House subcommittee approves single stormwater bill

advertisement

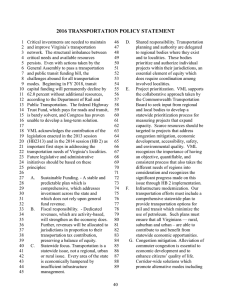

A digest of news from the General Assembly of interest to local governments Jan. 24, 2014 Budget | Education | Environment | Ethics | Finance/Taxes | FOIA | Human Services | Land Use | Local Authority | Personnel | Public Safety | Retirement/Benefits | Transportation | Miscellaneous Environment House subcommittee approves single stormwater bill A House subcommittee has approved a bill that will make it optional for certain local governments to adopt a state-mandated stormwater program by July 1. Specifically, the House Agriculture, Chesapeake, and Natural Resources Chesapeake Subcommittee rolled nine competing bills into one. HB 1173 (Hodges) now includes the following reforms: Provides the option for cities and counties that do not operate under the EPA mandated Municipal Separate Storm Sewer System (MS4) permit to have the Virginia Department of Environmental Quality (DEQ) run the program. MS4 jurisdictions are typically more urban in nature and meet certain population thresh holds as prescribed in state law. (VML will post a list of its members next week that would be granted the option of running a local program if this becomes law.) Removes the unnecessarily complicated requirement for applicants to comply with post construction standards for stormwater runoff through the federal permit. This is something the EPA does not require, nor has any other state implemented. Allows localities to accept a simplified plan for construction of a single home site “in lieu of” mandating the submission of certified engineered drawings and calculations to show compliance for new standards for treating stormwater runoff. Conforms the process for appealing permit decisions at the local level to the same as those under the Virginia Erosion and Sediment Control Law. The amended bill is not yet available on the legislature’s website, but you can view or download it as a PDF file on the VML website at http://bit.ly/1dBsNOz. The full committee could take up the bill on Wednesday. In the Senate, four bills dealing with the new stormwater program at the local level are wending their way through the committee process. They could be heard as early as Thursday in the Senate Agriculture, Conservation, and Natural Resources Committee. A detailed story on the stormwater issue appeared in the Jan. 10 Legislative Bulletin, which you can read at: http://bit.ly/1fc43Bb. Staff contact: Joe Lerch, jlerch@vml.org Finances/Taxes Substitute BPOL bill in play; VML continues to urge opposition Del. Chris Head has put forth a new version of his BPOL bill. House Finance Subcommittee #2 accepted the substitute for HB 371 on Wednesday, but took no other action. The substitute now excludes amounts paid by a taxpayer to another person, who is not an employee of the taxpayer, but is tied to the taxpayer by a subcontract. For example, a “contractor” receives a grant or contract to provide a service and engages a “subcontractor” to do a portion of the job. Under the bill’s provisions, the contractor would deduct from his company’s gross proceeds the dollar amount of the subcontract. The Department of Taxation in its fiscal analysis says the “potential local revenue loss from this bill could be substantial.” VML continues to urge its members to contact delegates, particularly those on the House Finance Committee, to oppose the measure. The bill is scheduled to be back before the subcommittee on Wednesday. Staff contact: Neal Menkes, nmenkes@vml.org Other bills ... Exempting solar equipment from local taxation SB 418 (Hanger) and SB 512 (Wagner) add solar equipment to the definition of certified pollution control equipment and facilities that are exempt from state and local taxation pursuant to Article X, Section 6 of the Virginia Constitution. The bills have been referred to the Senate Finance Committee. The committee decided to take up the bills next week. A similar bill in the House, HB 1239 (Hugo), is before the House Finance Committee. This bill would exempt from real and personal property tax solar energy equipment, facilities, or devices that are collecting, generating, transferring, or storing thermal or electric energy. Exempting real property owned by religious bodies from taxation SB 175 (Black) specifies that the real property tax exemption for churches and religious bodies includes: 1) property used primarily for outdoor worship activities and 2) property whose use is reasonably connected to and supportive of the principal religious worship use. The bill was heard this week in the Senate Finance Committee. The committee asked VML and VACo to work with the bill’s supporters on possible amendments. A House companion bill – HB 156 (Minchew) – was reported by a House Finance Subcommittee, and will be taken up on Monday by the entire committee. That bill escaped any amendments, although the patron said he was willing to discuss them. Staff contacts: Joe Lerch, jlerch@vml.org and Neal Menkes, nmenkes@vml.org Retirement / Benefits House, Senate poised to take up retirement bills Following the release of the Virginia Retirement System’s fiscal impact statements, legislation dealing with retirement issues will be heard, possibly as early as next week. The House Appropriations Subcommittee on Compensation and Retirement will hear these bills: HB 1105 (Ingram) provides a minimum group life insurance death benefit of $8,000 for all retirees who retire with at least 15 years of creditable service. Further, the $8,000 minimum benefit would increase each year at the same rate as general salary increases for state employees. VRS estimates that about 4,400 current retirees would have their group life insurance benefit increased as a result of this bill. The bill would cost localities $823,000 in FY15 (and a similar amount in succeeding years.) HB 110 (McQuinn) extends the health insurance credit currently afforded teachers to other employees of school boards (cafeteria workers, bus drivers, etc.) The cost to localities would be $7.6 million a year. HB 182 (Farrell) allows localities to offer a defined contribution retirement plan in lieu of a defined benefit plan. HB 857 (Jones) allows localities to administer their own deferred compensation plans. The Senate Finance Committee will hear these bills: SB 566 (Colgan), which increases the monthly retirement allowance payable to any person who retired with at least 15 years of creditable service before January 1, 1990. According to the impact statement, this bill would increase the unfunded liability of the various state, teacher and local plans by $83 million. Local costs would increase by $2.1 million in FY15 (and a similar amount in succeeding years). SB 102 (Ruff) is similar to HB 1105, reported above. SB 103 (Ruff) increases the monthly health insurance credit for state employees from $4 per year of creditable service to $5 per year of creditable service. While the bill applies only to state employees, there would be more pressure to increase the credit for local employees, which is $1.50 per year of creditable service for local employees. The bill would cost the state $11 million in FY15 (and a similar amount in succeeding years). SB 109 (Stanley) would increase the health insurance credit for retired local employees from $1.50 per year of creditable service with a cap of $45, to $4 per year of creditable service, with no cap. The bill would cost $9.5 million in increased contributions in FY15 (and a similar amount in succeeding years). SB 188 (McDougle) allows the state and localities to offer a Roth IRA. VRS presented a summary of legislation affecting retirement at the Jan. 23 legislation liaison meeting. The summary is posted on VML’s website at: http://bit.ly/1hSzKQq. Staff contact: Mary Jo Fields, mfields@vml.org. Miscellaneous Reminder: Governor to speak at Local Government Day Feb. 6 Gov. Terry McAuliffe has agreed to be the featured speaker at Local Government Day in Richmond on Feb. 6. If you and your colleagues have not signed up to attend this important annual event sponsored by VML, VACo and the Virginia Association of Planning District Commissions, please do so now. It promises to provide you with an assortment of essential information on legislation before the General Assembly this session that will affect local governments. In addition to the governor’s remarks, staff will report on the status of legislation of interest to local governments, then local officials are encouraged to participate in committee meetings and lobby state legislators at the Capitol. Local officials who want to meet or have dinner with their legislators while they are in town should make that request as soon as possible. The cost is $45, which includes a box lunch. A cash bar reception for local officials will be held from 5:30-6:30 p.m. Information on registering or reserving a room for the event, which will be held at the Richmond Marriott located at 500 E. Broad St. in downtown, is available at http://bit.ly/1la4WKg. Download the form, print it, and return to VML. For more information, contact Sherall Dementi at 804-523-8533 or sdementi@vml.org. VML legislative staff Kim Winn (VML Executive Director) kwinn@vml.org (O) 804-523-8521 (C) 804-205-4671 Janet Areson – Lobbies on issues involving health and human services, and the state budget. jareson@vml.org (O) 804-523-8522 (C) 804-400-0556 Mary Jo Fields – Lobbies on issues involving education policy, education funding and retirement. mfields@vml.org (O) 804-523-8524 (C) 804-400-0555 Mark Flynn – Lobbies on issues involving legal matters, housing, elections, telecommunications and technology. mflynn@vml.org (O) 804-523-8525 (C) 804-400-1321 Joe Lerch – Lobbies on issues involving the environment, land use, natural resources and transportation policy. jlerch@vml.org (O) 804-523-8530 (C) 804-640-5615 Neal Menkes – Lobbies on issues involving taxation and finance, the state budget, transportation funding, and community and economic development. nmenkes@vml.org (O) 804-523-8523 (C) 804-400-1191 Kimberly Pollard – Lobbies on issues involving public safety and legislative procedural matters. kpollard@vml.org (O) 804-523-8528 (C) 804-400-1987 Robie Ingram (under contract) – Lobbies on issues involving courts, criminal law, civil law, FOIA, procurement and general laws. memechose2@yahoo.com (C) 804-683-3201 Chris LaGow (under contract) – Lobbies on issues involving insurance and workers’ compensation chris@lagowlobby.com (O) 804-225-8570 (C) 804-356-0118