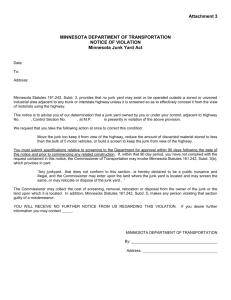

98th Day] Monday, April 2, 2012 Journal of the House [98th Day

advertisement

![98th Day] Monday, April 2, 2012 Journal of the House [98th Day](http://s3.studylib.net/store/data/006786780_1-8b99c061fa911bb245225269376528fc-768x994.png)