Chapter 12 Comparison SCrCL

advertisement

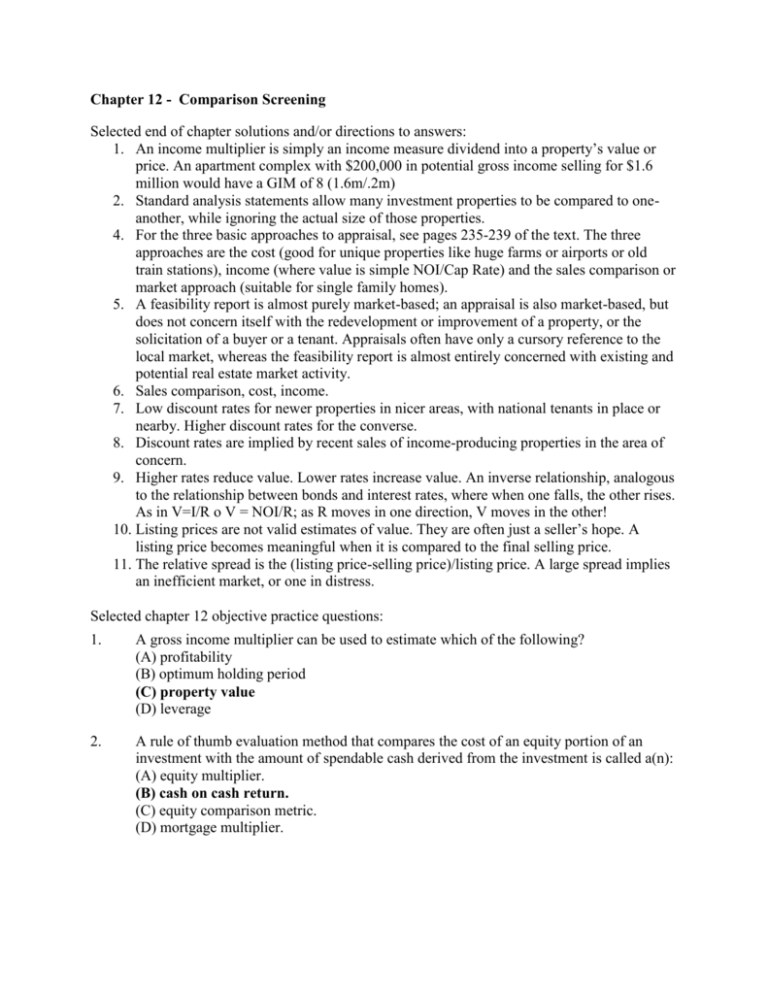

Chapter 12 - Comparison Screening Selected end of chapter solutions and/or directions to answers: 1. An income multiplier is simply an income measure dividend into a property’s value or price. An apartment complex with $200,000 in potential gross income selling for $1.6 million would have a GIM of 8 (1.6m/.2m) 2. Standard analysis statements allow many investment properties to be compared to oneanother, while ignoring the actual size of those properties. 4. For the three basic approaches to appraisal, see pages 235-239 of the text. The three approaches are the cost (good for unique properties like huge farms or airports or old train stations), income (where value is simple NOI/Cap Rate) and the sales comparison or market approach (suitable for single family homes). 5. A feasibility report is almost purely market-based; an appraisal is also market-based, but does not concern itself with the redevelopment or improvement of a property, or the solicitation of a buyer or a tenant. Appraisals often have only a cursory reference to the local market, whereas the feasibility report is almost entirely concerned with existing and potential real estate market activity. 6. Sales comparison, cost, income. 7. Low discount rates for newer properties in nicer areas, with national tenants in place or nearby. Higher discount rates for the converse. 8. Discount rates are implied by recent sales of income-producing properties in the area of concern. 9. Higher rates reduce value. Lower rates increase value. An inverse relationship, analogous to the relationship between bonds and interest rates, where when one falls, the other rises. As in V=I/R o V = NOI/R; as R moves in one direction, V moves in the other! 10. Listing prices are not valid estimates of value. They are often just a seller’s hope. A listing price becomes meaningful when it is compared to the final selling price. 11. The relative spread is the (listing price-selling price)/listing price. A large spread implies an inefficient market, or one in distress. Selected chapter 12 objective practice questions: 1. A gross income multiplier can be used to estimate which of the following? (A) profitability (B) optimum holding period (C) property value (D) leverage 2. A rule of thumb evaluation method that compares the cost of an equity portion of an investment with the amount of spendable cash derived from the investment is called a(n): (A) equity multiplier. (B) cash on cash return. (C) equity comparison metric. (D) mortgage multiplier. 3. A property appraisal prepared by a qualified professional provides the investor with (A) the true worth of a property (B) an outline of possible encroachments (C) a market study that relates to value (D) an estimate of value 4. The most important approach to value for an appraisal of a building rented to a grocery store would be (A) income approach (B) cost approach (C) feasibility approach (D) market approach 5. A principal difference between an appraisal and a feasibility study is the latter places greater emphasis on the: (A) physical structure. (B) comparative location. (C) competitive market evaluation. (D) area economy. 6. A property has an operating expense ratio of 40%, no vacancies, and a potential gross income of $100,000. What is the property’s value in a market applying a capitalization rate of 5%? (A) $1.2 million (B) $2.0 million (C) $600,000 (D) $800,000 7. A property has a breakeven ratio of 90%. Operating expenses are two-times the annual debt service. There are no vacancies. If operating expenses are $100,000 per year, what is the property’s potential gross income? (A) $133,333 ( B) $150,000 (C) $166,667 (d) $333,333