Revenue Manual FY2013

advertisement

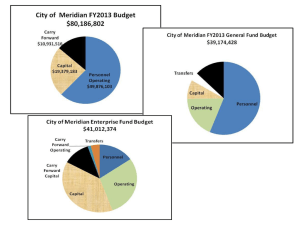

City of Meridian – Revenue Manual City of Meridian FY2013 Budget Revenue Manual IDAHO ECONOMIC FORECAST - DIV of FINANICAL MANAGEMENT On a quarterly basis the State of Idaho Division of Financial Management releases an economic forecast. The State of Idaho uses data and analysis from a company called Global Insight Inc. The Idaho economic forecast is of particular interest to the City in forecasting our revenue. Idaho economic indicators such as employment, population growth, job sector growth, and new construction are particularly relevant to the Treasure Valley. The Idaho Economic Forecast released in April 2012 for the period 2012-2015 (Volume XXXIV, No. 2) indicates slight improvements on the horizon in comparison to last year’s forecast. This is the result of some improvement in the national economy and because job growth in 2011 was stronger by a small percentage, than previously predicted. Idaho employment grew by .05% in 2011. Most of the improvement was in the nongoods producing sector which accounts for two thirds of Idaho’s nonfarm payroll. The nongoods producing sector consists of two categories: services and trade. The major service categories include information services, financial services, transportation, warehousing, and utilities, professional and business services, education and health services, and leisure and hospitality services. The trade category is split between retail and wholesale with retail being 75%. Service employment is expected to grow slightly faster than trade employment, 2.8% to 3% through 2015. Professional and business services are expected to pick up and be an important sector of the state’s employment as will be health and private education. The trade sector, namely retail also is expected to grow. This April unemployment marked the seventh straight month of decline falling to 7.7%. This percentage while an improvement is note worthy considering Idaho’s unemployment percentage before the recession was 3%! Mike Ferguson, Idaho’s former chief economist said “Idaho is characterized by having turned down earlier and deeper, and it’s turning around more slowly than other states.” In the period around 2010 to 2011 Idaho housing starts had fallen to 4,600, the lowest level since 1989. Construction jobs were at 30,000, the lowest level since 1995. The Gobal Insight forecast calls for construction growing 2.3% in 2013, 4.2% in 2014, and 3.6% in 2015. 1 City of Meridian – Revenue Manual The graph below illustrates that through the years the forecasts have been optimistic to say the least. However the Idaho Economic Forecast Housing Start Predictions line for the 2012 Housing Starts Forecast 2008 forecast and the Housing Starts Forecast 2009 FY2013 forecast 25,000 Housing Starts Forecast 2010 are identical and Housing Starts Forecast 2011 the FY2012 Housing Starts Forecast 2012 20,000 forecast hit the Housing Starts Forecast 2013 actual. This may 15,000 indicate that the industry has leveled 10,000 off instead of being in free fall. 5,000 0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 CITY of MERIDIAN ECONOMIC & POPULATION FORECAST In FY2010 Meridian sold 562 residential building permits, exactly the same number sold in FY2009 and the smallest number since FY1991 until FY2011. In FY2011 Meridian issued 483 building permits. In FY2008 commercial building permit sales were at an all time high of $1,316,153, the culmination of a five year over year increase in commercial building activity. In FY2010 commercial building permit sales dropped to $372,654 but did climb to $816,820 in FY2011. At the end of April 2012, halfway through FY2012, residential building permits are up 54% over the same period last year. Commercial building permits are also significantly exceeding FY2011 with the month of April being a single month sales record breaker. In April permits were issued for the Center Cal power shopping center at the corner of Fairview and Eagle Rd as well as for a 168,000 square foot office tower on the Scentsy campus. Building permit sales of course influence the Building Department revenue but also impact the amount of property tax the City will collect due to new construction. New construction for the tax year starting 1/1/2011 (FY2012) was valued at $96,073,750 with new construction for the tax year ending 1/1/2012 valued at approximately $128,659,413. The uptick in building permits sales occurring in the spring of 2012 indicate that new construction will increase over FY2013 when it is calculated for collection during the City’s 2014 fiscal year. The City of Meridian is located in Ada County, by far the state’s largest county. One quarter of the state population is in the metropolitan area of Ada County. The population of Meridian is one quarter of the entire population of Ada County. Unemployment in the City of Meridian as of April 2012 was 6.4% compared to 7.8% at the same time last year. The county unemployment 2 City of Meridian – Revenue Manual rate in April 2012 was 6.9% compared to the prior year rate of 8.2% with the State of Idaho at 7.7% compared to 8.7%. Per trulia.com the median sales price for homes in Meridian during the three months ending April 12, 2012 was $199,080. This is an increase of 17.1% compared to the last year. At the end of the week ending May 9th, 2012 Meridian had 604 homes listed for sale and 355 homes in foreclosure. So, the economic outlook is improving for the State of Idaho although the factors that marked the recession still exist; high unemployment, large inventory of housing, and lack of consumer spending. The City of Meridian’s economic improvement is ahead of the State as a whole, with lower unemployment rates and a larger percent of new construction. Meridian has the advantage of availability of assessable undeveloped land and also enjoys a higher per capita and median household income than both the State of Idaho and the national average. ct 20 30 S P re di ct 20 20 A S M P C O M P A S S P re di ct 20 10 re di C O C O M P A S S P al C en su s 20 10 A ct u 20 05 C en su s 20 00 al A ct u 19 95 19 90 C en su s When we use population forecasts in the report we are using the COMPASS (Community Planning Association of Southwest Idaho) demographic reports. COMPASS prepares both predictive demographic reports and estimates of annual actual populations (based on building data). The chart below illustrates the estimated historical population estimates compared to the census compared to the current COMPASS population estimates through 2030. COMPASS last updated their forecast in March of 2010 so it does not reflect the 2010 census. The COMPASS forecast for 2010 population was 81,950 whereas the census came back at 75,092. Since 2007 Meridian’s City of Meridian Actual Population Estimates and annual growth COMPASS Predictions rate has been between 2% and 160,000 3% and we 140,000 expect it to stay 120,000 100,000 in that 80,000 neighborhood 60,000 40,000 through 2015. 20,000 This rate is also 0 consistent with the population increase expected by the State of Idaho. The complete COMPASS Trend Forecast can be found on their website www.compassidaho.org REVENUE SOURCES City revenue comes from two principal sources; first, tax revenue that is used to finance services that cannot be provided on a fee per user basis such as public safety, parks, and city administration and two, fee revenue that results from charging a fee for the measurable use of a 3 City of Meridian – Revenue Manual service such as consumption fees for water and sewer or connection fees to connect buildings to utility lines in order to pay to increase capacity for drinking water and sewer service. The former are tracked in the General Fund and the later in the Enterprise Fund. Community Development is part of the general fund but also tracked separately because any excess of revenue over expense is directed to the Capital Improvement Fund. The Community Development Department has three division; Planning, Building, and Economic Development. Analysis and projection of revenue is essential to the City’s budget development process. Starting in budget year 2002 the City adopted a budget process that identified the cost necessary to maintain the current service and activity levels, referred to as the “base budget”. Estimated revenue minus base equals discretionary revenue, the revenue that is available to the City to use for program “enhancements”. Budget enhancements are additions to the budget for new programs or services to allow the City to provide that same service level in spite of population growth. The following graphs illustrate changes in the base budget and available discretionary revenue over time in the City’s two major funds. General Fund FY2013 Budget Discretionary Revenue $30,000,000 $25,000,000 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 Base Budget Discretionary Revenue Impact Fees Grant Revenue 4 City of Meridian – Revenue Manual Community Development Services Discretionary Revenue $6,000,000 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 -$1,000,000 -$2,000,000 Base Budget Discretionary Revenue Enterprise Fund Discretionary Revenue (Cash Basis - excludes depreciation expense) $25,000,000 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 Budget FY2006 Budget FY2007 Budget FY2008 Base Budget Budget FY2009 Budget FY2010 Budget FY2011 Budget FY2012 Budget FY2013 Discretionary Revenue 5 City of Meridian – Revenue Manual GENERAL FUND REVENUE The majority of general fund revenue comes from property tax. Other sources of revenue include state revenue sharing and other intergovernmental agreements, cable, electrical, gas franchise agreements, park impact fees and investment interest. These revenues fund the fire, police, parks, and city administration. The percent of contribution of each type of revenue to the general fund revenue “pie” changes little from year to year. Revenue is classified in the audit report illustrated in the sidebar to the right. TAXES FRANCHISE FEES Propertay tax revenue Gas Franchise Revenue Penalties & Interest Cable TV Franchise Revenue LICENSES & PERMITS Power Franchise Revenue Alcohol permits FINES & FORFEITURES Dog Licenses Parking Fines Building Permits Court Revenues INTERGOVERNMENTAL False Alarms State Liquor Apportionment Restitution State Sales Tax Sharing CHARGES For SERVICES State Revenue Sharing Park & Recreation Fees Rural Fire School Resource Revenue Grants Impact Fee Revenue INTEREST Planning Filing Fees as The only “service” that has been fully supported by user fee charges is the Building Department. The Building Department issues permits and conducts building inspections for both residential and commercial developments. The Planning Department also charges fees for services. The Building Department, the Planning Department, and Economic Development are divisions of the department Community Development. From FY2003 through FY2007 building permit fees generated revenue above and beyond expenses for both the Planning Department and the Building Department. The 6 City of Meridian – Revenue Manual City has an ordinance that this excess revenue be transferred to the Capital Improvement Fund to be used for general fund capital projects. Total actual audited general fund revenue for fiscal year FY2011 on a fund accounting basis was $32 million compared to an original budget of $30.7 million and a final amended budget of $31.5 million. FY2012 revenue is budgeted at $30.5 million and the actual is projected to be consistent with that amount. This total revenue number includes revenues and interest income that are available only for specific uses, such as the interest from the Public Safety fund, impact fees and interest, and Capital Improvement Fund interest. PROPERTY TAX Property tax is the City of Meridian’s largest source of general fund revenue. Property tax is calculated by Ada County based on State of Idaho code. The following is a brief summary of very complicated tax code that has changed many times since its inception. Idaho code limits the amount of property tax that cities can collect. Starting in the late seventies and continuing through the nineties, the Idaho Legislature passed numerous laws in response to taxpayers concern with increases in property tax. Finally in 1995, the Idaho legislature enacted code that limited property tax increases to 3% over the prior year. The first cap became effective in fiscal year 1997. Later code revisions allowed cities to apply the prior years levy rate to new construction and annexation. A quasi tax revolt started in 2005 with citizens protesting rapid increases in property tax bills. The building bubble resulted in the market prices of homes increasing by double digit percentages. The grumbling started in resort type areas where property values had increased substantially. The Idaho legislature convened an interim tax committee who conducted large public hearings all over the state. State law now requires the homeowner’s exemption to change each year as home values change. For tax year 2008 the maximum exemption was $100,938, for tax year 2009 the value was $104,471, for tax year 2010 the value was $101,153, tax year 2011 the value fell to $92,040, and for tax year 2012 it is $83,974. Meridian has traditionally had a low levy rate. During the eighties cities had various opportunities to increase the levy rate. Meridian, as a small town with few services, did not take advantage of them. The only way to increase the levy artificially is with a 60% vote. As will be discussed below the rapid decline in market values has resulted in a steep increase in Meridian’s levy rate compared to historical rates. 7 City of Meridian – Revenue Manual The levy rate is the percentage of each dollar of market value of a property that will be paid in property tax. Each year the rate “levied” against the taxable value of all properties is recalculated. The ability to include the value of new construction and annexation to arrive at the maximum property tax that can be levied has helped the City collect enough property tax revenue to keep pace during periods of rapid growth. Calculating the levy “rate” involves creating a fraction with the property tax dollar amount as the numerator and the total taxable value of the City as the denominator. An important item to note is that the City receives tax revenue a year in arrears from the date of the property valuation. At the writing of this report in May 2012 we used the preliminary Ada County Assessor number for new construction and taxable value. The total taxable value is not the final number. The Idaho Legislature passed legislation during the 2012 session that will allow developers to exempt certain site improvements such as roads and utilities from property tax. The legislation was made effective immediately in spite of opposition by the counties and cities. The counties did not have any mechanism in place to capture this information so it will be the last hour before we know what the dollar impact of this might be. We also still lose some new construction value due to previously passed legislation that allowed developers to change tax status from new commercial back to agricultural if their project is stalled. Cities will likely continue to face threats from state legislative changes made to property tax After several years of decline the City’s total taxable value has started to increase. For the tax year ending 1/1/2012 the value increased just over 8%. This is a marked change from last year’s decrease of 10.8% and the year before decrease of 9.21%. Construction values used to calculate the allowable property tax levy increased dramatically in fiscal years 2005 through 2008 and started to descend in FY09. The taxable value of new construction peaked in FY07 (tax year 2006) at $695,193,626. In contrast the new construction used to calculate last’s year’s property tax revenue was $96 million with the low being the year before at $93 million. This year new construction is up slightly at $128 million. 8 City of Meridian – Revenue Manual The following graph illustrates the components that make up the total dollar amount of tax the City receives each year. The base is the dollar amount of property tax levied the prior year increased by 3%. The new construction portion of the tax received is the value of new construction multiplied by the prior year’s levy rate. The annexation portion is recently annexed property value multiplied by the prior year levy rates. The City elected to not take the allowable 3% increase to base in FY2011 or FY2012. The FY2013 estimate does include the 3% allowable tax base increase. The last two years the City has not taken the base levy tax increase in consideration of the need to keep taxes low for property owners during the recession. The decrease in the taxable value of property meant that to sustain the same amount of property tax revenue the levy rate increased even without the City taking the allowable 3% to base increase. Although the levy rate changes look dramatic on the graph in actuality the increase in the levy rate was offset by the change in property value. Almost all residential property owners experienced significant declines in the value of their individual properties. 9 City of Meridian – Revenue Manual The graph below is a sampling of taxes paid by property owners in different parts of Meridian. STATE REVENUE SHARING State revenue sharing is the City’s second largest general fund revenue source. The State of Idaho collects a 6% sales tax however 1% is exempt from city and county revenue sharing. 13.75% of the collected sales tax is distributed to cities and counties. 7.75% is distributed into a program called Revenue Sharing – State Distribution, and 6% is distributed into a program called Revenue Sharing – County Distribution. The City portion is divided and distributed based on market value and population. The base is distributed based on the fourth quarter 1999 distribution plus 5%. The excess portion is then divided by population. House Bill 468 passed in the 2000 legislature created a new distribution formula for that portion of the state sales tax that had been known as the “Business Inventory Replacement”. The new revenue sharing combined the old Business Inventory Tax replacement portion with the sales tax distribution known as City-County Revenue Sharing. The state revenue sharing distribution remained the same but the amount is distributed like the state revenue, each city, county, and special district will be provided a new base. The base is the amount received for the fourth quarter of 1999. Additional growth in sales tax will be distributed to cities and counties according to population growth. Sales tax revenue sharing is often on the table each the State of Idaho legislative session. The State passed a temporary sales tax hike a few years ago to help get through a budget shortfall. This increase became permanent but was not shared with municipalities. There were a couple of bills on the table during the 2012 legislative session generally dealing with exemptions. One of the bills to decrease 10 City of Meridian – Revenue Manual exemptions, tax services, and lower the percentage did not make it out of committee. A second bill to collect sales tax from internet sales through the Streamlined Sales and Use Tax Agreement also did not make it out of committee. A third bill with an industry specific exemption did pass. Idaho sales tax steadily increased during the first part of decade. Revenue peaked in 2008 and then declined as the recession took hold in Idaho. By 2011 consumer spending started to creep upward and sales tax revenue reversed its downward course. The State is predicting sales tax revenue will continue to climb at a bit faster rate, in 2013. In 2008 Meridian’s share of state sales tax peaked at $3.5 million, falling to about $3 million from FY2009 through FY2011. When preparing for the FY2012 budget the City took a very conservative approach and budgeted $2.75 million. It looks like the actual revenue for FY2012 will be right around the $3 million mark and that is what has been budgeted for FY2013. LIQUOR TAX The City receives a portion of the State’s liquor sales surcharge. The State charges a 15% surcharge on liquor sold through the State Liquor Dispensary. The surcharge is distributed to cities, counties and specific programs. After distributions to alcoholism treatment, public schools, community colleges, the cooperative welfare account and the state general fund, the remainder was distributed between the counties and cities, 49% to counties and 60% to cities. For incorporated cities with liquor stores the distribution is based on the city’s proportion of total sales. Some portion of the overall city share is distributed to cities that do not have a liquor store based on their population. Meridian has three liquor stores. Unfortunately the State is in the process of reducing the 60% distribution to cities and counties to 50% by 2014. This means each year the distribution has decreased by 2%. Additionally the state has finished a repayment to cities and counties that resulted from a use of liquor funds to purchase water rights. The decease in the sharing percentage has been offset by the increase in the volume of sales and the revenue has remained between $450,000 and $500,000. For FY2013 it is budgeted at $490,000. RURAL FIRE The final piece of intergovernmental income the City receives is from the Meridian Rural Fire District. The City has an agreement with the District to provide service within the fire district boundaries. As the City’s boundaries grow, the Rural Fire District service area becomes smaller. 11 City of Meridian – Revenue Manual The Rural Fire District normally pays 20% of the City Fire Department operating expenses. By special agreement they have built fire stations and made other major capital improvements as well as picking up an additional operating expense reimbursement for specific periods of time. The City will be repaying the Rural District for some capital projects, such as Fire Station #5, with public safety impact fees as the City collects them. At the writing of this report it appears that the reimbursement for FY2013 is expected to remain at 20%. The actual reimbursement cannot be calculated until the Fire Department budget has been set however for the last five years it has been right around $1.5 million so we will use that number for the FY2013 budget. FRANCHISE FEES The state of Idaho allows cities to enter into franchise agreements with water, gas, electric, cable and solid waste collection providers. The percentage collected varies from 1% to 5% of the provider’s gross sales. Natural Gas – The franchise fee is 3% of gross (net of uncollected accounts) annual sales. The City currently has a 30-year franchise agreement with Intermountain Gas Company which expires January 7, 2017. Intermountain Gas lowered rates in 2010 resulting in revenue decreasing the next two years, additionally revenue will go up or down depending on the winter weather. It is anticipated that revenue will continue to stay around $650,000 for the foreseeable future. Cable – The franchise fee is 5% of gross sales. Cable franchise revenue is paid twice a year based on a calendar year. The existing agreement is for a term of 15 years and was renewed July of 2011. Over the past few years the revenue has gradually increased to slightly over $300,000 however decreased to under $300,000 in FY2011. We expect our revenue from the agreement to remain under $300,000 in FY2013. Electricity – Franchise fee is 1% of Idaho Power gross sales in Meridian. The City currently has a 25-year franchise agreement with Idaho Power, which expires November 1, 2023. As with gas, uncertainty over rate changes and weather makes predictions difficult. GENERAL FUND FRANCHISE FEES Actual FY2008 Description Natural Gas Actual FY2010 Actual FY2011 Budget FY2012 Budget FY2013 781,353 $ 804,270 $ 658,508 $ 673,082 $ 650,000 $ 650,000 Cable 331,190 334,158 324,010 295,742 285,000 280,000 Electricity 314,684 372,247 391,353 383,044 383,000 383,000 TOTAL $ Actual FY2009 $ 1,427,227 $ 1,510,674 $ 1,373,871 $ 1,351,868 $ 1,318,000 $ 1,313,000 12 City of Meridian – Revenue Manual PUBLIC SAFETY Court Revenue: The City receives ninety percent (90%) of all fines and forfeitures collected under Idaho Code. The number of infractions and the pay schedule of each is the basis for the City’s fine revenue. The penalty for an infraction is set in the payment schedule adopted by the Supreme Court order. The City contracts with the City of Boise to handle prosecution services, currently neither Meridian nor the City of Boise have been able to get access to the data controlled by Ada County needed to determine if 100% of total fine revenue is collected or if some of it is lost to delinquency. The amount of revenue collected is inconsistent varying in recent years from over $500,000 to $400,000. The relationship between the City and the Ada County court system is currently in contention as the County has alleged that the City should pay Ada County for use of the court for Meridian related cases. This dispute is not anywhere near resolution but at some point may eliminate any revenue Meridian receives and additionally require the City spend additional money to house a courthouse or pay for court costs. Due to the uncertainty over the timing and end result of this legal dispute court revenue is included in the FY2013 revenue budget. Animal Control and Adoption Fees: City code authorizes animal fees and fines to be charged for licensing and impounding domestic animals and for animal adoptions. Annual fee collections vary from $65,000 to $70,000. School Resource Officers: Meridian School District #2 has had an agreement with the Meridian Police Department to provide School Resource Officers at designated campuses and special events. The school district has paid approximately 47% of the officer’s wages (the cost of benefits is not shared). The agreement is for the school period; which starts in August and ends in June. PUBLIC SAFETY REVENUE Description Court Revenue School Resource Officers Actual F2008 Actual FY2009 Actual FY2010 Actual FY2011 Budget FY2012 Budget FY2013 $ 457,477 $ 401,432 $ 485,572 $ 424,426 $ 400,000 $ 400,000 . 167,167 223,548 224,629 224,608 200,000 200,000 Animal Control TOTAL 70,937 $ 695,581 63,122 $ 688,102 66,382 $ 776,583 69,045 $ 718,079 65,000 $ 665,000 65,000 $ 665,000 PARKS AND RECREATION Parks and Recreation Fees: Specific programs are charged fees, such as the summer recreation programs. The City Council is authorized by Idaho State Code to establish fees for certain services provided. Rates are separately set for each fee. Fee schedules are periodically reviewed and adjusted as necessary to cover related costs. There are two types of recreation programs. Adult sports revenue are fees collected for teams playing in leagues such as the softball league. Recreation program revenue is the revenue collected 13 City of Meridian – Revenue Manual from a wide variety of classes and activities organized through the City Parks Department. It includes revenue from the summer camp program and special events such as fun runs. The City sports and recreation programs continue to increase in popularity and participation. Park Reservations: Fees are charged for the reserved use of the City’s park shelters, baseball fields and special events held on City property. Revenue projections are based on the population growth, availability of park shelters, ball fields and weather. As the number of available shelters increases reservation revenue also increases. Facilities Lease: In October 1978, a 25-year lease agreement was signed between the City of Meridian and Cherry Lane Recreation, Inc. A 25-year time extension was put in place in 2001. During the years of this lease the City received $6,000 per year. During FY05 the leaseholder was changed to Lake View Meridian Investors and Boise Ranch Golf Course and the name of the course changed to Lake View. The golf course management contract was somewhat modified in FY2010. Since the management change in 2005 the City has not collected a lease fee and has actually provided some financial assistance for golf course improvement projects. Donations for Parks: The City has received small cash donations as well as larger donations of land, equipment or in-kind services. We do not budget for donations; they are only recorded when actually received. PARKS AND RECREATION REVENUE Recreation Programs Sports Programs Community Events Park Reserv Donations Actual FY2008 $109,602 $115,344 $17,437 $36,238 $95,665 $374,286 Actual FY2009 $125,648 $131,712 $13,565 $51,531 $36,570 $359,026 Actual FY2010 $106,920 $154,254 $16,250 $50,085 $327,509 Actual FY2011 $116,159 $173,791 $20,132 $56,401 $8,000 $374,483 Budgeted FY2012 $130,000 $156,000 $24,100 $50,000 Budgeted FY2013 $120,000 $175,000 $16,000 $56,000 $360,100 $367,000 IMPACT FEES The City has had park impact fees for several years. At the issuance of a residential building permit the City collects $1,384 (fee effective Jan. 1, 2008) per single family residence to use for new park development. The money is tracked in a separate account and is used only to develop new parks which maintain the current level of service. In December of 2006 the City instituted fire and police impact fees to help pay for the capital cost of constructing fire stations and paying for major equipment necessary due to growth. The Fire impact fee is $377 per residential building permit and .25 per square foot per commercial building permit. The Police impact fee is $85 per residential building permit and .06 per square for commercial building permits. 14 City of Meridian – Revenue Manual The impact fees can only be spent for the portion of capital construction that can be attributed to growth. The City has a capital outlay plan that defines what percentage of a planned project is due to growth and maintenance of the current level of service. Impact fees cannot be used to increase the level of service so their use is restricted. In addition, since the Rural Fire Department has paid for several capital construction projects for the City Fire Department (fire stations, training tower, etc.); impact fees collected for Fire will need to be returned to the Rural District. Impact fee revenue peaked for Parks in FY2005 at $2 million dollars compared to $733,220 in FY2011. Park impact fee collections for FY2012 are trending higher than the $600,000 budget however the amount budgeted in FY2013 for Parks, Fire, and Police remains conservative at $700,000, $280,000, and $60,000 respectively. LICENSES AND FEES The City collects fees for various licenses and permits. These fees are a minor percentage of general fund revenue and do not change significantly from around $45,000 year to year. The City Clerk’s Office plans to start selling passports and has determined that this will bring in $56,000. However, the revenue is offset by the need to hire additional staff. BUILDING AND DEVELOPMENT REVENUE Fees collected for building permits, inspections and planning and development services are General Fund revenue. These revenue sources are generated in the Community Development Services Department which includes the Planning Division, the Building Division, and Economic Development. Any excess of revenue over expenditures for this department are transferred to a fund set aside for general fund capital projects. Over 90% of the revenues collected in the Community Development Department are from the Building Division. The Building Division issues and collects money for building permits and performs building inspections. The Department contracts with inspectors who conduct building, electrical, plumbing, fire and gas inspections for residential and commercial building projects. These private inspectors are paid a percentage of the permit fees. Permit fees are based on the size and dollar value of the project. 15 City of Meridian – Revenue Manual Fees for the Planning Department cover the cost of development applications; site inspections, site and landscape plan reviews, certificates of zoning compliance etc. Effective January 2, 2002, the City Council approved new fees and increased fees to cover the costs that were not being recouped through the old fee structure. The fees were increased again in September of 2005. The new fees substantially increased fee revenue. Another new fee schedule became effective April 1, 2008. As with building permit sales, Planning Department revenue has dramatically decreased during this construction slow down. Both Building Department and Planning Department revenues are obviously tied to construction activity. When building growth drops, the revenue will drop correspondingly. The following graph provides a history of Community Development revenue. The first decade of the new century was boom and bust as far as the building industry. Residential building permits peaked in FY2005 with commercial building permits peaking in FY2008. Residential building permit sales started to slow in FY2006 and continued to drop until FY2008 remaining fairly flat from that point on. Defying the normal scenario that a spurt of commercial growth follows residential growth commercial growth shot upward in FY2012 and continues in that vein in FY2012. However many of the larger projects were planned a few years ago and put on hold during the worst of the recession. Although residential growth is picking up in FY2012 we are taking a cautious approach with revenue for our FY2013 budget. Commercial building is very hard to project and revenue varies drastically with the size of project. There are still several uncertainties on the horizon such as 16 City of Meridian – Revenue Manual economic uncertainties in Europe and the economic slowdown in China. Some economists feel the sudden burst of residential building in Idaho may not be sustainable. ENTERPRISE FUND The City provides water and sewer services on a fee basis. There are two separate fee structures. Water and sewer usage fees are charged for the day to day operation and maintenance of the existing utility infrastructure. Assessment (connection) fees are charged when a new property connects to the utility system and are to expand or extend the system to accommodate additional service demands. Connection Fees Connection fees peaked in FY2005 at $10.5 million. Since FY2009 they have been approximately $3 million dollars but a spark in building activity in FY2012 is resulting in pushing revenue over the $3 million dollar mark. In the FY2013 budget we increased our revenue to $3.4 million dollars. The assessment (or connection fee) is collected at the time the building permit is issued. For commercial assessments, Public Works makes a determination of the amount the business will use, referred to as “ERU” or “equivalent residential unit”. For example, a business might be assessed 10 ERU’s, which means that they will use an amount of water equivalent to the amount 10 homes would use. 17 City of Meridian – Revenue Manual When a new residential property connects to the City Sewer and Water systems, the homeowner is assessed $2,749 for a sewer connection and $1,794 for a water connection. Utility Fees The City of Meridian started the decade with 12,000 individual utility accounts and by mid-year FY2012 there are just over 27,000 accounts. The City has two sets of fees: a fee for water usage and a fee for sewer usage. Water and sewer usage revenues have grown steadily with the growth in customer accounts and various small rate increases. However the costs to operate the utility systems, particularly the sewer system, outpaced revenue growth. The sewer system is more costly to operate than the water system. To address this problem the City approved a fixed cost rate increase for water and sewer usage effective in three installments over three years. Rates were increased in FY2009 and FY2010 but the FY2011 rate increase was cancelled. The City was hesitant to impose another rate increase during a sluggish economy and opted to postpone projects until growth picks up again. On an annual basis the City forecasts operating and capital costs for a five year period to determine if fees are sufficient to operate the system, keep up with growth, and meet regulatory requirements. WATER The rate consists of two components: Base (minimum charge) – Administrative costs that stay fixed regardless of the level of operation. For example, billing and accounting services. Even if the account has zero usage this rate will be charged. Volume Charge – Covers the direct costs of providing the service, costs tend to fluctuate with the quantity of output. Such costs include maintenance and repairs, depreciation of assets and plant labor. The fee structure is as follows: The base fee is $5.38 The volume charge (cost per 1000 gallons) is $1.86 Projecting water sales is not clear cut. Factors like weather, length of the irrigation season and water conservation are impossible to predict. Water revenue changes from year to year are somewhat erratic. Most new subdivisions in Meridian have pressurized irrigation and do not need to use City water to water their landscaping. The number of water accounts has increased steadily during the mid-decade building spurt but has now slowed to less then 2% per fiscal year. FY2011 water sales were just under $6.8 million dollars with the budget for FY2012 at $6.7 million dollars and the FY2013 budget at $6.9 million dollars. 18 City of Meridian – Revenue Manual SEWER The fee structure is as follows: The base fee is $8.48 The volume charge (cost per 1000 gallons) is $5.43 The philosophy and methodology for the monthly user sewer charge is the same as the water charge with one change. The system cannot separate water used outside the house from water used inside the house. Water used inside the house goes into the sewer system. So, to calculate the sewer rate for each user the City averages the gallons used by the homeowner during the four winter months December, January, February and March. This is based on the assumption that no water is used outside the house during those months. This averaged rate is recalculated on an annual basis. FY2012 revenue was budgeted at $11.8 million dollars with FY2013 revenue budgeted at $ 12.2 million dollars. Actual FY2011 revenue was $11.9 million dollars. PUBLIC WORKS REVIEW FEES The Public Works Department charges fees for providing certain services such as review of development applications, inspections, site plans, and water, sewer and drainage system inspections. During the building boom these fees have generated up to $500,000 per year. However the last few years’ fees have been between $35,000 and $40,000. For FY2013 budget we are budgeting $40,000. Sanitary Service Administration Fee The City has contracted with a private company, Sanitary Services Co to provide garbage pick-up service since April 1, 1997. During FY2012 SSC was purchased by another trash hauler, Republic Services, however the contract remains the same. The City receives 6% of gross sales for an administration fee because the City does all of the billing and collection. The City includes the garbage collection charge on its utility bills and remits it to the contracted trash hauler. SSC administrative fee revenue increased annually until FY2008. About that time residential growth rates started to slow and construction dumpster accounts decreased significantly. In the spring of 2010 the City switched from unlimited pick-up to an automated can collection system with free recycling. Revenues for FY2011 at $511,760, under the new rate structure were 6% over FY2010. From FY2011 to FY2012 revenues are up about 3%. We set the FY2013 budget at $500,000. 19 City of Meridian – Revenue Manual Other Income Various other departments within the utility charge small fees for other services such as making arrangements for property managers to direct the services bill to the tenant, rental of hydrant meters for construction, and certain inspections and reviews. INTEREST INCOME All of the City of Meridian’s funds have cash and investment balances that generate interest. The City’s investment vehicles are in accordance with the Idaho code. The City retains an investment advisor who, for an annual fee of a quarter of a percent of the dollar amount invested, maintains a portfolio of certificates of deposit, and government bonds of varying maturities. The City’s checking account balances, held at Bank of The Cascades are currently 100% insured under the NOW FDIC insurance program. NOW insurance is temporary unlimited insurance for government accounts earning no interest. The City also invests in the State of Idaho investment pool. The pool behaves somewhat like a money market account; it is highly liquid with no restrictions on deposits or withdrawals. Due to the lack of restrictions on allowable withdrawals the interest rate is generally low. The State of Idaho allows local governments to invest in its diversified bond fund. Fees for participating in the bond fund are minimal. This fund is considered to be a longer term investment and withdrawals and deposits are limited. The graphs below show the City’s investment portfolio and interest rates as of May 31st, 2012. At the writing of this report in May of 2012 the City was earning an average of less than 1% on our total investment portfolio. For the fiscal year ended 2007 the City earned almost $3.5 million dollars on a portfolio of $45.8 million dollars. In stark contrast for the fiscal year ended 2012 the City will likely only earn $400,000 on a portfolio of about $68 million dollars. On a hopeful note we are budgeting FY2013 interest revenue at $428,000, for FY2013. 20 City of Meridian – Revenue Manual ACTUAL YEAR-END CASH AND INVESTMENT BALANCES General Fund Impact Fee Fund Public Safety Fund Develop Serv/CIP Fund Enterprise Fund Total City YE FY07 $22,395,898 $2,356,215 YE FY08 $15,778,460 $2,192,009 YE FY09 $17,762,377 $1,982,180 YE FY2010 $21,716,017 $1,964,241 $4,895,585 $38,916,598 $5,434,155 $26,926,585 $2,204,535 $28,834,247 $2,519,705 $31,002,315 YE FY2011 $18,626,778 $2,980,470 $2,089,202 $4,732,850 $32,667,245 $68,564,296 $50,331,208 $50,783,338 $57,202,278 $61,096,545 ACTUAL FISCAL YEAR INTEREST INCOME BY FUND General Fund Impact Fee Fund Capital Imprv Public Safety Enterprise Fund Develp Services Total City Actual FY07 Actual FY08 Actual FY09 Actual FY2010 Actual FY2011 $918,038 $845,980 $511,534 $432,118 $248,059 $124,803 $63,759 $55,804 $16,228 $21,967 $261,244 $66,521 $14,954 $2,981 $4,159 $29,348 $2,228,460 $1,141,833 $907,521 $489,414 $386,311 $102,659 $31,010 $22,361 $9,478 $13,000 $3,635,204 $2,149,103 $1,512,175 $950,220 $702,844 Estimated FY2012 Budget FY2013 $170,000 $170,000 $16,000 $16,000 $2,000 $2,000 $240,000 $240,000 $428,000 $428,000 The General Fund is the fund for the general activities of the City. Revenues and expenses for public safety, parks and recreation, and general administration go through the General Fund. The largest source of revenue flowing into the General Fund is property tax. The City always maintains a four month operating reserve in the General Fund, the rest of the balance is referred to as unrestricted. Unrestricted funds are available to use for capital projects and/or to provide an additional safety margin. CIP stands for Capital Improvement Fund. The Development Services Fund was used to account for the Building Department and the Planning Department. Any excess in the Development Services Fund over operating reserves was transferred to the Capital Improvement Fund. This model worked well when the City’s building permit revenue was rapidly growing. Once the building boom stopped Building Department revenues were not sufficient to support the Building and Planning Department. Technically these functions are general fund functions and reported that way in the audited year-end financial statements. Starting in FY2012 the Development Services Fund was merged into the General Fund. We do continue to isolate Planning and Building revenue and expenses and should there be an excess of revenue over expense again those funds will be transferred to the Capital Improvement Fund. Impact Fund is used to segregate impact fees for Fire, Police and Parks that are collected when building permits are sold. This fund is restricted and may only be used for designated capital projects. The Enterprise Fund balance is the fund used for the water and sewer utility operations. The fund balance is used to provide operating and other reserves and as a source of funding for large infrastructure projects. 21 City of Meridian – Revenue Manual FY2013 REVENUE BY FUND Attached are the budgeted FY2013 schedules of revenue by fund. For questions or additional information concerning the material in this report please contact the City of Meridian Finance Department by phone at 489-0419 or by email at skilchenmann@meridiancity.org. CAPITAL IMPROVEMENT FUND Revenues Interest Actual Actual Actual Actual Actual Budget Budget FY2007 $214,390 FY2008 $63,056 FY2009 $14,523 FY2010 $1,657 FY2011 $4,159 FY2012 $1,000 FY2013 $2,000 COMMUNITY DEVELOPMENT Actual Actual Actual Actual Actual Budget Budget FY2007 FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 $3,752,683 $330,165 $4,082,847 $3,450,564 $230,636 $3,681,200 $2,212,842 $127,410 $2,340,252 $1,938,875 $125,963 $2,064,838 $2,371,844 $134,293 $2,506,137 $1,808,000 $135,000 $1,943,000 $2,135,000 $135,000 $2,270,000 Interest $98,933 $36,365 $20,671 $8,552 $13,000 $10,000 $0 Miscellaneous $65,291 $16,858 $29,581 $19,240 $660 $0 $0 $4,247,071 $3,734,423 $2,390,505 $2,092,630 $2,519,797 $1,953,000 $2,270,000 Revenues Building Perm its & Fees Planning Fees Total charges for services TOTAL REVENUE ENTERPRISE FUND Revenues Actual Actual Actual Actual Actual Budget Budget FY2007 FY 2008 FY2009 FY2010 FY2011 FY2012 FY2013 Charges for services: Water revenues 4,324,846 5,271,449 5,830,195 6,390,976 6,756,589 6,700,000 6,920,000 Sew er revenues 6,052,325 6,411,722 7,862,962 10,436,067 11,912,510 11,800,000 12,248,000 Sale of m eters 325,007 201,737 153,663 141,479 125,448 150,000 150,000 Engineering Fees 339,487 170,066 51,331 63,505 62,418 45,000 55,000 Trash Billing Service 475,587 483,148 511,761 500,000 500,000 331,874 367,676 432,428 362,019 488,669 325,000 325,000 Interest Incom e 1,904,725 1,282,178 672,301 430,820 386,311 425,000 240,000 Water connections 2,256,295 1,855,581 1,270,867 1,188,783 1,080,403 1,150,000 1,300,000 Sew er connections 3,063,556 2,709,045 2,017,216 1,834,076 1,807,672 1,900,000 2,150,000 18,598,116 18,269,453 18,766,549 21,330,873 23,131,781 22,995,000 23,888,000 Miscellaneous TOTAL REVENUE: Operating Revenue Capital Projects Revenue - - 11,373,540 12,422,650 14,806,166 17,877,194 19,857,395 19,520,000 20,198,000 7,224,576 5,846,804 3,960,383 3,453,679 3,274,386 3,475,000 3,690,000 22 City of Meridian – Revenue Manual GENERAL FUND Revenues Actual Actual Actual Actual Actual Budget Budget FY2007 FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 Property Tax Base + New Construction $13,434,463 $15,679,063 $17,060,769 $18,784,574 $19,416,599 $19,335,124 $19,915,560 $13,434,463 $15,679,063 $17,060,769 $18,784,574 $19,416,599 $19,335,124 $20,491,577 24% 17% 9% 10% 3% 0% 3% Alcohol licenses $53,196 $42,385 $50,312 $53,725 $53,675 $50,000 $52,000 Dog License/Adoption $69,650 $70,937 $63,122 $66,382 $69,045 $65,000 $65,000 Miscellaneous $11,462 $5,073 $10,949 $16,717 $16,645 $5,000 $60,925 $134,308 $118,395 $124,383 $136,823 $139,365 $120,000 $177,925 Allow able Increase $576,017 Licenses and Perm its Total licenses-perm its Intergovernm ental State liquor apport. $418,775 $458,546 $496,850 $474,307 $489,949 $450,000 $490,000 State revenue sharing $3,388,596 $3,568,686 $3,126,994 $3,012,053 $3,087,105 $2,750,000 $3,000,000 Rural Fire $1,012,107 $1,504,890 $1,488,522 $1,407,660 $1,598,137 $1,569,061 $1,500,000 $46,621 $101,425 $288,824 $603,269 $719,885 $709,074 $645,000 $4,866,099 $5,633,548 $5,401,189 $5,497,288 $5,895,076 $5,478,135 $5,635,000 $1,307,324 $1,427,227 $1,510,674 $1,373,872 $1,351,868 $1,320,000 $1,313,000 $523,639 $457,477 $401,432 $485,572 $424,426 $400,000 $400,000 $19,469 $28,483 $35,222 $25,987 $9,670 $5,000 $543,107 $485,960 $436,654 $511,560 $434,096 $405,000 $400,000 School Resource Officer $159,876 $167,167 $223,548 $224,629 $224,608 $200,000 $200,000 Sanitary Service Adm in $399,427 $488,609 $0 $0 $0 $0 $0 $24,310 $19,300 $25,850 $107,971 $85,994 $20,000 $20,000 $171,211 $242,384 $270,925 $277,424 $310,082 $301,000 $311,000 $35,389 $36,238 $51,531 $50,085 $56,401 $50,000 $56,000 $7,632 $6,730 $32,609 $54,946 $41,095 $4,000 $4,000 $797,845 $960,428 $604,462 $715,056 $718,180 $575,000 $591,000 $810,877 $777,328 $381,766 $383,100 $277,407 $300,000 $170,000 Grants Total intergovernm ental Franchise Fees Fines and forfeitures Court Revenue Other Total Fines and Forfeitures Charges for Service Special Events Recreation program s Park Reservations Rental Incom e Total charges for services Interest Unrestricted Miscellaneous Rent $0 $0 $0 $0 $0 $0 $0 Donations $335,183 $61,047 $245,961 $90,485 $54,634 $14,000 $4,000 Miscellaneous $135,936 $282,400 $64,321 $11,804 $92,942 $100,000 $35,000 $471,120 $343,447 $310,283 $102,288 $147,575 $114,000 $39,000 Park Im pact Fees $891,706 $1,039,104 $757,938 $753,830 $711,299 $600,000 $700,000 Fire Im pact Fees $445,555 $523,836 $241,814 $266,060 $335,697 $275,000 $280,000 Police Im pact Fees $103,116 $126,770 $54,824 $64,732 $77,720 $65,000 $60,000 $1,440,377 $1,689,710 $1,054,575 $1,084,622 $1,124,716 $940,000 $1,040,000 $114,947 $76,603 $44,180 $25,803 $21,967 $20,000 $16,000 $23,920,467 $27,191,708 $26,928,937 $28,614,986 $29,526,850 $28,607,259 $29,873,502 Total Miscellaneous RESTRICTED Im pact Total Im pact Revenues Interest Restricted TOTAL REVENUE Incom e Restricted Incom e Unrestricted $1,555,324 $1,766,313 $1,098,755 $1,110,424 $1,146,683 $960,000 $1,056,000 $22,365,143 $25,425,396 $25,830,182 $27,504,561 $28,380,167 $27,647,259 $28,817,502 23