DOCX 255KB - Department of Industry

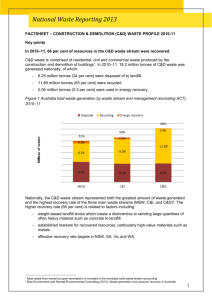

advertisement