mba elective outline: project and infrastructure finance

advertisement

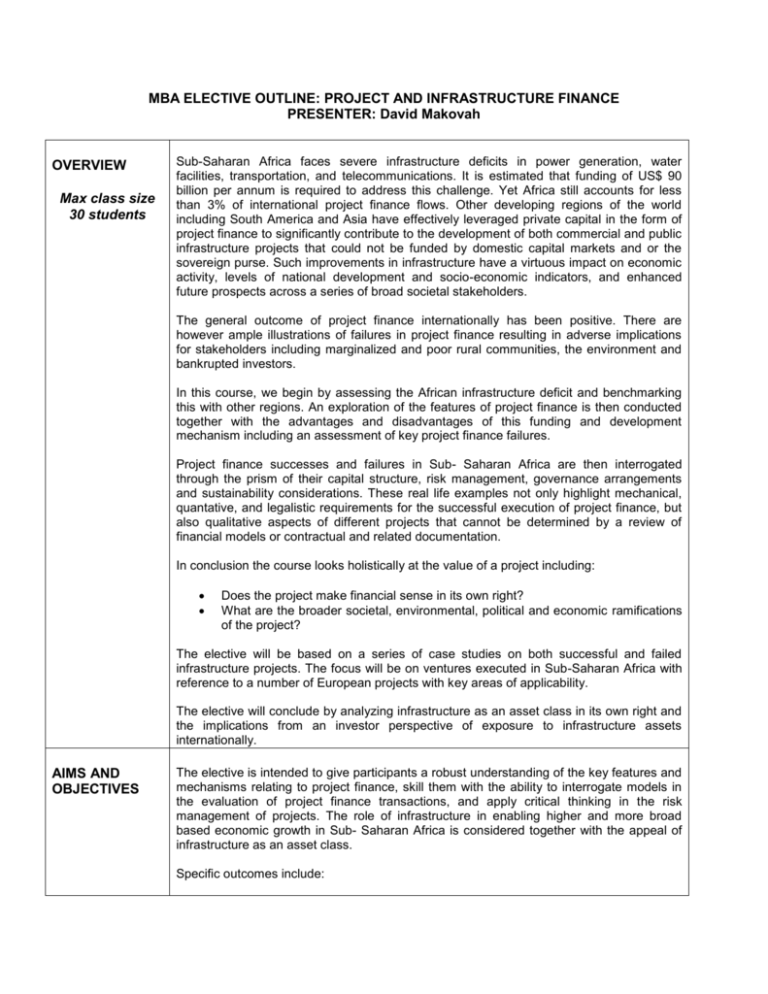

MBA ELECTIVE OUTLINE: PROJECT AND INFRASTRUCTURE FINANCE PRESENTER: David Makovah OVERVIEW Max class size 30 students Sub-Saharan Africa faces severe infrastructure deficits in power generation, water facilities, transportation, and telecommunications. It is estimated that funding of US$ 90 billion per annum is required to address this challenge. Yet Africa still accounts for less than 3% of international project finance flows. Other developing regions of the world including South America and Asia have effectively leveraged private capital in the form of project finance to significantly contribute to the development of both commercial and public infrastructure projects that could not be funded by domestic capital markets and or the sovereign purse. Such improvements in infrastructure have a virtuous impact on economic activity, levels of national development and socio-economic indicators, and enhanced future prospects across a series of broad societal stakeholders. The general outcome of project finance internationally has been positive. There are however ample illustrations of failures in project finance resulting in adverse implications for stakeholders including marginalized and poor rural communities, the environment and bankrupted investors. In this course, we begin by assessing the African infrastructure deficit and benchmarking this with other regions. An exploration of the features of project finance is then conducted together with the advantages and disadvantages of this funding and development mechanism including an assessment of key project finance failures. Project finance successes and failures in Sub- Saharan Africa are then interrogated through the prism of their capital structure, risk management, governance arrangements and sustainability considerations. These real life examples not only highlight mechanical, quantative, and legalistic requirements for the successful execution of project finance, but also qualitative aspects of different projects that cannot be determined by a review of financial models or contractual and related documentation. In conclusion the course looks holistically at the value of a project including: Does the project make financial sense in its own right? What are the broader societal, environmental, political and economic ramifications of the project? The elective will be based on a series of case studies on both successful and failed infrastructure projects. The focus will be on ventures executed in Sub-Saharan Africa with reference to a number of European projects with key areas of applicability. The elective will conclude by analyzing infrastructure as an asset class in its own right and the implications from an investor perspective of exposure to infrastructure assets internationally. AIMS AND OBJECTIVES The elective is intended to give participants a robust understanding of the key features and mechanisms relating to project finance, skill them with the ability to interrogate models in the evaluation of project finance transactions, and apply critical thinking in the risk management of projects. The role of infrastructure in enabling higher and more broad based economic growth in Sub- Saharan Africa is considered together with the appeal of infrastructure as an asset class. Specific outcomes include: FORMAT An analysis of the Africa infrastructure deficit (telecommunications, energy, water, transport) Defining project finance (capital structure, risk management, legal contracts and sustainability considerations) A comparison of project finance versus syndicated loans Advantages of project finance Disadvantages of project finance Sources of funding (DFIs, ECAs, Commercial lenders, Bonds) Public Private Partnerships Financial modelling project finance ventures Analysis of infrastructure as an asset class Project finance successes and failures (an African and global experience) The South African Renewable Energy Independent Power Producers Programme: A model for infrastructure development This course will be offered in a single 4 day block. The course will be case-based and interactive. Students will be expected to prepare the case studies prior to each session and will be encouraged to contribute to the discussion. The method of delivery places an emphasis of debate and discussion rather than formal lecturing. The sessions will include a range of activities. There will be several guest speakers from the project finance environment, who will discuss recent project finance transactions including the Seacom Undersea Cable and the Gautrain Rapid rail Link. For the financial modeling students will be expected to have a working knowledge of excel. The course will include a DVD summary of each key facilitated chapter for pre-reading and post contact reference. METHOD OF ASSESSMENT Class participation Case submissions (and case preparation) Syndicate assignment RESUME David Makovah is a consultant and adviser specialising in the areas of project and corporate finance. He is a founding member of Tactus Advisory Services and Zuko Capital, the latter housing the equity investments of the group. He is also the managing director of Advantica that facilitates the executive education arm of the company. David began his career serving articles at KPMG in Johannesburg. His client portfolio included leading multi-nationals such as Mercedes Benz, BMW, Siemens, and Daewoo. Subsequent to this he joined Nedbank focusing on risks in structured and trade finance. This included a secondment to Old Mutual Asset Management in London. David returned briefly to public practice at PWC in the Banking and Capital Markets division before setting up a boutique advisory. His research includes a doctorate in project finance transactions covering South Africa, Mozambique and Zimbabwe. By focusing on the capital structure, risk management, corporate governance and sustainability arrangements he devised a qualitative theory for the execution of project finance ventures in these three countries.