Ecu-Bol-Per

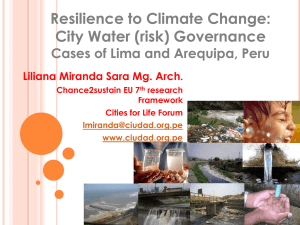

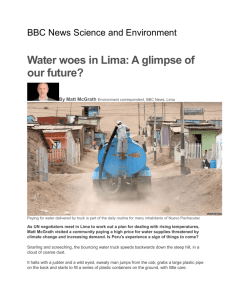

advertisement

EIU In brief Ecuador's leftist president, Rafael Correa, faces increased discontent from business and the middle class given increased taxes and his confrontational political style, although he remains popular among the poor. Growth, which is dominated by public spending and oil activity, will be constrained by weaker oil export prices over the forecast period. Although declines in fiscal revenue will be partially offset by external lending, the government will be forced to prioritise investment projects. Currency The US dollar was officially adopted as legal tender in March 2000, replacing the former national currency, the sucre, at a conversion rate of Su25,000:US$1. The sucre ceased to be legal tender in September 2000, apart from sucre coins, equivalent to US dimes, nickels and cents, used as fractional money. Amid a macroeconomic environment reliant on high oil prices and public spending, combined with a consistently heterodox approach to policymaking by the current left-wing government, Ecuador scores poorly in our business environment rankings, and is expected to drop from 68th of 82 countries in the historical period to 73rd in the forecast period. Although weaker oil prices have obliged the government to seek more private investment, shortcomings in the investment environment and much-needed structural reforms will not be fully addressed. Low levels of productivity and a wealth of natural resources offer scope for Ecuador to catch up with more developed countries, provided that policies are implemented to transform its resource wealth into productive investment in other sectors. However, poor prospects for improvements to Ecuador's institutions do not bode well for a more stable economic policy direction. Despite the increased stability that dollarisation has brought, erratic policymaking will hamper reforms needed to embed confidence in the currency regime and encourage long-term investment. In view of this, we forecast that income levels will continue to lag behind OECD levels in the long term. https://atlas.media.mit.edu/en/profile/country/ecu/ EIU In brief Following a lacklustre performance at local elections in March, the ruling Movimiento al Socialismo (MAS) is pushing for a third term for its popular leader, Evo Morales. Social unrest remains a risk. The business environment will be weak (hindered by Interventionist policies and a weak judicial system), and lower gas prices will weigh on the fiscal and economic outlook, requiring some adjustments. Bolivia's large stock of reserves will cushion the blow. Currency Boliviano (Bs) = 100 centavos; average exchange rate in 2014: Bs6.91:US$1 https://atlas.media.mit.edu/en/profile/country/bol/ EIU In brief The centre-left president, Ollanta Humala, faces considerable short-term challenges stemming from a sluggish economy and heightened political tension driven by a fractured Congress. Mr Humala's administration will maintain an orthodox policy stance, including sound fiscal and monetary policies (notwithstanding a short-term fiscal stimulus boost), but in the context of lower prices and demand for Peru's main exports, growth will be lower in 2015-19 (4.5% average) than in the last decade. Currency Nuevo sol (Ns). There are 100 céntimos in one nuevo sol. Average exchange rate in 2014: Ns2.84:US$1 The Economist Intelligence Unit expects Peru's business environment score to rise in 2014-18, mostly owing to improvements in infrastructure and financing. Although Peru's regional ranking will remain stable, its global ranking will fall slightly (to 48th place). Peru's key strength as a business location will be its openness to foreign trade—secured by multiple free-trade agreements (FTAs)—and its prudent macroeconomic management. The business-friendly approach that existed within the historical period (2009-13) will suffer only minimal disruptions related to Mr Humala's aim of promoting a larger role for the state in the economy. Infrastructure will improve markedly, although we expect significant gaps to remain. Peru's labour market is expected to remain the weakest aspect of the business environment in the outlook period. Long Term Outlook Growth in Peru's real GDP per head is forecast to slow from an annual average of 3.7% in 2013-20, to 2.7% in 2021-30. The poor institutional environment and widespread income and regional inequalities will continue to hold back stronger growth. Overall, education levels will remain low, with only marginal progress forecast. Comparatively low inflation (in the 1-3% range) and a stable currency will contribute to macroeconomic stability. Abundant opportunities in energy, mining and infrastructure will continue to lure domestic and foreign investment. Nevertheless, Peru will remain vulnerable to fluctuations in external demand and commodity prices. https://atlas.media.mit.edu/en/profile/country/per/ PERU September 14th 2015 EIU Basic data Land area 1,285,216 sq km Population 30m (2010; Instituto Nacional de Estadística e Informática) Main towns Population in '000 (2005 census). Apart from Lima, the following refer to population of regional departments: Lima (capital): 8,153 Piura: 1,679 La Libertad: 1,596 Cajamarca: 1,412 Puno: 1,290 Cusco: 1,208 Junín: 1,182 Arequipa: 1,173 Lambayeque: 1,122 Áncash: 1,089 Climate Varies by region and altitude. In general, temperate on the coast, tropical in the jungles, cool in the highlands; the western highlands have a dry climate, but there is heavy rainfall in the eastern and northern highlands between October and April Weather in Lima (altitude 120 metres) Hottest month, February, 19-28°C (average daily minimum and maximum); coldest month, August, 13-19°C; driest months, February and March, 1 mm average monthly rainfall; wettest month, August, 8 mm average monthly rainfall Languages Spanish is the principal language and the lingua franca for the large numbers of Quechua and Aymara speakers; Quechua and Aymara also have official status Measures Metric system; also old Spanish measures, particularly in rural areas Currency Nuevo sol (Ns). There are 100 céntimos in one nuevo sol. Average exchange rate in 2014: Ns2.84:US$1 Time 5 hours behind GMT Public holidays January 1st; Easter (half-day Maundy Thursday and all day Good Friday); May 1st (Labour Day); June 29th (Saint Peter and Saint Paul); July 28th (Independence Day); August 30th (Santa Rosa de Lima); October 8th (Battle of Angamos); November 1st (All Saints' Day); December 8th (Immaculate Conception); December 25th (Christmas Day) Lima - Perú 2015 (Video Hd) https://www.youtube.com/watch?v=RYTO_J7ix9Y El colapso del Metro de Lima: medio de transporte dejó de ser un servicio cómodo https://www.youtube.com/watch?v=jlDsQhNKBk8 Línea 2 Metro de Lima https://www.youtube.com/watch?v=W0Sz9QOaUmo http://www.forbes.com/pictures/eglg45hdkjd/americas-largestcontainer-port/ http://www.forbes.com/pictures/feki45efjgh/the-15-mostprofitable-i/