Walz saw the tax exemption for religious organizations as forcing

Student #2

U.S. Government B3

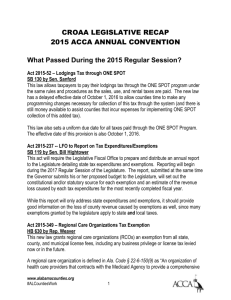

Section 1: Overview

In November of 1969, Frederick Walz, owner of property in Richmond County, New

York, sued the New York City Tax Commission on the grounds that property tax exemptions for religious organizations (i.e. Churches, Synagogues) indirectly forced him to support said organizations. The case, Walz v. Tax Commission of City of New York, addressed the issue of if property tax exemptions violated the Establishment Clause of the first amendment.

1

The case was decided May 4, 1970 and the ruling served to reinforce the opinion that the purpose of such tax exemptions is not to inhibit or advance religion.

2

Not only does the tax-exempt status of religious organizations force taxpayers to indirectly support them, but also to support the political stances and opinions of said organizations.

Section 2: Facts of the Case

Frederick Walz owned property in the state of New York. The New York Constitution allows religious bodies exemption from state property tax. Walz argued that this exemption forced him to indirectly support these religious organizations as he was paying more to compensate for the fact that they did not pay any. Furthermore, he argued that this exemption violated the First and Fourteenth amendments.

3

1 WALZ v. TAX COMMISSION OF THE CITY OF NEW YORK. The Oyez Project at IIT Chicago-Kent College of Law. 13

March 2013. <http://www.oyez.org/cases/1960-1969/1969/1969_135>

2 Ibed.

3 "Walz v. Tax Comm'n of the City of New York." Walz v. Tax Comm'n of the City of New York. N.p., 19 Nov. 1969.

Web. 14 Mar. 2013.

Section 3: Legal Issues and Problems Presented by Case

Walz saw the tax exemption for religious organizations as forcing him to indirectly support said organizations as he had to pay more property tax as the organizations were not taxed at all. Does this exemption really force Walz to contribute to religious organizations? Was the

Tax Commission’s exemption aimed at supporting religious organizations? Does such a tax exemption violate the separation of church and state guaranteed by the First Amendment? If so, then does it also violate the Fourteenth Amendment as New York is defying federal law? Would the taxation of religious organizations violate the First Amendment? Would taxation of religious organizations do more to entangle church and state than allowing them to be tax exempt?

Section 4: Discussion of Arguments for and Against

The central argument in allowing New York to continue such tax exemptions was that a tax exemption is not a sponsorship since the government does not transfer revenue to religious organizations.

4

Walz’s argument was that citizens were indirectly forced to support religious organizations, as they had to pay higher property taxes to compensate for the exemption.

The majority opinion, delivered by Chief Justice Burger, was in favor of the appellee, the

Tax Commission of the City of New York.

5

He cited the discussion of the historical background of the development of the First Amendment that took place in Everson v. Board of Education and Engel v. Vitale . During these cases the court determined that “the men who wrote the

Religion Clauses of the First Amendment, the "establishment" of a religion connoted sponsorship, financial support, and active involvement of the sovereign in religious activity.”

6

Justice Brennan concurred with the majority opinion, stating “Religious tax exemptions were not

4 Ibid.

5 Ibid.

6 Ibid.

an issue in the petitions calling for the Bill of Rights, in the pertinent congressional debates, or in the debates preceding ratification by the States. The absence of concern about the exemptions could not have resulted from failure to foresee the possibility of their existence, for they were widespread during colonial days.”

7

The majority opinion also states that the First Amendment does not say that in every and all respects there shall be a separation of Church and State, and as such, in either exempting or taxing religious organizations, there will be contact between the two. The opinion stated that since the two cannot be completely separated and the Establishment and Free Exercise Clauses of the First Amendment are not meant as statutes, that each incidence must be judged on a case by case basis to maintain a neutrality on religion that “is not so narrow a channel that the slightest deviation from an absolutely straight course leads to condemnation.”.

8

In short, the court determined that it is more permissible to exempt religious organizations than it would be to tax them, as long as tax exemptions do not favor specific religious groups.

Only Justice Douglas dissented. Stating that he believes “I would suppose that, in common understanding, one of the best ways to "establish" one or more religions is to subsidize them, which a tax exemption does.”

9

Like the other Justices, Douglas views there as being a line in what a state may do in regards to promoting religious activities, but unlike the other Justices he believes a tax exemption to be over the line. Furthermore Justice Douglas states

“the

Everson decision was five to four, and, though one of the five, I have since had grave doubts about it, because I have become convinced that grants to institutions teaching a sectarian creed

7 Ibid.

8 Duncan, Ann W., and Steven L. Jones. Church-State Issues In America Today. n.p.: Praeger, 2008. eBook Collection

(EBSCOhost). Web. 14 Mar. 2013.

9 Ibid

violate the Establishment Clause.”

10

In reference to Everson v. Board of Education which the

Chief Justice cited as establishing a precedent in the majority opinion.

Section 5: Agree or Disagree, and Defense of Thesis Statement

Despite the fact that taxation of religious organizations would result in more contact between church and state I disagree with the Courts decision, and I strongly believe that religious organizations should be subject to taxation. A tax exemption for religious organizations is an obvious violation of the Establishment Clause as it creates a situation in which individuals who are unaffiliated with religious organizations to pay higher tax rates, live in a country at a greater budget deficit, and to indirectly support tax-exempt religious organizations. Justice Douglas stated it perfectly in saying, “A tax exemption is a subsidy. Is my Brother BRENNAN correct in saying that we would hold that state or federal grants to churches, say, to construct the edifice itself would be unconstitutional? What is the difference between that kind of subsidy and the present subsidy?”. The obvious answer to his rhetorical question? There is no difference. In exempting religious organizations from taxes the government is promoting their growth by lowering their operating costs, a direct and inarguable violation of the First amendment. In addition, this promotion of growth supports the political beliefs of religious organizations by allowing them more funds to finance advertisements and protests. Tax exemptions for religious organizations result in a loss of an estimated $71 billion in tax revenue.

11

While this figure is probably inflated, it does open eyes to the impact of these unconstitutional exemptions.

10 Ibid.

11 "Council for Secular Humanism." Council for Secular Humanism . N.p., 15 Mar. 2013. Web.

15 Mar. 2013.

Since 1970 precedents set by Walz v. the Tax Commission of the City of New York have been applied to other cases including Elk Grove Unified School Dist. v. Newdow.

12 Which focused on the use of “under God” in the Pledge of Allegiance.

12 Ibid.