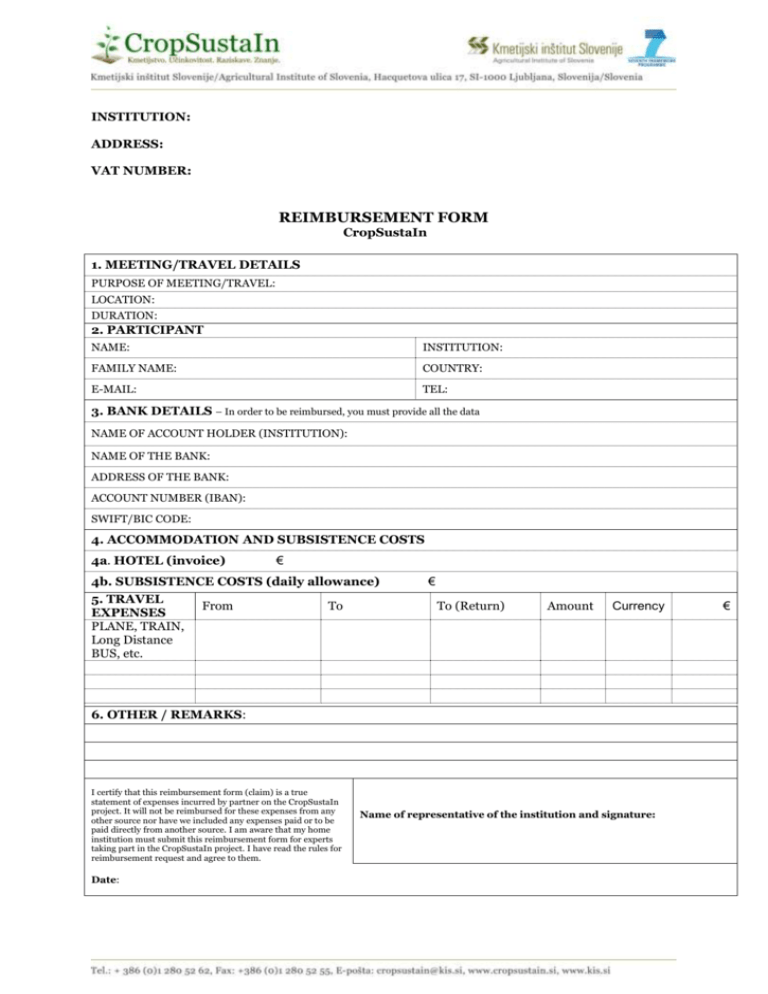

INSTITUTION: ADDRESS: VAT NUMBER: REIMBURSEMENT

advertisement

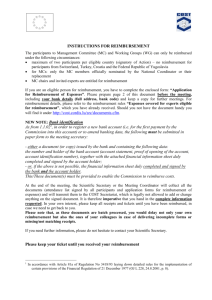

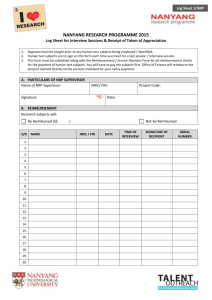

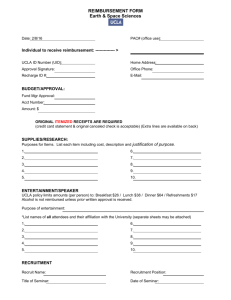

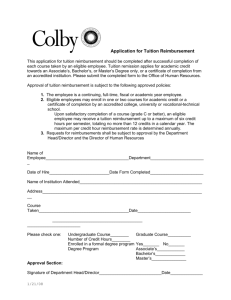

INSTITUTION: ADDRESS: VAT NUMBER: REIMBURSEMENT FORM CropSustaIn 1. MEETING/TRAVEL DETAILS PURPOSE OF MEETING/TRAVEL: LOCATION: DURATION: 2. PARTICIPANT NAME: INSTITUTION: FAMILY NAME: COUNTRY: E-MAIL: TEL: 3. BANK DETAILS – In order to be reimbursed, you must provide all the data NAME OF ACCOUNT HOLDER (INSTITUTION): NAME OF THE BANK: ADDRESS OF THE BANK: ACCOUNT NUMBER (IBAN): SWIFT/BIC CODE: 4. ACCOMMODATION AND SUBSISTENCE COSTS 4a. HOTEL (invoice) € 4b. SUBSISTENCE COSTS (daily allowance) 5. TRAVEL From To EXPENSES PLANE, TRAIN, Long Distance BUS, etc. € To (Return) Amount Currency 6. OTHER / REMARKS: I certify that this reimbursement form (claim) is a true statement of expenses incurred by partner on the CropSustaIn project. It will not be reimbursed for these expenses from any other source nor have we included any expenses paid or to be paid directly from another source. I am aware that my home institution must submit this reimbursement form for experts taking part in the CropSustaIn project. I have read the rules for reimbursement request and agree to them. Date: Name of representative of the institution and signature: € Rules for reimbursement of expenses for experts eligible for reimbursement CropSustaIn Please read carefully before completing the form. Participants to CropSustaIn meetings should arrive and depart as close as possible to the beginning and to the end of the meeting. The Institution eligible to receive reimbursement for travel expenses and allowances for experts taking part in the CropSustaIn project must declare that he/she has not received any similar reimbursement or allowance or is not entitled to a similar reimbursement or allowance from another Institute, organisation or person for the same trip. IMPORTANT If the complete reimbursement form is not submitted within 30 days, it is presumed that no claim for payment or for reimbursement of expenses will be requested by the participant; For the reimbursement of all costs, originals must be provided with the claim form. They must clearly indicate the amount paid and the amount without VAT (value added tax) Reimbursement is in euro (€) The following are some examples of items not eligible for reimbursement: Costs of health, life and luggage insurance are not reimbursed; Cancellation insurance for tickets or similar not changeable tariffs are not reimbursed; Other costs such as telephone calls. cannot be reimbursed; Value added tax (VAT) is not eligible cost and cannot be reimbursed. 4a. Accommodation – hotel For the reimbursement of hotel accommodation copies of hotel invoices must be provided with the claim form. Hotel accommodation is justified by real costs, but according to FP7 financial rules hotel accommodation for one night must not be higher as the flat rate per day for accommodation (for Slovenia: 110 EUR). 4b. Daily subsistence costs For the reimbursement of daily subsistence costs copy of document which shows that the daily subsistence costs (allowance) have been paid to the staff and document which shows how the subsistence costs (daily allowance) have been calculated. Daily subsistence costs are calculated according to the national rules. 5. Travel expenses Travel expenses are refunded on the principle of the most economical overall expenditure. Travel costs are justified by real cost. For the reimbursement of travel costs copies of transport tickets must be provided with the claim form. They must clearly indicate the amount paid and the full itinerary (showing departure/arrival dates and times). Copies of all travel documents (boarding passes, other invoices and other documents which show that the costs occurred, such as public transport, parking ticket, ect.) must be provided with the reimbursement form. 5a. Travel by plane, train or long distance bus (coach) For travelling by air low cost tickets have to be used. To benefit from the most economical fare, early booking is essential. Where no price is indicated on the ticket, the invoice must also be enclosed. The most economical tariff shall be reimbursed if originals or legible photocopies of the ticket are provided. Local airport transfer should use the most economical means of transport. Airport parking may be reimbursed, if economical. The shortest and most economical route by rail or bus between the departure point and the place where the meeting is held must be used. Costs for seat reservations, transport of necessary luggage and supplements for fast trains and sleeper (instead of hotel) are eligible expenses. 5b. Local Transport For local transport expenses receipts are always required. Also the copies of all justifications and receipts have to be added to the reimbursement form. 5c. Taxi Taxi fares receipts are always required. They shall only be reimbursed where no reasonable public transport is available.