Parish Financial Manual: Chapter 12 – Revenue Recognition

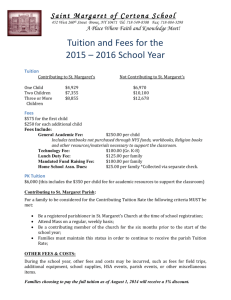

advertisement

Chapter 12 X Revenue Recognition Parishes and schools receive many types of revenue including parishioner contributions, rental and usage fees, capital contributions, tuition, registration fees and program fees. The purpose of this policy is to promote a consistent methodology for categorizing, recording and reporting parish and school revenues on financial statements. This chapter is closely related to Chapter 11– Net Assets/Equity and Chapter 14 – Expense Recognition. Please refer to these chapters for additional information. ACCOUNTING POLICY The Archdiocese of Saint Paul and Minneapolis has adopted the accrual method of accounting for recognition of parish and school revenue. The accrual method requires recording revenues as they are earned throughout the fiscal year. This timing does not necessarily correspond with the receipt of money or the timing of invoices. The Archdiocese of Saint Paul and Minneapolis has defined a standardized chart of general ledger accounts for use by all parishes and schools. Separate accounts are established for the wide variety of parish contribution revenues and fees discussed in this chapter. SCOPE Common Revenue Sources for Parishes and Schools Sunday Giving: Contributions received via weekly collections, envelope system and electronic giving. These are recognized as revenue to the parish/school when received. See journal entry example # 1 later in this chapter. Pledges/Intent to Pay: Pledges are not generally recorded as revenue until payment has been received. In these cases, it is not appropriate to record pledges as receivables on the Statement of Financial Position. Many parishes ask parishioners for an indication of their proposed giving for an upcoming year. If the request states that the pledge is for budget purposes only and/or that the pledge is not binding, this indicates intent to pay and is not binding. There are many different formats for this type of pledge form. Pledges/Promise to Pay: In certain cases, a pledge may be recorded before receipt of pledged money. Along with recognition of revenue on the Statement of Activities, a corresponding pledge receivable would be established on the Statement of Financial Position. This receivable would be disclosed until money is received to fulfill the pledge. In order for a pledge to be recorded as revenue and a contribution/pledge receivable established, there must be sufficient evidence in the form of verifiable documentation. This type of pledge must be supported by a donor’s written promise to pay. See example of Promise to Pay Pledge Form located near the end of this chapter. CHAPTER 12 – REVENUE RECOGNITION PAGE 1 OF 13 If the Pledge/Promise to Pay is over multiple years, the reporting process is much more complex and involves determining both current and long term receivable amounts. These pledges might need to be discounted; additionally a reserve for uncollectible pledges should be recorded. We advise the parish/school to seek the advice of an accounting professional for proper recognition of multi-year Pledge/Promise to Pay. Pass Through Donations: Parishes/Schools regularly receive contributions to be remitted to other nonprofit organizations. These donations are typically received via special collections. Examples include World Mission Sunday, Holy Land collection, and Religious Retirement Fund. These contributions are recorded in an accrued liability account on the Statement of Financial Position until remitted. They are not recognized as revenue in the accounting records. The parish/school is acting as an agent between the donor and the other non-profit organization and will receive no financial benefit from the transaction. Donor Imposed Restrictions: Some contributions may be made by a donor with specific restrictions. Most restrictions are temporary in nature limiting the parish/school’s use of the contribution to a later period or after a specific date (time restriction), a specific purpose (purpose restriction) or may include both types of restrictions. In most cases a contribution made with donor imposed restrictions will be recognized as revenue in the period received. The contribution should be recognized as revenue on the Statement of Activities at the time of receipt. With regard to the Statement of Financial Position, contributions will be classified as temporarily (or possibly Permanently) Restricted Net Assets until the restriction is satisfied. Examples include capital campaign contributions and school scholarship fund contributions given in one year but to be used in the following fiscal or school year. Any unfulfilled restrictions should be reviewed by the pastor, trustees and finance council on a regular basis, at a minimum on an annual basis. For additional information, see also Chapter 11, Net Assets/Equity and journal entry example #4 later in this chapter. Donor Imposed Conditions: If a donor makes a contribution but imposes conditions that allow the donor to maintain control over the contribution, revenue will not be recognized until the conditions have been met. For example, if a donor gives a parish/school a contribution for a statue and tells the parish/school that they would like their money returned if the statue is not purchased, the contribution would not be recognized until the statue is purchased. Another example is when a donor makes a contribution to be used to match other contributions given for a specific purpose. The contribution would not be recognized as revenue until other contributions are received that satisfy the donor condition. Parish/Board Designated Contributions (Unrestricted Designated): If a parish/school solicits contributions for use within a particular project or program but leaves the exact use of funds to the discretion of the pastor, the contributions to the project or program are considered Unrestricted Designated. For example, the parish/school may have an outreach ministry to help parishioners or others that are in need of financial assistance for rent, transportation, groceries and other living expenses. Contributions are made for this ministry but the pastor or his designees decide exactly how to use the funds. Revenue would be recognized at the time of receipt of the contribution. With regard to the Statement of Financial Position, contributions will be classified as Unrestricted Net Assets-Board Designated until the funds are used. Any balances remaining in these accounts should be reviewed by the pastor, trustees and finance council on a regular basis, at a minimum on an annual basis. In the event the donation initiates a capital purchase or capital project, an asset may need to be capitalized. See CHAPTER 12 – REVENUE RECOGNITION PAGE 2 OF 13 Chapter 8, Fixed Assets, for Capitalization Policy. For additional information, see Chapter 11, Net Assets/Equity and journal entry example # 5 later in this chapter. Rental Revenue: Rental revenue includes fees received from an ongoing lease arrangement or from single events. Examples include rental of a parish/school building to a charter school, cell tower leases and rental of parish/school facility spaces for receptions and community programs. If a parish/school receives any refundable deposit, it should be recorded as an accrued liability on the Statement of Financial Position until the event or lease is completed and all conditions for returning the deposit have been met. If the deposit is fully refunded, the deposit liability account is reduced. If a parish/school retains a deposit, it is recognized as revenue at that time of retention and removed from the liability account. Rental revenue from a lease arrangement should be recorded according to the terms of the lease. However, generally accepted accounting principles require that rent revenue be recognized on a straight line basis over the term of the lease. If the lease includes rent increases over the lease term, please seek advice on the proper accounting treatment. In many cases the parish may need to send a rental invoice to the tenant. In order to track the outstanding amount due from the tenant a deferred revenue liability and an accounts receivable asset can be recorded on the Statement of Financial Position. Revenue is recognized monthly and deferred revenue is reduced. When the rent payment is received from the tenant, the accounts receivable balance will be reduced. In addition to rental revenue, the lease arrangement may also outline payments to the parish/school for a pro-rate portion of operating expense. The parish/school may charge tenants for a pro-rata portion of custodial and maintenance services, utility charges, facility repair work, trash removal, lawn care and other facility expenses. These amounts are determined according to the lease terms and are generally measured as a percentage of the expenses, based on the tenants’ percentage of the total usable square footage, less the square footage of common space in the building. Amounts billed to the tenant should be recorded as revenue, not netted against expenses. If a rental invoice is sent, this amount would be recorded as revenue and a part of the accounts receivable. The accounts receivable balance will be reduced when the rental payment is received. See also journal entry example # 6 later in this chapter. Tuition: Tuition is an amount received for various parish/school programs that are ongoing rather than onetime events. Examples include payments for school, preschool and faith formation. Through disclosure of the components of net tuition, the Statement of Activities will show the difference between gross/stated tuition and net/collected tuition in accordance with the Archdiocesan chart of accounts. Schools shall use contra accounts to track and disclose all tuition revenue components applicable to their particular operations. Examples of contra tuition revenue accounts include tuition discounts such as multiple child, early payment and employee discounts. Financial aid and scholarship expenses are also recorded as contra revenue accounts. Annual school tuition revenue deferrals shall be calculated and recorded as deferred revenue as of September 1st of each fiscal year. The offset for the deferred revenue liability balance is the tuition/accounts receivable asset. Monthly Tuition Revenue shall be recognized throughout the school year in increments of 1/9 per month from September through May. See also journal entry example # 2 later in this chapter. CHAPTER 12 – REVENUE RECOGNITION PAGE 3 OF 13 Tuition received during one fiscal year for the following fiscal year’s school activity shall be recorded as deferred revenue on the parish/school books and recognized as income during the fiscal year to which it applies. Tuition prepayments are to be included within total deferred tuition, which will be recognized evenly as revenue during the next school year. Preschool tuition income may be recorded as revenue as received or on the accrual method depending on the contract terms for the preschool program. At year-end, unpaid preschool tuition should be recorded as a tuition/accounts receivable asset. If applicable, an appropriate amount should be recorded as an allowance for uncollectible tuition. Faith Formation tuition revenue should be deferred to the proper year for revenue recognition, but does not need to be recognized evenly throughout the months of the program year. At year end, unpaid faith formation tuition revenue should be recorded as a tuition/accounts receivable asset. If applicable, an appropriate amount should also be recorded as an allowance for uncollectible tuition. Fees: Fees are received for one-time and seasonal events, as well as for participation in certain programs. Examples include school hot lunch programs, athletic fees for various sports, mission trips fees, sacrament preparation fees and extended day fees. Registration fees for both school and parish activities received during one fiscal year for the following fiscal year’s activities shall be recorded as deferred revenue on the parish/school books and recognized as income during the fiscal year to which they apply. School registration fees shall be recognized on September 1st of each fiscal year. School Program fees shall be recognized as income when they are received provided the funds will be used during the same fiscal year. Any leftover funds at fiscal year-end shall be recorded as liabilities or refunded. An example of this activity is hot lunch program income. See also journal entry example # 3 later in this chapter. Donor Contributions According to IRS tax regulations, a donor must have a bank record or written communication from a charity for any monetary contribution before the donor can claim a charitable contribution deduction on his/her federal income tax return. In order to deduct a single contribution of $250 or more, an individual or corporation is required to obtain a written acknowledgement that recognizes the receipt of the contribution, the amount or description of the property contributed and a statement whether the donor received any goods or services in exchange for the contribution. In order to assist the donors in meeting this requirement, parishes/schools are advised to acknowledge any individual gifts over $250. An annual contribution statement that includes all donor contributions for the year satisfies the minimum IRS requirement. Please refer to IRS Publication 1771. Donations need to be postmarked or physically received by December 31st in order to be recorded as a contribution for any particular calendar year. For donations received close to the calendar year-end cutoff date, parishes/schools are advised to retain postmarked envelopes for a period of three years for audit purposes. As a good business practice, parishes and schools should provide written acknowledgement of donor contributions. It is recommended to send all parishioners and donors contribution statements that disclose stewardship, capital contributions and other similar gifts donated throughout the calendar year. Other forms and letters should be CHAPTER 12 – REVENUE RECOGNITION PAGE 4 OF 13 used throughout the year for donations such as stock gifts and auction activity. As a courtesy to the donors, written acknowledgements of all donations for a particular calendar year should be postmarked no later than January 31st of the year following the donation. The following items are deductible and should be acknowledged in writing: ● ● ● ● ● ● ● ● Capital Campaign Donations – Include this type of giving on the donor contribution statement. Fundraising Donations – As long as no goods or services are received in exchange for these donations, the donations are fully deductible and should be disclosed on the donor contribution statement or in a separate acknowledgment letter. Examples include school marathon and mission trip sponsorship gifts. If a good or service is received, the value above the good or service is deductible and should be determined by the donor. Stock Donations – Parishes/Schools should recognize receipt of stock donations by issuing a written acknowledgement to the donor. This document should include the donor name, address, description of the stock, number of shares donated and the date of donation. If the parish/school can obtain the high/low value of the stock on the donation date, this information may also be included. The parish/school should provide this information not as a calculation of market value, but as a courtesy to the donor. It is also a good practice to include a disclaimer on the receipt that directs the donor to seek professional tax guidance for market value determination. Parishes should remind donors they may need to file IRS forms to claim the gift as a deduction. Stock donations being applied against an outstanding pledge may be handled in a variety of ways depending on the software being used by the parish and its specific functionality. Please consult with your software application specialist for instructions. Auction items donated – Items donated for the parish or schools to auction are deductible by the donor in the amount of the donor’s tax basis in the contributed item. The parish or school should acknowledge the item received, but should not assign a value to the item. Similar to monetary donations, the parish or school should indicate the value, if any, of goods or services received in exchange for the donation on the receipt. It is the donor’s responsibility to document the value for income tax purposes. Auction item information is not typically included on the annual donor giving statements. Auction Purchases – Auction purchases are deductible only to the extent that the payment made exceeds the value of the benefit received. Written documentation regarding the payment amount and value of the item purchased may be given to the donor at the time of auction or at a later date. Auction Event Monetary Donations – Donations received during an auction event which are unrelated to items being auctioned are fully deductible by the donor and should be disclosed on a separate receipt or included on the annual donor contribution statement. Pass Through Donation – Include this type of giving on the donor contribution statement unless the donation is going directly to an outside organization and that organization will be issuing a receipt. Quid Pro Quo Contributions – Contributions received that are partly for goods and services provided by the organization and partly tax deductible are known as Quid Pro Quo contributions. An example would be a fund raising dinner where the cost per plate is $100 and the value of the meal provided is $50, only the amount over the value of the goods or services provided is tax deductible by the donor. Parishes/schools are required by the Internal Revenue Service to provide a written disclosure statement which informs the donor that the portion of the contribution that is deductible for federal income tax CHAPTER 12 – REVENUE RECOGNITION PAGE 5 OF 13 ● purposes is limited to the excess of money contributed over the value of the goods or services provided. The parish/school must also provide the donor with a good-faith estimate of the fair market value of the goods or services. Catholic Service Appeal Contributions are deductible. Note that the Office of Stewardship and Development sends out their own donor acknowledgements. CSA donations should NOT be included on the donor contribution statement. The following are NOT deductible and if shown on the contribution statement should be noted as non-deductible for tax purposes: ● ● ● ● ● Mass Stipends Stole Fees Raffle Tickets Auction Items. The portion of the contribution that is less than the value of the benefit received is NOT deductible. Tuition Volunteer Time: Volunteers often offer their time, knowledge, skills and expertise to parishes/schools for no charge. Although the IRS may allow some donors to deduct certain expenses related to providing volunteer services, the volunteer services themselves are not typically tax deductible. Generally Accepted Accounting Principles (GAAP) does provide guidance to organizations for recording volunteer time in their financial records. Contributed services shall be recognized as income and expense only to the extent that the contributed services possess either one of the following characteristics. 1. The service creates or enhances a non-financial asset (e.g. land, buildings, intangible assets, etc.). 2. The service requires a specialized skill, it is provided by an individual possessing that skill, and the service is one that would typically need to be purchased if it had not been voluntarily contributed to the organization. For non-GAAP volunteer services the parish/school may record the service hours served for time and talent and grant matching purposes only. CHAPTER 12 – REVENUE RECOGNITION PAGE 6 OF 13 DEFINITIONS Accounts Receivable/Tuition Receivable: Money owed by individuals or corporations to another entity in exchange for goods or services that have been delivered or used, but not yet paid for. Receivables are usually due within a relatively short time period, ranging from a few days to one year. Accounts receivable is considered an asset because it represents a legal obligation to be paid by another entity to a parish/school. Accrual Method of Accounting: Method of accounting that recognizes revenue when earned, rather than when collected. Expenses are recognized when incurred rather than when paid. Accrued Liability: An entity’s legal debts or obligations that arise during the course of business operations. Liabilities are settled over time through the transfer of economic benefits including money, goods or services. Liabilities are recorded on the Statement of Financial Position (Balance Sheet) and include loans, accounts payable, mortgages, deferred revenues and accrued expenses. Asset: A resource with economic value that an entity owns or controls with the expectation that it will provide future benefit. Balance Sheet: See Statement of Financial Position. Cash Basis Method of Accounting: Method of bookkeeping by which revenues and expenditures are recorded when they are received and paid. The accrual basis of accounting is the accounting method adopted for entities within the Archdiocese. Contra Account: An account on an entity's financial statement that offsets the balance of a related and corresponding account. A contra account is generally established to reduce an account to amounts that can be realized or collected. Deferred Revenue: Advance payments or unearned revenue, recorded on the recipient's Statement of Financial Position (Balance Sheet) as an accrued liability, until services have been rendered. Deferred revenue is a liability because it refers to revenue that has not yet been earned. Deferred revenue liabilities represent products or services that are owed to the customer. As products or services are delivered over time, they are recognized as revenue on the Statement of Activities (Income Statement). Gross Tuition: Gross tuition is calculated by multiplying stated tuition, the highest published rate of tuition, by enrollment. Income Statement: See Statement of Activities. Net/Collected Tuition: Discounts such as parishioner, multiple children or early payment, financial aid and scholarship expenses that are subtracted from gross tuition. Parish: Parish operations and all activities operating under the parish umbrella including but not limited to parish ministries, departments, Men’s and Women’s Clubs, Card Club, Rosary Makers, Outreach and other activities. Permanently Restricted Net Asset: An asset with a permanent donor imposed restriction such as an endowment fund. CHAPTER 12 – REVENUE RECOGNITION PAGE 7 OF 13 School: School operations and all activities operating under the school umbrella including but not limited to Extended Day, Athletics, Theater Program and Art Programs. Stated Tuition: Highest published rate of tuition before consideration of any discounts, scholarship awards or financial aid deductions. Statement of Activities (Income Statement): A financial statement that measures an entity’s financial performance over a specific accounting period. Financial performance is assessed by giving a summary of how an entity incurs its revenues and expenses. It also shows the net surplus or deficit incurred over a specific accounting period, typically over a fiscal month, quarter or year. Statement of Financial Position (Balance Sheet): A financial statement that summarizes an entity’s assets, liabilities and equity (net assets) at a specific point in time. These three balance sheet segments give readers an idea as to what the entity owns and owes. The balance sheet follows the following formula: Assets = Liabilities + Net Assets/Equity Please see Chapter 1 - Important Concepts for more detailed information. Temporarily Restricted Net Asset: An asset that has a donor imposed restriction such as fulfilling a specific purpose and/or the passage of time. Unrestricted Net Assets - Board Designated: Unrestricted net asset that has a defined use or purpose, as determined by an organization’s board of directors, finance council, pastoral council and/or pastor. Volunteer Services - GAAP: Professional services, often called pro bono services, donated by a person or business for which a parish would typically have to pay and that a parish would report on their financial records. This time is not tax deductible for the volunteer; however, donors may be able to deduct some of the costs associated with volunteering, such as mileage. Volunteer Services - Non-GAAP: Services which are performed by individuals that do not require a specialized skill and are not reported on the parish financial records. This time is not tax deductible for the volunteer; however, donors may be able to deduct some of the costs associated with volunteering such as mileage. CHAPTER 12 – REVENUE RECOGNITION PAGE 8 OF 13 IMPLEMENTATION GUIDANCE & JOURNAL ENTRIES Sources of revenue should be identified for their parish/school and document the policy for recording various types of revenue during the year. Parishes/schools should also document and perform year-end procedures for proper revenue recognition and end of year reporting. Year-end review procedures should include but not be limited to: 1. Review all accounts receivable balances for collectability. Determine necessary allowances and record write-offs. 2. Reconcile accounts receivable subsidiary ledger to the general ledger on a monthly and yearly basis. 3. At a minimum on an annual basis, review Donor Imposed Restricted balances and determines if restriction is still valid. If not, contact the donor to change restriction or return donation. See Chapter 11 – Net Assets/Equity for more details. 4. Review tuition and fee receipts during the last quarter of the fiscal year to ensure revenue are recorded in the proper fiscal year. Ensure proper cut- off by making necessary entries to defer revenue until the next fiscal period. Chart of Account Implication: It should be noted that donor imposed restriction and parish/board designated contributions and corresponding expenses should run through either a separate fund or non-operating accounts in the chart of accounts. This decision will depend upon the volume and magnitude of the activity. This activity may or may not be budgeted depending on the nature and timing of the contribution and expense. Journal Entry Examples: 1. Immediate Revenue Recognition: At the time of receipt of contribution: Debit: Cash Credit: Contribution Revenue xxxxx xxxxx To record a contribution. 2. Deferred Tuition Revenue Recognition: In July and August, before the start of school: Debit: Accounts Receivable Credit: Deferred Tuition (net of discounts) xxxxx xxxxx To set up the tuition receivable at the beginning of the school year. If significant changes in enrollment occur subsequent to August, adjust deferred tuition and accounts receivable accounts as necessary. CHAPTER 12 – REVENUE RECOGNITION PAGE 9 OF 13 During the school year, on a monthly basis: Debit: Deferred Tuition Debit: Tuition Discounts (Revenue Contra Account) Debit: Financial Aid Expense (Revenue Contra Account) Credit: Tuition Revenue xxxxx xxxxx xxxxx xxxxx To recognize tuition revenue when earned and contra revenues when incurred throughout the school year. During the school year, as payments are received: Debit: Cash Credit: Accounts Receivable xxxxx xxxxx To record the receipt of tuition payments. Note that tuition journal entries may differ from example depending upon the level of integration between the school tuition billing and accounting general ledger systems. Care should be taken when establishing journal entries not to duplicate tuition billing system activity. 3. Deferred Fee Revenue Recognition: At the time of receipt of payment-prior to the fiscal year to which payments apply: Debit: Cash xxxxx Credit: Deferred Revenue-Fees xxxxx To record receipt of fees and payments prior to the fiscal year for which they apply. Examples include school tuition, school registration fees, faith formation fees and other program prepayments. During the proper fiscal year: Debit: Deferred Revenue-Fees Credit: Fee Revenue xxxxx xxxxx To recognize the fee revenue during the proper fiscal year. *Note that this entry does not apply to school tuition revenue recognition during the school year. See also journal entry example # 2 for additional information. 4. Donor Imposed Restrictions: At the time of the donation: Debit: Cash Credit: Contribution Revenue Debit: Unrestricted Net Assets Credit: Temporarily Restricted Net Assets xxxxx xxxxx xxxxx xxxxx To recognize revenue at the time of the receipt of donation and to restrict the net asset. At the time that the restriction is met: Debit: Temporarily Restricted Net Assets Credit: Unrestricted Net Assets xxxxx xxxxx To remove the restriction of the net asset. CHAPTER 12 – REVENUE RECOGNITION PAGE 10 OF 13 *Note: Depending on the type of accounting system in use by the parish/school, the entries to reclassify net assets may be automated through the use of a “net assets released from restriction” account. 5. Parish/Board Designated Contributions: At the time of donation: Debit: Cash Credit: Contribution Revenue Debit: Unrestricted Net Assets Credit: Unrestricted Net Assets-Board Designated xxxxx xxxxx xxxxx xxxxx To record a parish/board designated contribution and to restrict the net asset. When expenses are incurred for the designated purpose: Debit: Expense Credit: Cash xxxxx Debit: Unrestricted Net Assets-Board Designated Credit: Unrestricted Net Assets xxxxx xxxxx xxxxx To record designated expenses and remove net asset from restricted designation. 6. Rental Revenue: At the time of receipt of the deposit: Debit: Cash Credit: Deposit (Accrued Liability) xxxxx xxxxx To record the receipt of the rental deposit. At the time of completion of event-fully refunded: Debit: Deposit (Accrued Liability) Credit: Cash xxxxx If not refunded: Debit: Deposit (Accrued Liability) Credit: Rental Revenue xxxxx xxxxx xxxxx To record the return of the rental deposit or to record the rental revenue if the deposit is not returned. If partially refunded: Debit: Deposit (Accrued Liability) Credit: Cash (refunded amount) Credit: Rental Revenue (un-refunded amount) xxxxx xxxxx xxxxx To record the partial return of the rental deposit and record the remaining as rental revenue. . CHAPTER 12 – REVENUE RECOGNITION PAGE 11 OF 13 Examples of Pledge Cards: Front of Form Intent to Pay Parish 2013 Sunday Giving Support Pledge January 1, 20xx – December 31, 20xx This pledge is an estimated intention to give (budgetary purposes only) for the period from January 1, 20xx to December 31, 20xx Name:__________________________________________________ My (our) Sunday Giving support pledge for 20xx: $_________________________ Per Year $_________________________ Monthly I want to participate in the 20xx monthly direct withdrawal payments option. Attached is a “voided” check as I am a new participant OR banking account information has changed. (Please complete back of this form.) Comments: Back of Form Intent to Pay Signature:_________________________________________ Phone:________________________ Date: ________________________ Please return this form by November 15 to _______________. Mail it to the Parish office or bring it to the ____________________________ meeting in a sealed envelope. (Add any special instructions) Front of Form Promise to Pay Parish Pledge – Promise to Give This pledge is a promise to give a single gift as of _________________ or Installment payments from the period _____________ to ______________. Name:___________________________________________ Address:_________________________________________ Telephone Number:________________________________ My (our) pledge for 20xx: $_______________Per Year $_______________Monthly (Please complete the back of this form.) Comments: Back of Form Promise to Pay Signature:________________________________________ Phone: ________________________ (Add any special instructions) Date: CHAPTER 12 – REVENUE RECOGNITION ________________________ PAGE 12 OF 13 REFERENCES AND RESOURCES Archdiocesan Chart of Accounts: On Archdiocese of Saint Paul and Minneapolis Extranet under Finance and Administration – Parish Financial Manual. Standards in Ministry School/Tuition Revenue Recognition Presentation for implementation guidance and sample entries: On Archdiocese of Saint Paul and Minneapolis Extranet under Finance and Administration. CHAPTER 12 – REVENUE RECOGNITION PAGE 13 OF 13