The Evaluation of Chinese Crop Insurance in Farmer`s

advertisement

The evaluation of Chinese Crop Insurance in farmer’s perspective

1

Ke Wang, 2Qiao Zhang, 3Shingo Kimura and 4Suraya Akter

1 Ke Wang is a Ph.D. Student of Graduate School of CAAS, assistant professor at Agricultural Information Institute of CAAS

and Key Laboratory of Digital Agricultural Early-warning Technology of Ministry of Agriculture of China. Address: No.12 South

Zhongguancun St. Beijing 100081 China. Tel: 86-10-5949 2969; Fax: 86-10-8210 6261. E-Mail: wangke01@caas.cn

wangkeable@gmail.com

2 Qiao Zhang is a professor at Agricultural Information Institute of Chinese Academy of Agricultural Science (CAAS) and Key

Laboratory of Digital Agricultural Early-warning Technology of Ministry of Agriculture of China. Address: No.12 South

Zhongguancun St. Beijing 100081 China.Tel: 86-10-8210 9883; Fax: 86-10-8210 6261. E-Mail: zhangqiao@caas.cn

3 Shingo Kimura is a senior researcher at Trade and Agricultural Directorate of Organization for Economic Cooperation and

Development (OECD). Address: 2 rue André-Pascal; 75775 Paris Cedex 16. Tel: +33 (0) 1 45 24 95 35; Fax: +33 (0) 1 44 30 61

01; E-mail: shingo.kimura@oecd.org

3 Suraya Akter is a Ph.D. Student of Graduate School of CAAS, Address: No.12 South Zhongguancun St. Beijing 100081 China.

E-Mail: surayabd78@gmail.com

Abstract

Purpose - This paper aims to evaluate the effectiveness of the Chinese crop insurance program in

terms of farmer utility and welfare.

Design/Methodology/Approach – A simulation model based on the power utility function was first

developed to evaluate the effectiveness of crop insurance. Then, the Monte Carlo approach was used

to generate the datasets of area, price, yield, cost, and income based on the characteristics of

representative farmers, which were clustered and calibrated using the farm-level data of 574

individual farmers from five Chinese provinces. Finally, the effectiveness of Chinese crop insurance

was evaluated by comparing the certainty equivalence (CE) of farmer’s utility/welfare under

alternative crop insurance scenarios.

Findings - Government subsidy is a necessary premise for implementing the crop insurance program.

The government should subsidize more than 50% of the crop insurance premium to motivate more

farmers to participate in the program. The findings also show that the current crop insurance program

in China has increased the welfare of farmers but still need to be improved to achieve the Pareto

improvement and to make full use of the financial fund of the government.

Originality/Value- The current study is the first to quantitatively evaluate the effectiveness of Chinese

crop insurance according to the welfare of individual farmers. This paper is believed to not only extend

academic research but also contribute to the better design of the Chinese crop insurance program.

Keywords:

Paper type:

Crop insurance, effectiveness evaluation, expected utility model, China

Research Paper

Introduction

Agriculture is an important industry for almost all countries, especially for developing countries with

high population density such as China. However, agriculture is also considered a high-risk sector

because it continually faces risks in production due to adverse weather conditions that farmers cannot

control. Droughts, floods, and other natural disasters may result in serious consequences, such as crop

failure, poverty, and food insecurity. To minimize the effect of adverse weather on the income of

farmers, more than 100 countries have conducted crop insurance program (Mahul & Stutley, 2010).

The Chinese government has also paid more attention to developing a crop insurance program. The

Chinese agricultural insurance program has been very successful since its establishment in 2007, when

the central government began to provide a premium subsidy. The premium of Chinese agricultural

insurance rose to CNY 24.6 billion (appropriately USD 4 billion) in 2012 from CNY 5.2 billion in 2007

and CNY 24.06 billion in 2012. Until now, China is the first and the second agricultural insurance

market in terms of premiums in Asia and in the world, respectively (CIRC*).

Along with rapid development, the Chinese government had allotted an increasing fund to subsidize

crop insurance program. Now, the Chinese government subsidizes more than 70% of crop insurance

premiums. In 2012, the central government of China, who can afford to pay 40%-50% of the premium

subsidy, had paid CNY 10 billion to the agricultural insurance program. At the same time, the low

insured value of the Chinese crop insurance program was criticized in China. Current Chinese crop

insurance only covered some of the physical costs during crop planting, which account for 25% to 40%

of crop returns. Thus, government officers, agricultural economists, and farmers argue that the insured

value of crop insurance is excessively low and may be of no use for farmers. Therefore, the serious

question of valuing Chinese crop insurance has been proposed, and the effective evaluation of the

Chinese crop insurance program in China was highlighted.

In the literature from the end of the 1990s, agricultural economists began to study the effect of crop

insurance, revenue insurance, hedging, loans, and other risk management tools. Certain scholars

investigated the effect of crop insurance on agricultural production (Coffey, Skees, Dillon, & Anderson,

2001; Hennessy, 1998; O'Donoghue, Key, & Roberts, 2005), and some explored the effect of crop

insurance on farmer welfare (Chen, Wang, & Makus, 2007; H. Holly Wang, Hanson, Myers, & Black,

1998). Other scholars studied the interaction of alternative risk management tools (Antón & Kimura,

2009; Keith H Coble & Heifner, 1998; K. H. Coble, Miller, Zuniga, & Heifner, 2004; H Holly Wang,

Makus, & Chen, 2004). Most of them had evaluated the effect of risk management tools under the

*

China Insurance Regulatory Commission: http://www.circ.gov.cn

expected utility framework and conducted empirical studies that adopted a robust stochastic simulation

approach. However, in China, the majority of studies focused on the theoretical discussion of the

necessary and potential effect of subsiding crop insurance (Tuo, 2003; Zhang et. al, 2005; Wu, 2005;

Shi, 2008; Hou et al, 2010), with the exceptions of Zhang & Shi (2007) and Sun & Zhong (2008).

Zhang and Shi (2007) investigate the crop insurance effect in theory by analyzing the issues of crop

insurance subsidy and social welfare, but he fails to conduct an empirical study. Sun and Zhong (2008)

estimated the net welfare of subsidized crop insurance by calculating the willingness of farmers to pay

(WTP) based on survey data. However, this approach, compared to the stochastic simulation approach,

lacks the feasibility to be used for hypothesis research.

Agriculture insurance is initially designed to stabilize the income of farmers by helping them fight

against yield loss due to adverse weather. Thus, evaluating the effect of crop insurance according to

farmers is valuable and meaningful. However, no studies evaluate the effectiveness of the Chinese crop

insurance program from the perspective of farmers and no studies have adopted the stochastic

simulation approach, which has the advantage of analyzing the interactions among different policies,

allowing the analysis of the possible consequences of modifying crucial points in each policy (Kimura

& Thi, 2011). This study is the first to conduct a quantitative assessment of Chinese crop insurance

effectiveness based on the welfare of individual farmers. In this paper, using farm-level data of 574

individual farmers from the provinces of ShanDong (SD), HeNan (HN), JiangSu (JS), SiChuan (SC),

and Shan’Xi (SX), the effectiveness of Chinese crop insurance is evaluated by comparing the certainty

equivalence (CE) of the utility/welfare of representative farmers under alternative crop insurance

policy scenarios. This paper is believed to not only extend academic research but will also contribute to

the better design of the Chinese crop insurance program.

The rest of this paper is organized as follows: the second section describes the methodology. The

sample data and empirical results are shown in the third section. The fourth section presents the

discussion based on empirical results, and the conclusion and policy implications are presented in the

final section.

Method

The basic idea to evaluate the effect of Chinese crop insurance in this paper is to compare farmer

welfare in alternative scenarios. Four scenarios, including no crop insurance (NOCI), Chinese current

crop insurance (CCI), modified crop insurance (MCI) and directly subsiding farmers (DSF) are

hypothesized in this paper. The process to achieve this goal can be divided into four steps.

Step 1: Estimating farmer welfare

In economic theory, using expected utility is the most general approach for comparing risky choices

and studying risk behaviors under uncertainty. Thus, a simulation model based on expected utility

function was developed in this paper to estimate farmer welfare. Similar to previous studies (K. H.

Coble, Heifner, & Zuniga, 2000; Lin, 2001; Turvey, 1992; H. Holly Wang et al., 1998), this paper also

adopted the power utility function (Eq. 1) to compute for farmer utility.

U(w0 + w) =

1

1−𝜃

(𝑤 + 𝑤0 )(1−𝜃)

(1)

Where θ depicts the constant relative risk aversion (CRRA) and was set to 2, 4, and 6, respectively,

to test the robustness of the analysis. Moreover, w0 depicts farmer’s initial wealth, and w is farmer’s net

income, which can be expressed as Equation (2)

w = 𝑤0 + ∑ 𝑃𝑖 ∗ 𝑌𝑖 ∗ 𝐴𝑖 + 𝑓𝑎𝑟𝑚𝑖𝑛𝑐𝑜𝑡ℎ𝑒𝑟 + 𝑜𝑓𝑓 + 𝑇𝑟𝑖𝑛𝑐𝑜𝑚𝑒 + 𝑍𝑐𝑖𝑛𝑐𝑜𝑚𝑒 − 𝑐𝑜𝑠𝑡 + 𝐼𝑛𝑑 − 𝑃𝑟𝑒 + 𝑠𝑢𝑏

(2)

Where Pi is the output price of crop i, Yi is the output yield of crop i, Ai is the area of land

cultivated for crop i, and farminc_other is the farm income from minority crops, livestock, and other

agricultural production activities. Off is the income obtained from working in a city and other non-farm

activities, cost is the crop planting costs, including physical cost and labor cost, Ind and Pre is the

indemnity and premium* of crop insurance, respectively, and sub is the Gov. Premium subsidy for crop

insurance. The indemnity and premium of crop insurance can be calculated as follows:

Ind = A ∗ Ivalue ∗ max(

(1−𝑎)∗𝑦𝑡−𝑦

𝑦𝑡

, 0)

(3)

Where A is the insured acreage, Ivalue is the insured value per unit (which equals price times yield

per unit times coverage level), a is the deductible level, yt is the regular yield in a normal year, and y is

the actual yield.

Given that the CE is the guaranteed amount that has the same utility as farmer’s excepted utility in risk

prospect but has the advantage of being easily compared, the certainty equivalent of farm income is

used to compute for farmer’s welfare within a given level of risk aversion.

1

𝐶𝐸 = {(1 − 𝜃)𝐸[𝑈(𝑤0 + 𝑤)]}(1−𝜃) − 𝑊0

(4)

Step 2: Defining representative farmers

The contribution of crop insurance to farmer welfare may be different to different farmers, depending

on the individual characteristics and risk exposures of farmers. Thus, the problem of which welfare

should be chosen as the standard for evaluating crop insurance first needs to be addressed. The most

standard method is defining the representative farm. This approach is widely used in previous studies

and has the advantage of producing results that are easily interpreted and flexible structures for

carrying out a large number of scenarios (Kimura & Thi, 2011). When defining the representative farm,

ensuring that the representative farm fully reflects the risk exposure of farmers is important. In this

paper, the cluster analysis approach is adopted to group the sample farms into several clusters that are

homogenous in terms of risk characteristics. Specifically, hierarchical clustering analysis is applied to

group farmers in a province into several homogenous clusters according to the variance of agri. income

and the proportion of agri. income to household income.

Step 3: Calibrating risk characteristics of individual farmers

Given that, in a region, the good yield of one farmer may be offset by another farmer with a serious

yield loss, assessing farmer production risk using aggregated data can be misleading (Ketih H Coble,

Dismukes, & Thomas, 2007). Micro data from agricultural planting and agribusiness are used to

calculate and aggregate the characteristics of individual farmers to calibrate the characteristics of

representative farmer. To calibrate risk exposures, the crop yields of individual farmers are detrended at

the county-level† to eliminate the influence of technology improvement. In addition, all monetary

* Note, in theory, premium of crop insurance should be calculated based on actuarial principles. The current premium of crop

insurance, however, is set based on intuitional experiences in China. Thus, when we evaluate the effectiveness of current crop

insurance, the premium is provided based on current crop insurance policies in China instead of being calculated.

†Given that the panel data of agricultural production is short (only six or seven years), historical data collected for

variables such as price and income are deflated to avoid the effects of inflation. Rural CPIs are adopted

to deflate all monetary variables including price, agricultural income, off income, and covert nominate

price into real price at the base year. Log-linear trends are estimated to get the annual percentage

growth of yield at the region level.

Log(Yt ) = a + b ∗ t + ε

(5)

Where Yt is the yield level at the county level in year t, and b can be estimated by log-linear

regression to indicate the annual percentage growth of yield. Subsequently, b is subtracted from

individual observations to estimate the yield risk of individual farmers, as shown in Equation (6).

Dyit = yit + yi1 ∗ (1 − (1 + b)t−1 )

(6)

Where 𝐷𝑦𝑖𝑡 is the detrended yield for farmer i in year t, 𝑦𝑖𝑡 is the yield observation of farmer i

in year t, and yi1 is the yield observation of farmer i in the base year.

After the micro data of farmers are detrended or deflated, the statistic features (mean, standard

deviation) of yield, price, cost, and returns from crop. Other farming and off-farm data are calculated

by crops, by cluster, and by province. The correlation coefficient of yield and price by crops are also

calculated to reflect agricultural production diversity and the relationship of yield and price.

Step 4: Calculating representative farmer’s welfare using simulated approach

Although following the methods in Steps 1 to 3, representative farmer’s welfare could be calculated

using historical data. Thus, we use the stochastic simulation approach in this paper to estimate farmer’s

welfare because a) the time span of micro-level historical data is usually limited and unbalanced; b) the

simulation approach allows us to specify a joint price and yield generating process that reflects actual

conditions (H. Holly Wang et al., 1998); and c) the simulated approach has the advantage of analyzing

the interactions among different policies and allows us to analyze the possible consequences of

modifying crucial points in each policy (Kimura & Thi, 2011).

In spite of the arguments that normal distribution cannot appropriately capture crop yield and price

generation process (Harri, Erdem, Coble, & Knight, 2009), multivariable normal distribution is still

primarily favored when fitting the joint distribution of crop yield and price because it is relative simple

and the conclusion that normal distribution is inappropriate are doubted (Just & Weninger, 1999; H

Holly Wang et al., 2004). In this paper, we still assume that the joint distribution of crop yields and

prices can be captured through multivariable normal distribution, and the Monte Carlo approach was

adopted to generate 1,000 combinations of crop yield and price for each representative farmer.

Regarding other variables, including area, household income, other farm income, cost, and off-farm

income, we assume that they will be fixed and equal to the value of the previous year in the process of

stochastic simulation so that the effect of crop insurance can be highlighted.

Results

Data source

In this paper, 574 individual farmers from 12 counties in 5 provinces (JS, SD, HN, SX, and SC) were

each farmer may underestimate the yield risk when yield trend by farmer is removed. Therefore, the yield trend

should be removed at the regional level. Taking account the huge geographic area of each province in China, the

regional level is set to the county level in this paper.

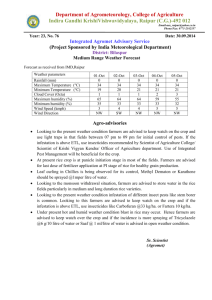

selected as the sample for collecting farm-level data. Farm-level data were obtained from the China

Rural Fixed Observation Office (CRFOO), Ministry of Agriculture of China. The time span was from

2003 to 2009. Figure 1 shows the geographic location of sample farmers. Table 1 lists the description

of sample farmers.

[Figure 1 here]

[Table 1 here]

Table 1 shows that the crop planting characteristics are reasonable because most farmers in the five

sample provinces plant more than two crops. Moreover, the crop varieties planted by farmers in each

province are consistent with local cropping practices and weather conditions. Although the

observations and the number of farmers are unbalanced in Table 1, which may result in inconsistent

explanatory power, we believe that the sample data are acceptable because this paper is aim to provide

evidence about the effect of Chinese crop insurance on farms instead of infer the whole effect of the

Chinese agricultural insurance program.

Characteristics of representative farmers

As mentioned above, hierarchical clustering analysis was adopted to ensure the homogeneity of

representative farmers. Using hierarchical clustering analysis, the sample farmers in HN are classified

into four groups. Moreover, farmers in JS, SD, SX and SC are divided into two groups, as shown in

Table 2.

[Table 2 here]

After grouping the sample farmers, the characteristics of representative farmers in terms of crop

planting and income were summarized in Table 3. The following can be observed:

1) The crop sowing area in China is relatively small. Farmers in SC and JS have the lowest sowing area,

mostly less than 1.5 Mu (0.1 hectare) per crop. Wheat farmers in SD plant 6.9 Mu of wheat on average,

which is the biggest in the sample but still less than 0.5 hectare.

2) Wheat and corn are the main crops for farmers in SD, HN, and SX, whereas, in JS and SC, farmers

also plant rice and oilseed.

3) The yield risk of crop planting are high in China because the coefficient of variations (CVs) of crop

yield in the five provinces is above 20% on average, ranging from 10% to 40%.

4) The majority of Chinese farmers may face higher risk of yield variation than price fluctuations

because the CVs of yield are higher than the CVs of price for almost all sample farmers. A notable

exception is the oilseed farmers in JS who were more concerned about price than yield because they

have modest yield risk but may sell their oilseed with huge price fluctuations. A possible explanation

for this finding is that JS is one of the best oilseed producers in China.

5) Although part-time farming is increasing at a high pace in China, agriculture remains vital for

Chinese farmers because agricultural income contributes more than 50% of household income in all

sample provinces, which is consistent with the values published by the National Statistics Bureau of

China.

6) However, revenue from grain crops (wheat, rice, corn, and oilseed) only accounts for 3% to 8% of a

farmer’s total income. This fact highlights the necessity and importance of stabilizing the grain revenue

of farmers by crop insurance in China because insurance can help to increase the willingness of farmers

to be involved in grain production.

[Table 3 here]

In practice, diversity production is a common strategy for farmers for stabilizing their crop income. The

negative relationship between crop price and crop yield also contribute to the stability of the farmer’s

income. Table 4 shows the correlation characteristics between yield and price by crop and by province.

Notably, certain crops in Table 4 are not planted at the same time. For example, corn and wheat are

usually rotated every year in SD and HN. Calculating the correlation of crops not planted at the same

time is arguably problematic. However, although certain crops are planted at different times, they are

planted within the same year and the crops planted in the same year experience a similar climate

environment. Therefore, we believe that calculating the correlation matrix as in Table 4 is reasonable.

[Table 4 here]

Based on the characteristics shown in Tables 3 and 4, the Monte Carlo approach was used to generate

the simulated data for representative farmers following the assumption and approach shown in Step 4

in the methodology section.

Effectiveness of current crop insurance program

Although certain pilots of weather index insurance and crop price index insurance exist in one or two

regions in China, the dominant crop insurance program in China is yield insurance, which works

similar to the multi-peril crop insurance (MPCI) in the U.S. but with much lower insured value. At

present, the central, provincial, and local government in China subsidizes more than 70% of crop

insurance premiums. Table 5 lists the crop insurance policies in sample provinces.

[Table 5 here]

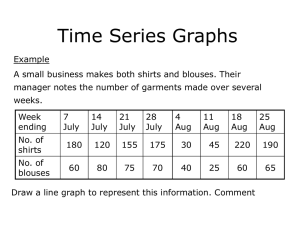

Using the simulation model mentioned in the methodology section, the effectiveness of the current

Chinese crop insurance program is evaluated by comparing the representative farmer’s welfare (CE)

under three alternative scenarios. The first scenario is NOCI, the second is with the CCI, and the last is

DSF or transferring government subsidy to farmers directly instead subsidizing crop insurance. Figure

2, which demonstrates the change in the welfare of representative farmers under the alternative

scenarios, shows the following:

1) The current crop insurance program has no doubt increased the welfare of Chinese farmers despite

complaints that CCI only providing low-risk guarantees.

2) Given that revenue from grain crops only contribute 3% to 8% to famers’ total income (as shown in

Table 3), limited welfare improvement due to CCI, which ranged from 0.1% to 0.6% in all sample

provinces except HN, is appropriate.

3) Crop insurance in China remains in need of improvement because the CE under CCI of farmers is

less than DSF in all provinces except HN.

4) The exception of HN farmers in choosing from CCI and DSF may imply that crop insurance is more

useful to HN farmers because HN is one of the main producers of grain in China.

5) The constant result in terms of the representative farmer’s choice between CCI and DSF for different

risk aversions implies that the above findings are robust.

6) The elasticity difference in farmer’s welfare change with the degree of risk aversion degree. This

finding demonstrates the importance of setting appropriate risk aversion coefficients for farmers with

different characteristics, which future studies must address. Future studies that find the underlying

reason for elasticity differences in terms of farmer welfare according to changes in risk aversion

coefficients would also be of research interest.

[Figure 2 here]

Simulated analysis on the modification of crop insurance

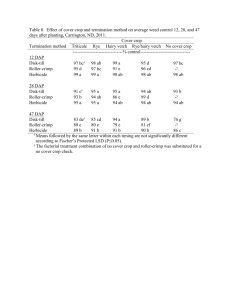

Figure 2 shows that farmers in four out of five provinces in China prefer DSF to WCI, which may be

linked to the complaint of insufficient insured value. However, is this complaint the reason why

farmers prefer DSF? To answer this question, this paper increases the insured value of crop insurance

(time insured value with 1.2, 1.5, and 2, respectively) with the premium, subsidy level, and other

factors fixed to test whether increasing insured value will affect the results. The simulation result of

increasing the insured value of crop insurance in JS, SD, SC, and SX are shown in Figure 3. Farmers in

all provinces would benefit more when the insured value of the crop insurance program is increased.

However, farmer’s welfare under the modified crop insurance scenario remains lower than farmers’

welfare under the DSF scenario even when the insured value of crop insurance is doubled. The finding

drawn from Figure 3 implies that only increasing the insured value of crop insurance would not make

farmers prefer crop insurance compared with DSF.

[Figure 3 here]

When the premium subsidy ratio is fixed, increasing insured value of crop insurance will definitely

increase the premium expenditures of the government. The government may wonder whether they can

lower the premium subsidy ratio while increasing insured value. If so, how much can they do so?

Therefore, we allow the government to change the subsidy ratio in the future to investigate whether the

subsidy ratio can be decreased while insured value increases. For simplicity, the simulation results with

the hypothesis that CRRA equals two are demonstrated in Figures 4 and 5. The following can be

observed:

1) The government subsidy is necessary for the implementation of Chinese crop insurance because

farmer’s welfare with NOCI is less than farmer’s welfare with crop insurance only when government

subsidy is higher than 60% in JS, 55% in SD, 20% in SC, and 45% in SX.

2) As expected, farmers’ welfare increased as the premium subsidy ratio increased, but increasing the

insured value of crop insurance decreased, rather than increased, farmer’s welfare when the subsidy

ratio are lower.

3) To maintain farmer’s welfare at par, the premium subsidy ratio can be reduced by increasing the

insured value of crop insurance. When increasing insured value by 50%, the government can reduce the

premium subsidy ratio by 5% in JS, 5%~10% in SD, 20% in SD, and 10%~15% in SX.

[Figure 4 here]

Conclusions

With the rapid development of agricultural insurance in China, the effectiveness of agricultural

insurance program had elicited an increasing amount of attention and has been heavily debated by

government officers, academic experts, and farmers. Unlike previous studies that evaluate the effect of

Chinese crop insurance, this paper adopted the stochastic simulation model (which was originally used

to compare the interaction effects of crop insurance, hedging, contract farming and other risk

management tools) to evaluate the effectiveness of Chinese crop insurance. Based on the simulated

results, three key conclusions can be made.

The first conclusion is that the Chinese crop insurance program has increased the welfare of farms.

However, the crop insurance program in China requires improvement to achieve Pareto improvement

because the majority of farmers prefer DSF, in which the government subsidizes the money of farmers

directly to the current crop insurance program, under the DSF scenarios.

The second meaningful conclusion is that, in most cases, the government should subsidize more

than 40% of premiums to make farmers participate in the crop insurance program. Although the

minimum subsidy ratios of crop insurance differ across provinces, the government should provide more

than 50% of crop insurance premiums to stimulate the willingness of farmers to participate in the

program in China. Such finding is consistent with that of Hazell, Pomareda, & Valdés (1986), who

found that the crop insurance for maize and beans would require a subsidy of two-thirds of the total

premium to be attractive to farmers in Mexico. The conclusion in this paper provides empirical

evidence to the theoretical inference that crop insurance will not work unless premium subsidy is

available.

Although many criticize the low insured value of the Chinese crop insurance program, Chinese

crop insurance will not be improved significantly by only increasing the coverage level or insured

value because these two factors would not make the majority of farmers choose crop insurance

compared to DSF. However, in case of increasing the insured value of crop insurance, it is possible to

reduce the premium subsidy ratio without lowering farmers’ welfare and decreasing the crop insurance

participating ratio. This final conclusion has obvious policy implications for policymakers to improve

Chinese crop insurance program.

Finally, this paper could be improved in several aspects. For example, this paper assumes that the

joint distribution of yield and price fits multi-normal distribution. However, alternative multivariable

distribution, such as joint kernel distribution, could be used to capture the underlying joint distribution

of yield and price more appropriately. We also assume that the degree of farmer’s risk aversion across

sample provinces is the same, which may not be consistent with practical conditions. The two

drawbacks will be improved in following works. Moreover, exploring the difference of the choice

between CCI and DSF in HN and other provinces is not explained in depth because it is beyond the

scope of this paper, but we believe that finding the underlying factor to explain the significant

discrepancy between HN and other provinces is meaningful.

Reference

Antón, J., & Kimura, S. (2009). Farm Level Analysis of Risk, and Risk Management Strategies and

Policies: Evidence from German Crop Farms. Paper presented at the International Association

of Agricultural Economists Conference, Beijing.

Chen, X., Wang, H. H., & Makus, L. D. (2007). Production risk and crop insurance effectiveness: organic

versus conventional apples. Paper presented at the Economics and Management Risk in

Agriculture and Natural Resources, Gulf Shores

Coble, K. H., Dismukes, R., & Thomas, S. (2007). Policy Implications of Crop YIeld and Revenue

Variability at differing levels of Disaggregation. Paper presented at the American Agricultural

Economics Association Annual Meeting 2007, Portland, Oregon.

Coble, K. H., & Heifner, R. (1998). The Effect of Crop or Revenue Insurance on Optimal Hedging. Paper

presented at the Proceedings of the NCR-134 Conference on Applied Commodity Price

Analysis, Forecasting, and Market Risk Management.

Coble, K. H., Heifner, R. G., & Zuniga, M. (2000). Implications of crop yield and revenue insurance for

producer hedging. Journal of Agricultural and Resource Economics, 25(2), 432-452.

Coble, K. H., Miller, J. C., Zuniga, M., & Heifner, R. (2004). The joint effect of government crop

insurance and loan programmes on the demand for futures hedging. European Review of

Agricultural Economics, 31(3), 309-330. doi: DOI 10.1093/erae/31.3.309

Coffey, B. K., Skees, J. R., Dillon, C. R., & Anderson, J. D. (2001). Potential Effects of Subsidized Livestock

Insurance on Livestock Production. Paper presented at the 2001 Annual meeting, August 5-8,

Chicago, IL.

Harri, A., Erdem, C., Coble, K. H., & Knight, T. O. (2009). Crop Yield Distributions: A Reconciliation of

Previous Research and Statistical Tests for Normality. Review of Agricultural Economics, 31(1),

163-182. doi: DOI 10.1111/j.1467-9353.2008.01431.x

Hazell, P. B., Pomareda, C., & Valdés, A. (1986). Crop insurance for agricultural development: issues

and experrience: IICA Biblioteca Venezuela.

Hennessy, D. A. (1998). The Production Effects of Agricultural Income Support Policies under

Uncertainty. American Journal of Agricultural Economics, 80(1), 46-57. doi: 10.2307/3180267

Hou, L.L., Y. Y., Mu and Y. Z. Zeng. 2010. Empirical Analysis on the Farmers Willing of Buying Insurance

Effects and Subsidies Policy ofAgricultural Insurance, Issues in Agricultural Economy, 4, 19-25.

(In Chinese)

Just, R. E., & Weninger, Q. (1999). Are Crop Yields Normally Distributed? . American Journal of

Agricultural Economics, 81, 287-304.

Kimura, S., & Thi, C. L. (2011). Farm Level Analysis of Risk and Risk Management Strategies and Policies:

TECHNICAL NOTE (Vol. OECD Food, Agriculture and Fisheries Working Paper). Paris: OECD

Publishing.

Lin, C. Y. (2001). An Economic Analysis of Alternative Rice Insurance Policies in Taiwan. Taiwanness

Agricultural Economic Review, 6(2), 235-253.

Mahul, O., & Stutley, C. J. (2010). Government Support to Agricultural Insurance: Challenges and

Options for Developing Countries. Washington D.C: The World Bank.

O'Donoghue, E. J., Key, N., & Roberts, M. J. (2005). Does risk matter for farm businesses? The effect of

crop insurance on production and diversification. Paper presented at the 2005 AAEA meeting,

Providence, TO.

Turvey, C. G. (1992). An Economic Analysis of Alternative Farm Revenue Insurance Policies. Canadian

Journal of Agricultural Economics, 40, 403-426.

Wang, H. H., Hanson, S. D., Myers, R. J., & Black, J. R. (1998). The Effects of Crop Yield Insurance

Designs on Farmer Participation and Welfare. American Journal of Agricultural Economics,

80(4), 806-820.

Wang, H. H., Makus, L. D., & Chen, X. (2004). The impact of US commodity programmes on hedging in

the presence of crop insurance. European Review of Agricultural Economics, 31, 331-352.

Wu, Y. 2005. Theoretical Basis of Agricultural Insurance and the Analysis of Its Effectiveness, Social

Sciences, 12, 20-25 (In Chinese)

Shi, H. 2008. Review on the fiscal subsidy system for Agricultural Insurance in the United States.

Insurance Studies, 4, 91-94. (In Chinese)

Sun, X. Y., & Zhong, F. N. (2008) The welfare economic anlysis of crop insurance subsidy. Issues in

Agricultural Economy, 2, 1-11 (In Chinese)

Tuo, G.Z. and G. J., Wang. 2003. Study on Chinese Agricultural Insurance and Rural Social Security,

Beijing: Capital University of Economics and Business Press (In Chinese)

Zhang, Y. H., & Shi, H. (2007). Subsideis, welfare and policy-oriented agricultural insurance: an

intensive study based on welfare economics. Journal of Zhejiang University (Humanities and

Social Sciences), 37(6), 138-146. (In Chinese)

Zhang, Y. H., Q. H., Shi and H. Y., Gu. 2005. A Theoretical and Positive Study on the Demand of Crop

Insurance —— Based on the questionnaires from 662 Farmers’ households of Henan

province, The Journal of Quantitative & Technical Economics, 4, 65-75(In Chinese)

Annex

Figure 1 Location of sample farmers

Table 1 Description of Sample data

Province

JiangSu

ShanDong

HeNan

SiChuan

Shan'Xi

Total

Farm Type

Crop Farm

Crop Farm

Crop Farm

Crop Farm

Crop Farm

Crop Farm

Major

Commodity

Num of

Sample

Length of

the data

Corn,Oilseed Corn,oilseed Corn,Oilseed Corn,Oilseed

,Rice, Wheat

, Wheat

,Wheat

,Rice,Wheat

Corn,Wheat

97

39

282

75

81

574

6 years

(2003-2008)

6 years

(2003-2008)

7 years

(2003-2009)

7 years

(2003-2009)

7 years

(2003-2009)

6 or 7

years

Table 2 Cluster analysis for sample farmers in five provinces

cluster

Cluster 1

Cluster 2

Cluster 3

Cluster 4

Total

# of Individual Farmers

Risk of Agri. income (Normalized)

% of Agincome in Household income

# of Individual Farmers

Risk of Agri. income (Normalized)

% of Agincome in Household income

# of Individual Farmers

Risk of Agri. income (Normalized)

% of Agincome in Household income

# of Individual Farmers

Risk of Agri. income (Normalized)

% of Agincome in Household income

# of Individual Farmers

Risk of Agri. income (Normalized)

% of Agincome in Household income

JS

84

-0.389

52.90%

13

2.025

36.10%

SD

37

-0.512

63.80%

2

1.966

69.00%

97

-0.0657

50.6%

39

-0.385

64.1%

HN

235

-0.051

40.80%

37

-0.156

85.60%

9

3.304

47.50%

1

6.805

22.60%

282

0.0667

46.9%

SC

69

-0.129

48.00%

6

3.297

50.30%

SX

75

-0.351

51.40%

6

2.431

73.20%

Total

75

0.145

48.2%

81

-0.145

53.0%

574

-0.00593

49.7%

Table 3 Summary of representative farmers, by crops, by cluster, and by provinces

JS

Cluster 1

mean

Area

(Mu)

Price*

(CNY)

sd

mean

Cluster 1

sd

corn

1.2

0.6

oilseed

1.7

0.9

1.6

0.8

rice

1.5

0.6

1.4

0.4

wheat

Yield*

(kg/Mu)

SD

Cluster 2

mean

HN

Cluster 2

sd

mean

Cluster 1

sd

mean

Cluster 2

sd

mean

SC

Cluster 3

sd

mean

3.1

1.9

3.2

1.1

2.9

1.5

2.9

1.6

0.3

0.1

0.2

0.1

2.0

1.4

2.2

2.2

3.1

Cluster 4

sd

1.5

mean

0.8

Cluster 1

sd

mean

0.3

SX

Cluster 2

sd

mean

Cluster 1

sd

1.3

0.9

0.9

0.3

1.3

0.7

1.3

0.5

1.4

0.9

1.0

0.5

mean

4.7

Cluster 2

sd

2.0

mean

sd

5.6

2.2

1.7

1.1

6.9

2.7

6.1

3.2

4.3

2.6

4.2

3.2

3.3

1.9

0.8

0.3

1.2

0.7

0.9

0.5

6.7

3.2

5.9

1.8

corn

345.3

123.1

398.5

71.6

407.2

64.1

342.4

143.4

354.4

297.4

340.8

95.9

498.6

26.8

355.7

122.5

348.9

118.3

257.0

66.6

234.8

60.0

oilseed

181.1

29.4

172.7

8.1

168.1

68.3

186.6

59.2

56.5

43.4

62.1

33.1

163.8

58.0

139.9

38.0

rice

592.9

44.2

602.5

45.7

407.5

159.9

401.3

101.3

wheat

257.3

69.4

350.8

58.0

326.4

35.8

336.8

156.8

326.4

69.8

353.8

61.8

389.8

30.3

304.2

80.6

297.1

76.7

226.7

62.5

245.4

72.5

corn

1.4

0.3

1.1

0.1

1.1

0.1

1.0

0.1

1.0

0.1

1.0

0.1

1.0

0.1

1.3

0.2

1.3

0.2

1.0

0.1

1.0

0.1

oilseed

9.7

9.2

15.5

12.3

3.4

1.3

3.3

1.4

6.4

1.6

5.8

2.2

2.3

0.5

2.2

0.5

rice

1.5

0.1

1.5

0.1

2.4

1.3

2.3

1.2

1.1

0.1

1.3

0.1

1.3

0.1

1.2

0.1

1.2

0.1

1.2

0.1

1.2

0.1

1.3

0.1

1.3

0.1

1.3

0.1

1.3

0.1

Total income*

wheat

28353

24732

32228

11896

17265

7830

29426

34192

16806

13378

18158

14195

25727

23143

20988

18533

20862

10050

24004

17465

15888

23531

19978

20162

Agri. income*

15921

25587

12676

13372

10530

4237

22298

25562

6601

9489

15667

13580

15113

24147

10578

21606

9011

5167

13692

17022

9588

24166

16481

16812

G_Crops income*

1776

1632

1467

1509

1107

361

1183

661

735

303

706

306

774

186

907

154

1748

630

1681

608

441

195

419

203

Other Agri_income*

14145

25838

11209

13649

9423

4242

21115

25547

5866

9477

14961

13589

14339

24140

9670

21556

7263

5115

12011

17001

9147

24160

16062

16797

Cost_Farming

1184

677

1143

444

4097

1817

3936

1940

5204

88339

2032

1787

2238

1133

959

243

1996

1229

1643

1000

2756

1317

2570

1252

Non-Ag income*

1770

5682

2764

8424

1783

5174

1410

3445

3252

7776

496

2289

3147

8992

1873

4156

3820

8677

3404

7513

1371

3240

264

1195

NAInc_Local*

1234

4173

1717

5931

408.1

3937

0

0

207.5

1989

0

0

1088

7769

0

0

169.5

2107

35.56

346.6

120

1033

47.38

299.7

NAInc_Migrate*

680.4

4064

1047

5515

1375

3540

1410

3445

3045

7471

495.8

2289

2059

5002

1873

4156

3651

8481

3369

7454

1251

3094

216.7

948.2

428

1444

150

546

546

1545

3177

5904

500

1616

386

934

505

1206

27

60

890

1747

622

979

309

985

897

3038

10327

9599

16663

10143

4368

4694

2602

3989

6474

8147

1684

2874

6983

8666

8545

4881

7203

7742

6335

9158

4747

4521

2364

3129

Trincome*

A&R income*

Note:The unit of all monetary variables in this table is Chinese Yuan, and * indicates deflated or detrended. G_crops income=income from grain crops (wheat, rice, corn and oilseed); Other Agri_income= other agricultural income from

other crops, livestock and other farming activities; Cost_farming includes the cost of grain crops and other crops; NAinc_local and NAinc_migrate means the wage income from working in local s and outside city, respectively; Trincome

means the Transfer income; A&R income means the Assert and residual income

Table 4 Correlation matrix of yield and price by crops, by cluster, and by provinces

JS_Cluster 1

Yield

Corn Oilseed Rice

Corn

1.0

-1.0

-1.0

Oilseed

1.0

1.0

yield

Rice

1.0

Wheat

Corn

Oilseed

Price

Rice

Wheat

JS_Cluster 2

Price

Wheat Corn Oilseed Rice

-0.8

-0.6

-0.8

0.8

0.8

0.6

0.8

-0.8

0.8

0.6

0.8

-0.8

1.0

1.0

1.0

-0.3

1.0

1.0

0.0

1.0

-0.3

1.0

Yield

Wheat Corn Oilseed Rice

1.0

Na

Na

Na

-1.0

1.0

0.0

-0.9

1.0

-0.9

-0.8

-0.9

0.6

1.0

SD_Cluster 1

Yield

Corn Oilseed Rice

Corn

1.0

-0.2

Na

Oilseed

1.0

Na

yield

Rice

Na

Wheat

Corn

Oilseed

Price

Rice

Wheat

Yield

Wheat Corn Oilseed Rice

-0.4

1.0

-0.3

Na

0.0

1.0

Na

Na

Na

0.2

0.4

-0.3

Na

1.0

Yield

Wheat Corn Oilseed Rice

0.02 1.00 0.44

Na

-0.02

1.00

Na

Na

Na

0.36

0.27

-0.63

Na

1.00

Price

Wheat Corn Oilseed Rice

0.59 -0.04

Na

Na

Na

Na

Na

Na

Na

Na

Na

Na

1.00 0.08

Na

Na

1.00

Na

Na

Na

Na

Na

Yield

Wheat Corn Oilseed Rice

0.08 1.00

Na

Na

Na

Na

Na

Na

Na

0.00

0.63

Na

Na

1.00

HN_Cluster 3

Yield

Corn Oilseed Rice

Corn 1.00

Na

Na

Oilseed

Na

Na

yield

Rice

Na

Wheat

Corn

Oilseed

Price

Rice

Wheat

Price

Wheat Corn Oilseed Rice

0.3

-0.1

-0.2

Na

0.8

0.2

0.9

Na

Na

Na

Na

Na

1.0

-0.1

0.6

Na

1.0

0.7

Na

1.0

Na

Na

Wheat

0.0

-0.7

Na

-0.9

0.5

-0.3

Na

1.0

HN_Cluster 2

Price

Oilseed Rice

-0.09

Na

0.21

Na

Na

Na

-0.50

Na

-0.25

Na

1.00

Na

Na

Wheat Corn

0.15 -0.01

-0.09 0.23

Na

Na

1.00 -0.02

1.00

Wheat

Na

Na

Na

Na

Na

Na

Na

Na

SD_Cluster 2

Price

Wheat Corn Oilseed Rice

0.0

-0.3

0.0

Na

0.0

0.0

0.0

Na

Na

Na

Na

Na

1.0

0.1

0.0

Na

1.0

0.7

Na

1.0

Na

Na

HN_Cluster 1

Yield

Corn Oilseed Rice

Corn 1.00 -0.05

Na

Oilseed

1.00

Na

yield

Rice

Na

Wheat

Corn

Oilseed

Price

Rice

Wheat

Price

Wheat Corn Oilseed Rice

Na

Na

Na

Na

Na

Na

0.2

-1.0

Na

Na

-0.1

0.1

Na

Na

Na

Na

Na

Na

Na

1.0

-0.3

1.0

Price

Wheat Corn Oilseed Rice

0.67 0.25 -0.50

Na

0.29 -0.39 -0.52

Na

Na

Na

Na

Na

1.00 -0.15 -0.78

Na

1.00 0.27

Na

1.00

Na

Na

Wheat

0.58

0.54

Na

0.53

0.04

-0.71

Na

1.00

HN_Cluster 4

SC_Cluster 1

Yield

Price

Corn Oilseed Rice Wheat Corn Oilseed Rice Wheat

Corn 1.00 0.36 0.32 0.28 -0.03 0.25 -0.32 0.23

Oilseed

1.00 0.43 0.25 -0.09 0.15 -0.44 0.08

yield

Rice

1.00 0.47 0.05 0.16 -0.75 0.16

Wheat

1.00 0.02 0.13 -0.42 0.15

Corn

1.00 -0.47 -0.12 0.33

Oilseed

1.00 -0.15 0.05

Price

Rice

1.00 -0.05

Wheat

1.00

SX_Cluster 1

Yield

Price

Corn Oilseed Rice Wheat Corn Oilseed Rice Wheat

Corn 1.00

Na

Na

0.26 -0.21

Na

Na

-0.02

Oilseed

Na

Na

Na

Na

Na

Na

Na

yield

Rice

Na

Na

Na

Na

Na

Na

Wheat

1.00 -0.04

Na

Na

-0.02

Corn

1.00

Na

Na

0.52

Oilseed

Na

Na

Na

Price

Rice

Na

Na

Wheat

1.00

Price

Wheat Corn Oilseed Rice

0.86 -0.22

Na

Na

Na

Na

Na

Na

Na

Na

Na

Na

1.00 0.01

Na

Na

1.00

Na

Na

Na

Na

Na

Wheat

-0.42

Na

Na

-0.01

-0.17

Na

Na

1.00

SC_Cluster 2

Yield

Price

Corn Oilseed Rice Wheat Corn Oilseed Rice Wheat

1.00 -0.17 0.34 0.79 0.99 0.15 0.37 0.77

1.00 0.38 0.30 -0.23 0.94 -0.33 0.49

1.00 0.79 0.23 0.54 0.73 0.51

1.00 0.73 0.56 0.49 0.88

1.00 0.09 0.30 0.74

1.00 -0.14 0.73

1.00 0.07

1.00

SX_Cluster 2

Yield

Price

Corn Oilseed Rice Wheat Corn Oilseed Rice Wheat

1.00

Na

Na

0.05 0.10

Na

Na

0.09

Na

Na

Na

Na

Na

Na

Na

Na

Na

Na

Na

Na

Na

1.00 -0.53

Na

Na

0.13

1.00

Na

Na

0.57

Na

Na

Na

Na

Na

1.00

Table 5 Practical crop insurance policies in five Chinese provinces

Insured Value (CNY/Mu)

Gov. subsidy ratio*

Premium Ratio (%)

Province

Corn

Oilseed

Rice

Wheat

Corn

Oilseed

Rice

Wheat

JS

300

300

300

300

5

5

5

5

SD

300

300

320

3.3

5

HN

192

300

263

311

6

6

6

6

SC

300

280

300

300

7

5.5

7

7

SX

280

300

300

7

5

Crops

3.1

80%

5

CRRA=2

CRRA=4

5

4

3

2

1

0

JS

SD

HN

SC

SX

SC

SX

JS

SD

HN

SC

SX

CRRA=6

5

4

3

2

1

0

JS

SD

HN

CCI

DSF

Note: NOCI is the Baseline,=0

Figure 2 Welfare change of representative farmers under alternative scenarios

*

In practice, the crop insurance subsidy ratios range from 75% to 80% in China, depending on the region and

crop. For simplicity, the subsidy ratio in this paper is set to 80% for all crops in all provinces.

CRRA=2

CRRA=4

JS

JS

SD

SD

SC

SC

SX

SX

-.4

-.2

0

.2

.4

.6

CRRA=6

JS

SD

SC

SX

-.4

-.2

0

.2

.4

.6

Change of Farmer's CE, %

MCI120%

MCI150%

MCI200%

NOCI

DSF

Note: CCI is the Baseline equal to zero; Farmers in cluster 1 are selected;

MCI120% means increaing insured value of CCI to 120%

Figure 3 Simulation results of increasing insured value of crop insurance

MCI200%

MCI150%

MCI100%

CCI

DSF

JS

SD

SC

SX

NOCI

1.0050

1.0000

0.9950

0.9900

0.9850

1.0050

1.0000

0.9950

0.9900

0.9850

0

10

20

30

40

50

60

70

80

90

0

10

20

30

40

50

60

70

80

90

Premium subsidy ratio by government (%)

Note: CCI is the Baseline equal to one; Farmers in cluster 1 are selected;

MCI150% means increaing insured value of CCI to 150%

Figure 4 Farmer’s Welfare of alternative crop insurance program in SD, HN, SC, and SX