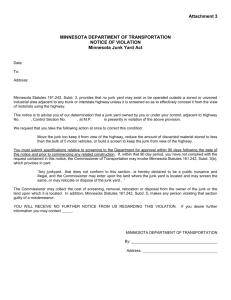

36th Day] Monday, April 20, 2009 Journal of the House [36th Day

advertisement

![36th Day] Monday, April 20, 2009 Journal of the House [36th Day](http://s3.studylib.net/store/data/006787825_1-3d84e33b9965adc94102a26583553a2a-768x994.png)