I group Medicaid and long-term care together because Medicaid is

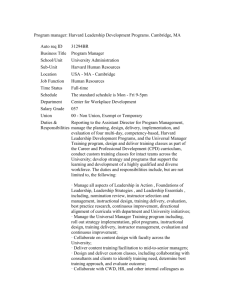

advertisement