Unrelated Business Income Tax (UBIT) General Questionnaire PURPOSE

advertisement

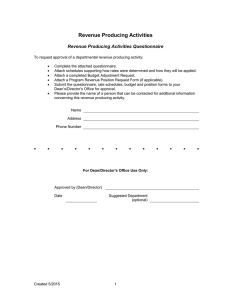

Unrelated Business Income Tax (UBIT) General Questionnaire PURPOSE The University of Cincinnati is subject to a federal tax on “unrelated business income,” that is, income from activities that are unrelated to our taxexempt purposes of education, scientific research and charitable public outreach. This questionnaire is intended to help our Tax Compliance function identify sources of revenue and determine which of those are potentially taxable and subject to reporting to IRS. Please complete, sign and return this questionnaire by July 13 to Barry Holland, Director Tax Compliance, Treasurer’s Office, ML 0641. REVENUE-GENERATING ACTIVITIES Please indicate whether your department generates revenue from the following activities. We are looking for what you did to generate the revenue, not what you intend to use the money for. In all affirmative cases, please indicate the 6-digit General Ledger account number(s) in which you record that revenue. For each activity you list, please attach a printed statement of your FY2012 budget or your Year-To-Date profit/loss. Attach any other pages you deem necessary. DEPARTMENTS FOR WHICH YOU ARE RESPONDING: ________________________________________________ ACTIVITY Advertising (indicate type of media – newspaper, radio, etc.) Entertainment events (concerts, etc.) Partnerships and joint ventures (indicate with whom, doing what) Patents or other licenses Publishing of journals or periodicals (indicate titles) COST CENTER(S) G/L ACCT #s COMMENTS ACTIVITY COST CENTER(S) G/L ACCT #s COMMENTS Rentals of facilities or equipment (indicate assets rented to others) Research for government entities (indicate primary customers) Research for corporate or private entities (indicate primary customers) Sales or rentals of mailing lists Sales of donated items Sales of services Sponsorships by outside parties (indicate party & attach copy of agreement) Summer camps Other revenue-generating activities (indicate activity(ies)) RETURN AND FOLLOW-UP Please indicate your business manager or other person that the Director, Tax Compliance should contact for any necessary follow-up questions about these activities. CONTACT PERSON TITLE PHONE NUMBER MAIL LOCATION Thank you for your assistance!