Salary Recoveries & SBA Journal Process Narrative

advertisement

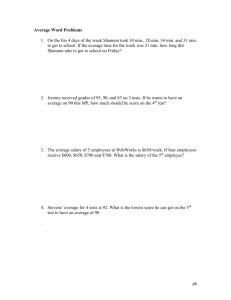

Salary Recoveries & SBA Journal Process Narrative 2013 Salary Recovery / SBA Journals - Process Workflow Narrative BACKGROUND There are 3 mechanisms by which a salary and benefit adjustment can be processed: 1. Salary Recovery – a HRR Journal via Salary Recovery module processing. An adjustment requires a Salary Recovery when: Operating salaries that are secondarily sourced from either a University of Calgary held project, or are billed to an external agency. A one-time salary recovery adjustment is required: a) to catch up prior periods for a salary recovery, or b) to reverse an existing salary recovery. This type of adjustment is not used for GAT, Post Docs, Hourly, Scholarship, Fixed Term (project), or salary splits within the same business unit adjustments. For a complete list of items included and excluded from the salary recovery model refer to the Salary Recovery Module User Guide at http://www.ucalgary.ca/finance/documentation) Salary Recovery requests should be submitted to the Faculty / Business Unit’s Finance Service Analyst (FSA). FSAs are Salary Recovery Initiators in PS. 2. SBA Journal – a special FSCM-GL journal. An adjustment requires a SBA Journal when: a) The transaction does not fit the criteria for HCM Retro Accounting or Salary Recovery Processing. b) The redistribution is for: i. a specific, finite period, AND ii. is not intended to trigger ongoing prospective accounting changes c) The redistribution is for: i. specific amounts, AND ii. is NOT intended to trigger ongoing prospective accounting changes d) Scholarships e) Hourly employee (timesheet) distribution corrections f) Prior fiscal Period adjustments g) Move recovered costs from the employee home Dept ID to another operating Dept ID Note: Journals cannot move charges between “accounts codes”, must use the same account as in the original transaction. Must use a SBA Journal if a recovery is to debit fund 10 and credit is to a project. 1 Salary Recoveries & SBA Journal Process Narrative 2013 For a complete list of SBA Journal parameters, including SBA Journal restrictions, refer to the Salary and Benefit Accounting Manual at http://www.ucalgary.ca/finance/files/finance/FRSalary-and-Benefit-Adjustment-Processes.pdf Fund 60, 70, 11: requests are submitted to RTAHELP@ucalgary.ca (no change in process). All other funds: requests are submitted to the Faculty / Business Unit’s Finance Service Analyst (FSA). FSAs hold GL Journal Entry Requestor status. Journal initiator status is restricted to the Office of the Controller (OC). 3. HCM Retro Processing – a HRP Journal via HCM system-based retro processing. An adjustment requires HCM Retro Processing when: The accounting distribution is for i. Pay periods in the current fiscal year, AND ii. Are on-going changes to future pay periods Accounting distribution is to clear a suspense account (54995 posting) The request should be through the HCM document submission process (i.e.) Job Change request or Academic Accounting request. A determination will be made regarding whether HCM processing is appropriate. FSA’s and RA staff will have the necessary level of education, training, skills and knowledge of University policies and procedures to act as requestors / initiators for salary and benefit adjustments. Supporting Documentation can be found at http://www.ucalgary.ca/finance/documentation : Salary Adjustment Process – Decision Matrix Salary and Benefit Adjustment Process (Salary and Benefit Accounting Manual) Salary Recovery Module User Guide Salary Recovery Template (currently on RA website) Salary and Benefit Adjustment Journal Request (SBA Journal template) General Ledger Journal Entry and Supporting Documentation Requirements General Ledger Journal Entry (GLJE) Request Form SUBMISSION OF REQUESTS Requests may be submitted by a PI, Budget Owner, HR Administrator, Manager, Finance Partner, or another source and should be directed to: All Salary Recovery requests should be directed go to the Faculty / Business Unit’s assigned FSA. All Fund 60, 70, and 11 SBA Journal requests should be submitted to RTAHELP@ucalgary.ca. All Other fund SBA Journal requests should be submitted to the Faculty / Business Unit’s assigned FSA. 2 Salary Recoveries & SBA Journal Process Narrative 2013 Requests should be submitted via email and contain the following supporting documentation: Subject line of email should contain: “Salary Recovery Request” or “SBA Journal Request” A brief description of the salary and benefit adjustment required. Information required to process the adjustment: - Name and Department of the requestor. - Name, Employee ID, and Record Number (if known) of the employee requiring the salary and benefit adjustment, - Salary amount(s) to be moved and the time span covering the adjustment. - Faculty/Unit and Dept ID where the salary currently resides, - Fund/Dept ID/Project/Internal code where charges should be applied, or agency name / address / contact person if the charges should be billed to an external agency. - Name of budget owner / trust holder where charges should be applied. - Details of any special considerations and supporting documentation as required. PROCESS UPON RECEIPT OF REQUEST The FSA or RA staff member receiving an adjustment request will assesses the request against the Salary and Benefit Accounting Adjustment’s Decision Matrix to determine if the adjustment meets the criteria for 1) Salary Recovery, 2) SBA Journal, or 3) HCM retro processing and redirect the requestor to the appropriate contact person if necessary. 1) Salary Recoveries – HRR Journal The FSA ensures the request and data is complete, valid and accurate, verifying all coding, amounts and dates for the recovery / adjustment (verifications obtained via Earnings Distribution Reports, E-Fin, Enterprise Reporting, or other sources as required). FSA determines if the salary recovery is an: 3 I. On-Going Salary Recovery – operating salaries are charged to a project. The entry is set up in PS Salary Recovery module in accordance with the guidelines of the agency providing the funds. An HRR journal is produced semi monthly to record the transaction in the GL. II. External Billing (FARxxxxx) – operating costs are billed to an external agency (i.e. Alberta Health Services). The FARxxxxx internal is specific to the agency that will be billed for the costs. FAR coded salary recoveries are pulled by A/R each month for monthly invoicing to external entities. Invoices are generated by A/R. III. One-Time Salary Recovery Corrections / Adjustments – used to catch up retro periods for new salary recoveries or to reverse transactions for existing recoveries. Salary Recoveries & SBA Journal Process Narrative 2013 On-Going Salary Recovery OR External Billings: o o The FSA fills out the Salary Recovery Template as per template instructions and the Salary Recovery Module User Guide. External Billings - require a FARxxxxxx internal code in the recovery chartfield string [no fund/dept, account 12226, internal FARxxxxxx]. A unique FAR code is generated for each external agency (with a new FAR code created for each U of C department to receive the credit). For new external billing arrangements, contact Accounts Receivable to determine if the customer is already in the system. - If the customer is set up: o determine whether the billing information on file is correct per the billing instructions o check with Internal Reporting to determine if a FARxxxxxx internal is in the system. The FAR123456 internal = the customer number in A/R. - If the customer is not set up: o fill in Internal Chartfield Request form (found on Finance webpage) and email to fsgl@ucalgary.ca o when the internal is set up, the transaction can be entered into the module. FAR coded salary recoveries are pulled by A/R each month for monthly invoicing to external entities. Invoices are generated by A/R. Questions on the FAR code process may be directed to Danielle Whyte in A/R. o o o o o Approval: FSA obtains documented budget owner approval via email or written signature on the Salary Recovery Template. FSA initiates salary recovery into PeopleSoft module. See Salary Recovery Module User Guide for process. Review & Approval Workflow in PS: when a recovery is entered into PS and charges are to a Project Type = RSRCH, it is routed through to Compliance & Eligibility for review and approval (is it an eligible expense, are there are funds in the account, etc.). This workflow is not applicable for external billings. Approval Workflow in PS: if an external billing, the system then workflows through to the Department owner for approval. (currently reviewing this to have the system change the workflow for Faculty of Medicine to only four potential approvers – Research, Academic, Education, Administration). Paperwork / electronic copies are retained by the FSA (potential FP / FSA shared drive). Note: Only use Salary Recovery Template if credit is to operating and debit to a project or external agency. 4 Salary Recoveries & SBA Journal Process Narrative 2013 One-Time Salary Recovery Corrections / Adjustments: o o o o FSA initiates a “One Time Adjustment” in the Salary Recovery module. See Salary Recovery Module User Guide for process. Back up data to retain: proof of budget owner approval, detailed journal entry of debits / credits (can use SBA Journal Template), Empl ID, Empl Record, full chartfield strings, and effective dates, and explanation why a Salary Recovery and/or HCM Retro Distribution is not being used to process the transaction. If an on-going recovery change is also required, follow the steps to process an On-Going Salary Recovery as noted above. Approval Workflow in PS for One-time Adjustments: are routed to the: a) Department owner – for external billing corrections / adjustments b) Project owner – for project recovery corrections / adjustments Monthly Maintenance for Salary Recoveries On a monthly basis FSAs will monitor all assigned Faculty / Units for potential adjustments to ongoing recoveries, take corrective action where required, and updating the corresponding requestor / budget owner / Finance Partner on those recoveries requiring corrective action. See Salary Recovery Module User Guide for a listing of instances when manual interventions are required for Salary Recoveries (i.e. leaves – maternity, sick, research & scholarly, etc.). See Salary Recovery Module User Guide for a listing of queries to assist with monthly maintenance of Salary Recoveries. 2) SBA Journal For Fund 60, 70, 11 – requests go directly to - RTAHELP@ucalgary.ca (no change in process) All other funds – request to - the Faculty/Unit’s Finance Service Analyst FSA ensures the request is complete, valid and accurate, verifying all coding, amounts and dates for the recovery / adjustment. Verifications and additional supporting documentation is obtained (via Earnings Distribution Reports, E-Fin, Enterprise Reporting, other sources). FSA follows the General Ledger Journal Entry and Supporting Documentation Requirements, filling out: GL Journal Entry Request Form SBA Journal Request Template Proof of Budget Owner Approval Supporting documentation as required 5 Salary Recoveries & SBA Journal Process Narrative 2013 FSA submits all documentation to: OC.GLJE@ucalgary.ca (all funds other than 60, 70, 11) FSA receives confirming email with SBAxxxxx journal number once journal has been processed. 3) HCM Retro Processing If the transaction meets the criteria for HCM retro accounting, the request should be returned to the requestor noting the salary adjustment should be through the HCM document submission process (i.e.) Job Change request or Academic Accounting request. 6 Salary Recoveries & SBA Journal Process Narrative 2013 Salary Recovery / SBA Journals - Process Workflow Diagram Salary Recovery / SBA Journal Request Submitted to FSA FSA obtains additional clarification/ data if needed. FSA determines if adjustment meets criteria for Salary Recovery, SBA Journal, or HCM Retro Processing Salary Recovery? SBA Journal? No FSA verifies and provides supporting data as required. Completes: GL Journal Entry Request Form SBA Journal Request Template Obtains budget owner approval YES Submit documentation to RTAHELP@ucalgary.ca YES YES YES Fund 60, 70, or 11 HCM Retro Processing? All other funds, submit documentation to OC.GLJE@ucalgary.ca One time Correction / Adjustment? No YES One Time Corrections / Adjustments FSA verifies data, obtains budget owner / project owner approval and initiates a “One Time Adjustment” in the Salary Recovery module. See Salary Recovery Module User Guide for process. Approval Workflow in PS: one-time adjustments are routed to the: a) Department owner – for external billing corrections / adjustments b) Project owner – for project recovery corrections / adjustments 7 Return to requestor – adjustment s/b through the HCM document submission process (i.e.) Job Change request or Academic Accounting request. On-Going OR External Billings FSA verifies data, obtains budget owner / project owner approval, and provides supporting data as required. Completes: Salary Recovery Template Obtains FAR code from A/R for external billings Obtain budget owner signoff on Template if other proof of authorization is not attained Initiates salary recovery into PS module Approval Workflow in PS: PS routs to Compliance & Eligibility (if Project Type = RSRCH) If an External Billing, then routed to the Dept ID owner for approval. Follow-up: monthly monitoring for potential adjustments to on-going recoveries.