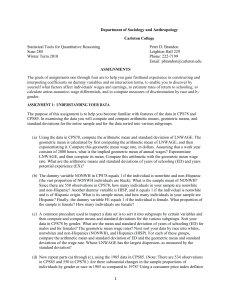

Specification of the Econometric Model

advertisement

Introduction Econometrics has been defined as "the application of mathematics and statistical methods to economic data" and described as the branch ofeconomics "that aims to give empirical content to economic relations." More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." For example, consider one of the basic relationships in economics: the relationship between the price of a commodity and the quantities of that commodity that people wish to purchase at each price (the demand relationship). According to economic theory, an increase in the price would lead to a decrease in the quantity demanded, holding other relevant variables constant so as to isolate the relationship of interest. A mathematical equation can be written that describes the relationship between quantity, price, other demand variables like income, and a random term ε to reflect simplification and imprecision of the theoretical model: Q 1 2 Pr ice 3 Income ui METHODOLOGY OF ECONOMETRICS Theory A theory should have a prediction. In statistics and econometrics, we also speak of hypothesis. One example is the marginal propensity to consume (MPC) proposed by Keynes. Other examples could be that lower taxes would increase growth, or maybe that it would increase economic inequality, and that introducing a common currency has a positive effect on trade. Specification of the Mathematical Model This is where the algebra enters. We need to use mathematical skills to produce an equation. Assume a theory predicting that more schooling increases the wage. In economic terms, we say that the return to schooling is positive. The equation is: Y = β1 + β2X, where Y is the variable for wage and β1 is a constant and β2 is the coefficient of schooling, and X is a measurement of schooling, i.e. the number of years in school. We also call β1intercept and β2 a slope coefficient. Normally, we would expect both β1 and β2 to be positive. Specification of the Econometric Model Here, we assume that the mathematical model is correct but we need to account for the fact that it may not be so. We add an error term, u to the equation above. It is also called a random (stochastic) variable. It represents other non-quantifiable or unknown factors that affect Y. The econometric equation is: Y = β1 + β2X + u. Obtaining Data We need data for the variables above. This can be obtained from government statistics agencies and other sources. A lot of data can also be collected on the Internet in these days. But we need to learn the art of finding appropriate data from the ever increasing huge loads of data Estimation of the model Here, we quantify β1 and β2, i.e. we obtain numerical estimates. This is done by statistical technique called regression analysis. Hypothesis Testing Now we go back to the part where we had economic theory. The prediction was that schooling is good for the wage. Does the econometric model support this hypothesis. What we do here is called statistical inference (hypothesis testing). Technically speaking, the β2 coefficient should be greater than 0. Forecasting If the hypothesis testing was positive, i.e. the theory was concluded to be correct, we forecast the values of the wage by predicting the values of education. For example, how much would someone earn for an additional year of schooling? If the X variable is the years of schooling, the β2 coefficient gives the answer to the question. Use for Policy Recommendation Lastly, if the theory seems to make sense and the econometric model was not refuted on the basis of the hypothesis test, we can go on to use the theory for policy recommendation.