012). Rising sea levels will breach the Thames Barrier by 2029 flooding London. The base of the Washington Monument (D.C.) will be inundated

by 2031. Total global deglaciation > will cause the sea level to rise up the lower 35% of the Washington Monument by 2051 (68.3 m or 224 feet above present sea level). Because

of the massive increase in the strength of the storm systems and waves, high rise buildings in many of the coastal city centers will suffer irreparable damage and collapse so that

the core zones of the cities will be represented by a massive pile of wave pulverised debris. Unfortunately by that time a large portion of sea life will be extinct and the city debris

fields will not form a haven for coral reefs. The seas will probably still be occupied by the long lasting giant jellyfish (such as are now fished off Japan), rays and sharks (living

respectively since 670, 415 and 380 million years ago) and the sea floor by coeolocanths (living since 400 million years ago)(Calder, 1984). The city rubble zones will probably be

occupied by predatory fish (living since 425 million years ago)(Calder 1984). Life will also continue in the vicinity of oceanic black smokers so long as the oceans remain below

boiling point. ANGELS Proposal

If left alone the subsea Arctic methane hydrates will explosively

destabilize on their own due to global warming and produce a massive Arctic wide methane

“blowout ” that will lead to humanity’s total extinction , probably before the middle of

this century (Light 2012 a, b and c). AIRS atmospheric methane concentration data between 2008 and 2012 (Yurganov 2012)

show that the Arctic has already entered the early stages of a subsea methane “blowout” so we need

to step in as soon as we can (e.g. 2015) to prevent it escalating any further (Light 2012c). The Arctic Natural

Gas Extraction, Liquefaction & Sales (ANGELS) Proposal aims to reduce the threat of large, abrupt releases of

methane in the Arctic, by extracting methane from Arctic methane hydrates prone to

destabilization (Light, 2012c). After the Arctic sea ice has gone (probably around 2015) we propose that a large

consortium of oil and gas companies/governments set up drilling platforms near the regions of maximum subsea

methane emissions and drill a whole series of shallow directional production drill holes into the subsea subpermafrost “free

methane” reservoir in

order to depressurize it in a controlled manner (Light 2012c). This methane will be

produced to the surface, liquefied, stored and transported on LNG tankers as a “green energy”

source to all nations, totally replacing oil and coal as the major energy source (Light

2012c). The subsea methane reserves are so large that they can supply the entire earth’s energy

needs for several hundreds of years (Light 2012c). By sufficiently depressurizing the

Arctic subsea subpermafrost methane it will be possible to draw down Arctic ocean water through the old

eruption sites and fracture systems and destabilize the methane hydrates in a controlled way thus shutting

down the entire Arctic subsea methane blowout (Light 2012c).

[insert warming impact here]

Marine CCS Module

[warming real and anthropogenic]

Reductions in emissions alone are insufficient – even absent a methane leak,

current consumption levels have made CO2 based warming inevitable - strongly

err affirmative

Mills 11—Robin Mills, Head of Consulting at Manaar Energy Consulting, Non-Resident Scholar

at INEGMA, MSc in Geological Sciences from Cambridge, Capturing Carbon: The New Weapon

in the War Against Climate Change, p. 41

Even if carbon dioxide emissions were to stop today, the built-in inertia in the climate system would

lead to temperatures increasing further. In addition to the 0.75CC rise since the nineteenth century, we are already committed to a further

warming of 0.6°C. If emissions, and hence temperatures, continue to rise, warming may be as much as 4°C by 2050—and locally much more, 15°C hotter in the Arctic and 10°C

in western and southern Africa. At this level, climate impacts will become more and more serious.

Extinctions are likely to increase

sharply , while extreme heat-waves, forest die-offs, flooding of major river deltas, persistent severe droughts, mass

migrations,33 wars and famines are all possible. We may soon pass, or already have passed, the point at which, over the next few centuries, parts of

the West Antarctic and Greenland ice sheets melt irreversibly, with potential sea level rises of 1.5 and 2-3 metres respectively.34 Due to feedback

mechanisms and poorly understood components of global climate, there is even the possibility of a sudden, rapid

catastrophic change . For example, open ocean absorbs more heat from the sun than ice. Melting

permafrost35 and warming ocean bottom waters36 release carbon dioxide and the powerful greenhouse gas methane, driving further

warming. Carbon sinks will become increasingly ineffective37 as forests die off, soils dry out and

warmer oceans dissolve less carbon dioxide, so that ecosystems may become net

contributors

of carbon dioxide to the atmosphere,

rather than net absorbers as today. The shade of clouds may diminish over warming

oceans,38 while melting ice shelves may lead to sudden collapse of grounded ice, and hence rapid rises in sea level. The picture is complicated further by some offsetting effects,

due for instance to increased plant growth in a warmer, more CO2-rich world. Changes in cloudiness, snowfall and albedo (reflectiveness) of vegetation may have warming or

non-linear effects can lead to prolonged droughts in the

Mediterranean, California41 or West Africa,42 or to weakening of ocean circulation43 with knock-on effects including a rise in North Atlantic sea

levels of up to 1 metre, a collapse of fisheries, disruption of the South Asian monsoon,44 and possibly (albeit unlikely)

sharp cooling in Europe.45 Similar rapid changes are documented from Earth history, as at the end of the Ice Ages. At one time, at the end of the so-called

Younger Dryas event around 12,000 years ago, Europe warmed by some 5°C within two decades.4" It seems increasingly clear, from

geological studies, that the climate system is unstable and prone to abrupt transitions from one

state to another, so further warming might trigger entirely unforeseen consequences.47 We should not give in to

cooling effects. Such positive feedbacks may greatly accelerate warming. Unpredictable,

alarmism, and such disastrous shifts are thought to be unlikely—but their consequences are serious enough to be worth guarding against. This is about as far as the weight of

many

continue to deny

anthropogenic climate change

consensus has reached,48 Yet

individuals and corporations

the reality of

. The

US petroleum and coal businesses, in particular certain commentators,49 and many of the general public across the world, 50 continue to maintain that the climate is not

warming, that elevated carbon dioxide does not cause warming, that rising carbon dioxide and temperatures are not caused by humans, that the consequences of climate change

will be benign, or some combination of these positions. Beyond this understanding, there remains great uncertainty and debate on how much warming will occur for given

changes in atmospheric carbon dioxide, how serious the impacts of this warming will be, how the climate will change at regional and local levels, how much it is worth spending

Despite extensive and

continuing research, these major uncertainties will persist for the foreseeable future. Some of the debate is

a normative one, about the values of our civilisation, and therefore is not even capable of being solved by scientific inquiry. Such uncertainty and controversy,

though, is not a reason for inaction . After all, we ban certain drugs suspected to be carcinogenic, without waiting for

absolute proof, and we will only know the truth about some of these climate change disasters when they

actually strike. I will take as my starting point here, in this fast-evolving area of research, the view that we should attempt to keep total warming below 2-3°C.52 The

to reduce climate change,51 exactly what types of action we should take, and how we should go about encouraging global action.

original goal of the EU, recommended by the International Climate Change Task Force, was for a maximum temperature rise of 2°C,53 but given the delay in taking major

Anything above 2°C is already dangerous but, with luck,

avoiding rises over 3°C will prevent the most damaging effects of climate change .

action, and the latest science, this already seems to be very tough to achieve.

Otherwise, we will venture into uncharted territory, where the risk of abrupt climatic changes is

high : 'Once the world has warmed by 4°C, conditions will be so different from anything we can observe today (and still more different from the last ice age) that it is

inherently hard to say where the warming will stop.'55

Carbon sequestration in methane hydrates is specifically key to solve – other

approaches fail

Park et al. 8 (Youngjune Park, Minjun Cha, Jong-Ho Cha, Kyuchul Shin, and Huen Lee,

Department of Chemical & Biomolecular Engineering, Korea Advanced Institute of Science and

Technology, Department of Environmental Engineering, Kongju National University, Korea

Institute of Geoscience and Mineral Resources, “SWAPPING CARBON DIOXIDE FOR

COMPLEX GAS HYDRATE STRUCTURES” // AK)

Large amounts of CH4 in the form of solid hydrates are stored on continental margins and in

permafrost regions. If these CH4 hydrates could be converted into CO2 hydrates, they would

serve double duty as CH4 sources and CO2 storage sites. Herein, we report the swapping

phenomena between global warming gas and various structures of natural gas hydrate including

sI, sII, and sH through 13C solid-state nuclear magnetic resonance, and FT-Raman

spectrometer. The present outcome of 85% CH4 recovery rate in sI CH4 hydrate achieved by the direct use of binary N2 + CO2 guests is quite

surprising when compared with the rate of 64 % for a pure CO2 guest attained in the previous approach . The direct use of a mixture of

N2 + CO2 eliminates the requirement of a CO2 separation/purification process. In addition, the

simultaneously-occurring dual mechanism of CO2 sequestration and CH4 recovery is expected

to provide the physicochemical background required for developing a promising large-scale

approach with economic feasibility . In the case of sII and sH CH4 hydrates, we observe a spontaneous structure transition to

sI during the replacement and a cage-specific distribution of guest molecules. A significant change of the lattice dimension

due to structure transformation induces a relative number of small cage sites to reduce,

resulting in the considerable increase of CH4 recovery rate. The mutually interactive pattern of targeted guest-cage

conjugates possesses important implications on the diverse hydrate- based inclusion phenomena as clearly illustrated in the swapping process between

CO2 stream and complex CH4 hydrate structure. INTRODUCTION There

are currently two urgent global issues that

should be resolved, global warming effects and future energy sources . In order to

effectively control atmospheric CO2 levels, CO2 needs to be sequestered to appropriate

sites on a large scale . Several suggested methods that entail injecting CO2 into the ocean involve producing relatively pure CO2 at its

source and transporting it to the injection point [1]. In particular, when CO2 is injected in seawater below a certain

depth, a solid CO2 hydrate can be formed according to the stability regime [2]. On the other hand,

naturally-occurring gas hydrates are deposited on the continental margin and its permafrost

regions and are scattered all over the world [3]. The total amount of natural gas hydrate over the

world is estimated to be about twice as much as the energy contained in fossil fuel reserves [4,

5]. In order to recover CH4 efficiently, several strategies such as thermal treatment, depressurization, and inhibitor addition into the hydrate layer have

been proposed [6]. However, all these methods are based on the decomposition of CH4 hydrate by external stimulation and could potentially trigger

catastrophic slope failures [7]. It thus needs to be recognized that the present natural gas production technologies have inherent limitations in terms of

their adoption for the effective recovery of natural gas hydrates. As

such, the safest and most economically feasible

means should be developed with full consideration of environmental impacts. Recently, the

replacement technique for recovering CH4 from CH4 hydrate by using CO2 has been suggested

as an alternative option for recovering CH4 gas [8, 9]. This swapping process between two gaseous

guests is considered to be a favorable approach toward long-term storage of CO2. It also

enables the ocean floor to remain stabilized even after recovering the CH4 gas, because CH4

hydrate maintains the same crystalline structure directly after its replacement with CO2. If the

CH4 hydrates could be converted into CO2 hydrates, they would serve double duty as CH4

sources and CO2 storage sites. Here, we further extend our investigations to consider the occurrence of CO2 replacement phenomena

on sII, and sH hydrate. In this point of view, we present an interesting conclusion reached by inducing a structure transition. A microscopic

analysis is conducted in order to examine the real swapping phenomena occurring between CO2

guest molecules and various types of hydrate through spectroscopic identification, including

solid-state Nuclear Magnetic Resonance (NMR) spectrometry and FT-Raman spectrometry. More

importantly, we also investigate the possibility of direct use of binary N2 and CO2 gas mixture for recovering CH4

from the hydrate phase, which shows a remarkably enhanced recovery rate by means of the

cage-specific occupation of guest molecules due to their molecular properties.RESULTS AND

DISCUSSION The recoverable amount of CH4 by replacing sI CH4 hydrate with CO2 could reach around 64% of hydrate composition because CO2

molecules only preferably replace CH4 in large cages, while CH4 molecules in small cages remain almost intact [8]. This swapping process between two

gaseous guests is considered to be a favorable way as a long-term storage of CO2 and enables the ocean floor to remain stabilized even after recovering

the CH4 gas because sI CH4 hydrate maintains the same crystalline structure directly after its replacement with CO2. We first attempted to examine

real swapping phenomenon occurring between binary guest molecules of N2 and CO2 and crystalline sI CH4 hydrate through spectroscopic

identification. For CO2 its molecular diameter is the same as the small cage diameter of sI hydrate, and thus only a little degree of distortion in small

cages exists to accommodate CO2 molecules. Accordingly, we sufficiently expect that CO2 molecules can be more stably encaged in sI-L under favorable

host-guest interaction. On the other hand, N2 is known as one of the smallest hydrate formers and its molecular size almost coincides with CH4.

Although N2 itself forms pure sII hydrate with water, the relatively small size of N2 molecules leads to the preference of sI-S over other cages and

moreover the stabilization of overall sI hydrate structure when N2 directly participates in forming hydrate. Figure 1 13C cross-polarization NMR spectra

for identifying replaced CO2 molecules in sI CH4 hydrate.  Accordingly, CH4 and N2 are expected to compete for better occupancy to

sI-S, while CO2 preferentially occupies only sI-L without any challenge of other guests. Thus, the successful role of these two external guests of N2 and

CO2 in extracting original CH4 molecules makes it possible for diverse flue gases to be directly sequestrated into natural gas hydrate deposits. Figure 2

In-situ Raman spectra of sI CH4 hydrate replaced with N2 + CO2 (80 mol% N2 and 20 mol% CO2) mixture. (a) C-H stretching vibrational modes of

CH4 molecules, (b) N-N stretching modes of N2 molecules, (c) C=O stretching and bending vibrational modes of CO2 in clathrate hydrate cages. To

verify several key premises mentioned above we first identified ternary guest distribution in cages through the 13C NMR and Raman spectra. As shown

in Figure 1. the NMR spectra provide a clear evidence such that CO2 molecules are distributed only in sI-L. For qualitative description of cage

occupancy enforced by N2 molecules, we measured the Raman spectra of the sI CH4 hydrates replaced with N2 + CO2 mixture. Two peaks in Figure 2a

representing CH4 in sI-S (2914 cm-1) and CH4 in sI-L (2904 cm-1) continuously decreased during the replacing period of 750 min, but after that no

noticeable change occurred in peak intensity. This kinetic pattern can be also confirmed by crosschecking them with the corresponding Raman peaks of

N2 and CO2 (Figures 2b and 2c). The quantitative Raman analysis revealed that, 23% of CH4 in hydrate is replaced with N2, while 62% of CH4 is

replaced with CO2. Accordingly, approximately 85% of CH4 encaged in saturated CH4 hydrate is recovered and, of course, this recovery rate might be

expected to more or less change with variations of external variables such as pressure, temperature and hydrate particle size. The overall kinetic results

lead us to make a clear conclusion that the replacement of sI CH4 hydrate with N2 + CO2 mixture proceeds more effectively in crystalline hydrate than

using only pure CO2 because N2 molecules is confirmed to possess the excellent cage-guest interaction in an unusual configuration. Even for simple

hydrate systems focused in the present work the unique cage dynamics drawn from spectroscopic evidences might be expected to offer the new insight

for better understanding of inclusion phenomena, particularly, host lattice- guest molecule interaction as well as guest-guest replacement mechanism.

However, sII and sH hydrates, which are known to be formed by the influence of thermogenic hydrocarbon and mainly includes oil-related C1-C7

hydrocarbons, were discovered at shallow depth in sea floor sediment in a few sites such as the Gulf of Mexico or Cascadian margin [10-12]. Thus, it is

also required to verify the swapping phenomena occurring on sII or sH type clathrate hydrate. For sII hydrate, C2H6 is specially selected to form the

hydrate with CH4. We note that both CH4 and C2H6 form simple crystalline sI hydrates with water. But, when they are mixed within the limits of

specific concentrations, they act as binary guests causing to form the stable sII double hydrate [13]. Figure 3 shows the 13C HPDEC MAS NMR spectra

of  mixed CH4 + C2H6 hydrates that are replaced with CO2 molecules. Three peaks representing the CH4 in sII-S, CH4 in sII-L and C2H6 in sII-L

appeared at chemical shifts of -3.95, -7.7 and 6.4 ppm, respectively. Interestingly, during swapping process the external guest CO2 molecules attack

both small and large cages for better occupancy, which causes the structure transition of sII to sI to continuously proceed. Within 24 hours the sII

peaks almost disappeared and instead only a very small amount of CH4 in sI-S and sI-L and C2H6 in sI-L was detected at chemical shifts of -4.0, -6.1

and 7.7 ppm, respectively. Figure 3. The 13C HPDEC MAS NMR spectra of sII CH4 +C2H6 hydrate replaced with CO2. Figure 4. Relative moles in the

sII CH4 + C2H6 hydrate replaced with CO2 measured by gas chromatography. From structural viewpoint we think that the hydrate lattices are slightly

adjusted to accommodate three guests of CH4, C2H6 and CO2 in the highly stabilized hydrate networks. The cage-specific behavior revealed by CO2

can be sufficiently expected according to its molecular dimension over a small cage. Thus, the approaching CO2 competes only with CH4 and C2H6 in

sII-L at the initial stage of swapping. CH4 and C2H6 expelled from sII-L provoke losing sustainability of sII phase by getting out of the limit of critical

guest concentration. The reestablishment process of guest molecule distribution in the hydrate network causes to alter and ultimately adjust the lattice

dimension for structure transition to occur. The effect of a substantial small-cage reduction on CH4 recovery rate was checked by the GC analysis and

the results are shown in Figure 4. During the swapping process, the CH4 and C2H6 molecules in hydrate phase continuously decrease until reaching

the recovery rate of 92% for CH4 and 99% for C2H6. Both the NMR and GC results imply that most of CH4 molecules in sI-L as well as sI-S were

displaced by CO2 molecules. The externally approaching CO2 guests attack and occupy most of the sII-S and sII-L cages accompanying structure

transition of sII to sI. We note again that CO2 molecules possess a sufficient enclathration power to be entrapped in sI-S during change of sII to sI,

while the CO2 occupancy to sI-S of pure CH4 hydrate is very difficult to occur. The 30% or more CH4 recovery enhancement in sII over 64% in sI is

caused by structure transition totally altering the host-guest interactions during swapping. Furthermore, the naturally-occurring sII hydrates contain

more amount of CH4 than the laboratory- made sII hydrates used in these experiments and thus the actual limitation of recoverable CH4 in sII hydrate

would be higher than the present outcome of 92%. We also examined the swapping capacity of the N2 + CO2 mixture occurring in the mixed sII CH4 +

C2H6 hydrate and found that the recovery rates are 95% for CH4 and 93% for C2H6. Figure

5. The 13C HPDEC MAS NMR spectra of sH CH4 + isopentane hydrate replaced with CO2. In case of sH CH4 hydrate, structure transition was also

occurred during the swapping process as shown in Figure 5. Before replacement, isopentane was entrapped in large cages of sH hydrate with CH4 in

both small and middle cages. However, external CO2 gas provokes structure transition to sI type hydrate and finally sH phase disappeared. During the

replacement, 92% of CH4 was recovered. In addition, by using N2 + CO2 mixture exceeding 90% of recovered CH4 readily achieved. Table. 1.

Recoverable CH4 (mol%) in various types of gas hydrates CONCLUSION In

this study, we investigated the swapping

phenomena through flue gas mixtures of N2 and CO2 for efficiently developing gas hydrate in

the deep ocean floor. The direct use of N2 + CO2 mixture enhanced CH4 recovery as well as

eliminated the CO2 separation/purification process for sequestering CO2. In addition, a

spectroscopic analysis reveals that the external N2 molecules attack CH4 molecules already

entrapped in sI-S and play a significant role in substantially increasing the CH4 recovery rate. In

particular, we performed the replacement experiment for naturally occurring sI, sII, sH hydrate.

During the swapping the sII and sH CH4 hydrate, structure transition to sI were observed. The

utilization of this natural swapping phenomenon might greatly contribute to realizing both

ocean storage of CO2 and CH4 recovery from marine deposits in a large scale.

Only carbon dioxide REMOVAL solves—slow absorption rate proves

Mills 11—Robin Mills, Head of Consulting at Manaar Energy Consulting, Non-Resident Scholar

at INEGMA, MSc in Geological Sciences from Cambridge, Capturing Carbon: The New Weapon

in the War Against Climate Change, p. 41

we can at a cost in money and energy, remove any quantity of

carbon dioxide from the atmosphere. This may be crucial if we discover that we are on the path

to sudden, catastrophic climate change. Even if we were to halt all emissions immediately, it

Indirect capture is therefore the ultimate backstop for climate policy. Storage capacity permitting,

,

would take millennia for the elevated concentration of atmospheric carbon dioxide to be fully

absorbed . By contrast, air cap-ture might be able to take us back to pre-industrial levels within

some decades. As a 'geo-engineering' solution, it addresses the problem directly, rather than reducing global warming indirectly.141 Undesirable

sjde-effects are, as far as we can tell now, minimal compared with other geo-engineering techniques, and it

also addresses the other key issue of ocean acidification. Some major studies have dismissed air capture without serious consideration,14mainly on cost grounds. It is, indeed, likely to be one of the more expensive carbon mitigation options, but it does not have to compete with CCS on large centralised sources, nor

It is intended to address otherwise intractable polluters such as flying,

and to provide a way of returning rapidly to a pre-industrial atmosphere. In contrast to other 'carbon offset' schemes

with major low-carbon power solutions such as wind or nuclear.

such as forestry (see Chapter 4), which have been heavily criticised,141 it offers completely verifiable, and unde-niably 'additional', reductions. I will return to this issue in

Chapter 6.

US leadership on marine CCS spills over globally by demonstrating

economic feasibility—modeling gets China and India on board

MIT 7—MIT Panel Provides Policy Blueprint for Future of Use of Coal as Policymakers Work to

Reverse Global Warming, p. http://web.mit.edu/coal/

Leading academics from an interdisciplinary Massachusetts Institute of Technology (MIT) panel issued a report

today that examines how the world can continue to use coal, an abundant and inexpensive fuel, in a way that

mitigates , instead of worsens, the global warming crisis. The study, "The Future of Coal – Options for a Carbon Constrained World," advocates

the U.S. assume global leadership on this issue through adoption of significant policy actions. Led by co-chairs Professor John Deutch,

Institute Professor, Department of Chemistry, and Ernest J. Moniz, Cecil and Ida Green Professor of

Physics and Engineering Systems, the report states that carbon capture and sequestration (CCS)

is the critical enabling technology to help reduce CO2 emissions significantly while also

allowing coal to meet the world's pressing energy needs. According to Dr. Deutch, "As the world's

leading energy user and greenhouse gas emitter, the U.S. must take the lead in showing

the world CCS can work . Demonstration of technical, economic, and institutional features

of CCS at commercial scale coal combustion and conversion plants will give policymakers and the public confidence that a

practical carbon mitigation control option exists, will reduce cost of CCS should carbon emission controls be adopted, and will maintain

the low-cost coal option in an environmentally acceptable manner." Dr. Moniz added, "There are many opportunities for enhancing the performance of coal plants in a carbonconstrained world – higher efficiency generation, perhaps through new materials; novel approaches to gasification, CO2 capture, and oxygen separation; and advanced system

concepts, perhaps guided by a new generation of simulation tools. An aggressive R&D effort in the near term will yield significant dividends down the road, and should be

undertaken immediately to help meet this urgent scientific challenge." Key findings in this study: • Coal is a low-cost, per BTU, mainstay of both the developed and developing

world, and its use is projected to increase. Because of coal's high carbon content, increasing use will exacerbate the problem of climate change unless coal plants are deployed

with very high efficiency and large scale CCS is implemented. • CCS is the critical enabling technology because it allows significant reduction in CO2 emissions while allowing

coal to meet future energy needs. • A significant charge on carbon emissions is needed in the relatively near term to increase the economic attractiveness of new technologies

that avoid carbon emissions and specifically to lead to large-scale CCS in the coming decades. We need large-scale demonstration projects of the technical, economic and

Several integrated largescale demonstrations with appropriate measurement, monitoring and verification are needed in the U nited S tates over the next decade

environmental performance of an integrated CCS system. We should proceed with carbon sequestration projects as soon as possible.

with government support . This is important for establishing public confidence for the very

large-scale sequestration program anticipated in the future. The regulatory regime for large-scale commercial sequestration

should be developed with a greater sense of urgency, with the Executive Office of the President leading an interagency process. • The U.S. government should provide assistance

only to coal projects with CO2 capture in order to demonstrate technical, economic and environmental performance. • Today, IGCC appears to be the economic choice for new

coal plants with CCS. However, this could change with further RD&D, so it is not appropriate to pick a single technology winner at this time, especially in light of the variability

in coal type, access to sequestration sites, and other factors. The government should provide assistance to several "first of a kind" coal utilization demonstration plants, but only

with carbon capture. • Congress should remove any expectation that construction of new coal plants without CO2 capture will be "grandfathered" and granted emission

Emissions will be stabilized

only through global adherence to CO2 emission constraints. China and India are unlikely

allowances in the event of future regulation. This is a perverse incentive to build coal plants without CO2 capture today. •

to adopt carbon constraints unless the U.S. does so and leads the way in the

development of CCS technology.

Future Sustainability Module

Natural methane gas is a bridge fuel to renewables, but it fails alone – conjunction

with CCS is key to future sustainability

Brown et al. 9 (internationally recognized scholar for his work in energy economics, PhD and

professor of economics at UNLV, “Natural Gas: A Bridge to a Low‐Carbon Future?” // AK)

Over the next 20 years, the United States and other countries seem likely to take steps toward a

low‐carbon future. Looking beyond this timeframe, many analysts expect nuclear power and emergent energy technologies—

such as carbon capture and sequestration, renewable power generation, and electric and plug‐in hybrid vehicles—to

hold the keys to achieving a sustainable reduction in carbon dioxide (CO2) emissions. In the

meantime, however, many are discussing greater use of natural gas to reduce CO2 emissions.

Recent assessments suggest that the United States has considerably more recoverable natural gas in shale formations than was

previously thought, given new drilling technologies that dramatically lower recovery cost. Because natural gas use yields CO2

emissions that are about 45 percent lower per Btu than coal and 30 percent lower than oil, its apparent abundance raises the

possibility that natural gas could serve as a bridge fuel to a future with reduced CO2 emissions. Such a transition would seem

particularly attractive in the electric power sector if natural gas were to displace coal. To

assess the role of natural gas as

a bridge fuel to a low‐carbon future, we compare four scenarios that reflect different

perspectives on natural gas availability and climate policy. These scenarios run through 2030

and were modeled using NEMS‐RFF.2 Two scenarios are business‐as‐usual cases and assume that the United States

adopts no new policies to reduce CO2 emissions. The first uses what now seem to be conservative estimates of shale gas resources;

the numbers date from 2007 but have been used as recently as early 2009 by the Energy Information Administration. The second

uses newer, more optimistic estimates developed by the Potential Gas Committee (2009). The third and fourth scenarios assume

that the United States adopts a low‐carbon policy with CO2 emission targets similar to those in the American Clean Energy and

Security Act proposed by Representatives Henry Waxman and Edward Markey, and to those proposed by the Obama administration

prior to the UN climate conference in Copenhagen. Like the first scenario, Scenario 3 uses conservative estimates of U.S. shale

By comparing these four scenarios, we

assess how the relative abundance of natural gas might affect its usage and potential to reduce

CO2 emissions. We find that more abundant natural gas supplies result in greater natural gas

use in most sectors of the economy. More importantly, we find that with appropriate carbon

policies in place—such as a cap‐and‐trade system or a carbon tax—natural gas can play a role as a bridge fuel

to a low‐ carbon future. Having low‐carbon policies in place is crucial. Without such

policies, more abundant natural gas does not reduce CO2 emissions. Although greater natural gas

resources reduce the price of natural gas and displace the use of coal and oil, they also boost overall energy

consumption and reduce the use of nuclear and renewable energy sources for electric power

generation. As a result, projected CO2 emissions are almost one percent higher.

resources of natural gas. Scenario 4 uses the more optimistic estimates.

Independently, carbon sequestration in methane hydrates reverses the effects of

current consumption, and causes a paradigm shift that locks in future

sustainability

Sabil et al. 11 (K.M. Sabil – Department of Chemical Engineering at University Teknologi

Petronas, PhD (Chemical Engineering) Delft University MSc (Chemical Engineering) Universiti

Sains Malaysia| BEng (Chemical Engineering), Universiti Sains Malaysia, Azmi and H. Mukhtar,

“A Review on Carbon Dioxide Hydrate Potential in Technological Applications” // AK)

INTRODUCTION The

increasing demand for energy to supply for the need of industrial

developments and the escalating human population has led to accelerated mining and

combustion of fossil fuels. These woldwide activities cause a continuing increase of the rates of

anthropogenic carbon dioxide emissions, resulting in the increase of the level of atmospheric

carbon dioxide. The atmospheric carbon dioxide level has increased 22% since 1958 and about

30% since 1880 (Robinson et al., 2007). The alarmingly increase of carbon dioxide in the atmosphere

is believed to have caused some significant climate changes. For instance, the worldwide

temperature measurements, carefully screened for instrumental and experimental conditions

such as effects of urbanization, show an increase in global mean annual surface temperatures of

0.3 to 0.6°C for the last 159 years (Nicholls and Leatherman, 1996). If the temperature continues to

increase, devastating effects on world population will be unavoidable. Due to this concern,

the increasing quantities of carbon dioxide and other greenhouse gases in the atmosphere has

caused widespread global concerns and has attracted international action such as the Kyoto Protocol. The main

sources of carbon dioxide in the atmosphere are thermal power generation, oil and natural gas

refining and processing, cement manufacturing, iron and steel making and petrochemical

industries. As shown in Table 1, fossil-fuelled power combined with oil and gas refining and

processing cover more than 87% of the industrial carbon dioxide emissions. Table 1: Annual carbon

dioxide emissions from major industrial sources* *Source:http://www.ipcc.ch/pdf/special-reports/srccs/srccs_technical

summary.pdf As

the world’s dependency on oil and gas as the main source of energy is foreseen to

continue for years to come, a new approach should be developed in order to reduce the

increasing amount of carbon dioxide release as a by-product of energy production. A

paradigm shift is required in order to successfully combat this environmental problem and

the basis of this paradigm shift is to look at carbon dioxide not just as a polluting greenhouse gas

but also as a valuable raw material. This approach requires the development of separation

technologies to separate the carbon dioxide in bulk from the natural gas under different

concentrations, techniques to sequestrate or store the carbon dioxide and processes to convert

the bulk carbon dioxide to different added-value products like chemicals, temperate-farming-agro-products

and refrigerants. The benefits from this approach are three-fold. Firstly, for the growth of the hydrocarbon based industries, new

technologies suitable to cater for high carbon dioxide concentration have to be developed on a high

priority basis. Secondly, from the large quantities of carbon dioxide that is produced, a variety of added-value products could be

obtained, thus converting a polluting greenhouse gas into a valuable resource. Thirdly, carbon credit is gained under the Kyoto

Protocol for utilizing the carbon dioxide which can be used to generate additional revenue. CLATHRATE HYDRATES Gas or

clathrate hydrates were discovered almost two centuries ago by Davy (1814). In the early days, interest in gas hydrates was mainly

focused on the discovery of new hydrate formers, mainly inorganic chemicals and the composition of these hydrates (Sloan, 1998).

Only after the discovery of the occurrence of hydrates in oil production pipelines by Hammerschmidt (1934), a shift towards more

industrial hydrate research focusing on hydrocarbons based hydrates was carried out to cater for the needs of oil and gas production.

Since then, hydrate research has been intensified especially after the discovery of natural gas hydrate deposits in the Siberian

permafrost regions by Makogon (1981). Clathrate

hydrates or gas hydrates are crystalline solid compounds

that are formed in mixtures of water and non-or slightly polar low molecular weight gases or

volatile liquids and when subjected to appropriate temperature and pressure conditions. They

are formed when hydrogen-bonded water molecules form cage-like structures, known as cavities

in the crystalline lattice. These cavities have to be at least partially filled with the hydrateforming molecules, also known as the ‘guest molecule’s, in order to stabilize the structure. Guest

molecules are either non-polar or slightly polar in nature and the most common guest molecules are methane, ethane, propane, isobutane, normal butane, nitrogen, carbon dioxide and hydrogen sulfide. Depending on the type and the size of guest molecule

presents, different gas hydrate structures can be formed. The types of cavities that are formed and the distribution of those cavities

in a unit cell are used to distinguish the clathrate hydrate structures. A numerous number of structures are known but there are

three different structures have been well studied, namely, structure I (sI), structure II (sII) and structure H (sH) (Sloan, 1998). The

unit cell of structure I hydrate consists of 46 water molecules forming two small cavities and six large cavities. The small cavity has

the shape of a pentagonal dodecahedron (512) while the large cavity has the shape of a tetradecahedron (51262). The unit cell of

structure II hydrate consists of 136 water molecules forming sixteen small cavities and eight large cavities. Similar to the small cavity

of sI, the small cavity of sII also has the shape of a pentagonal dodecahedron (512) but the large cavity has a shape of a

hexadecahedron (51264). In structure H, the unit cell consists of three small cavities of 512, two medium cavities of 435663 and one

large cavity of 51268. The number of water molecules, cages and some geometry of the different hydrate structures are given in Table

2. Table 2: Geometry of hydrate unit cells and cavities (Sloan and Koh, 2008) Table 3: Ratios of molecular diameter to cavity

diameters for clathrate hydrate former (Sloan, 1998) In order to form clathrate hydrate, the size of the guest molecules must not be

too large or too small compared to the size of the cavities. A ratio of the molecular diameter to the cavity diameter of approximately

0.75 appears to be optimal (Christiansen and Sloan, 1994). Structures I and II can be formed with a single guest component while

structure H requires at least two different guest molecules (large and small). Most components of natural gas (CH4, C2H6, C3H8,

CO2, N2 and H2S etc.) form hydrates. Table 3 presents the diameter ratios of natural gas components and a few other components

relative to the diameter of each cavity in structures I and II. In Table 3, size ratios denoted with a superscript ζ are those occupied by

a simple hydrate former. On one hand, if the size ratio is less than 0.76, the molecular attractive forces cannot contribute to cavity

stability. On the other hand, above the ratio value of about 1.0, the guest molecule does not fit into a cavity without lattice distortion

(Sloan, 1998). CARBON DIOXIDE HYDRATE As previously mentioned,

carbon dioxide has been known to be

among a number of molecules that can form clathrate hydrate. The first evidence for the existence of CO2

hydrates probably dates back to the year 1882, when Wroblewski reported the clathrate hydrate formation in a system of carbonic

acid and water (Wroblewski, 1882). Fig. 1: Three-phase equilibrium data of simple hydrates of carbon dioxide (Sabil et al., 2010) The

hydrate dissociation curve in the range 267 to 283 K is first published by Villard in 1897 (Villard, 1897). Later on, Tamman and Krige

measured the hydrate decomposition curve from 230 to 250 K (Tamman and Krige, 1925). Frost and Deaton determined the

dissociation pressure between 273 and 283 K (Frost and Deaton, 1946). Takenouchi and Kennedy (1965) measured the

decomposition curve from 4.5 to 200 MPa. Carbon dioxide hydrate was classified as a structure I clathrate for the first time by Von

Stackelberg and Muller (1954). As

a simple hydrate, carbon dioxide forms structure I hydrate under

appropriate pressure and temperature conditions. If all the hydrate cavities are occupied, the chemical formula is

8 CO2. 46 H2O or CO2. 5.75 H2O. Extended compilations of published hydrate equilibrium conditions of carbon dioxide in pure

water can be found in Sloan and Koh (2008). The phase behaviour of carbon dioxide and water in the hydrate forming region is

measured by Sabil et al. (2010) in the temperature and pressure ranges of 271-292 K and 1.0-7.5 MPa, respectively as presented in

Fig. 1. There are four different phases are observed namely: hydrate phase (H), vapour phase (V), liquid water phase (LW) and

condensed gas or liquid organics phases (Lv). As shown in this figure, the hydrate stability region is bounded by the H-LW-V and HLW-LV. As such, at any specified temperature, carbon dioxide hydrate will be stable as long as the pressure of the system is higher or

equal to the equilibrium pressure of the system. The upper quadruple point, Q2 (Fig. 1) at which hydrate, vapour, condensed carbon

dioxide and liquid water phases exist in equilibrium is measured at 283.0 K and 4.47 MPa. Carbon dioxide itself has a triple point at

T = 216.58 K and P = 0.5185 Mpa and a critical point at T = 304.2 K and P = 7.3858 MPa. In literature, the lowest measured

equilibrium pressure for carbon dioxide hydrate is at 0.535 kPa and 151.5 K for I-H-V equilibrium point and its value is reported by

Miller and Smythe (1970). INTERESTS ON CARBON DIOXIDE HYDRATE Like

other fields of research with a focus

on carbon dioxide, the interest of carbon dioxide hydrates is mainly based on the possibilities of

using the formation of carbon dioxide hydrates for carbon dioxide separation, capture and

storage (CCS). Any technique that prevents or reverses the release of carbon dioxide to the atmosphere and diverts the carbon

to a viable carbon sink can be considered carbon capture. Currently, there are a few techniques available for

carbon dioxide capture and separation with some degree of success such as chemical solvents, physical absorption,

physical adsorption, chemisorptions and chemical bonding through mineralization. However, the main concerns of

these techniques are the amount of chemicals to be used in these processes, the energy penalties

and the costs associated with these processes in their present form make these processes

becoming less attractive for large-scale carbon capture (GCEP) carbon capture technology

assessment, (Anonymous, 2005). The global climate and energy project (GCEP) lead by Stanford University is a major

on-going research project with a long-term aim of the development of global energy systems with significantly

lower greenhouse gas emissions In this retrospect, clathrate hydrate technique offers a couple of

advantages. Firstly, the main chemical required for carbon dioxide hydrate formation is water

which provides the process with abundant (cheap) and green raw chemical. Secondly, reduction

of energy requirements for hydrate formation can be obtained by including certain organic

chemicals in low concentrations, known as hydrate promoter in the hydrate forming system

(Mooijer-van den Heuvel, 2004). The inclusion of one of these hydrate promoters will reduce

the pressure requirement or increase the temperature at which the clathrate hydrates are stable.

This leads to a reduction in the energy required for pressurization or cooling the targeted

systems. Moreover, the interest in carbon dioxide hydrates is not limited to carbon capture and

sequestration. As mentioned earlier, a paradigm shift is required to look into carbon dioxide also as a material to be used in

industrial processes. The various areas of interest of carbon dioxide hydrates in accordance with their respective possibilities to be

developed as tools to overcome the ever increasing carbon dioxide concentration in the atmosphere are summarized in the following

sections. Marine

carbon dioxide sequestration: Due to the pressures and temperatures at ocean

depths which are suitable for carbon dioxide hydrates formation (Aya et al., 1997; Brewer et al., 1999);

sequestration of carbon dioxide as clathrate hydrates has been thoroughly investigated. Between

1000 and 2000 m (deep water), carbon dioxide in the liquid state diffuses and also dissolves in

the ocean (Liro et al., 1992). In addition, carbon dioxide hydrates can appear from 500 to 900 m

in CO2-rich seawater (Kojima et al., 2002). Due to their densities (Holder et al., 1995), these hydrate sink towards

the deep sea bottom where they stabilize in the long term (Lee et al., 2003; Harrison et al., 1995). Additionally, it

has been

proposed to replace the natural gas in naturally occurring hydrate fields by replacement with

carbon dioxide (Komai et al., 2000). In bulk, these carbon dioxide hydrates can be transported

as slurries in pipelines or in pressurized and chilled vessels from the points of carbon dioxide

captured to the points of carbon dioxide sequestrated. Currently, marine carbon dioxide sequestration is

presently at an experimental stage implying that on-going research activities on carbon dioxide solubility (Aya et al., 1997; Yang et

al., 2000); carbon dioxide hydrate formation and dissociation kinetics (Englezos, 1992; Circone et al., 2003); carbon dioxide hydrate

stability (Harrison et al., 1995), hydrodynamics conditions (Yamasaki et al., 2000) and other related fields are required to ensure the

success of this sequestration method.

[renewables good]

Solvency

Carbon sequestration in the ocean can recover methane in hydrates – oceanic

dynamics mean no risk of leakage

Dornan et al. 7 (Peter Dornan, Saman Alavi, and T. K. Woo, Centre for Catalysis Research and

Innovation, Department of Chemistry, University of Ottawa, The Journal of Chemical Physics,

“Free energies of carbon dioxide sequestration and methane recovery in clathrate hydrates” //

AK)

As concern over global warming increases, there is considerable interest in the use of carbon

neutral fuels.1 How- ever, in the short term, “dirty” hydrocarbon based fossil fuels will remain

widely used to meet the world’s growing energy needs. As such, the capture and long term

storage of carbon dioxide from fossil fuels has emerged as a prominent strategy for reducing

anthropogenic release of this greenhouse gas. For example, Japan has recently set a target of storing 200 Mton of

CO2 annually �approximately one-sixth of its current carbon dioxide production� by the year 2020.2 Al- though a number of long

term storage strategies have been proposed as far back as the 1970’s,3 the technology to safely store CO2 in such vast quantities has

not been fully developed. Currently, the

leading approach involves injecting CO2 into spent natural gas

reservoirs deep underground.4 There is, however, a concern that this CO2 storage approach may be vulnerable to leakage

resulting from large scale geological perturbations such as earthquakes or fractures.5 Under the temperature and

pressure conditions of terrestrial gas wells, CO2 is more buoyant than the other pore fluids, and

therefore may escape back to the surface if there is a leak. Recently, the injection of carbon

dioxide in porous sediments at a depth of several hundred meters below the deep ocean floor

has been proposed as an alternative long term sequestration option that would be resistant to

geophysical perturbations. At a depth of about 2600 m in the ocean, CO2 becomes denser

than the surrounding seawater and is considered to be gravitationally stable. Furthermore,

depositing the CO2 under hundreds of meters of sediment prevents the transport of the carbon

dioxide back to the surface. This is in part due to the formation of a CO2 clathrate hydrate

capping layer that reduces the migration. In the ocean, temperature decreases at greater depths, but in sediments

below the seafloor, the geothermal gradient results in a rise in temperature upon further descent, causing the density of CO2���

in sediments to decrease at a quicker rate than the pore liq- uid. For example, where the seafloor depth is 3500 m, CO2��� is

denser than seawater, but at a depth of about 200 m into the seafloor sediment, the pore seawater once again becomes denser than

CO2���. This indicates that there is a significant region in the sediment, called the negative buoyancy zone �NBZ�,6 where the

density of liquid CO is 2 greater than pore sea water. The

negative buoyancy zone, where CO2��� is

gravitationally stable, overlaps significantly with the hydrate formation zone �HFZ� where

CO2 clathrate hydrate formation can occur. The clathrate hydrate layers formed at the HFZ as a

result of the contact of CO2 with the pore seawater coupled with the gravitational stability of

CO2 in the NBZ will form a cap6 which prevents CO2 from seep- ing up through the pore fluid

and into the ocean even with the occurrence of geophysical perturbations. Initial estimates

suggest that this storage strategy should be safe for millions of years.6 Determining the stability of the

clathrate phases at the NBZ will help us understand the properties of the cap mate- rial for CO2 storage in the deep ocean sediments.

Under subseafloor pressures, CO2 clathrate hydrates are likely to be structure I �sI� or structure II �sII� clathrates, whereas,

pure CH4 clathrate reserves are sI, since pure methane is a poor sII former.8 Figure 1 shows a sI CO2 / CH4 mixed clathrate.

Structures I and II clathrates have two types of cages in their unit cell. A sI unit cell has two “small” cages with 12 pen- tagonal faces

�512�, and six “large” cages with 12 pentagonal faces and two hexagonal faces �51262�. A sII unit cell has sixteen small cages of

type �512�, and eight large cages of type �51264�. For more details on clathrate structures, see some reviews.9 In

addition

to forming a capping layer to impede the migration of CO2, clathrates may play additional roles

in deep ocean carbon dioxide sequestration. Vast amounts of methane clathrates are known to

exist below the ocean floor and replacement of methane with carbon dioxide has been put