Acceptance of Gifts

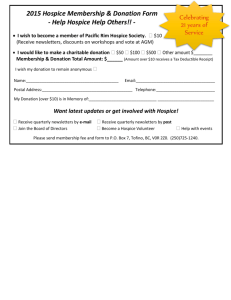

advertisement

POLICY Title ACCEPTANCE OF GIFTS Document #. Section Revision # NEW Application Issue date Jan 1 2014 Issued By Director of Development Approved By Bethell Hospice Foundation Board of Directors Replaces Policy Statement: No gift shall be knowingly accepted which may jeopardize the tax-exempt/charitable status of the Bethell Hospice Foundation. Procedures: Any persons to whom the responsibility of negotiating gift agreements has been delegated shall be authorized to do so with prospective donors following approved program guidelines. Only the Director of Development or the Board Chair of Fundraising may delegate this responsibility. In certain cases a gift may be refused. Some reasons for the refusal of a gift include, but are not limited to: the gift has an attached liability that could created an undesired financial burden acceptance of the gift would violate the policies and procedures of the Foundation and/or the hospice the donor is an individual, corporation or organization whose philosophy and values are inconsistent with those of the Bethell Hospice Foundation or Bethell Hospice the donation contains unreasonable conditions the donation violates federal and/or provincial laws or regulations in some way In cases where financial valuations are required in order to issue a tax receive or determine future values, the gift must be approved by the Director of Development or the Bethell Hospice Foundation Board of Directors. Determination of which party will incur the cost of the valuations required to meet CRA tax receipt regulations will be made on a case-by-case basis. Planned gifts of real estate and residual interests must be reviewed and approved by the Director of Development and the Bethell Hospice Foundation Board of Directors. The Bethell Hospice Foundation Board shall always have the final determination on any gift that may incur any future expenses. Before acceptance, relevant information about the gift shall be ascertained, including a copy of any appraisal secured by the donor. The Bethell Hospice Foundation reserves the right to secure and rely on its own appraisal and may, at the discretion of the Foundation, ask that the donor bear the cost of the appraisal. Outright gifts of cash, life insurance and publicly traded securities do not require approval. There are several types of gifts that are actively encouraged in the giving program: bequests by Will cash publicly traded securities in-kind life insurance real estate RRSP, RRIF, pension or annuity proceeds Charitable gift annuities POLICY Title ACCEPTANCE OF GIFTS Document #. Section Revision # NEW Application Issue date Jan 1 2014 Issued By Director of Development Approved By Bethell Hospice Foundation Board of Directors Replaces Due to their complexity, the following methods will be accepted by the Bethell Hospice Foundation on a caseby-case basis: reinsured gift annuity charitable remainder trusts registered assets real estate residual interest How to Donate: Gifts may be in the form of cash, cheques, electronic fund transfer and credit card transactions. Cheques and money orders must be made payable to the Bethell Hospice Foundation. Donors wishing to pay their donation by credit card (American Express, MasterCard, Visa) have several options: donation by phone o contact the Bethell Hospice Foundation at 905-838-3534 on-line o use the “Donate Now” button on the Bethell Hospice webpage to provide credit card information over the internet by mail o go to How to Donate on the Bethell Hospice webpage to print a donation form o fax to 905-838-0302 or mail to: Bethell Hospice Foundation P.O. BOX 75 Inglewood, Ontario L7C 3L6 For all pledges, written confirmation must be provided by the donor. The details on the pledge documentation must include: donor’s name donor’s mailing address pledge amount form of payment (cash, credit card, cheque, securities, gift-in kind, etc.) payment schedule (i.e. one-time payment or scheduled payments) The documentation may also include comments including whether the donor wishes to direct support to different areas or has any other specific requests for their donation. Once the written documentation has been received by the Bethell Hospice Foundation the pledge will be processed. Donors wishing to donate monthly can do so through credit card payments, post-dated cheques, on-line through CanadaHelps.ca or the Bethell Hospice website and by payroll arranged with their employer. POLICY Title ACCEPTANCE OF GIFTS Document #. Section Revision # NEW Application Issue date Jan 1 2014 Issued By Director of Development Approved By Bethell Hospice Foundation Board of Directors Replaces Any employee of the Bethell Hospice Foundation or Bethell Hospice is eligible to make a donation through payroll deduction. These deductions must be a minimum of ten dollars ($10) per gift transaction. The funds donated through payroll deduction will be provided directly to Bethell Hospice. Charitable donations deducted from employment income are included in taxable income however, for the purposes of claiming charity tax credit, the charity donation amount will be reflected on a charitable tax receipt for gifts received through payroll deduction. To initiate a donation through payroll deduction, employees must notify the Bethell Hospice Finance Officer, in writing, of their desire to make payroll deductions. The Canada Revenue Agency (CRA) has strict guidelines regarding the provision of charitable tax receipts when gifts are a portion of funds received to pay for an event. Examples of such events include golf tournaments and silent auctions. Donors should contact the Charities Directorate at the CRA to discuss the details surrounding amounts eligible for charitable tax receipts prior to the event. For one time gifts, the Bethell Hospice Foundation will provide donors with a thank you letter to accompany tax receipts and mail both to the donor within twenty (20) working days. For donations that are received monthly, tax receipts will be sent out once a year in January following the year of the donation. If a Board member, employee or volunteer accepts a gift from a donor they are required to immediately forward the gift to the Director of Development or designate authorized to receive gifts. If an individual or corporation approaches a Board member, employee or volunteer regarding making a donation, they are required to direct that person/corporation to the Director of Development or designate. The Director of Development or designate is required to maintain a record of all gifts that are donated. The record shall contain: a description of the gift the name of the person and/or entity who made the gift the date of the gift Donors will be thanked for their gift in writing. The amount of a monetary gift will be specified. In the case of non-monetary gifts the thank you letter shall not make reference to the value of the gift. Letters of thanks will not include any statement regarding the tax implications of a gift. No statement of endorsement should appear in a thank you letter to the donor. The Bethell Hospice Foundation reserves the right to review any gift requests on a case-by-case basis, using the Gift Assessment Checklist, including seeking legal counsel where appropriate. References: Canadian Code of Practice for Consumer Protection in Electronic Commerce Related Forms: Gift Assessment Checklist Pledge Documentation