2015 Compensation Information - West Ohio Conference of the

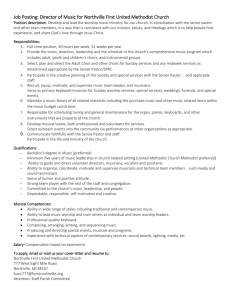

advertisement

Capitol Area South District 2014 Charge Conference Form 2014 Charge Conference Form The enclosed document is to be completed, presented, voted on and signed at your 2014 church or charge conference. Complete this copy manually, or Go online to the Resources link on the homepage of the Capitol Area South website (www.capitolareasouth.org) where you’ll find an online version which can be completed electronically, printed out and signed. Take completed, printed form to your church or charge conference for voting and required signatures. This form may also serve as your church or charge conference minutes. Keep one copy for your church records and return the completed signed original to your district office. What is the difference between a charge conference and church conference? The Book of Discipline of The United Methodist Church requires that each local church hold a church or charge conference annually. This annual conference directs the work of the church, gives general oversight to the church council and reviews and evaluates the mission and ministry of the church, in addition to other tasks (as appropriate), such as setting salaries for pastors, electing church officers, and recommending candidates for ministry. 1. The charge conference is the basic governing body of each United Methodist local church and is composed of all members of the church council (or administrative board or leadership team). 2. A church conference invites broader participation of the members of the congregation beyond just the church council members in that all members of a local United Methodist church are invited to attend and are extended the privilege of vote. All members of the charge or church conference must be members of the local church. Please note: The symbol “¶” refers to the relevant paragraph in the 2012 Book of Discipline. Capitol Area South District 2014 Charge Conference Form Basic information: Church Name: Charge Name: District: Capitol Area South GCFA Number: Employer Identification Number (EIN): County: Location: Mailing Address: Church Phone: Church Fax: Church Email: Church Website URL: Pastor(s) under Bishop’s Appointment: Pastor(s) under District Superintendent Assignment: Procedural information: Date of Conference*: / / Which did you hold? (see page 1 for difference between a church and charge conference) Charge Conference Church Conference Location of Conference: Presiding Elder: ¶ 246-250 The term “Conference” used in this document will refer to either your charge or church conference. Capitol Area South District 2014 Charge Conference Form Worship & Sunday School List Sunday School times: List Worship Service times: Do you change your Worship or Sunday School times during the summer? __Yes _No If so, Sunday School Times (summer): If so, Worship times (summer): Do you have a Saturday or mid-week worship service(s)? Yes No If yes, what day(s) and time(s): Trustees report* (¶2533.4 and ¶2550) The Charge Conference has received the 2014 Board of Trustees Annual Legal & Property Report: YES NO The Charge Conference has received the 2014 Parsonage Inspection Form: YES NO Church does not own a parsonage . * Both a completed Trustees Legal & Property Report and Parsonage Inspection Form should be filed with the district office annually. Capitol Area South District Ministry recommendations: (Must be recommended from church where membership is held) Recommendations to the District Committee on Ordained Ministry: CANDIDATE(s) FOR CERTIFICATION (¶ 311.2) Name(s): CANDIDATE(s) FOR RENEWAL OR CONTINUATION OF CANDIDACY (¶ 247.9, 312) Name(s): CANDIDATE(s) FOR CHURCH-RELATED VOCATIONS (¶ 247.10) Name(s): Recommendations to the District Committee on Lay Servant Ministries: LOCAL CHURCH LAY SERVANT – FIRST TIME (¶ 247.11 & 266-269). Name(s): LOCAL CHURCH LAY SERVANT – RENEWAL(S) (¶ 267.3) Name (s): CERTIFIED LAY SERVANT – INITIAL CERTIFICATION (¶ 247.11 & 266-269) Name(s): CERTIFIED LAY SERVANT RENEWALS: (¶ 268.3b) Name(s): LAY SPEAKER – INITIAL CERTIFICATION (¶ 247.11 & 266-269) Name(s): LAY SPEAKER RENEWALS: (¶ 268.3b) Name(s): LOCAL OR CERTIFIED LAY SERVANTS or LAY SPEAKERS REMOVED: Name(s): Recommendations to the District Superintendent: CERTIFIED LAY MINISTER (www.westohioumc.org/CLM) Name(s): 2014 Charge Conference Form Capitol Area South District 2014 Charge Conference Form Lay Leadership Nominations for 2015 Church Officers (All church officers must be members of the local church) Office (as applicable) Name 1. Ad Board/Council/Leadership Team Chair 2. Finance Chair 3. Lay Leader 4. Lay Member to Annual Conference 5. Lay Member Alternate to Annual Conference 6. SP/PPRC Chair 7. Treasurer 8. Trustees Chair Other offices to be VOTED on Name 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. Please make sure ALL of these names are listed on the next page with correct contact information. Capitol Area South District 2014 Charge Conference Form Lay Leadership Nominations for 2015 Church Officers This information is used to notify your church leadership of upcoming trainings and events, and other correspondence from the District. All correspondence is sent via email, so it is imperative to include email addresses! Administrative Board/Council Chairperson Name Address:________________________________________ City:__________________________ Zip:_____________ Cell Phone:_____________________________________ Home Phone:____________________________________ Work Phone:____________________________________ Email:__________________________________________ Finance Chairperson:_Name________________________ Address:________________________________________ City:___________________________ Zip:____________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ Lay Leader:_Name________________________________ Address:________________________________________ City:___________________________ Zip:____________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ Lay Member to Annual Conference: Name_________________________________________ Address:_______________________________________ City:__________________________ Zip:____________ Cell Phone:______________________________________ Home Phone:____________________________________ Email:__________________________________________ Trustee Chairperson: _Name________________________ Address:________________________________________ City:_________________________ Zip:______________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ UMM President:_Name____________________________ Address:_________________________________________ City:_____________________________ Zip:___________ Cell Phone:______________________________________ Home Phone:____________________________________ Email:__________________________________________ UMW President:_Name____________________________ Address:_________________________________________ City:____________________________ Zip:____________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ Also include contact information for additional lay members from your charge to Annual Conference if you have more than one. Please attach additional contact information for other lay leadership or staff (secretary, administrative assistant, office manager, etc.) who need to receive information from the District. Mission/Outreach Chairperson: Name ___________ Address:________________________________________ City:____________________________ Zip:____________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ Other Position:___________________________________ Name:___________________________________________ Address:_________________________________________ City:______________________________ Zip:__________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ SPRC Chairperson:_Name___________________________ Address:________________________________________ City:__________________________ Zip:_____________ Cell Phone:_____________________________________ Home Phone:____________________________________ Work Phone:____________________________________ Email:__________________________________________ Other Position:___________________________________ Name:___________________________________________ Address:_________________________________________ City:______________________________ Zip:__________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ Treasurer: _Name________________________________ Billing Address:___________________________________ City:__________________________ Zip :_____________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ Other Position:___________________________________ Name:___________________________________________ Address:_________________________________________ City:______________________________ Zip:__________ Cell Phone:_____________________________________ Home Phone:____________________________________ Email:__________________________________________ Capitol Area South District 2014 Charge Conference Form Membership Report (¶ 230.2) Please list those members to be removed by charge conference action. (You may attach a list if you prefer) Names 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Capitol Area South District 2014 Charge Conference Form 2015 Compensation Packet The following documents pertain to Compensation, Health Insurance, Housing Exclusion and Accountable Reimbursement for the calendar year 2015, and must be completed and kept on file in your church office. Included forms and information: 2015 Compensation & Health Insurance Information 2015 Accountable Reimbursement Resolution for 2015 Parsonage or Housing Allowance Exclusion Need more information? Visit the West Ohio Conference website and click on the Charge Conference link on the homepage or for questions, please contact the West Ohio Conference Treasurer’s Office: Beth Gibbs, Benefits Officer, bgibbs@wocumc.org, ext 226 Sandi George, Healthcare Coordinator, sgeorge@wocumc.org, ext 312 Bill Brownson, Treasurer, bbrownson@wocumc.org, ext 221 Capitol Area South District 2014 Charge Conference Form 2015 Compensation Information Minimum Salaries (as approved by the 2014 Session of the West Ohio Annual Conference) Full member (elder/deacon) Full-time appointment ...................................................................................... $38,900 Three-quarter time appointment ..................................................................... $29,175 Halftime appointment ...................................................................................... $19,450 Quarter time appointment ................................................................................$ 9,725 Provisional member (elder/deacon), associate member Full-time appointment ...................................................................................... $35,300 Three-quarter time appointment ..................................................................... $26,475 Halftime appointment ...................................................................................... $17,650 Quarter time appointment ................................................................................$ 8,825 Licensed local pastor (upon completion of Course of Study or equivalent) Full-time appointment ...................................................................................... $34,000 Licensed local pastor Full-time appointment ...................................................................................... $32,200 Health insurance rates Rates for 2015 will be available in early Fall 2014 – information will be mailed to the district offices and churches, as well as posted on the conference website at www.westohioumc.org/healthinsurance, at that time. Additional information Denominational Average Compensation (DAC) for 2015 = $66,259 Conference Average Compensation (CAC) for 2015 = $59,647 2014 IRS Business Mileage Rate is $0.56/mile 2014 IRS Charitable Mileage Rate is $0.14/mile 2015 Compensation Information Capitol Area South District 2014 Charge Conference Form 2015 Accountable Reimbursement Policy The following resolution was duly adopted by the Administrative Board/Church Council/Leadership Team (or Charge Conference) of the at a meeting held on United Methodist Church , 2014. Under Internal Revenue Code Section 62(a)(2)(A) gross income does not include reimbursed business expenses or adequately accounted business expense allowances for employees. Internal Revenue Service Regulation 1.162-17(b) provides that an employee need not report on his tax return expenses paid or incurred by him solely for the benefit of his employer for which he is required to account and does account to his employer and which are charged directly or indirectly to the employer. Further, I.R.S. Regulation 1.274-5(e)(4) provides that an adequate accounting means the submission to the employer of an account book, diary, statement of expense, or similar record maintained by the employee in which the information (as to each element of expenditure amount, time and place, business purpose, and business relationship) is recorded at or near the time of the expenditure, together with supporting documentary evidence, in a manner that conforms to all the adequate records requirements as set forth in the regulations. Therefore, the United Methodist Church hereby establishes an accountable reimbursement policy pursuant to I.R.S. Regulations upon the following terms and conditions: 1. Expenses deemed ordinary and necessary shall be made solely for the benefit of the church and shall be paid directly, whenever possible by the United Methodist Church, or indirectly and reimbursed to the person or entity who does pay the expense. Ordinary expenses include, but are not limited to: automobiles, office supplies, postage, computer supplies, books, subscriptions, professional dues, vestments, continuing education, lodging and meals while traveling and entertainment related to church business. 2. The church must be given an adequate accounting of the expense, which means that there shall be submitted a statement of expense, account book diary, or other similar record showing the amount, date, place, business purpose, and business relationship involved. Appropriate documents, cash receipts, canceled checks, credit card sales slips, and contemporaneous records for those non-receipt expenses less than $25.00 must be attached to a monthly expense report. Both the minister/staff person and the church shall retain copies of the documentary evidence and expense report. Voucher information need not include data that would violate pastoral confidences. 3. Reimbursements or advances must be paid out of budgeted church funds and not by reducing the compensation of a minister/staff person. Budgeted amounts not spent must not be paid as a salary bonus or other personal compensation in any fiscal year. If such payments are made, the entire amount of the accountable reimbursement policy account will be taxable income to the pastor/staff person. Capitol Area South District 2014 Charge Conference Form 4. The church may pay amounts in advance of the minister/staff person’s actual expenditure on either an as needed basis or by standard monthly expense allowance. However, an adequate accounting of the advances by expense report must be made in the month following expenditure. Any excess advance must be returned to the church before additional needed or allowance amounts are provided to the minister/staff person. 5. It is understood by the various parties that all elements of this resolution must be carefully followed to prevent the church salary-paying unit from being required by regulation to list total payments for the following items on I.R.S. W-2 as includable compensation. The primary responsibility of expense reporting is the minister/staff person to the church payroll person. 6. The Staff/Parish or Pastor/Parish Relations Committee (SP/SPRC) is responsible for approving vouchers submitted by the pastor. The local church treasurer is responsible for paying approved vouchers. 7. By previous or concurrent resolution, duly adopted by the Administrative Board/Church Council/Leadership Team (or Charge Conference) of the Methodist Church at a meeting held on United , 2014, the following ordinary and necessary expenses as suggested for the employment needs of the minister/staff person, are included in this accountable reimbursement policy from January 1, 2015 to December 31, 2015. 2015 Accountable Reimbursement Total* Attested to this day, $ , 2014, the foregoing resolution is hereby accepted. REQUIRED SIGNATURES: Chair, Administrative Board/Church Council/Leadership Team Treasurer, Church or Charge Pastor *2015 Accountable Reimbursement – Enter total on line 3b on the 2015 Compensation Report Distribution: 1 copy to each of the following: Pastor, Recording Secretary, District Office Capitol Area South District 2014 Charge Conference Form Instructions: Resolution for 2015 Parsonage or Housing Allowance Exclusion What is the purpose of this form? The Internal Revenue Code Section 107 has a provision that allows ministers of the Gospel to exclude from their reportable income some costs of living in a parsonage or their own home. The church uses the Parsonage or Housing Allowance Exclusion form. Does this cost the church anything? No. The pastor’s salary is not increased or decreased as a result of the resolution. It merely designates a portion of the pastor’s salary as being excluded from the amount of compensation the church reports to the IRS on the pastor’s W-2. When should this form be filled out? At least annually and whenever there is a change in pastors. It must be done before the pastor incurs the expenses. The exclusion cannot be made retroactive. How much should the exclusion be? The pastor establishes the amount in consultation with the Pastor/Parish Relations Committee. For a church-owned parsonage, the amount should not exceed the fair rental value of the parsonage or house. A rule of thumb for the annual fair rental value” is to take 5% - 8% of the market value of the parsonage or house. If a housing allowance is paid to the pastor, the exclusion should include the amount of the allowance as well as other anticipated expenses. What is included in the exclusion? Any expenses the pastor may incur in living in the parsonage or home. The following is a partial listing and not meant to be inclusive of all items that may be excluded. 1. Rent or principal payments, cost of buying a home, and down payments, if paid by the pastor. 2. Real estate taxes and mortgage interest for the home, if paid by the pastor. 3. Insurance on a home, if paid by the pastor. 4. Improvements, repairs, upkeep of the home and/or contents. New roof, room addition, carpet, garage, etc. 5. Furnishings and appliances: dish washer, vacuum sweeper, TV, VCR, DVD, piano, computer for personal use, washer, dryer, sewing machine, cookware, dishes etc. 6. Decorator items: drapes, throw rugs, pictures, knickknacks, painting, wallpapering, bedspreads, sheets, etc. 7. Utilities: heat, electric, cable TV, etc. (ONLY IF PAID BY THE PASTOR) 8. Misc: anything that maintains the home and its contents that you have not included in repairs or decorator items: cleaning supplies for the home, brooms, light bulbs, lawnmower maintenance, landscaping tools etc. DO NOT INCLUDE THE FOLLOWING: Maid (or any labor hired for maintenance such a lawn care), groceries, personal toiletries, CD’s etc. These may be excluded even if they become the pastor’s personal property, as long as they are paid from money received as salary. Major appliances such as refrigerators and ranges purchased with church funds may not be excluded. What if I have other questions? Speak with the District Superintendent or the Conference Treasurer’s office. Capitol Area South District 2014 Charge Conference Form Resolution for 2015 Parsonage or Housing Allowance Exclusion WHEREAS this church provides a parsonage or housing allowance as part of the compensation of our regularly appointed or assigned minister of the Gospel, and; WHEREAS the cost of providing the parsonage or housing allowance with utilities and/or furnishings may be excluded from gross income the Internal Revenue revised rule 599,359-51-52 and Section 107; THEREFORE BE IT RESOLVED that designate $ United Methodist Church will of the pastor’s salary as parsonage/housing allowance. This amount is to be excluded from the reported taxable income. This resolution is effective during calendar year for 2015. Approved at the Charge or Church Conference or Administrative Board, Church Council, or Leadership Team meeting on (date). Required Signatures: Date: Chair, Administrative Board/Church Council/Leadership Team Please Print Name I accept full responsibility for maintaining and keeping available for any requirements of the Internal Revenue Service all supporting leases, mortgages, tax bills, utility bills, repair or maintenance bills and any other documentation necessary to document that portion of the above estimate that I shall claim as actually expended for housing or furnishings. Pastor Please Print Name Date *2015 Housing/Parsonage Allowance Exclusion – Enter total on line 3a on the 2015 Compensation Report Distribution: 1 copy to each of the following: Pastor, Recording Secretary, District Office Capitol Area South District 2014 Charge Conference Form Compensation Report for 2015 Please copy this page and complete a separate compensation report for each pastor under Episcopal appointment or district superintendent assignment to this church. Signatures on the last page of this charge conference form confirm the information on THIS page is correct) Pastor Name: 1. COMPENSATION INFORMATION: Cash salary approved at your Church/Charge Conference a. Amount paid by this church $ b. Amount paid by Equitable Compensation $ c. Amount paid by District or Mission Society $ d. Cash Allowances paid to the Pastor and reported on W-2 $ Total Approved Cash Salary (add a+b+c+d) $ 2. HOUSING ARRANGEMENTS a. Does this pastor live in a parsonage provided by this church? Yes No b. Housing Allowance amount this church provides instead of a parsonage $ 3. ADDITIONAL PASTORAL SUPPORT a. Housing Exclusion Resolution* Amount Adopted by Church/Charge Conference (a signed exclusion resolution must be on file in the local church office) $ b. Accountable Reimbursement (a signed policy resolution must be on file in the local church office) $ 4. CLERGY BENEFITS a. Pastor is enrolled in the United Methodist Church pension program b. West Ohio Conference health insurance (please see page 8 of this form) __Yes No Yes No i. If yes, Pastor is enrolled in which type of health insurance plan: Single Family of Two Family of Three or More 5. 2014 COMPENSATION a. During 2014, has this pastor been paid in accordance with the compensation reported on the 2013 charge conference form? Yes _____ No If this compensation package is for an Associate Pastor, please have the associate sign below: Capitol Area South District 2014 Charge Conference Form Clergy Health Insurance: Each charge shall fund health insurance for its eligible pastor and family through the West Ohio Conference program. The following chart shows who shall be covered and who has responsibility for payment of premiums. Status Full Member Provisional Member Associate Member Fulltime Local Pastor Coverage Required Required Required Required Responsibility for Premium Payment Shared Cost Church/Participant Shared Cost Church/Participant Shared Cost Church/Participant Shared Cost Church/Participant Approved reasons for waiver/opt out of the West Ohio Conference health insurance program: Duplicate coverage through spouse’s employment Access to military coverage Prior employer insurance Note: Clergy opting out of the West Ohio Conference health insurance plan for any reason must do so in writing using the Waiver of Health Coverage below. Please contact the West Ohio Conference Benefits Office (614-8446200) for questions on completing the waiver below. Waiver of Health Coverage I acknowledge that I have been offered the opportunity to participate in health coverage offered through the West Ohio Conference for myself and my dependents. I decline enrollment at this time because I have other medical coverage provided by: Duplicate coverage through spouse’s employment Access to military coverage Prior employer insurance I waive the West Ohio Conference health insurance. Date: Pastor Signature Pastor Printed Name Please send this completed and signed form to: West Ohio Conference of The United Methodist Church Attn: Beth Gibbs 32 Wesley Boulevard Worthington, Ohio 43085 Capitol Area South District 2014 Charge Conference Form Charge Conference Signatures: (All signatures must be included and apply to all pages of this charge conference form, including attachments) Date: Local Church Lead Pastor Signature Local Church Lead Pastor Printed Name Date: Ad Board/Council/Leadership Team Chair Signature Ad Board/Council/Leadership Team Chair Printed Name Date: SP/PPRC Chair Signature (church or charge) SP/PPRC Chair Printed Name Date: Treasurer Signature (church or charge) Treasurer Printed Name Date: Charge Conference Presiding Elder Signature (if applicable) Charge Conference Presiding Elder Printed Name Date: District Superintendent Signature District Superintendent Printed Name Completed signature page is required.