State Budget Outlook - Virginia Municipal League

advertisement

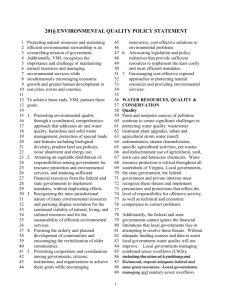

State Budget Outlook 2015 VML Legislative Priorities REGIONAL SUPPERS W Y T H E V I L L E , FA R M V I L L E , N E W P O R T N E W S , V I R G I N I A B E A C H , A L E X A N D R I A , A N D H A R R I S O N B U R G OC TOBER -NOVEMBER , 2014 Economic Realities Confound Projections FEBRUARY REVENUE FORECAST INTERIM REVENUE FORECAST (AUGUST) 1. Modest 1% revenue growth in FY14 over FY13 collections 1. 2. Healthy 5.2% revenue growth projected for 2. FY15 August (Interim) forecast for fiscal year 2015 drops to 2.7% 3. Revenue increase in FY16 projected to slip to 4.1% August forecast for fiscal year 2016 skids down to 2.7% 3. Actual FY14 revenues drop 1.6% compared to year earlier 2 State General Fund Rises/Falls on Two Major Revenues Over 80% of state revenues come from individual income taxes and the state’s sales and use tax. The hit in collections marks the first time Virginia revenues have fallen outside of a national recession. Here are key indicators: Indicator FY14 Projections FY14 Actuals Wages & Salaries Growth 2.6% 1.1% Employment Growth 1.0% 0.4% Professional/Business Services 1.0% (1.8%) Personal Income 2.6% 1.1% Sales & Use (4.4%) (4.8%) 3 State Balances Budget in Two Parts: June Actions Tackle $1.55 Billion Shortfall Governor McAuliffe and General Assembly parsed the revenue shortfall as follows: $350.0 million in FY14 $950.0 million in FY15 $600.0 million in FY16 Broad stroke plan taps $707.5 million from the “Rainy Day Fund”. Establishes an $842.5 million Appropriated Revenue Reserve, $480.0 million in FY15 and $362.5 million in FY16 through the Appropriation Act approved on June 23 (2014 Special Session I, Virginia Acts of Assembly, Chapter 2) The revenue reserve was pulled from new spending, representing 31% of the new spending proposed last December by former Gov. Bob McDonnell. 4 Appropriated Revenue Reserve ITEM AMOUNT in MILLIONS Higher Education $183.9 K-12 Public Education $166.6 Health and Human Resources $80.1 Commerce and Trade 39.0 Public Safety and Veteran Affairs 27.0 Compensation $168.3 Additional Cash Balances and Revenue Adjustments $177.7 TOTAL $842.6 5 Cuts to local programs made in June… • Teacher salary increase ($100.9 million) • Partial restoration of SOQ inflation update ($9.7 million) • Partial restoration of NVA Cost of Competing Adjustment for support positions ($5.4 million) • Career development programs for constitutional officers (eliminated new funding) • Removed authorization allowing school divisions to participate in the state health insurance program • Proposed Line of Duty Act funding was eliminated • Governor’s Opportunity Fund reduced to $10.0 million each year • Enterprise Zone Grant Program (removed $2.0 million each year) • Homelessness programs (removed new funding of $11.0 million for biennium) • Virginia Tourism Authority (eliminated new funding of $1.4 million each year) 6 But these local programs were spared… o SOQ re-benchmarking o Pre-K “hold harmless” slots ($4.6 million) o Year round school grants ($3.4 million) o HB 599 local police department allocations kept at FY 2014 level o Training for assistant commonwealth’s attorneys ($200,000) o Instructional Specialists in schools not accredited ($3.6 million) o Teach for America grants ($1.0 million) o Water Quality Improvement Fund ($31.4 million in FY15) 7 May and June Revenues Force an August Reforecast Fiscal Year 2014 ended with a bigger thud than first thought. The anticipated $350.0 million revenue shortfall ballooned to $437.8 million, triggering the August (Interim) revenue reforecast. In a joint meeting of the General Assembly’s money committees, Gov. McAuliffe presented a new forecast reflecting the full impact of the FY14 shortfall along with projections of continued sluggish job and wage/salary growth. The assumed carry-forward balance in Chapter 2 of $128.6 million had shrunk to $40.1 million, resulting in a biennial budget shortfall of an additional $881.5 million. 8 Closing the Budget Gap in Sept. with Spending Cuts – Both Real and Conceptual Overall strategy agreed to by the governor and General Assembly consists of two major pieces: 1. Grabbing $267.7 million in agency unexpended balances, cash transfers, and reversions 2. Setting up four reversion clearing accounts to the tune of $614.4 million SEPTEMBER BUDGET STRATEGIES ($S IN MILLIONS) Action Balances/Transfers/Other FY 2015 FY 2016 $139.7 $78.0 State Agencies $92. 4 $100.0 Higher Education $45.0 $45.0 Aid to Localities $30.0 $30.0 Unspecified $50.0 $272.0 $357.1 $525.0 Reversion Accounts: TOTAL 9 Local Government Impacts No apparent additional spending cuts affecting K-12 budget. State agency cuts could affect localities, depending on strategies approved by Gov. McAuliffe in FY 2016. Possible examples include funding reductions for planning district commissions and soil and water conservation districts, cut backs for school efficiency reviews and community mental health programs, and reductions in litter control grants. State agency reduction plans will be submitted to the General Assembly by mid-October and incorporated into Gov. McAuliffe’s budget amendments in December. The transfer of non-general fund dollars to the state general fund and the interception of general fund money going to agencies traditionally funded by non-general fund dollars will likely affect localities. 10 Local Government Impacts (Continued) “Local Aid to the Commonwealth” pops up again at $30.0 million each year. State budget office will release reduction targets to cities and counties sometime in November. Targets based on the amount of state financial assistance received for each city and county, but excludes from the calculation amounts tied to K-12 and the car tax relief program. Local governments will have the option to choose how the targets will be achieved. Strategies adopted by local elected officials will be shared with the legislature in late fall. As shown on slide #9, there are no details or information on how the $322.0 million reduction in FY16 will be achieved. The answers will be included in the governor’s December budget amendments. 11 Time to Take Action VML and VACo wrote to Gov. McAuliffe prior to the General Assembly’s return to Richmond in September. The letter made four critical points: 1. Economic and budget situation today differs significantly from financial conditions before the Great Recession. 2. Relying exclusively on spending cuts jeopardizes mandated public services. Public education must be the budget’s highest priority. 3. It’s time to look at how services are delivered and to focus more on measurable results than on process. State must pay its fair share, if not, standards, requirements & deadlines should change. 4. State tax credits, tax deductions, and tax relief programs must undergo the same scrutiny as spending programs. Localities should discuss these points with their delegates and senators. 12 State Support for Local Programs is Declining Locals' Portion of State GF Budget 53% 52% 51% 50% 49% 48% 47% 46% 45% 44% 43% 52.2% 47.7% 2008-10 biennium 2010-12 biennium 46.5% 46.7% 2012-14 biennium 2014-16 biennium 13 Education is the Driving Force in Local Budgets Inflation-Adjusted State Per Pupil K-12 Funding Reveals Even Larger Declines in State Aid (2007 $ - All State Appropriated Funds) $5,200 $5,000 $5,039 $4,868 $4,807 $4,720 $4,800 $4,600 $4,342 $4,400 $4,175 $4,200 $4,242 $4,250 2013 2014 $4,240 $4,083 $4,000 2007 2008 2009 2010 2011 2012 2015 2016 14 Now is the Time to Act 1. Talk to legislators before the start of the 2015 session. 2. The message should explain: 1. 2. 3. 4. Local taxing authority must be retained, particularly as state spending and the rate of spending decreases. State agencies should work in concert with localities to find ways to improve the efficiencies and effectiveness of programs without being overly prescriptive. Think results. An educated and trained workforce is critical for Virginia to compete economically with other states and nations. Funding public education is paramount. Both tax expenditures and budget spending need to be evaluated. 15 2015 VML Legislative Priorities Education Funding 1. VML opposes changes that shift funding responsibility from the state to localities. 2. VML opposes policies that lower state contributions but do nothing to address the cost of meeting the requirements of the Standards of Accreditation and Standards of Learning. 3. VML also supports implementation of JLARC recommendations to promote 3rd grade reading performance. 16 4 most expensive unfunded SOQ standards Assistant principal for every 400 students - $70.6 million Reading specialist for every 1,000 students - $51.3 million Math specialist for every 1,000 students - $35 million Reduce speech-related language pathologist caseload from 68 to 60 – $51.3 million Total = $208.2 million Source: VA Dept. of Education 17 2015 VML Legislative Priorities State Assistance to Local Law Enforcement (HB 599) Funding for police should be a shared responsibility of state and local government as it has long been for sheriffs’ departments. The state’s commitment to HB 599 has increasingly lagged in the past decade. Law enforcement is a core function of state and local government. 18 2015 VML Legislative Priorities Transportation Funding The transportation package adopted in 2013 is a first step to comprehensively address transportation needs. More dedicated revenue for transit operations and capital as well as passenger and freight rail is needed to keep pace with growing public needs and expectations. Additional resources for urban and secondary road construction are needed in light of actions taken by the state to halt allocations for these projects in the SixYear Transportation Improvement Program. 19 2015 VML Legislative Priorities State and Local Government Fiscal Relationship VML opposes: Restricting local taxing authority without granting alternative revenue authority with reliable, sustainable revenue sources Confiscating or redirecting local tax revenues Requiring localities to bear expenses for costs of new state requirements Shifting traditional state funding responsibilities to local governments Piggybacking state fees, taxes or surcharges on local government services Placing additional administrative burdens on local governments Enacting State budget cuts without specifying the programs to be affected by the cuts (such as the $30 million reduction in Aid to Localities) 20 2015 VML Legislative Priorities State and Local Government Fiscal Relationship (continued) VML asks the State to: Have a dialogue with local governments to examine state requirements and service expansions that can be suspended or modified to alleviate the financial burden on state and local taxpayers. Develop spending and revenue priorities that support economic development, public safety, education and other public goals. State tax credits, tax deductions and tax relief policies must receive the same scrutiny as spending programs as part of the prioritization process. 21 2015 VML Legislative Priorities State and Local Government Fiscal Relationship (continued) VML asks the State to: Review ways to increase revenues to meet constitutional and statutory obligations to Virginia citizens after all other actions have been taken including eliminating unnecessary programs, achieving greater program efficiencies, and streamlining service delivery. Include local government representatives on any “blue ribbon” commission or other body established by the state that has as its purpose changes to local revenue authority or governance.” 22 2015 VML Legislative Priorities Low Performing Schools VML supports repeal of the legislation establishing the Opportunity Educational Institution. Any approach to improving low-performing schools must include adequate state financial support. VML supports increased state funding for the Virginia Preschool Initiative, the K-3 reduced class size program, Early Reading Intervention program, increased state stipends for highly effective teachers in high-poverty schools, and other innovative programs. The state has consistently underfunded the state Standards of Quality and other state accountability programs. In the absence of increased state funding, VML opposes any efforts that would transfer to the state additional local funding that exceeds the required local share. 23 Other Legislative Positions First Day Introduction for Bills with Local Fiscal Impact VML supports reinstituting the requirement for first day introduction of bills with a local fiscal impact. Local Collections VML supports repeal of language in the 2014 Appropriation Act that effectively bars local Treasurers from collecting delinquent fines and costs. Local Fines and Fees VML supports a budget amendment to end state confiscation of local fines, fees and forfeitures. 24 Other Legislative Positions Water Quality Funding VML supports adequate funding for water quality improvements for sewage treatment plants, urban stormwater, combined sewer overflows, and sanitary sewer overflows required by federal and state legislation and regulation. Workers Compensation – Medical Costs Virginia should adopt Medicare-based fee schedules for setting medical provider fees in workers’ compensation cases, instead of the prevailing community rate standard now used. This will make providing workers’ compensation coverage more affordable and will adequately protect the financial interests of the medical providers of Virginia. 25 Other Legislative Positions Taxing, Licensing and Regulating Internet-based Businesses & Services If the Commonwealth takes action to regulate private enterprises that emphasize the use of the Internet to either provide retail or facilitate lodging or ride-sharing services, state and local policies should (1) encourage a level playing field for competing services in the market place; (2) seek to preserve and/or replace local and state tax revenues; and (3) ensure safety and reliability for consumers. Transportation Networking Companies VML supports the continued option of local regulation of taxi companies. VML supports state regulation of ride-sharing companies as needed to ensure proper safety, liability, cleanliness, insurance coverage, local revenue, consideration of ADA access, and equitable service in communities. 26 Other Legislative Positions Municipal Net Metering VML supports (1) allowing local governments to aggregate the electric load of their governmental buildings, facilities, and other governmental operations for the purpose of net energy metering; and (2) raising the net-metering limit from 500 kilowatts to 2,000 kilowatts for non-residential customers. Hydraulic fracturing petroleum extraction The process of hydraulic fracturing raises concerns about the potential pollution of groundwater, the depletion of water supplies and an increase in seismic activity in previously benign or inactive zones. The consequences potentially are costly and irreversible to local communities. VML supports a state regulatory program that addresses these concerns while protecting the authority of local governments to regulate this type of mining activity through its land use ordinances. 27