Practice Final Exam

advertisement

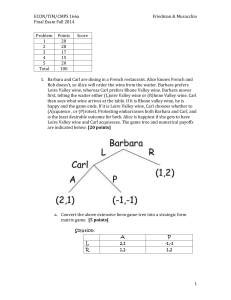

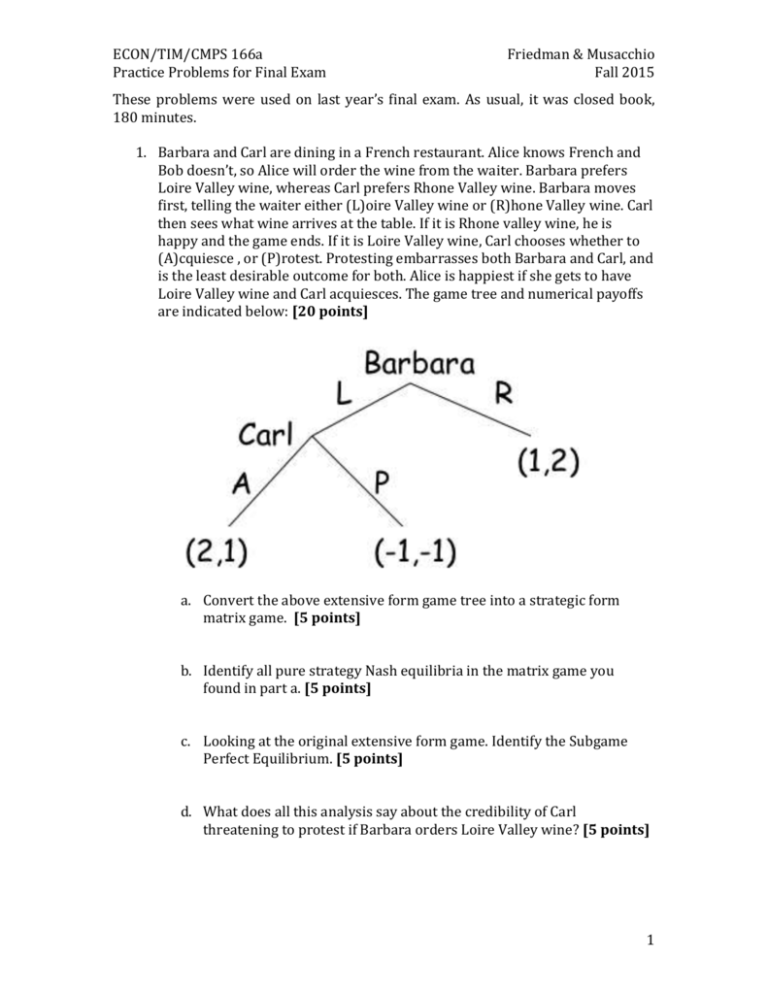

ECON/TIM/CMPS 166a Practice Problems for Final Exam Friedman & Musacchio Fall 2015 These problems were used on last year’s final exam. As usual, it was closed book, 180 minutes. 1. Barbara and Carl are dining in a French restaurant. Alice knows French and Bob doesn’t, so Alice will order the wine from the waiter. Barbara prefers Loire Valley wine, whereas Carl prefers Rhone Valley wine. Barbara moves first, telling the waiter either (L)oire Valley wine or (R)hone Valley wine. Carl then sees what wine arrives at the table. If it is Rhone valley wine, he is happy and the game ends. If it is Loire Valley wine, Carl chooses whether to (A)cquiesce , or (P)rotest. Protesting embarrasses both Barbara and Carl, and is the least desirable outcome for both. Alice is happiest if she gets to have Loire Valley wine and Carl acquiesces. The game tree and numerical payoffs are indicated below: [20 points] a. Convert the above extensive form game tree into a strategic form matrix game. [5 points] b. Identify all pure strategy Nash equilibria in the matrix game you found in part a. [5 points] c. Looking at the original extensive form game. Identify the Subgame Perfect Equilibrium. [5 points] d. What does all this analysis say about the credibility of Carl threatening to protest if Barbara orders Loire Valley wine? [5 points] 1 ECON/TIM/CMPS 166a Practice Problems for Final Exam Friedman & Musacchio Fall 2015 2. You are the CEO of Untidy airlines. Your airline competes with one other airline, called Epsilon Air on the popular New Amsterdam to Los Diablos route. Let qu and qe denote the number of seats per day Untidy and Epsilon offer respectively on the route. Suppose that neither airline offers a better product than the other, so neither can charge a price premium. Instead, the average fare on the route depends on the total number of seats per day as F = $1400 – Q where Q= qu+qe is the total seats per day on the route. [28 points] a. Suppose it costs each airline $500 per seat offered on the route, and that every seat offered gets bought at the fare F. Thus Untidy’s daily operating profit is u = (1400 – qu – qe) qu – 500 qu . Similarly, Epsilon’s profit is e = (1400 – qu – qe) qe– 500 qe . If both firms simultaneously choose the quantities of seats to offer on the route, what is the Nash Equilibrium number of seats the firms offer? What is each firm’s daily operating profit in equilibrium? [8 points] b. Suppose you have the opportunity to acquire a more fuel efficient fleet. After getting the new fleet your cost per seat offered will be only $200, while Epsilon’s cost per seat will be unchanged. Suppose you acquire the new fleet, and Epsilon does not. If both firms simultaneously choose the quantity of seats to place on the New Amsterdam to Los Diablos route, what will be the Nash equilibrium number of seats each firm offers? What is each firm’s daily operating profit in equilibrium? [7 points] c. Now we explore what would happen if both firms have a new fleet a cost per seat of $200. Again both firms choose their quantities of seats per day simultaneously. What will be the Nash equilibrium number of seats each firm offers? What is each firm’s daily operating profit in equilibrium? [5 points] d. Now we will explore the decision of both airlines to invest in a new fleet. For both airlines, a new fleet costs $100 million (for the entire fleet, not per plane). Suppose conditions (interest rates, etc.) are such that to convert daily profits into a net present value one must multiply by 1000. (e.g. a $1,000 a day has a Net Present Value of $1 million.) Thus If both firms buy a new fleet, their long-term payoff is 1000 times their daily profit calculated in part D minus $100 million. 2 ECON/TIM/CMPS 166a Practice Problems for Final Exam Friedman & Musacchio Fall 2015 If neither firm buys a new fleet, their long-term payoff is just 1,000 times their daily profit in part A. If one firm buys a new fleet and the other doesn’t, the firm that buys gets 1,000 times the daily profit of the firm with the cost advantage in part B minus $100 million. The other firm just gets 1,000 times the daily profit of the firm with the cost disadvantage in part B. If both firms make the Buy vs. Not Buy decision simultaneously, write a 2x2 game bimatrix to describe this game. Keep your numbers in millions for this part. [5 points] e. Is there a pure Nash equilibrium to the game you constructed in D? If so, what is it? [3 points] 3. Consider a variation of the traditional Hawk-Dove evolutionary game. In this variation, if two Doves meet, they cooperate to increase the value of the resources they share by an amount a. In particular, the game matrix has the form Hawk Dove Hawk V, 0 V -c V -c , 2 2 Dove 0, V V +a V +a , 2 2 Here, V is the value of the shared resource, and c is the cost of Hawks fighting each other. [17 points] a. Under what condition is it an ESS for everyone to play Hawk? Express your answer as a condition on V, c, and a. [5 points] (Your answer will look something like this: “(H,H) is an ESS if V> c/a or a< c2.” Of course your conditions will be different!) b. Under what condition is it an ESS for everyone to play Dove? [5 points] c. Suppose V=10, c=20, and a=5. Are there any pure ESS? Is there a mixed ESS? If so, find it and demonstrate that it meets the necessary conditions to be an ESS. [7 points] 3 ECON/TIM/CMPS 166a Practice Problems for Final Exam Friedman & Musacchio Fall 2015 4. On the planet Materialistic-land, there exists a species of human-like creatures that are very materialistic. In particular sex Y strongly prefers to partner with sex X creatures that are wealthy. Nature makes only 1/3 of sex X creatures wealthy and the rest are poor. Everyone on the planet knows these proportions. A particular sex X creature (player X) wants to win the affections of a particular sex Y creature (player Y). Player X knows whether it has been made wealthy or poor, and it must decide whether to buy a luxury space ship or not. Player Y will not see directly whether X is wealthy or poor, but Y will see whether X chooses to buy a luxury space ship. After seeing this, Y must decide whether to accept or reject X. Player X, whether X is rich or poor, gets 10 units of utility if accepted by Y, and 0 units if rejected. It costs 5 units of utility for a wealthy X to buy a luxury space ship, while it costs C>5 units of utility for a poor X to buy a luxury space ship since it would take a much greater fraction of a poor X’s wealth to buy one. In summary: OUTCOMES: Wealthy X Poor X Buy-Accept Not Buy Accept Buy Reject Not Buy Reject 10 – 5 10 – C 10 10 -5 -C 0 0 Player Y gets a utility of 10 if it accepts a wealthy player X, and a utility of -10 if it accepts a poor player X. Write the game tree for this game. Take care to mark information sets correctly! [15 points] a. Under what condition on C is it a Perfect Bayesian Equilibrium (PBE) for player X to have a separating strategy of buying only if wealthy and for Y to accept only those who buy a luxury space ship? [7 points] b. Suppose C =7. For this C, is there a PBE? If so, find it. [8 points] 5. Two weeks ago the business press reported major declines in telecom stocks triggered by Sprint’s large price cut for wireless data plan. The other two large firms in this industry are ATT and Verizon. [20 points] a. Write out a static 3-player game where the players simultaneously decide whether to charge a high (H) or low (L) price. Payoffs for ATT and Verizon are R(H)=2-NL when they choose H, where NL=number of competitors choosing L; and are R(L)=1+NH when that player chooses L, where NH=number of its competitors choosing H. Sprint's payoffs are R(H)-1 or R(L)-1 when it plays H or L. [5 points] 4 ECON/TIM/CMPS 166a Practice Problems for Final Exam Friedman & Musacchio Fall 2015 b. Find all NE for the static game. Which of them (if any) is in strictly dominant strategies? Which of them (if any) is efficient? [5 points] c. Now consider the game you just wrote out as the stage game of a repeated game with no definite final period. Explain briefly how each player’s discount factor affects its payoff in the repeated game, and what determines its discount factor. [5 points] d. Some analysts said that Sprint’s probability of surviving declined substantially earlier this year. Could that have any connection to Sprint’s decision to play L two weeks ago? [5 points] 5